Risky pricing engine for bonds. More...

#include <riskybondengine.hpp>

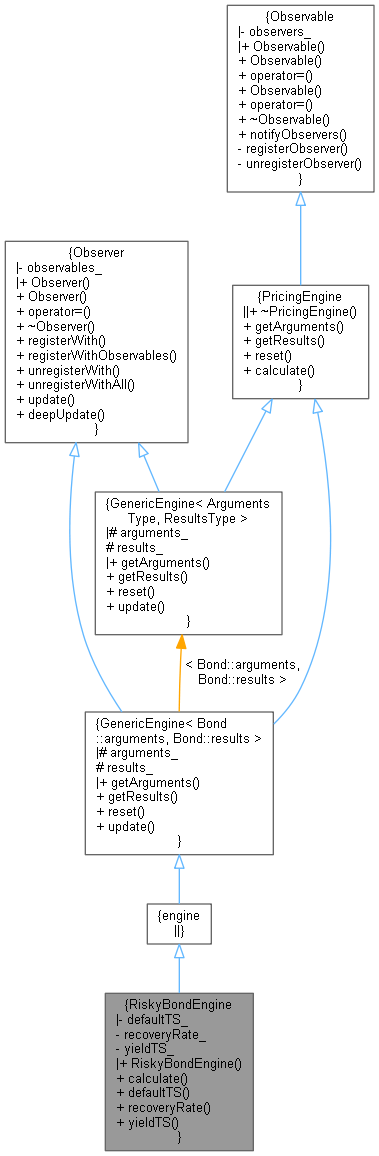

Inheritance diagram for RiskyBondEngine:

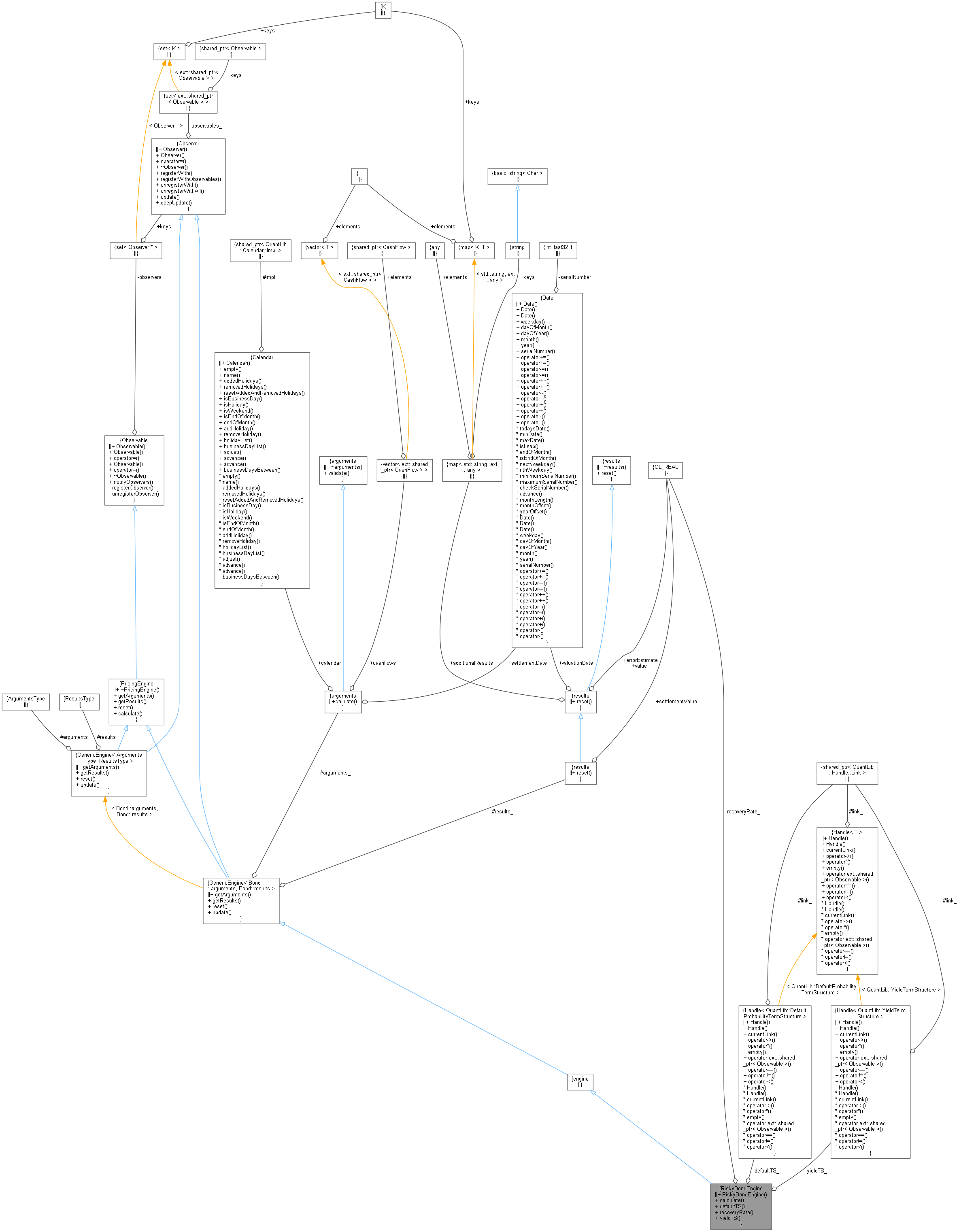

Inheritance diagram for RiskyBondEngine: Collaboration diagram for RiskyBondEngine:

Collaboration diagram for RiskyBondEngine:Public Member Functions | |

| RiskyBondEngine (Handle< DefaultProbabilityTermStructure > defaultTS, Real recoveryRate, Handle< YieldTermStructure > yieldTS) | |

| void | calculate () const override |

| Handle< DefaultProbabilityTermStructure > | defaultTS () const |

| Real | recoveryRate () const |

| Handle< YieldTermStructure > | yieldTS () const |

Public Member Functions inherited from GenericEngine< Bond::arguments, Bond::results > Public Member Functions inherited from GenericEngine< Bond::arguments, Bond::results > | |

| PricingEngine::arguments * | getArguments () const override |

| const PricingEngine::results * | getResults () const override |

| void | reset () override |

| void | update () override |

Public Member Functions inherited from PricingEngine Public Member Functions inherited from PricingEngine | |

| ~PricingEngine () override=default | |

| virtual arguments * | getArguments () const =0 |

| virtual const results * | getResults () const =0 |

| virtual void | reset ()=0 |

| virtual void | calculate () const =0 |

Public Member Functions inherited from Observable Public Member Functions inherited from Observable | |

| Observable ()=default | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| virtual | ~Observable ()=default |

| void | notifyObservers () |

Public Member Functions inherited from Observer Public Member Functions inherited from Observer | |

| Observer ()=default | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| virtual | ~Observer () |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | update ()=0 |

| virtual void | deepUpdate () |

Private Attributes | |

| Handle< DefaultProbabilityTermStructure > | defaultTS_ |

| Real | recoveryRate_ |

| Handle< YieldTermStructure > | yieldTS_ |

Additional Inherited Members | |

Public Types inherited from Observer Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

Protected Attributes inherited from GenericEngine< Bond::arguments, Bond::results > Protected Attributes inherited from GenericEngine< Bond::arguments, Bond::results > | |

| Bond::arguments | arguments_ |

| Bond::results | results_ |

Detailed Description

Risky pricing engine for bonds.

The value of each cashflow is contingent to survival, i.e., the knockout probability is considered.

In each of the \(n\) coupon periods, we can calculate the value in the case of survival and default, assuming that the issuer can only default in the middle of a coupon period. We denote this time \(T_{i}^{mid}=\frac{T_{i-1}+T_{i}}{2}\).

Given survival we receive the full cash flow (both coupons and notional). The time \(t\) value of these payments are given by

\[ \sum_{i=1}^{n}CF_{i}P(t,T_{i})Q(T_{i}<\tau) \]

where \(P(t,T)\) is the time \(T\) discount bond and \(Q(T<\tau)\) is the time \(T\) survival probability. \(n\) is the number of coupon periods. This takes care of the payments in the case of survival.

Given default we receive only a fraction of the notional at default.

\[ \sum_{i=1}^{n}Rec N(T_{i}^{mid}) P(t,T_{i}^{mid})Q(T_{i-1}<\tau\leq T_{i}) \]

where \(Rec\) is the recovery rate and \(N(T)\) is the time T notional. The default probability can be rewritten as

\[ Q(T_{i-1}<\tau\leq T_{i})=Q(T_{i}<\tau)-Q(T_{i-1}<\tau)=(1-Q(T_{i}\geq\tau))-(1-Q(T_{i-1}\geq\tau))=Q(T_{i-1}\geq\tau)-Q(T_{i}\geq\tau) \]

Definition at line 64 of file riskybondengine.hpp.

Constructor & Destructor Documentation

◆ RiskyBondEngine()

| RiskyBondEngine | ( | Handle< DefaultProbabilityTermStructure > | defaultTS, |

| Real | recoveryRate, | ||

| Handle< YieldTermStructure > | yieldTS | ||

| ) |

Member Function Documentation

◆ calculate()

|

overridevirtual |

Implements PricingEngine.

Definition at line 39 of file riskybondengine.cpp.

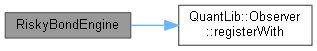

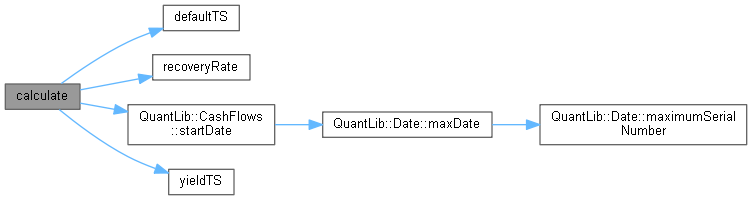

Here is the call graph for this function:

Here is the call graph for this function:◆ defaultTS()

| Handle< DefaultProbabilityTermStructure > defaultTS | ( | ) | const |

◆ recoveryRate()

| Real recoveryRate | ( | ) | const |

◆ yieldTS()

| Handle< YieldTermStructure > yieldTS | ( | ) | const |

Member Data Documentation

◆ defaultTS_

|

private |

Definition at line 74 of file riskybondengine.hpp.

◆ recoveryRate_

|

private |

Definition at line 75 of file riskybondengine.hpp.

◆ yieldTS_

|

private |

Definition at line 76 of file riskybondengine.hpp.