Namespaces | |

| namespace | chebyshev_interpolation_detail |

| namespace | detail |

| namespace | details |

| namespace | exponential_integrals_helper |

| namespace | ExponentialIntegral |

| namespace | ext |

| namespace | ForwardForwardMappings |

| namespace | io |

| namespace | LatentModelIntegrationType |

| namespace | MINPACK |

Classes | |

| class | Abcd |

| Abcd interpolation factory and traits More... | |

| class | AbcdAtmVolCurve |

| Abcd-interpolated at-the-money (no-smile) volatility curve. More... | |

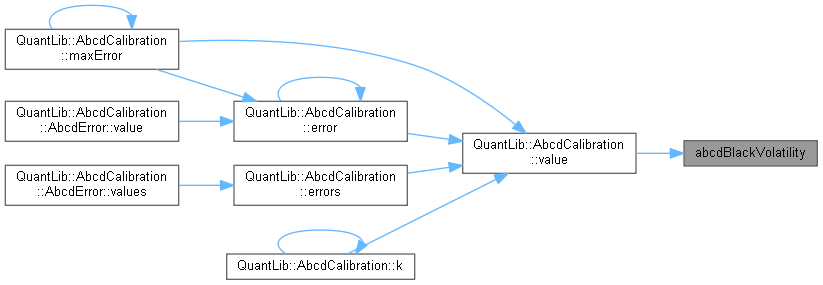

| class | AbcdCalibration |

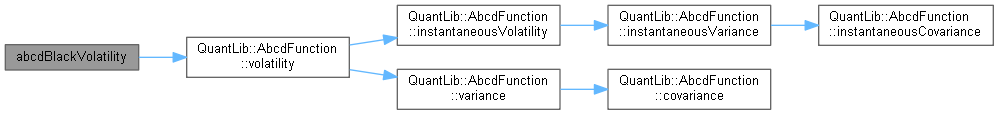

| class | AbcdFunction |

| Abcd functional form for instantaneous volatility More... | |

| class | AbcdInterpolation |

| Abcd interpolation between discrete points. More... | |

| class | AbcdMathFunction |

| Abcd functional form More... | |

| class | AbcdSquared |

| class | AbcdVol |

| Abcd-interpolated volatility structure More... | |

| class | AccountingEngine |

| Engine collecting cash flows along a market-model simulation. More... | |

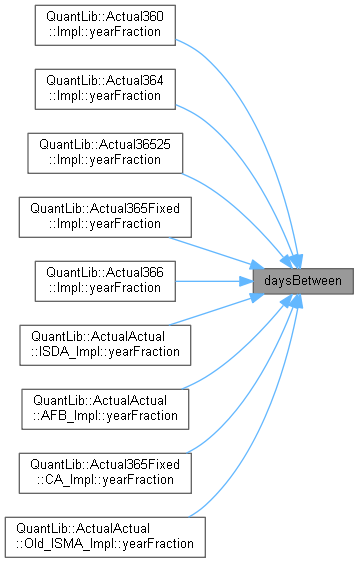

| class | Actual360 |

| Actual/360 day count convention. More... | |

| class | Actual364 |

| Actual/364 day count convention. More... | |

| class | Actual36525 |

| Actual/365.25 day count convention. More... | |

| class | Actual365Fixed |

| Actual/365 (Fixed) day count convention. More... | |

| class | Actual366 |

| Actual/366 day count convention. More... | |

| class | ActualActual |

| Actual/Actual day count. More... | |

| class | AcyclicVisitor |

| degenerate base class for the Acyclic Visitor pattern More... | |

| class | AdaptedPathPayoff |

| class | AdaptiveInertia |

| AdaptiveInertia. More... | |

| class | AdaptiveRungeKutta |

| class | AdditionalBootstrapVariables |

| class | AdditiveEQPBinomialTree |

| Additive equal probabilities binomial tree. More... | |

| class | AEDCurrency |

| United Arab Emirates dirham. More... | |

| struct | AffineHazardRate |

| class | AffineModel |

| Affine model class. More... | |

| class | AkimaCubicInterpolation |

| class | AliMikhailHaqCopula |

| Ali-Mikhail-Haq copula. More... | |

| class | AlphaFinder |

| class | AlphaForm |

| class | AlphaFormInverseLinear |

| class | AlphaFormLinearHyperbolic |

| class | AmericanBasketPathPricer |

| class | AmericanExercise |

| American exercise. More... | |

| class | AmericanPathPricer |

| class | AmericanPayoffAtExpiry |

| Analytic formula for American exercise payoff at-expiry options. More... | |

| class | AmericanPayoffAtHit |

| Analytic formula for American exercise payoff at-hit options. More... | |

| class | AmortizingCmsRateBond |

| amortizing CMS-rate bond More... | |

| class | AmortizingFixedRateBond |

| amortizing fixed-rate bond More... | |

| class | AmortizingFloatingRateBond |

| amortizing floating-rate bond (possibly capped and/or floored) More... | |

| class | AmortizingPayment |

| Amortizing payment. More... | |

| class | AnalyticAmericanMargrabeEngine |

| Analytic engine for American Margrabe option. More... | |

| class | AnalyticBarrierEngine |

| Pricing engine for barrier options using analytical formulae. More... | |

| class | AnalyticBinaryBarrierEngine |

| Analytic pricing engine for American binary barriers options. More... | |

| class | AnalyticBlackVasicekEngine |

| class | AnalyticBSMHullWhiteEngine |

| analytic european option pricer including stochastic interest rates More... | |

| class | AnalyticCapFloorEngine |

| Analytic engine for cap/floor. More... | |

| class | AnalyticCEVEngine |

| class | AnalyticCliquetEngine |

| Pricing engine for Cliquet options using analytical formulae. More... | |

| class | AnalyticComplexChooserEngine |

| class | AnalyticCompoundOptionEngine |

| Pricing engine for compound options using analytical formulae. More... | |

| class | AnalyticContinuousFixedLookbackEngine |

| Pricing engine for European continuous fixed-strike lookback. More... | |

| class | AnalyticContinuousFloatingLookbackEngine |

| Pricing engine for European continuous floating-strike lookback. More... | |

| class | AnalyticContinuousGeometricAveragePriceAsianEngine |

| Pricing engine for European continuous geometric average price Asian. More... | |

| class | AnalyticContinuousGeometricAveragePriceAsianHestonEngine |

| Pricing engine for European continuous geometric average price Asian. More... | |

| class | AnalyticContinuousPartialFixedLookbackEngine |

| Pricing engine for European continuous partial-time fixed-strike lookback options. More... | |

| class | AnalyticContinuousPartialFloatingLookbackEngine |

| Pricing engine for European continuous partial-time floating-strike lookback option. More... | |

| class | AnalyticDigitalAmericanEngine |

| Analytic pricing engine for American vanilla options with digital payoff. More... | |

| class | AnalyticDigitalAmericanKOEngine |

| Analytic pricing engine for American Knock-out options with digital payoff. More... | |

| class | AnalyticDiscreteGeometricAveragePriceAsianEngine |

| Pricing engine for European discrete geometric average price Asian. More... | |

| class | AnalyticDiscreteGeometricAveragePriceAsianHestonEngine |

| Pricing engine for European discrete geometric average price Asian. More... | |

| class | AnalyticDiscreteGeometricAverageStrikeAsianEngine |

| Pricing engine for European discrete geometric average-strike Asian option. More... | |

| class | AnalyticDividendEuropeanEngine |

| Analytic pricing engine for European options with discrete dividends. More... | |

| class | AnalyticDoubleBarrierBinaryEngine |

| Analytic pricing engine for double barrier binary options. More... | |

| class | AnalyticDoubleBarrierEngine |

| Pricing engine for double barrier european options using analytical formulae. More... | |

| class | AnalyticEuropeanEngine |

| Pricing engine for European vanilla options using analytical formulae. More... | |

| class | AnalyticEuropeanMargrabeEngine |

| Analytic engine for European Margrabe option. More... | |

| class | AnalyticGJRGARCHEngine |

| GJR-GARCH(1,1) engine. More... | |

| class | AnalyticH1HWEngine |

| Analytic Heston-Hull-White engine based on the H1-HW approximation. More... | |

| class | AnalyticHaganPricer |

| CMS-coupon pricer. More... | |

| class | AnalyticHestonEngine |

| analytic Heston-model engine based on Fourier transform More... | |

| class | AnalyticHestonForwardEuropeanEngine |

| Analytic Heston engine incl. stochastic interest rates. More... | |

| class | AnalyticHestonHullWhiteEngine |

| Analytic Heston engine incl. stochastic interest rates. More... | |

| class | AnalyticHolderExtensibleOptionEngine |

| Analytic enging for holder-extensible options. More... | |

| class | AnalyticPartialTimeBarrierOptionEngine |

| analytic engine for partial-time barrier options. More... | |

| class | AnalyticPDFHestonEngine |

| Analytic engine for arbitrary European payoffs under the Heston model. More... | |

| class | AnalyticPerformanceEngine |

| Pricing engine for performance options using analytical formulae. More... | |

| class | AnalyticPTDHestonEngine |

| analytic piecewise constant time dependent Heston-model engine More... | |

| class | AnalyticSimpleChooserEngine |

| Pricing engine for European simple chooser option. More... | |

| class | AnalyticTwoAssetBarrierEngine |

| Analytic engine for barrier option on two assets. More... | |

| class | AnalyticTwoAssetCorrelationEngine |

| Analytic two-asset correlation option engine. More... | |

| class | AnalyticWriterExtensibleOptionEngine |

| Analytic engine for writer-extensible options. More... | |

| class | AndreasenHugeLocalVolAdapter |

| class | AndreasenHugeVolatilityAdapter |

| class | AndreasenHugeVolatilityInterpl |

| Calibration of a local volatility surface to a sparse grid of options. More... | |

