cashflow-analysis functions More...

#include <cashflows.hpp>

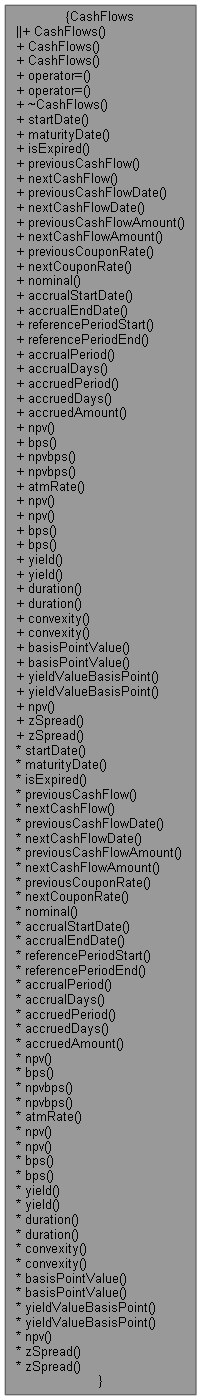

Collaboration diagram for CashFlows:

Collaboration diagram for CashFlows:Classes | |

| class | IrrFinder |

Public Member Functions | |

| CashFlows ()=delete | |

| CashFlows (CashFlows &&)=delete | |

| CashFlows (const CashFlows &)=delete | |

| CashFlows & | operator= (CashFlows &&)=delete |

| CashFlows & | operator= (const CashFlows &)=delete |

| ~CashFlows ()=default | |

Static Public Member Functions | |

Date functions | |

| static Date | startDate (const Leg &leg) |

| static Date | maturityDate (const Leg &leg) |

| static bool | isExpired (const Leg &leg, bool includeSettlementDateFlows, Date settlementDate=Date()) |

CashFlow functions | |

| static Leg::const_reverse_iterator | previousCashFlow (const Leg &leg, bool includeSettlementDateFlows, Date settlementDate=Date()) |

| the last cashflow paying before or at the given date More... | |

| static Leg::const_iterator | nextCashFlow (const Leg &leg, bool includeSettlementDateFlows, Date settlementDate=Date()) |

| the first cashflow paying after the given date More... | |

| static Date | previousCashFlowDate (const Leg &leg, bool includeSettlementDateFlows, Date settlementDate=Date()) |

| static Date | nextCashFlowDate (const Leg &leg, bool includeSettlementDateFlows, Date settlementDate=Date()) |

| static Real | previousCashFlowAmount (const Leg &leg, bool includeSettlementDateFlows, Date settlementDate=Date()) |

| static Real | nextCashFlowAmount (const Leg &leg, bool includeSettlementDateFlows, Date settlementDate=Date()) |

Coupon inspectors | |

| static Rate | previousCouponRate (const Leg &leg, bool includeSettlementDateFlows, Date settlementDate=Date()) |

| static Rate | nextCouponRate (const Leg &leg, bool includeSettlementDateFlows, Date settlementDate=Date()) |

| static Real | nominal (const Leg &leg, bool includeSettlementDateFlows, Date settlDate=Date()) |

| static Date | accrualStartDate (const Leg &leg, bool includeSettlementDateFlows, Date settlDate=Date()) |

| static Date | accrualEndDate (const Leg &leg, bool includeSettlementDateFlows, Date settlementDate=Date()) |

| static Date | referencePeriodStart (const Leg &leg, bool includeSettlementDateFlows, Date settlDate=Date()) |

| static Date | referencePeriodEnd (const Leg &leg, bool includeSettlementDateFlows, Date settlDate=Date()) |

| static Time | accrualPeriod (const Leg &leg, bool includeSettlementDateFlows, Date settlementDate=Date()) |

| static Date::serial_type | accrualDays (const Leg &leg, bool includeSettlementDateFlows, Date settlementDate=Date()) |

| static Time | accruedPeriod (const Leg &leg, bool includeSettlementDateFlows, Date settlementDate=Date()) |

| static Date::serial_type | accruedDays (const Leg &leg, bool includeSettlementDateFlows, Date settlementDate=Date()) |

| static Real | accruedAmount (const Leg &leg, bool includeSettlementDateFlows, Date settlementDate=Date()) |