| class | AOACurrency |

| class | Aonia |

| Aonia index More... | |

| class | Argentina |

| Argentinian calendars. More... | |

| class | ArithmeticAPOHestonPathPricer |

| class | ArithmeticAPOPathPricer |

| class | ArithmeticASOPathPricer |

| class | ArithmeticAveragedOvernightIndexedCouponPricer |

| class | ArithmeticAverageOIS |

| class | ArithmeticOISRateHelper |

| class | ArmijoLineSearch |

| Armijo line search. More... | |

| class | Array |

| 1-D array used in linear algebra. More... | |

| class | ARSCurrency |

| Argentinian peso. More... | |

| class | AssetOrNothingPayoff |

| Binary asset-or-nothing payoff. More... | |

| class | AssetSwap |

| Bullet bond vs Libor swap. More... | |

| class | AssetSwapHelper |

| struct | ASX |

| Main cycle of the Australian Securities Exchange (a.k.a. ASX) months. More... | |

| class | AtmAdjustedSmileSection |

| class | AtmSmileSection |

| struct | AtomicDefault |

| Atomic (single contractual event) default events. More... | |

| class | ATSCurrency |

| Austrian shilling. More... | |

| class | AUCPI |

| AU CPI index (either quarterly or annual) More... | |

| class | AUDCurrency |

| Australian dollar. More... | |

| class | AUDLibor |

| AUD LIBOR rate More... | |

| class | Australia |

| Australian calendar. More... | |

| class | AustraliaRegion |

| Australia as geographical/economic region. More... | |

| class | Austria |

| Austrian calendars. More... | |

| struct | Average |

| Placeholder for enumerated averaging types. More... | |

| class | AverageBasketPayoff |

| class | AverageBMACoupon |

| Average BMA coupon. More... | |

| class | AverageBMALeg |

| helper class building a sequence of average BMA coupons More... | |

| class | AveragingMultipleResetsPricer |

| class | BachelierCapFloorEngine |

| Bachelier-Black-formula cap/floor engine. More... | |

| class | BachelierSwaptionEngine |

| Normal Bachelier-formula swaption engine. More... | |

| class | BachelierYoYInflationCouponPricer |

| Bachelier-formula pricer for capped/floored yoy inflation coupons. More... | |

| class | BackwardFlat |

| Backward-flat interpolation factory and traits. More... | |

| class | BackwardFlatInterpolation |

| Backward-flat interpolation between discrete points. More... | |

| class | BackwardflatLinear |

| class | BackwardflatLinearInterpolation |

| class | BankruptcyEvent |

| class | BaroneAdesiWhaleyApproximationEngine |

| Barone-Adesi and Whaley pricing engine for American options (1987) More... | |

| class | BarrelUnitOfMeasure |

| struct | Barrier |

| Placeholder for enumerated barrier types. More... | |

| class | BarrierOption |

| Barrier option on a single asset. More... | |

| class | BarrierPathPricer |

| class | BaseCorrelationLossModel |

| class | BaseCorrelationTermStructure |

| class | BasisIncompleteOrdered |

| class | Basket |

| class | BasketGeneratingEngine |

| class | BasketOption |

| Basket option on a number of assets. More... | |

| class | BasketPayoff |

| class | BatesDetJumpEngine |

| class | BatesDetJumpModel |

| class | BatesDoubleExpDetJumpEngine |

| class | BatesDoubleExpDetJumpModel |

| class | BatesDoubleExpEngine |

| class | BatesDoubleExpModel |

| class | BatesEngine |

| Bates model engines based on Fourier transform. More... | |

| class | BatesModel |

| Bates stochastic-volatility model. More... | |

| class | BatesProcess |

| Square-root stochastic-volatility Bates process. More... | |

| class | Bbsw |

| Bbsw index More... | |

| class | Bbsw1M |

| 1-month Bbsw index More... | |

| class | Bbsw2M |

| 2-months Bbsw index More... | |

| class | Bbsw3M |

| 3-months Bbsw index More... | |

| class | Bbsw4M |

| 4-months Bbsw index More... | |

| class | Bbsw5M |

| 5-months Bbsw index More... | |

| class | Bbsw6M |

| 6-months Bbsw index More... | |

| class | BCHCurrency |

| Bitcoin Cash. More... | |

| class | BDTCurrency |

| Bangladesh taka. More... | |

| class | BEFCurrency |

| Belgian franc. More... | |

| class | BermudanExercise |

| Bermudan exercise. More... | |

| class | BermudanSwaptionExerciseValue |

| class | BernsteinPolynomial |

| class of Bernstein polynomials More... | |

| class | BespokeCalendar |

| Bespoke calendar. More... | |

| class | BetaRisk |

| class | BetaRiskSimulation |

| class | BFGS |

| Broyden-Fletcher-Goldfarb-Shanno algorithm. More... | |

| class | BGLCurrency |

| Bulgarian lev. More... | |

| class | BGNCurrency |

| Bulgarian lev. More... | |

| class | BHDCurrency |

| Bahraini dinar. More... | |

| class | BiasedBarrierPathPricer |

| class | Bibor |

| Bibor index More... | |

| class | Bibor1M |

| 1-month Bibor index More... | |

| class | Bibor1Y |

| 1-year Bibor index More... | |

| class | Bibor2M |

| 2-months Bibor index More... | |

| class | Bibor3M |

| 3-months Bibor index More... | |

| class | Bibor6M |

| 6-months Bibor index More... | |

| class | Bibor9M |

| class | BiborSW |

| 1-week Bibor index More... | |

| class | BiCGstab |

| struct | BiCGStabResult |

| class | Bicubic |

| bicubic-spline-interpolation factory More... | |

| class | BicubicSpline |

| bicubic-spline interpolation between discrete points More... | |

| class | Bilinear |

| bilinear-interpolation factory More... | |

| class | BilinearInterpolation |

| bilinear interpolation between discrete points More... | |

| class | BinomialBarrierEngine |

| Pricing engine for barrier options using binomial trees. More... | |

| class | BinomialConvertibleEngine |

| Binomial Tsiveriotis-Fernandes engine for convertible bonds. More... | |

| class | BinomialDistribution |

| Binomial probability distribution function. More... | |

| class | BinomialDoubleBarrierEngine |

| Pricing engine for double barrier options using binomial trees. More... | |

| class | BinomialLossModel |

| class | BinomialProbabilityOfAtLeastNEvents |

| Probability of at least N events. More... | |

| class | BinomialTree |

| Binomial tree base class. More... | |

| class | BinomialVanillaEngine |

| Pricing engine for vanilla options using binomial trees. More... | |

| class | Bisection |

| Bisection 1-D solver More... | |

| class | BivariateCumulativeNormalDistributionDr78 |

| Cumulative bivariate normal distribution function. More... | |

| class | BivariateCumulativeNormalDistributionWe04DP |

| Cumulative bivariate normal distibution function (West 2004) More... | |

| class | BivariateCumulativeStudentDistribution |

| Cumulative Student t-distribution. More... | |

| class | BjerksundStenslandApproximationEngine |

| Bjerksund and Stensland pricing engine for American options (1993) More... | |

| class | BjerksundStenslandSpreadEngine |

| Pricing engine for spread option on two futures. More... | |

| class | Bkbm |

| Bkbm index More... | |

| class | Bkbm1M |

| 1-month Bkbm index More... | |

| class | Bkbm2M |

| 2-months Bkbm index More... | |

| class | Bkbm3M |

| 3-months Bkbm index More... | |

| class | Bkbm4M |

| 4-months Bkbm index More... | |

| class | Bkbm5M |

| 5-months Bkbm index More... | |

| class | Bkbm6M |

| 6-months Bkbm index More... | |

| class | BlackAtmVolCurve |

| Black at-the-money (no-smile) volatility curve. More... | |

| class | BlackCalculator |

| Black 1976 calculator class. More... | |

| class | BlackCalibrationHelper |

| liquid Black76 market instrument used during calibration More... | |

| class | BlackCallableFixedRateBondEngine |

| Black-formula callable fixed rate bond engine. More... | |

| class | BlackCallableZeroCouponBondEngine |

| Black-formula callable zero coupon bond engine. More... | |

| class | BlackCapFloorEngine |

| Black-formula cap/floor engine. More... | |

| class | BlackCdsOptionEngine |

| Black-formula CDS-option engine. More... | |

| class | BlackConstantVol |

| Constant Black volatility, no time-strike dependence. More... | |

| class | BlackDeltaCalculator |

| Black delta calculator class. More... | |

| class | BlackDeltaPremiumAdjustedMaxStrikeClass |

| class | BlackDeltaPremiumAdjustedSolverClass |

| class | BlackIborCouponPricer |

| class | BlackIborQuantoCouponPricer |

| class | BlackKarasinski |

| Standard Black-Karasinski model class. More... | |

| class | BlackProcess |

| Black (1976) stochastic process. More... | |

| class | BlackScholesCalculator |

| Black-Scholes 1973 calculator class. More... | |

| class | BlackScholesLattice |

| Simple binomial lattice approximating the Black-Scholes model. More... | |

| class | BlackScholesMertonProcess |

| Merton (1973) extension to the Black-Scholes stochastic process. More... | |

| class | BlackScholesProcess |

| Black-Scholes (1973) stochastic process. More... | |

| class | BlackSwaptionEngine |

| Shifted Lognormal Black-formula swaption engine. More... | |

| class | BlackVarianceCurve |

| Black volatility curve modelled as variance curve. More... | |

| class | BlackVarianceSurface |

| Black volatility surface modelled as variance surface. More... | |

| class | BlackVarianceTermStructure |

| Black variance term structure. More... | |

| class | BlackVolatilityTermStructure |

| Black-volatility term structure. More... | |

| class | BlackVolSurface |

| Black volatility (smile) surface. More... | |

| class | BlackVolTermStructure |