YieldTermStructure functions | |

| static Real | npv (const Leg &leg, const YieldTermStructure &discountCurve, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date()) |

| NPV of the cash flows. More... | |

| static Real | bps (const Leg &leg, const YieldTermStructure &discountCurve, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date()) |

| Basis-point sensitivity of the cash flows. More... | |

| static std::pair< Real, Real > | npvbps (const Leg &leg, const YieldTermStructure &discountCurve, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date()) |

| NPV and BPS of the cash flows. More... | |

| static Rate | atmRate (const Leg &leg, const YieldTermStructure &discountCurve, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date(), Real npv=Null< Real >()) |

| At-the-money rate of the cash flows. More... | |

Yield (a.k.a. Internal Rate of Return, i.e. IRR) functions | |

| static Real | npv (const Leg &leg, const InterestRate &yield, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date()) |

| NPV of the cash flows. More... | |

| static Real | npv (const Leg &leg, Rate yield, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date()) |

| static Real | bps (const Leg &leg, const InterestRate &yield, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date()) |

| Basis-point sensitivity of the cash flows. More... | |

| static Real | bps (const Leg &leg, Rate yield, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date()) |

| static Rate | yield (const Leg &leg, Real npv, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date(), Real accuracy=1.0e-10, Size maxIterations=100, Rate guess=0.05) |

| Implied internal rate of return. More... | |

| template<typename Solver > | |

| static Rate | yield (const Solver &solver, const Leg &leg, Real npv, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date(), Real accuracy=1.0e-10, Rate guess=0.05) |

| static Time | duration (const Leg &leg, const InterestRate &yield, Duration::Type type, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date()) |

| Cash-flow duration. More... | |

| static Time | duration (const Leg &leg, Rate yield, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, Duration::Type type, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date()) |

| static Real | convexity (const Leg &leg, const InterestRate &yield, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date()) |

| Cash-flow convexity. More... | |

| static Real | convexity (const Leg &leg, Rate yield, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date()) |

| static Real | basisPointValue (const Leg &leg, const InterestRate &yield, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date()) |

| Basis-point value. More... | |

| static Real | basisPointValue (const Leg &leg, Rate yield, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date()) |

| static Real | yieldValueBasisPoint (const Leg &leg, const InterestRate &yield, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date()) |

| Yield value of a basis point. More... | |

| static Real | yieldValueBasisPoint (const Leg &leg, Rate yield, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date()) |

Z-spread functions | |

| static Real | npv (const Leg &leg, const ext::shared_ptr< YieldTermStructure > &discount, Spread zSpread, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date()) |

| NPV of the cash flows. More... | |

| static Spread | zSpread (const Leg &leg, Real npv, const ext::shared_ptr< YieldTermStructure > &, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date(), Real accuracy=1.0e-10, Size maxIterations=100, Rate guess=0.0) |

| implied Z-spread. More... | |

| static Spread | zSpread (const Leg &leg, const ext::shared_ptr< YieldTermStructure > &d, Real npv, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, bool includeSettlementDateFlows, Date settlementDate=Date(), Date npvDate=Date(), Real accuracy=1.0e-10, Size maxIterations=100, Rate guess=0.0) |

Detailed Description

cashflow-analysis functions

Definition at line 41 of file cashflows.hpp.

Constructor & Destructor Documentation

◆ CashFlows() [1/3]

|

delete |

◆ CashFlows() [2/3]

◆ CashFlows() [3/3]

◆ ~CashFlows()

|

default |

Member Function Documentation

◆ operator=() [1/2]

◆ operator=() [2/2]

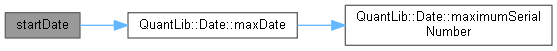

◆ startDate()