| Black-volatility term structure. More... | |

| class | BlackYoYInflationCouponPricer |

| Black-formula pricer for capped/floored yoy inflation coupons. More... | |

| class | BMAIndex |

| Bond Market Association index. More... | |

| class | BMASwap |

| swap paying Libor against BMA coupons More... | |

| class | BMASwapRateHelper |

| Rate helper for bootstrapping over BMA swap rates. More... | |

| class | Bond |

| Base bond class. More... | |

| class | BondForward |

| Forward contract on a bond More... | |

| struct | BondFunctions |

| Bond adapters of CashFlows functions. More... | |

| class | BondHelper |

| Bond helper for curve bootstrap. More... | |

| class | BootstrapError |

| bootstrap error More... | |

| class | BootstrapHelper |

| Base helper class for bootstrapping. More... | |

| class | Botswana |

| Botswana calendar. More... | |

| class | BoundaryCondition |

| Abstract boundary condition class for finite difference problems. More... | |

| class | BoundaryConditionSchemeHelper |

| class | BoundaryConstraint |

| Constraint imposing all arguments to be in [low,high] More... | |

| class | BoxMullerGaussianRng |

| Gaussian random number generator. More... | |

| class | Brazil |

| Brazilian calendar. More... | |

| class | Brent |

| Brent 1-D solver More... | |

| class | BRLCurrency |

| Brazilian real. More... | |

| class | BrownianBridge |

| Builds Wiener process paths using Gaussian variates. More... | |

| class | BrownianGenerator |

| class | BrownianGeneratorFactory |

| class | BSMOperator |

| class | BSMRNDCalculator |

| class | BSpline |

| B-spline basis functions. More... | |

| class | BTCCurrency |

| Bitcoin. More... | |

| class | BTP |

| Italian BTP (Buono Poliennali del Tesoro) fixed rate bond. More... | |

| class | Burley2020SobolBrownianBridgeRsg |

| class | Burley2020SobolBrownianGenerator |

| class | Burley2020SobolBrownianGeneratorFactory |

| class | Burley2020SobolRsg |

| Scrambled sobol sequence according to Burley, 2020. More... | |

| class | Business252 |

| Business/252 day count convention. More... | |

| class | BWPCurrency |

| class | BYRCurrency |

| Belarussian ruble. More... | |

| class | CADCurrency |

| Canadian dollar. More... | |

| class | CADLibor |

| CAD LIBOR rate More... | |

| class | CADLiborON |

| Overnight CAD Libor index. More... | |

| class | Calendar |

| calendar class More... | |

| class | CalibratedModel |

| Calibrated model class. More... | |

| class | CalibrationHelper |

| abstract base class for calibration helpers More... | |

| class | Callability |

| instrument callability More... | |

| class | CallableBond |

| Callable bond base class. More... | |

| class | CallableBondConstantVolatility |

| Constant callable-bond volatility, no time-strike dependence. More... | |

| class | CallableBondVolatilityStructure |

| Callable-bond volatility structure. More... | |

| class | CallableFixedRateBond |

| callable/puttable fixed rate bond More... | |

| class | CallableZeroCouponBond |

| callable/puttable zero coupon bond More... | |

| class | CallSpecifiedMultiProduct |

| class | CallSpecifiedPathwiseMultiProduct |

| class | Canada |

| Canadian calendar. More... | |

| class | Cap |

| Concrete cap class. More... | |

| class | CapFloor |

| Base class for cap-like instruments. More... | |

| class | CapFloorTermVolatilityStructure |

| Cap/floor term-volatility structure. More... | |

| class | CapFloorTermVolCurve |

| Cap/floor at-the-money term-volatility vector. More... | |

| class | CapFloorTermVolSurface |

| Cap/floor smile volatility surface. More... | |

| class | CapHelper |

| calibration helper for ATM cap More... | |

| class | CapletVarianceCurve |

| class | CappedFlooredCmsCoupon |

| class | CappedFlooredCmsSpreadCoupon |

| class | CappedFlooredCoupon |

| Capped and/or floored floating-rate coupon. More... | |

| class | CappedFlooredIborCoupon |

| class | CappedFlooredYoYInflationCoupon |

| Capped or floored inflation coupon. More... | |

| class | CapPseudoDerivative |

| class | CashFlow |

| Base class for cash flows. More... | |

| class | CashFlows |

| cashflow-analysis functions More... | |

| class | CashOrNothingPayoff |

| Binary cash-or-nothing payoff. More... | |

| class | CatBond |

| class | CatRisk |

| class | CatSimulation |

| class | CCTEU |

| class | CDO |

| collateralized debt obligation More... | |

| class | Cdor |

| CDOR rate More... | |

| class | CdsHelper |

| Base class for CDS helpers. More... | |

| class | CdsOption |

| CDS option. More... | |

| class | CeilingTruncation |

| Ceiling truncation. More... | |

| class | CEVCalculator |

| constant elasticity of variance process (absorbing boundary at f=0) More... | |

| class | CEVRNDCalculator |

| constant elasticity of variance process (absorbing boundary at f=0) More... | |

| class | ChebyshevInterpolation |

| class | CHFCurrency |

| Swiss franc. More... | |

| class | CHFLibor |

| CHF LIBOR rate More... | |

| class | ChfLiborSwapIsdaFix |

| ChfLiborSwapIsdaFix index base class More... | |

| class | Chile |

| Chilean calendars. More... | |

| class | China |

| Chinese calendar. More... | |

| class | ChoiAsianEngine |

| Pricing engine for arithmetic Asian options. More... | |

| class | ChoiBasketEngine |

| Pricing engine for basket option on multiple underlyings. More... | |

| class | Claim |

| Claim associated to a default event. More... | |

| class | ClaytonCopula |

| Clayton copula. More... | |

| class | ClaytonCopulaRng |

| Clayton copula random-number generator. More... | |

| class | CLFCurrency |

| Unidad de Fomento (funds code) More... | |

| class | CLGaussianRng |

| Gaussian random number generator. More... | |

| class | CliquetOption |

| cliquet (Ratchet) option More... | |

| class | Clone |

| cloning proxy to an underlying object More... | |

| class | ClosestRounding |

| Closest rounding. More... | |

| class | CLPCurrency |

| Chilean peso. More... | |

| class | ClubsTopology |

| Clubs Topology. More... | |

| class | CmsCoupon |

| CMS coupon class. More... | |

| class | CmsCouponPricer |

| base pricer for vanilla CMS coupons More... | |

| class | CmsLeg |

| helper class building a sequence of capped/floored cms-rate coupons More... | |

| class | CmsMarket |

| set of CMS quotes More... | |

| class | CmsMarketCalibration |

| class | CMSMMDriftCalculator |

| Drift computation for CMS market models. More... | |

| class | CmsRateBond |

| CMS-rate bond. More... | |

| class | CmsSpreadCoupon |

| CMS spread coupon class. More... | |

| class | CmsSpreadCouponPricer |

| base pricer for vanilla CMS spread coupons More... | |

| class | CmsSpreadLeg |

| helper class building a sequence of capped/floored cms-spread-rate coupons More... | |

| class | CMSwapCurveState |

| Curve state for constant-maturity-swap market models More... | |

| class | CNHCurrency |

| Chinese yuan (Hong Kong) More... | |

| class | CNYCurrency |

| Chinese yuan. More... | |

| class | Collar |

| Concrete collar class. More... | |

| class | Commodity |

| Commodity base class. More... | |

| class | CommodityCashFlow |

| class | CommodityCurve |

| Commodity term structure. More... | |

| class | CommodityIndex |

| base class for commodity indexes More... | |

| class | CommodityPricingHelper |

| commodity index helper More... | |

| class | CommoditySettings |

| global repository for run-time library settings More... | |

| class | CommodityType |

| commodity type More... | |

| class | CommodityUnitCost |

| class | ComplexChooserOption |

| Complex chooser option. More... | |

| class | CompositeConstraint |

| Constraint enforcing both given sub-constraints More... | |

| class | CompositeInstrument |

| Composite instrument More... | |

| class | CompositeQuote |

| market element whose value depends on two other market element More... | |

| class | CompositeZeroYieldStructure |

| class | CompoundingMultipleResetsPricer |

| class | CompoundingOvernightIndexedCouponPricer |

| CompoudAveragedOvernightIndexedCouponPricer pricer. More... | |

| class | CompoundOption |

| Compound option (i.e., option on option) on a single asset. More... | |

| class | Concentrating1dMesher |

| class | ConjugateGradient |

| Multi-dimensional Conjugate Gradient class. More... | |

| class | ConstantCapFloorTermVolatility |

| Constant caplet volatility, no time-strike dependence. More... | |

| class | ConstantCPIVolatility |

| Constant surface, no K or T dependence. More... | |

| class | ConstantEstimator |

| Constant-estimator volatility model. More... | |

| class | ConstantLossLatentmodel |

| class | ConstantLossModel |

| class | ConstantOptionletVolatility |

| Constant caplet volatility, no time-strike dependence. More... | |

| class | ConstantParameter |

| Standard constant parameter \( a(t) = a \). More... | |

| class | ConstantRecoveryModel |

| class | ConstantSwaptionVolatility |

| Constant swaption volatility, no time-strike dependence. More... | |

| class | ConstantYoYOptionletVolatility |

| Constant surface, no K or T dependence. More... | |

| class | ConstNotionalCrossCurrencyBasisSwapRateHelper |

| Rate helper for bootstrapping over constant-notional cross-currency basis swaps. More... | |

| class | ConstrainedEvolver |

| Constrained market-model evolver. More... | |

| class | Constraint |

| Base constraint class. More... | |

| class | ContinuousArithmeticAsianLevyEngine |

| Levy engine for continuously averaged arithmetic Asian options. More... | |

| class | ContinuousArithmeticAsianVecerEngine |

| Vecer engine for continuous-avaeraging Asian options. More... | |

| class | ContinuousAveragingAsianOption |

| Continuous-averaging Asian option. More... | |

| class | ContinuousFixedLookbackOption |

| Continuous-fixed lookback option. More... | |

| class | ContinuousFloatingLookbackOption |

| Continuous-floating lookback option. More... | |

| class | ContinuousPartialFixedLookbackOption |

| Continuous-partial-fixed lookback option. More... | |

| class | ContinuousPartialFloatingLookbackOption |

| Continuous-partial-floating lookback option. More... | |

| class | ConvergenceStatistics |

| statistics class with convergence table More... | |

| class | ConvertibleBond |

| base class for convertible bonds More... | |

| class | ConvertibleFixedCouponBond |

| convertible fixed-coupon bond More... | |

| class | ConvertibleFloatingRateBond |

| convertible floating-rate bond More... | |

| class | ConvertibleZeroCouponBond |

| convertible zero-coupon bond More... | |

| class | ConvexMonotone |

| Convex-monotone interpolation factory and traits. More... | |

| class | ConvexMonotoneInterpolation |

| Convex monotone yield-curve interpolation method. More... | |

| class | COPCurrency |

| Colombian peso. More... | |

| class | Corra |

| class | CorrelationTermStructure |

| class | COSHestonEngine |

| COS-method Heston engine based on efficient Fourier series expansions. More... | |

| class | CostFunction |

| Cost function abstract class for optimization problem. More... | |

| class | CoterminalSwapCurveState |

| Curve state for coterminal-swap market models More... | |

| class | CotSwapFromFwdCorrelation |

| class | CotSwapToFwdAdapter |

| class | CotSwapToFwdAdapterFactory |

| class | COUCurrency |

| Unidad de Valor Real. More... | |

| class | CounterpartyAdjSwapEngine |

| class | Coupon |

| coupon accruing over a fixed period More... | |

| class | CovarianceDecomposition |

| Covariance decomposition into correlation and variances. More... | |

| class | CoxIngersollRoss |

| Cox-Ingersoll-Ross model class. More... | |

| class | CoxIngersollRossProcess |

| CoxIngersollRoss process class. More... | |

| class | CoxRossRubinstein |

| Cox-Ross-Rubinstein (multiplicative) equal jumps binomial tree. More... | |

| struct | CPI |

| class | CPIBond |

| class | CPIBondHelper |

| CPI bond helper for curve bootstrap. More... | |

| class | CPICapFloor |

| CPI cap or floor. More... | |

| class | CPICapFloorTermPriceSurface |

| Provides cpi cap/floor prices by interpolation and put/call parity (not cap/floor/swap* parity). More... | |

| class | CPICashFlow |

| Cash flow paying the performance of a CPI (zero inflation) index. More... | |

| class | CPICoupon |

| Coupon paying the performance of a CPI (zero inflation) index More... | |

| class | CPICouponPricer |

| base pricer for capped/floored CPI coupons N.B. vol-dependent parts are a TODO More... | |