Definition at line 38 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

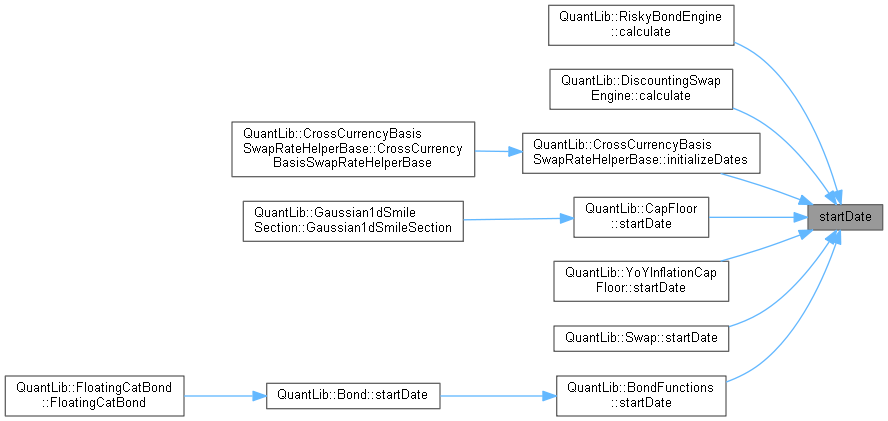

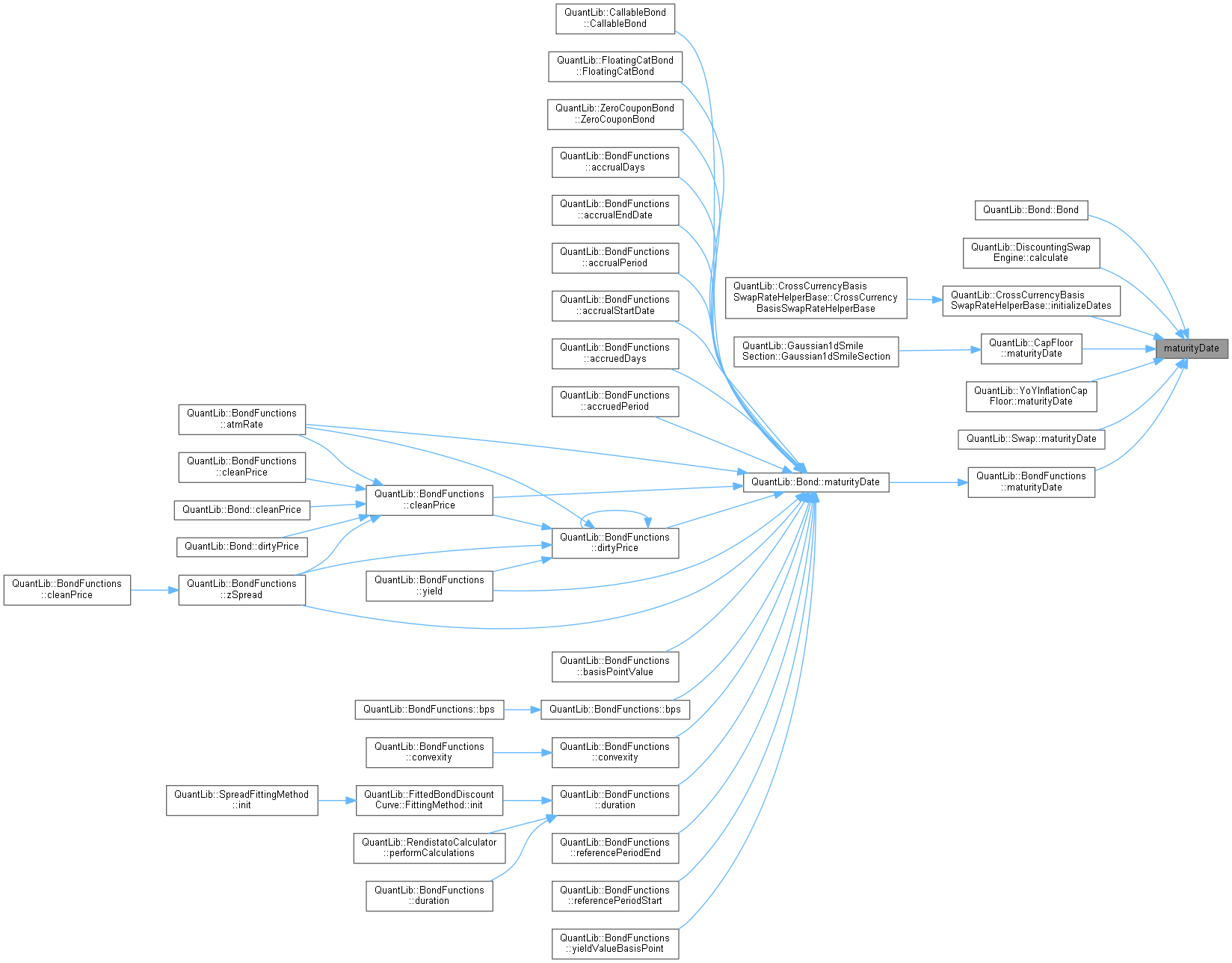

Here is the caller graph for this function:◆ maturityDate()

Definition at line 52 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

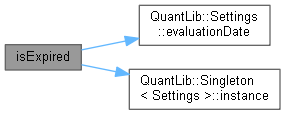

Here is the caller graph for this function:◆ isExpired()

|

static |

Definition at line 66 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

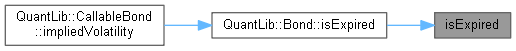

Here is the caller graph for this function:◆ previousCashFlow()