| class | CPILeg |

| Helper class building a sequence of capped/floored CPI coupons. More... | |

| class | CPISwap |

| zero-inflation-indexed swap, More... | |

| class | CPIVolatilitySurface |

| zero inflation (i.e. CPI/RPI/HICP/etc.) volatility structures More... | |

| class | CraigSneydScheme |

| class | CrankNicolson |

| Crank-Nicolson scheme for finite difference methods. More... | |

| class | CrankNicolsonScheme |

| class | CreditDefaultSwap |

| Credit default swap. More... | |

| class | CreditRiskPlus |

| class | CrossCurrencyBasisSwapRateHelperBase |

| Base class for cross-currency basis swap rate helpers. More... | |

| class | CTSMMCapletAlphaFormCalibration |

| class | CTSMMCapletCalibration |

| class | CTSMMCapletMaxHomogeneityCalibration |

| class | CTSMMCapletOriginalCalibration |

| class | Cubic |

| Cubic interpolation factory and traits More... | |

| class | CubicBSplinesFitting |

| CubicSpline B-splines fitting method. More... | |

| class | CubicInterpolation |

| Cubic interpolation between discrete points. More... | |

| class | CubicNaturalSpline |

| class | CubicSplineOvershootingMinimization1 |

| class | CubicSplineOvershootingMinimization2 |

| class | CumulativeBehrensFisher |

| Cumulative (generalized) BehrensFisher distribution. More... | |

| class | CumulativeBinomialDistribution |

| Cumulative binomial distribution function. More... | |

| class | CumulativeChiSquareDistribution |

| class | CumulativeGammaDistribution |

| class | CumulativeNormalDistribution |

| Cumulative normal distribution function. More... | |

| class | CumulativePoissonDistribution |

| Cumulative Poisson distribution function. More... | |

| class | CumulativeStudentDistribution |

| Cumulative Student t-distribution. More... | |

| class | CuriouslyRecurringTemplate |

| Support for the curiously recurring template pattern. More... | |

| class | Currency |

| Currency specification More... | |

| class | CurveState |

| Curve state for market-model simulations More... | |

| class | CustomIborIndex |

| class | CustomRegion |

| Custom geographical/economic region. More... | |

| class | CYPCurrency |

| Cyprus pound. More... | |

| class | CzechRepublic |

| Czech calendars. More... | |

| class | CZKCurrency |

| Czech koruna. More... | |

| class | DailyTenorCHFLibor |

| base class for the one day deposit BBA CHF LIBOR indexes More... | |

| class | DailyTenorEURLibor |

| base class for the one day deposit ICE EUR LIBOR indexes More... | |

| class | DailyTenorGBPLibor |

| Base class for the one day deposit ICE GBP LIBOR indexes. More... | |

| class | DailyTenorJPYLibor |

| base class for the one day deposit ICE JPY LIBOR indexes More... | |

| class | DailyTenorLibor |

| base class for all O/N-S/N BBA LIBOR indexes but the EUR ones More... | |

| class | DailyTenorUSDLibor |

| base class for the one day deposit ICE USD LIBOR indexes More... | |

| class | DASHCurrency |

| Dash coin. More... | |

| class | Date |

| Concrete date class. More... | |

| class | DatedOISRateHelper |

| struct | DateGeneration |

| Date-generation rule. More... | |

| class | DateInterval |

| Date interval described by a number of a given time unit. More... | |

| class | DateParser |

| class | DayCounter |

| day counter class More... | |

| class | DecreasingGaussianWalk |

| Decreasing Random Walk. More... | |

| class | DecreasingInertia |

| Decreasing Inertia. More... | |

| struct | Default |

| struct | DefaultDensity |

| Default-density-curve traits. More... | |

| class | DefaultDensityStructure |

| Default-density term structure. More... | |

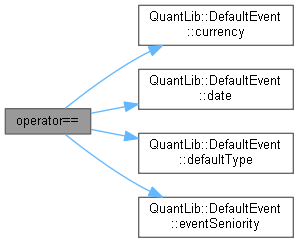

| class | DefaultEvent |

| Credit event on a bond of a certain seniority(ies)/currency. More... | |

| class | DefaultLatentModel |

| Default event Latent Model. More... | |

| class | DefaultLogCubic |

| class | DefaultLogMixedLinearCubic |

| class | DefaultLossModel |

| class | DefaultProbabilityTermStructure |

| Default probability term structure. More... | |

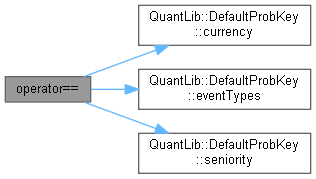

| class | DefaultProbKey |

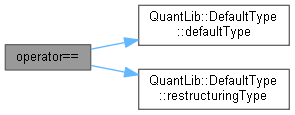

| class | DefaultType |

| Atomic credit-event type. More... | |

| class | DeltaVolQuote |

| Class for the quotation of delta vs vol. More... | |

| class | DEMCurrency |

| Deutsche mark. More... | |

| class | DengLiZhouBasketEngine |

| Pricing engine for basket option on multiple underlyings. More... | |

| class | Denmark |

| Danish calendar. More... | |

| class | DepositRateHelper |

| Rate helper for bootstrapping over deposit rates. More... | |

| class | DerivedQuote |

| market quote whose value depends on another quote More... | |

| class | Destr |

| Destr (Denmark Short-Term Rate) index. More... | |

| class | DifferentialEvolution |

| Differential Evolution configuration object. More... | |

| class | DigitalCmsCoupon |

| Cms-rate coupon with digital digital call/put option. More... | |

| class | DigitalCmsLeg |

| helper class building a sequence of digital ibor-rate coupons More... | |

| class | DigitalCmsSpreadCoupon |

| Cms-spread-rate coupon with digital digital call/put option. More... | |

| class | DigitalCmsSpreadLeg |

| helper class building a sequence of digital ibor-rate coupons More... | |

| class | DigitalCoupon |

| Digital-payoff coupon. More... | |

| class | DigitalIborCoupon |

| Ibor rate coupon with digital digital call/put option. More... | |

| class | DigitalIborLeg |

| helper class building a sequence of digital ibor-rate coupons More... | |

| class | DigitalNotionalRisk |

| class | DigitalPathPricer |

| class | DigitalReplication |

| class | DirichletBC |

| Dirichlet boundary condition (i.e., constant value) More... | |

| struct | Discount |

| Discount-curve traits. More... | |

| class | DiscountingBondEngine |

| Discounting engine for bonds. More... | |

| class | DiscountingSwapEngine |

| Discounting engine for swaps. More... | |

| class | DiscrepancyStatistics |

| Statistic tool for sequences with discrepancy calculation. More... | |

| class | DiscreteAveragingAsianOption |

| Discrete-averaging Asian option. More... | |

| class | DiscreteSimpsonIntegral |

| class | DiscreteSimpsonIntegrator |

| class | DiscreteTrapezoidIntegral |

| class | DiscreteTrapezoidIntegrator |

| class | DiscretizedAsset |

| Discretized asset class used by numerical methods. More... | |

| class | DiscretizedBarrierOption |

| class | DiscretizedCallableFixedRateBond |

| class | DiscretizedCapFloor |

| class | DiscretizedConvertible |

| class | DiscretizedDermanKaniBarrierOption |

| class | DiscretizedDermanKaniDoubleBarrierOption |

| Derman-Kani-Ergener-Bardhan discretized option helper class. More... | |

| class | DiscretizedDiscountBond |

| Useful discretized discount bond asset. More... | |

| class | DiscretizedDoubleBarrierOption |

| Standard discretized option helper class. More... | |

| class | DiscretizedOption |

| Discretized option on a given asset. More... | |

| class | DiscretizedSwap |

| class | DiscretizedSwaption |

| class | DiscretizedVanillaOption |

| class | Distribution |

| class | DistributionRandomWalk |

| Distribution Walk. More... | |

| class | Dividend |

| Predetermined cash flow. More... | |

| class | DKKCurrency |

| Danish krone. More... | |

| class | DKKLibor |

| DKK LIBOR rate More... | |

| class | DMinus |

| \( D_{-} \) matricial representation More... | |

| struct | DoubleBarrier |

| Placeholder for enumerated barrier types. More... | |

| class | DoubleBarrierOption |

| Double Barrier option on a single asset. More... | |

| class | DoubleBarrierPathPricer |

| class | DoubleStickyRatchetPayoff |

| Intermediate class for single/double sticky/ratchet payoffs. More... | |

| class | DoublingConvergenceSteps |

| class | DouglasScheme |

| class | DownRounding |

| Down-rounding. More... | |

| class | DPlus |

| \( D_{+} \) matricial representation More... | |

| class | DPlusDMinus |

| \( D_{+}D_{-} \) matricial representation More... | |

| struct | Duration |

| duration type More... | |

| class | DynProgVPPIntrinsicValueEngine |

| class | DZero |

| \( D_{0} \) matricial representation More... | |

| struct | earlier_than |

| compare two objects by date More... | |

| struct | earlier_than< CashFlow > |

| struct | earlier_than< DefaultEvent > |

| struct | earlier_than< ext::shared_ptr< T > > |

| class | EarlyExercise |

| Early-exercise base class. More... | |

| class | EarlyExercisePathPricer |

| base class for early exercise path pricers More... | |

| class | EarlyExerciseTraits |

| class | EarlyExerciseTraits< MultiPath > |

| class | EarlyExerciseTraits< Path > |

| struct | ECB |

| European Central Bank reserve maintenance dates. More... | |

| class | EEKCurrency |

| Estonian kroon. More... | |

| class | EGPCurrency |

| Egyptian pound. More... | |

| class | EndCriteria |

| Criteria to end optimization process: More... | |

| class | EndEulerDiscretization |

| Euler end-point discretization for stochastic processes. More... | |

| class | EnergyBasisSwap |

| Energy basis swap. More... | |

| class | EnergyCommodity |

| Energy commodity class. More... | |

| struct | EnergyDailyPosition |

| class | EnergyFuture |

| Energy future. More... | |

| class | EnergySwap |

| class | EnergyVanillaSwap |

| Vanilla energy swap. More... | |

| class | Eonia |

| Eonia (Euro Overnight Index Average) rate fixed by the ECB. More... | |

| class | EqualJumpsBinomialTree |

| Base class for equal jumps binomial tree. More... | |

| class | EqualProbabilitiesBinomialTree |

| Base class for equal probabilities binomial tree. More... | |

| class | EquityCashFlow |

| class | EquityCashFlowPricer |

| class | EquityFXVolSurface |

| Equity/FX volatility (smile) surface. More... | |

| class | EquityIndex |

| Base class for equity indexes. More... | |

| class | EquityQuantoCashFlowPricer |

| class | EquityTotalReturnSwap |

| Equity total return swap. More... | |

| class | Error |

| Base error class. More... | |

| class | ErrorFunction |

| Error function More... | |

| class | EscrowedDividendAdjustment |

| class | ESPCurrency |

| Spanish peseta. More... | |

| class | Estr |

| ESTR (Euro Short-Term Rate) rate fixed by the ECB. More... | |

| class | ETBCurrency |

| class | ETCCurrency |

| Ethereum Classic. More... | |

| class | ETHCurrency |

| Ethereum. More... | |

| class | EUHICP |

| EU HICP index. More... | |

| class | EUHICPXT |

| EU HICPXT index. More... | |

| class | EulerDiscretization |

| Euler discretization for stochastic processes. More... | |

| class | EURCurrency |

| European Euro. More... | |

| class | EURegion |

| European Union as geographical/economic region. More... | |

| class | Euribor |

| Euribor index More... | |

| class | Euribor10M |

| class | Euribor11M |