|

static |

the last cashflow paying before or at the given date

Definition at line 84 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

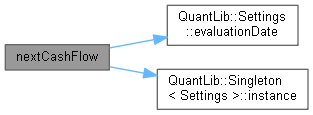

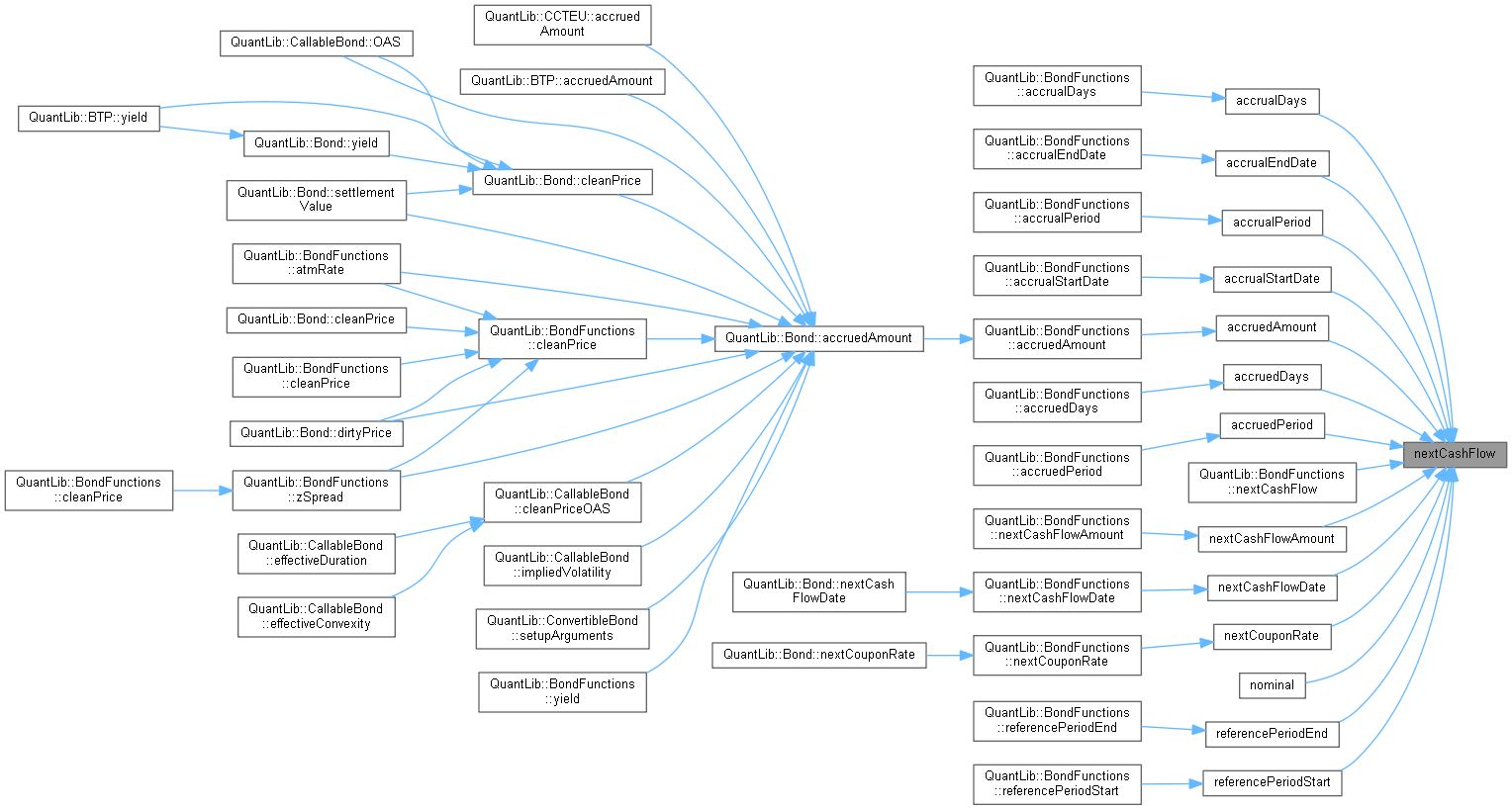

Here is the caller graph for this function:◆ nextCashFlow()

|

static |

the first cashflow paying after the given date

Definition at line 102 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

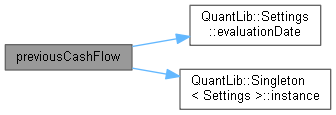

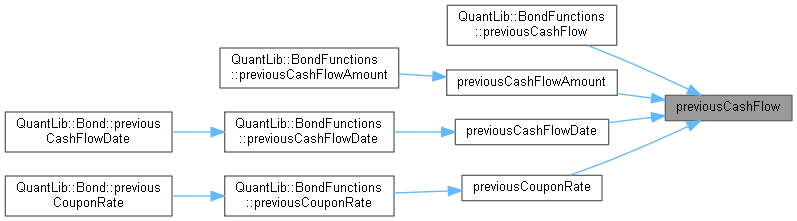

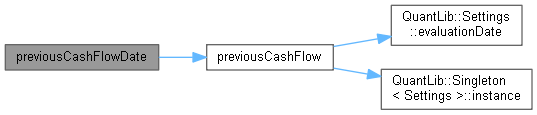

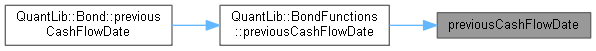

Here is the caller graph for this function:◆ previousCashFlowDate()

|

static |

Definition at line 119 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ nextCashFlowDate()