| class | Euribor1M |

| 1-month Euribor index More... | |

| class | Euribor1W |

| 1-week Euribor index More... | |

| class | Euribor1Y |

| 1-year Euribor index More... | |

| class | Euribor2M |

| class | Euribor2W |

| class | Euribor365 |

| Actual/365 Euribor index. More... | |

| class | Euribor365_10M |

| class | Euribor365_11M |

| class | Euribor365_1M |

| class | Euribor365_1Y |

| class | Euribor365_2M |

| class | Euribor365_2W |

| class | Euribor365_3M |

| class | Euribor365_3W |

| class | Euribor365_4M |

| class | Euribor365_5M |

| class | Euribor365_6M |

| class | Euribor365_7M |

| class | Euribor365_8M |

| class | Euribor365_9M |

| class | Euribor365_SW |

| class | Euribor3M |

| 3-months Euribor index More... | |

| class | Euribor3W |

| class | Euribor4M |

| class | Euribor5M |

| class | Euribor6M |

| 6-months Euribor index More... | |

| class | Euribor7M |

| class | Euribor8M |

| class | Euribor9M |

| class | EuriborSwapIfrFix |

| EuriborSwapIfrFix index base class More... | |

| class | EuriborSwapIsdaFixA |

| EuriborSwapIsdaFixA index base class More... | |

| class | EuriborSwapIsdaFixB |

| EuriborSwapIsdaFixB index base class More... | |

| class | EURLibor |

| base class for all ICE EUR LIBOR indexes but the O/N More... | |

| class | EURLibor10M |

| class | EURLibor11M |

| class | EURLibor1M |

| 1-month EUR Libor index More... | |

| class | EURLibor1Y |

| 1-year EUR Libor index More... | |

| class | EURLibor2M |

| class | EURLibor2W |

| class | EURLibor3M |

| 3-months EUR Libor index More... | |

| class | EURLibor4M |

| class | EURLibor5M |

| class | EURLibor6M |

| 6-months EUR Libor index More... | |

| class | EURLibor7M |

| class | EURLibor8M |

| class | EURLibor9M |

| class | EURLiborON |

| Overnight EUR Libor index. More... | |

| class | EURLiborSW |

| class | EurLiborSwapIfrFix |

| EurLiborSwapIfrFix index base class More... | |

| class | EurLiborSwapIsdaFixA |

| EurLiborSwapIsdaFixA index base class More... | |

| class | EurLiborSwapIsdaFixB |

| EurLiborSwapIsdaFixB index base class More... | |

| class | EurodollarFuturesImpliedStdDevQuote |

| quote for the Eurodollar-future implied standard deviation More... | |

| class | EuropeanExercise |

| European exercise. More... | |

| class | EuropeanGJRGARCHPathPricer |

| class | EuropeanHestonPathPricer |

| class | EuropeanMultiPathPricer |

| class | EuropeanOption |

| European option on a single asset. More... | |

| class | EuropeanPathMultiPathPricer |

| class | EuropeanPathPricer |

| class | Event |

| Base class for event. More... | |

| class | EventPaymentOffset |

| class | EventSet |

| class | EventSetSimulation |

| class | EverestMultiPathPricer |

| class | EverestOption |

| class | EvolutionDescription |

| Market-model evolution description. More... | |

| class | ExchangeContract |

| class | ExchangeRate |

| exchange rate between two currencies More... | |

| class | ExchangeRateManager |

| exchange-rate repository More... | |

| class | Exercise |

| Base exercise class. More... | |

| class | ExerciseAdapter |

| class | ExerciseStrategy |

| class | ExplicitEuler |

| Forward Euler scheme for finite difference methods More... | |

| class | ExplicitEulerScheme |

| class | ExponentialFittingHestonEngine |

| analytic Heston-model engine based on More... | |

| class | ExponentialForwardCorrelation |

| class | ExponentialIntensity |

| Exponential Intensity. More... | |

| class | ExponentialJump1dMesher |

| class | ExponentialSplinesFitting |

| Exponential-splines fitting method. More... | |

| class | ExpSinhIntegral |

| class | ExtendedAdditiveEQPBinomialTree |

| Additive equal probabilities binomial tree. More... | |

| class | ExtendedBinomialTree |

| Binomial tree base class. More... | |

| class | ExtendedBlackScholesMertonProcess |

| experimental Black-Scholes-Merton stochastic process More... | |

| class | ExtendedBlackVarianceCurve |

| Black volatility curve modelled as variance curve. More... | |

| class | ExtendedBlackVarianceSurface |

| Black volatility surface modelled as variance surface. More... | |

| class | ExtendedCoxIngersollRoss |

| Extended Cox-Ingersoll-Ross model class. More... | |

| class | ExtendedCoxRossRubinstein |

| Cox-Ross-Rubinstein (multiplicative) equal jumps binomial tree. More... | |

| class | ExtendedEqualJumpsBinomialTree |

| Base class for equal jumps binomial tree. More... | |

| class | ExtendedEqualProbabilitiesBinomialTree |

| Base class for equal probabilities binomial tree. More... | |

| class | ExtendedJarrowRudd |

| Jarrow-Rudd (multiplicative) equal probabilities binomial tree. More... | |

| class | ExtendedJoshi4 |

| class | ExtendedLeisenReimer |

| Leisen & Reimer tree: multiplicative approach. More... | |

| class | ExtendedOrnsteinUhlenbeckProcess |

| Extended Ornstein-Uhlenbeck process class. More... | |

| class | ExtendedTian |

| Tian tree: third moment matching, multiplicative approach More... | |

| class | ExtendedTrigeorgis |

| Trigeorgis (additive equal jumps) binomial tree More... | |

| class | ExtOUWithJumpsProcess |

| class | Extrapolator |

| base class for classes possibly allowing extrapolation More... | |

| class | FaceValueAccrualClaim |

| Claim on the notional of a reference security, including accrual. More... | |

| class | FaceValueClaim |

| Claim on a notional. More... | |

| class | Factorial |

| Factorial numbers calculator More... | |

| class | FactorSpreadedHazardRateCurve |

| Default-probability structure with a multiplicative spread on hazard rates. More... | |

| class | FailureToPay |

| Failure to Pay atomic event type. More... | |

| class | FailureToPayEvent |

| class | FalsePosition |

| False position 1-D solver. More... | |

| class | FarlieGumbelMorgensternCopula |

| Farlie-Gumbel-Morgenstern copula. More... | |

| class | FarlieGumbelMorgensternCopulaRng |

| Farlie-Gumbel-Morgenstern copula random-number generator. More... | |

| class | FastFourierTransform |

| FFT implementation. More... | |

| class | FaureRsg |

| Faure low-discrepancy sequence generator. More... | |

| class | Fd2dBlackScholesVanillaEngine |

| Two dimensional finite-differences Black Scholes vanilla option engine. More... | |

| class | FdBatesVanillaEngine |

| Partial integro finite-differences Bates vanilla option engine. More... | |

| class | FdBlackScholesAsianEngine |

| class | FdBlackScholesBarrierEngine |

| Finite-differences Black/Scholes barrier-option engine. More... | |

| class | FdBlackScholesRebateEngine |

| Finite-differences Black/Scholes barrier-option rebate helper engine. More... | |

| class | FdBlackScholesShoutEngine |

| class | FdBlackScholesVanillaEngine |

| Finite-differences Black Scholes vanilla option engine. More... | |

| class | FdCEVVanillaEngine |

| class | FdCIRVanillaEngine |

| Finite-differences CIR vanilla option engine. More... | |

| class | FdExtOUJumpVanillaEngine |

| class | FdG2SwaptionEngine |

| class | FdHestonBarrierEngine |

| Finite-differences Heston barrier-option engine. More... | |

| class | FdHestonDoubleBarrierEngine |

| Finite-Differences Heston Double Barrier Option engine. More... | |

| class | FdHestonHullWhiteVanillaEngine |

| Finite-differences Heston Hull-White vanilla option engine. More... | |

| class | FdHestonRebateEngine |

| Finite-differences Heston barrier-option rebate helper engine. More... | |

| class | FdHestonVanillaEngine |

| Finite-differences Heston vanilla option engine. More... | |

| class | FdHullWhiteSwaptionEngine |

| class | FdKlugeExtOUSpreadEngine |

| class | Fdm1DimSolver |

| class | Fdm1dMesher |

| class | Fdm2dBlackScholesOp |

| class | Fdm2dBlackScholesSolver |

| class | Fdm2DimSolver |

| class | Fdm3DimSolver |

| class | FdmAffineModelSwapInnerValue |

| class | FdmAffineModelTermStructure |

| class | FdmAmericanStepCondition |

| class | FdmArithmeticAverageCondition |

| class | FdmBackwardSolver |

| class | FdmBatesOp |

| class | FdmBatesSolver |

| class | FdmBermudanStepCondition |

| class | FdmBlackScholesFwdOp |

| class | FdmBlackScholesMesher |

| class | FdmBlackScholesMultiStrikeMesher |

| class | FdmBlackScholesOp |

| class | FdmBlackScholesSolver |

| class | FdmCellAveragingInnerValue |

| class | FdmCEV1dMesher |

| class | FdmCEVOp |

| class | FdmCIREquityPart |

| class | FdmCIRMixedPart |

| class | FdmCIROp |

| class | FdmCIRRatesPart |

| class | FdmCIRSolver |

| class | FdmDirichletBoundary |

| class | FdmDiscountDirichletBoundary |

| class | FdmDividendHandler |

| class | FdmDupire1dOp |

| class | FdmEscrowedLogInnerValueCalculator |

| class | FdmExpExtOUInnerValueCalculator |

| class | FdmExtendedOrnsteinUhlenbeckOp |

| class | FdmExtOUJumpModelInnerValue |

| class | FdmExtOUJumpOp |

| class | FdmExtOUJumpSolver |

| class | FdmG2Op |

| class | FdmG2Solver |

| class | FdmHestonEquityPart |

| class | FdmHestonFwdOp |

| class | FdmHestonGreensFct |

| class | FdmHestonHullWhiteEquityPart |

| class | FdmHestonHullWhiteOp |

| class | FdmHestonHullWhiteSolver |

| class | FdmHestonLocalVolatilityVarianceMesher |

| class | FdmHestonOp |

| class | FdmHestonSolver |

| class | FdmHestonVarianceMesher |

| class | FdmHestonVariancePart |

| class | FdmHullWhiteOp |

| class | FdmHullWhiteSolver |

| class | FdmIndicesOnBoundary |

| class | FdmInnerValueCalculator |

| class | FdmKlugeExtOUOp |

| class | FdmKlugeExtOUSolver |

| class | FdmLinearOp |

| class | FdmLinearOpComposite |

| class | FdmLinearOpIterator |

| class | FdmLinearOpLayout |

| class | FdmLocalVolFwdOp |

| class | FdmLogBasketInnerValue |

| class | FdmLogInnerValue |

| class | FdmMesher |

| class | FdmMesherComposite |

| class | FdmMesherIntegral |

| class | FdmNdimSolver |

| class | FdmOrnsteinUhlenbeckOp |

| class | FdmQuantoHelper |

| class | FdmSabrOp |

| struct | FdmSchemeDesc |

| class | FdmShoutLogInnerValueCalculator |

| class | FdmSimple2dBSSolver |

| class | FdmSimple2dExtOUSolver |

| class | FdmSimple3dExtOUJumpSolver |

| class | FdmSimpleProcess1dMesher |

| class | FdmSimpleStorageCondition |

| class | FdmSimpleSwingCondition |

| class | FdmSnapshotCondition |

| struct | FdmSolverDesc |

| class | FdmSpreadPayoffInnerValue |

| class | FdmSquareRootFwdOp |

| class | FdmStepConditionComposite |

| class | FdmTimeDepDirichletBoundary |

| class | FdmVPPStartLimitStepCondition |

| class | FdmVPPStepCondition |

| class | FdmVPPStepConditionFactory |

| struct | FdmVPPStepConditionMesher |

| struct | FdmVPPStepConditionParams |

| class | FdmWienerOp |

| class | FdmZabrOp |

| class | FdmZabrUnderlyingPart |

| class | FdmZabrVolatilityPart |

| class | FdmZeroInnerValue |

| class | FdndimBlackScholesVanillaEngine |

| n-dimensional finite-differences Black Scholes vanilla option engine More... | |

| class | FdOrnsteinUhlenbeckVanillaEngine |

| class | FdSabrVanillaEngine |

| class | FdSimpleBSSwingEngine |

| class | FdSimpleExtOUJumpSwingEngine |

| class | FdSimpleExtOUStorageEngine |

| class | FdSimpleKlugeExtOUVPPEngine |

| class | FedFunds |

| Fed Funds rate fixed by the FED. More... | |

| class | FFTEngine |

| Base class for FFT pricing engines for European vanilla options. More... | |

| class | FFTVanillaEngine |

| FFT Pricing engine vanilla options under a Black Scholes process. More... | |

| class | FFTVarianceGammaEngine |

| FFT engine for vanilla options under a Variance Gamma process. More... | |

| class | FilonIntegral |

| Integral of a one-dimensional function. More... | |

| class | FIMCurrency |

| Finnish markka. More... | |

| class | FiniteDifferenceModel |

| Generic finite difference model. More... | |

| class | FiniteDifferenceNewtonSafe |

| safe Newton 1-D solver with finite difference derivatives More... | |

| class | Finland |

| Finnish calendar. More... | |

| class | FireflyAlgorithm |

| class | FirstDerivativeOp |

| class | FittedBondDiscountCurve |

| Discount curve fitted to a set of fixed-coupon bonds. More... | |

| class | FixedDividend |

| Predetermined cash flow. More... | |

| class | FixedLocalVolSurface |

| class | FixedRateBond |

| fixed-rate bond More... | |

| class | FixedRateBondHelper |

| Fixed-coupon bond helper for curve bootstrap. More... | |

| class | FixedRateCoupon |

| Coupon paying a fixed interest rate More... | |

| class | FixedRateLeg |

| helper class building a sequence of fixed rate coupons More... | |

| class | FixedVsFloatingSwap |

| Fixed vs floating swap. More... | |

| class | FlatExtrapolator2D |

| class | FlatForward |

| Flat interest-rate curve. More... | |

| class | FlatHazardRate |

| Flat hazard-rate curve. More... | |

| class | FlatSmileSection |

| class | FlatVol |

| class | FlatVolFactory |

| class | FloatFloatSwap |

| float float swap More... | |

| class | FloatFloatSwaption |

| floatfloat swaption class More... | |

| class | FloatingCatBond |

| floating-rate cat bond (possibly capped and/or floored) More... | |

| class | FloatingRateBond |

| floating-rate bond (possibly capped and/or floored) More... | |

| class | FloatingRateCoupon |

| base floating-rate coupon class More... | |

| class | FloatingRateCouponPricer |

| generic pricer for floating-rate coupons More... | |

| class | FloatingTypePayoff |

| Payoff based on a floating strike More... | |

| class | Floor |

| Concrete floor class. More... | |

| class | FloorTruncation |

| Floor truncation. More... | |

| class | FordeHestonExpansion |

| class | Forward |

| Abstract base forward class. More... | |

| class | ForwardEuropeanBSPathPricer |

| class | ForwardEuropeanHestonPathPricer |

| class | ForwardFlat |

| Forward-flat interpolation factory and traits. More... | |

| class | ForwardFlatInterpolation |

| Forward-flat interpolation between discrete points. More... | |

| class | ForwardMeasureProcess |

| forward-measure stochastic process More... | |

| class | ForwardMeasureProcess1D |

| forward-measure 1-D stochastic process More... | |

| class | ForwardOptionArguments |

| Arguments for forward (strike-resetting) option calculation More... | |

| class | ForwardPerformanceVanillaEngine |

| Forward performance engine for vanilla options More... | |

| struct | ForwardRate |

| Forward-curve traits. More... | |

| class | ForwardRateAgreement |

| Forward rate agreement (FRA) class More... | |

| class | ForwardRateStructure |

| Forward-rate term structure More... | |

| class | ForwardSpreadedTermStructure |

| Term structure with added spread on the instantaneous forward rate. More... | |

| class | ForwardSwapQuote |

| Quote for a forward starting swap. More... | |

| class | ForwardTypePayoff |

| Class for forward type payoffs. More... | |

| class | ForwardValueQuote |

| quote for the forward value of an index More... | |

| class | ForwardVanillaEngine |

| Forward engine for vanilla options More... | |

| class | ForwardVanillaOption |

| Forward version of a vanilla option More... | |

| class | FractionalDividend |

| Predetermined cash flow. More... | |

| class | France |

| French calendars. More... | |

| class | FranceRegion |

| France as geographical/economic region. More... | |

| class | FrankCopula |

| Frank copula. More... | |

| class | FrankCopulaRng |

| Frank copula random-number generator. More... | |

| class | FraRateHelper |

| Rate helper for bootstrapping over FRA rates. More... | |

| class | FRFCurrency |

| French franc. More... | |

| class | FRHICP |

| FR HICP index. More... | |

| class | FritschButlandCubic |

| class | FritschButlandLogCubic |

| class | FrobeniusCostFunction |

| struct | Futures |

| class | FuturesConvAdjustmentQuote |

| quote for the futures-convexity adjustment of an index More... | |

| class | FuturesRateHelper |

| Rate helper for bootstrapping over IborIndex futures prices. More... | |

| class | FwdPeriodAdapter |

| class | FwdToCotSwapAdapter |

| class | FwdToCotSwapAdapterFactory |

| class | FxSwapRateHelper |

| Rate helper for bootstrapping over Fx Swap rates. More... | |

| class | G2 |

| Two-additive-factor gaussian model class. More... | |

| class | G2ForwardProcess |

| Forward G2 stochastic process More... | |

| class | G2Process |

| G2 stochastic process More... | |

| class | G2SwaptionEngine |

| Swaption priced by means of the Black formula More... | |

| class | GalambosCopula |

| Galambos copula. More... | |

| class | GallonUnitOfMeasure |

| class | GammaFunction |

| Gamma function class. More... | |

| class | GapPayoff |

| Binary gap payoff. More... | |

| class | Garch11 |

| GARCH volatility model. More... | |

| class | GarmanKlassAbstract |

| Garman-Klass volatility model. More... | |

| class | GarmanKlassOpenClose |

| class | GarmanKlassSigma1 |

| class | GarmanKlassSigma3 |

| class | GarmanKlassSigma4 |

| class | GarmanKlassSigma5 |

| class | GarmanKlassSigma6 |

| class | GarmanKlassSimpleSigma |

| class | GarmanKohlagenProcess |

| Garman-Kohlhagen (1983) stochastic process. More... | |

| class | GaussChebyshev2ndIntegration |

| Gauss-Chebyshev integration (second kind) More... | |

| class | GaussChebyshev2ndPolynomial |

| Gauss-Chebyshev polynomial (second kind) More... | |

| class | GaussChebyshevIntegration |

| Gauss-Chebyshev integration. More... | |

| class | GaussChebyshevPolynomial |

| Gauss-Chebyshev polynomial. More... | |

| class | GaussGegenbauerIntegration |

| Gauss-Gegenbauer integration. More... | |

| class | GaussGegenbauerPolynomial |

| Gauss-Gegenbauer polynomial. More... | |

| class | GaussHermiteIntegration |

| generalized Gauss-Hermite integration More... | |

| class | GaussHermitePolynomial |

| Gauss-Hermite polynomial. More... | |

| class | GaussHyperbolicIntegration |

| Gauss-Hyperbolic integration. More... | |

| class | GaussHyperbolicPolynomial |

| Gauss hyperbolic polynomial. More... | |

| class | Gaussian1dCapFloorEngine |

| Gaussian1d cap/floor engine. More... | |

| class | Gaussian1dFloatFloatSwaptionEngine |

| One factor model float float swaption engine. More... | |

| class | Gaussian1dJamshidianSwaptionEngine |

| Jamshidian swaption engine. More... | |

| class | Gaussian1dModel |

| class | Gaussian1dNonstandardSwaptionEngine |

| One factor model non standard swaption engine. More... | |

| class | Gaussian1dSmileSection |

| class | Gaussian1dSwaptionEngine |

| One factor model swaption engine. More... | |

| class | Gaussian1dSwaptionVolatility |

| class | GaussianCopula |

| Gaussian copula. More... | |

| struct | GaussianCopulaPolicy |

| class | GaussianKernel |

| Gaussian kernel function. More... | |

| class | GaussianLHPLossModel |

| class | GaussianOrthogonalPolynomial |

| orthogonal polynomial for Gaussian quadratures More... | |

| class | GaussianQuadMultidimIntegrator |

| Integrates a vector or scalar function of vector domain. More... | |

| class | GaussianQuadrature |

| Integral of a 1-dimensional function using the Gauss quadratures method. More... | |

| class | GaussianRandomDefaultModel |

| class | GaussianWalk |

| Gaussian Walk. More... | |

| class | GaussJacobiIntegration |

| Gauss-Jacobi integration. More... | |

| class | GaussJacobiPolynomial |

| Gauss-Jacobi polynomial. More... | |

| class | GaussKronrodAdaptive |

| Integral of a 1-dimensional function using the Gauss-Kronrod methods. More... | |

| class | GaussKronrodNonAdaptive |

| Integral of a 1-dimensional function using the Gauss-Kronrod methods. More... | |