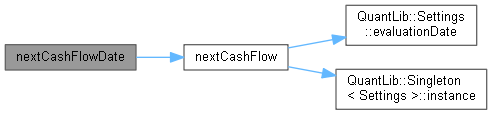

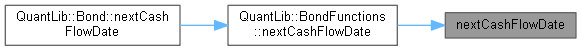

|

static |

Definition at line 131 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ previousCashFlowAmount()

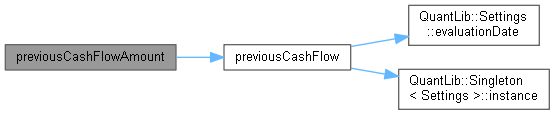

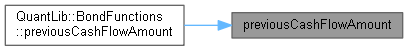

|

static |

Definition at line 143 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

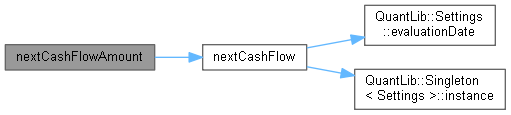

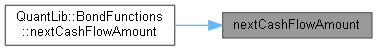

Here is the caller graph for this function:◆ nextCashFlowAmount()

|

static |

Definition at line 159 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

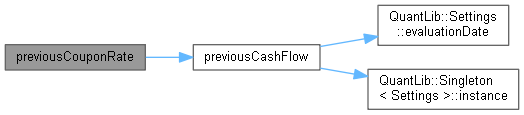

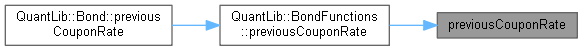

Here is the caller graph for this function:◆ previousCouponRate()