| class | GaussLaguerreCosinePolynomial |

| Gauss-Laguerre Cosine integration. More... | |

| class | GaussLaguerreIntegration |

| generalized Gauss-Laguerre integration More... | |

| class | GaussLaguerrePolynomial |

| Gauss-Laguerre polynomial. More... | |

| class | GaussLaguerreSinePolynomial |

| Gauss-Laguerre Sine integration. More... | |

| class | GaussLaguerreTrigonometricBase |

| class | GaussLegendreIntegration |

| Gauss-Legendre integration. More... | |

| class | GaussLegendrePolynomial |

| Gauss-Legendre polynomial. More... | |

| class | GaussLobattoIntegral |

| Integral of a one-dimensional function. More... | |

| class | GaussNonCentralChiSquaredPolynomial |

| class | GBPCurrency |

| British pound sterling. More... | |

| class | GBPLibor |

| GBP LIBOR rate More... | |

| class | GBPLiborON |

| Overnight GBP Libor index. More... | |

| class | GbpLiborSwapIsdaFix |

| GbpLiborSwapIsdaFix index base class More... | |

| class | GBSMRNDCalculator |

| class | GELCurrency |

| Georgian lari. More... | |

| class | GemanRoncoroniProcess |

| Geman-Roncoroni process class. More... | |

| class | GeneralizedBlackScholesProcess |

| Generalized Black-Scholes stochastic process. More... | |

| class | GeneralizedHullWhite |

| Generalized Hull-White model class. More... | |

| class | GeneralizedOrnsteinUhlenbeckProcess |

| Piecewise linear Ornstein-Uhlenbeck process class. More... | |

| class | GeneralLinearLeastSquares |

| general linear least squares regression More... | |

| class | GeneralStatistics |

| Statistics tool. More... | |

| class | GenericCPI |

| Generic CPI index. More... | |

| class | GenericEngine |

| template base class for option pricing engines More... | |

| class | GenericGaussianStatistics |

| Statistics tool for gaussian-assumption risk measures. More... | |

| struct | GenericLowDiscrepancy |

| class | GenericModelEngine |

| Base class for some pricing engine on a particular model. More... | |

| struct | GenericPseudoRandom |

| class | GenericRegion |

| Generic geographical/economic region. More... | |

| class | GenericRiskStatistics |

| empirical-distribution risk measures More... | |

| class | GenericSequenceStatistics |

| Statistics analysis of N-dimensional (sequence) data. More... | |

| class | GenericTimeSetter |

| class | GeometricAPOHestonPathPricer |

| class | GeometricAPOPathPricer |

| class | GeometricBrownianMotionProcess |

| Geometric brownian-motion process. More... | |

| class | Germany |

| German calendars. More... | |

| class | GFunction |

| class | GFunctionFactory |

| class | GHSCurrency |

| Ghanaian cedi. More... | |

| class | GJRGARCHModel |

| GJR-GARCH model for the stochastic volatility of an asset. More... | |

| class | GJRGARCHProcess |

| Stochastic-volatility GJR-GARCH(1,1) process. More... | |

| class | GlobalBootstrap |

| class | GlobalTopology |

| Global Topology. More... | |

| class | Glued1dMesher |

| class | GMRES |

| struct | GMRESResult |

| class | GoldsteinLineSearch |

| class | GRDCurrency |

| Greek drachma. More... | |

| class | Greeks |

| additional option results More... | |

| class | GridModelLocalVolSurface |

| class | Gsr |

| One factor gsr model, formulation is in forward measure. More... | |

| class | GsrProcess |

| GSR stochastic process. More... | |

| class | GumbelCopula |

| Gumbel copula. More... | |

| class | HaganIrregularSwaptionEngine |

| Pricing engine for irregular swaptions. More... | |

| class | HaganPricer |

| CMS-coupon pricer. More... | |

| class | Halley |

| Halley 1-D solver More... | |

| class | HaltonRsg |

| Halton low-discrepancy sequence generator. More... | |

| class | Handle |

| Shared handle to an observable. More... | |

| class | HarmonicCubic |

| class | HarmonicLogCubic |

| struct | HazardRate |

| Hazard-rate-curve traits. More... | |

| class | HazardRateStructure |

| Hazard-rate term structure. More... | |

| class | HestonBlackVolSurface |

| class | HestonExpansion |

| class | HestonExpansionEngine |

| Heston-model engine for European options based on analytic expansions. More... | |

| class | HestonHullWhitePathPricer |

| class | HestonModel |

| Heston model for the stochastic volatility of an asset. More... | |

| class | HestonModelHelper |

| calibration helper for Heston model More... | |

| class | HestonProcess |

| Square-root stochastic-volatility Heston process. More... | |

| class | HestonRNDCalculator |

| Risk neutral terminal probability density for the Heston model. More... | |

| class | HestonSLVFDMModel |

| struct | HestonSLVFokkerPlanckFdmParams |

| class | HestonSLVMCModel |

| class | HestonSLVProcess |

| class | HimalayaMultiPathPricer |

| class | HimalayaOption |

| Himalaya option. More... | |

| class | Histogram |

| Histogram class. More... | |

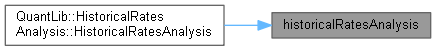

| class | HistoricalForwardRatesAnalysis |

| class | HistoricalForwardRatesAnalysisImpl |

| Historical correlation class More... | |

| class | HistoricalRatesAnalysis |

| Historical rate analysis class More... | |

| class | HKDCurrency |

| Hong Kong dollar. More... | |

| class | HolderExtensibleOption |

| Holder-extensible option. More... | |

| class | HomogeneousPoolLossModel |

| Default loss distribution convolution for finite homogeneous pool. More... | |

| class | HongKong |

| Hong Kong calendars. More... | |

| class | HouseholderReflection |

| class | HouseholderTransformation |

| class | HRKCurrency |

| Croatian kuna. More... | |

| class | HUFCurrency |

| Hungarian forint. More... | |

| class | HullWhite |

| Single-factor Hull-White (extended Vasicek) model class. More... | |

| class | HullWhiteForwardProcess |

| Forward Hull-White stochastic process More... | |

| class | HullWhiteProcess |

| Hull-White stochastic process. More... | |

| class | HundsdorferScheme |

| class | Hungary |

| Hungarian calendar. More... | |

| class | HuslerReissCopula |

| Husler-Reiss copula. More... | |

| class | HybridHestonHullWhiteProcess |

| Hybrid Heston Hull-White stochastic process. More... | |

| class | HybridSimulatedAnnealing |

| class | IborCoupon |

| Coupon paying a Libor-type index More... | |

| class | IborCouponPricer |

| base pricer for capped/floored Ibor coupons More... | |

| class | IborIborBasisSwapRateHelper |

| Rate helper for bootstrapping over ibor-ibor basis swaps. More... | |

| class | IborIndex |

| base class for Inter-Bank-Offered-Rate indexes (e.g. Libor, etc.) More... | |

| class | IborLeg |

| helper class building a sequence of capped/floored ibor-rate coupons More... | |

| class | IborLegCashFlows |

| class | Iceland |

| Icelandic calendars. More... | |

| class | IDRCurrency |

| Indonesian Rupiah. More... | |

| class | IEPCurrency |

| Irish punt. More... | |

| class | ILSCurrency |

| Israeli shekel. More... | |

| struct | IMM |

| Main cycle of the International Money Market (a.k.a. IMM) months. More... | |

| class | ImplicitEuler |

| Backward Euler scheme for finite difference methods. More... | |

| class | ImplicitEulerScheme |

| class | ImpliedStdDevQuote |

| quote for the implied standard deviation of an underlying More... | |

| class | ImpliedTermStructure |

| Implied term structure at a given date in the future. More... | |

| class | ImpliedVolTermStructure |

| Implied vol term structure at a given date in the future. More... | |

| class | IncrementalStatistics |

| Statistics tool based on incremental accumulation. More... | |

| class | IndependentCopula |

| independent copula More... | |

| class | Index |

| purely virtual base class for indexes More... | |

| class | IndexedCashFlow |

| Cash flow dependent on an index ratio. More... | |

| class | IndexManager |

| global repository for past index fixings More... | |

| class | India |

| Indian calendars. More... | |

| class | Indonesia |

| Indonesian calendars More... | |

| class | InflationCoupon |

| Base inflation-coupon class. More... | |

| class | InflationCouponPricer |

| Base inflation-coupon pricer. More... | |

| class | InflationIndex |

| Base class for inflation-rate indexes,. More... | |

| class | InflationTermStructure |

| Interface for inflation term structures. More... | |

| class | InhomogeneousPoolLossModel |

| Default loss distribution convolution for finite non homogeneous pool. More... | |

| class | INRCurrency |

| Indian rupee. More... | |

| class | Instrument |

| Abstract instrument class. More... | |

| class | IntegralCDOEngine |

| class | IntegralCdsEngine |

| class | IntegralEngine |

| Pricing engine for European vanilla options using integral approach. More... | |

| class | IntegralHestonVarianceOptionEngine |

| integral Heston-model variance-option engine More... | |

| class | IntegralNtdEngine |

| class | IntegrationBase |

| class | IntegrationBase< GaussianQuadMultidimIntegrator > |

| class | IntegrationBase< MultidimIntegral > |

| class | Integrator |

| class | InterestRate |

| Concrete interest rate class. More... | |

| class | InterestRateIndex |

| base class for interest rate indexes More... | |

| class | InterestRateVolSurface |

| Interest rate volatility (smile) surface. More... | |

| class | InterpolatedAffineHazardRateCurve |

| class | InterpolatedCPICapFloorTermPriceSurface |

| class | InterpolatedCurve |

| Helper class to build interpolated term structures. More... | |

| class | InterpolatedDefaultDensityCurve |

| DefaultProbabilityTermStructure based on interpolation of default densities. More... | |

| class | InterpolatedDiscountCurve |

| YieldTermStructure based on interpolation of discount factors. More... | |

| class | InterpolatedForwardCurve |

| YieldTermStructure based on interpolation of forward rates. More... | |

| class | InterpolatedHazardRateCurve |

| DefaultProbabilityTermStructure based on interpolation of hazard rates. More... | |

| class | InterpolatedPiecewiseForwardSpreadedTermStructure |

| Term structure with an added vector of spreads on the instantaneous forward rate. More... | |

| class | InterpolatedPiecewiseZeroSpreadedTermStructure |

| Yield curve with an added vector of spreads on the zero-yield rate. More... | |

| class | InterpolatedSimpleZeroCurve |

| YieldTermStructure based on interpolation of zero rates. More... | |

| class | InterpolatedSmileSection |

| class | InterpolatedSurvivalProbabilityCurve |