|

static |

Definition at line 215 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

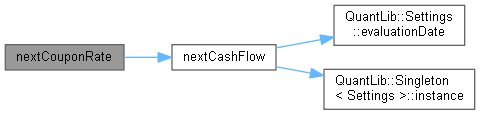

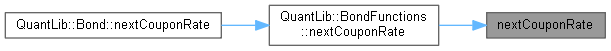

Here is the caller graph for this function:◆ nextCouponRate()

|

static |

Definition at line 224 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

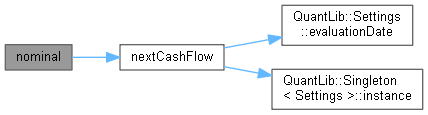

Here is the caller graph for this function:◆ nominal()

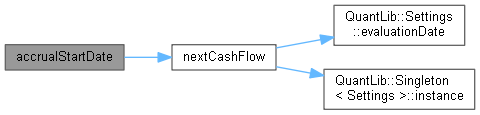

◆ accrualStartDate()

|

static |

Definition at line 247 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ accrualEndDate()

|

static |

Definition at line 263 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ referencePeriodStart()

|

static |

Definition at line 279 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ referencePeriodEnd()

|

static |

Definition at line 295 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ accrualPeriod()

|

static |

Definition at line 311 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ accrualDays()

|

static |

Definition at line 326 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ accruedPeriod()

|

static |

Definition at line 341 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

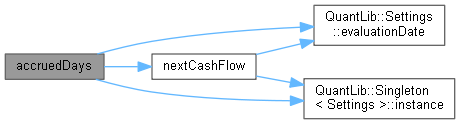

Here is the caller graph for this function:◆ accruedDays()

|

static |

Definition at line 359 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

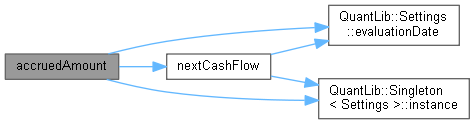

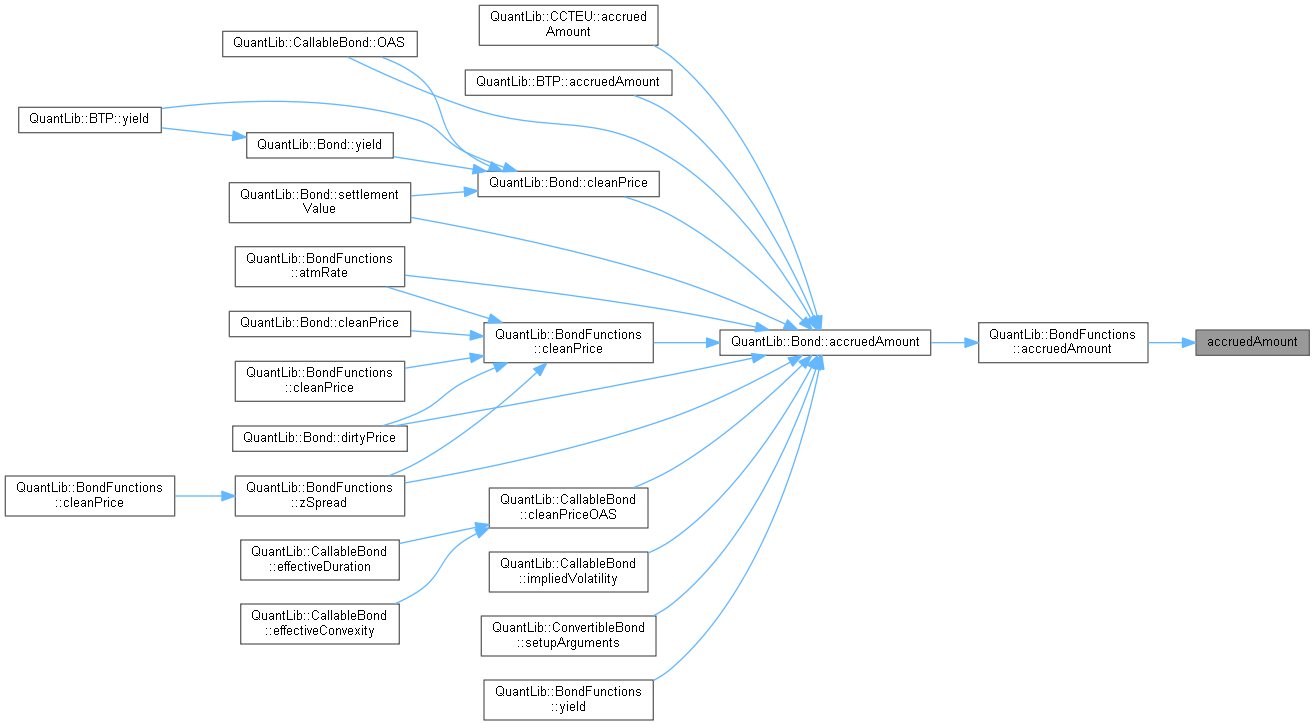

Here is the caller graph for this function:◆ accruedAmount()

|

static |

Definition at line 377 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

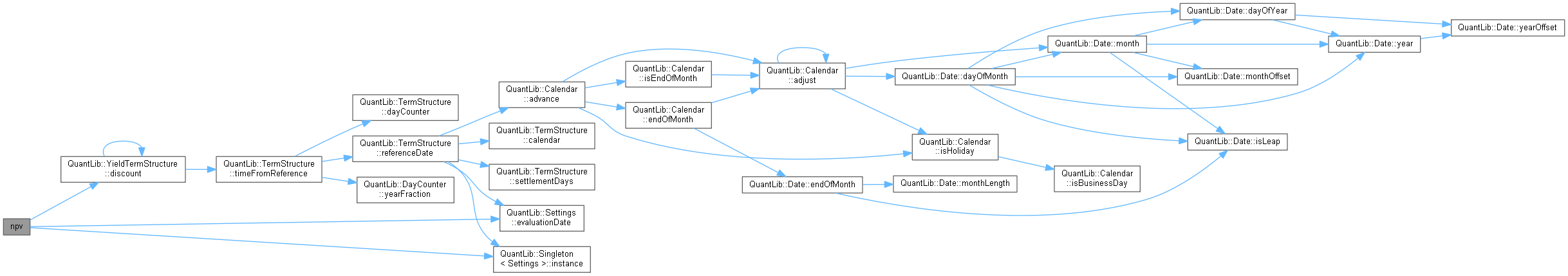

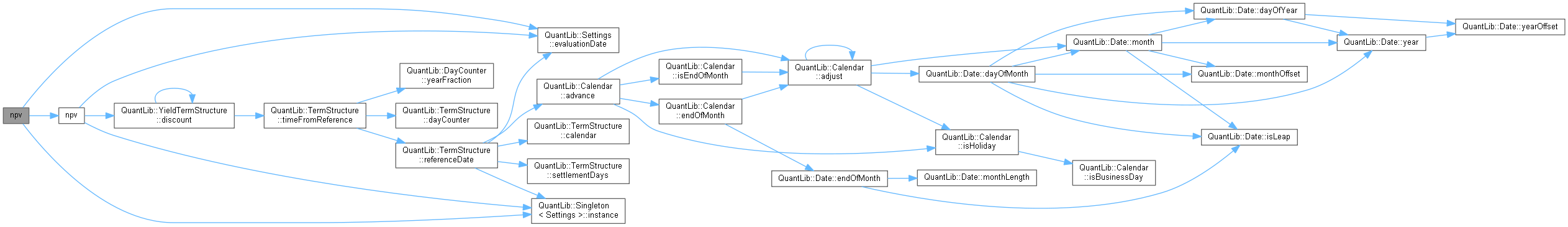

Here is the caller graph for this function:◆ npv() [1/4]

|

static |

NPV of the cash flows.

The NPV is the sum of the cash flows, each discounted according to the given term structure.

Definition at line 425 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

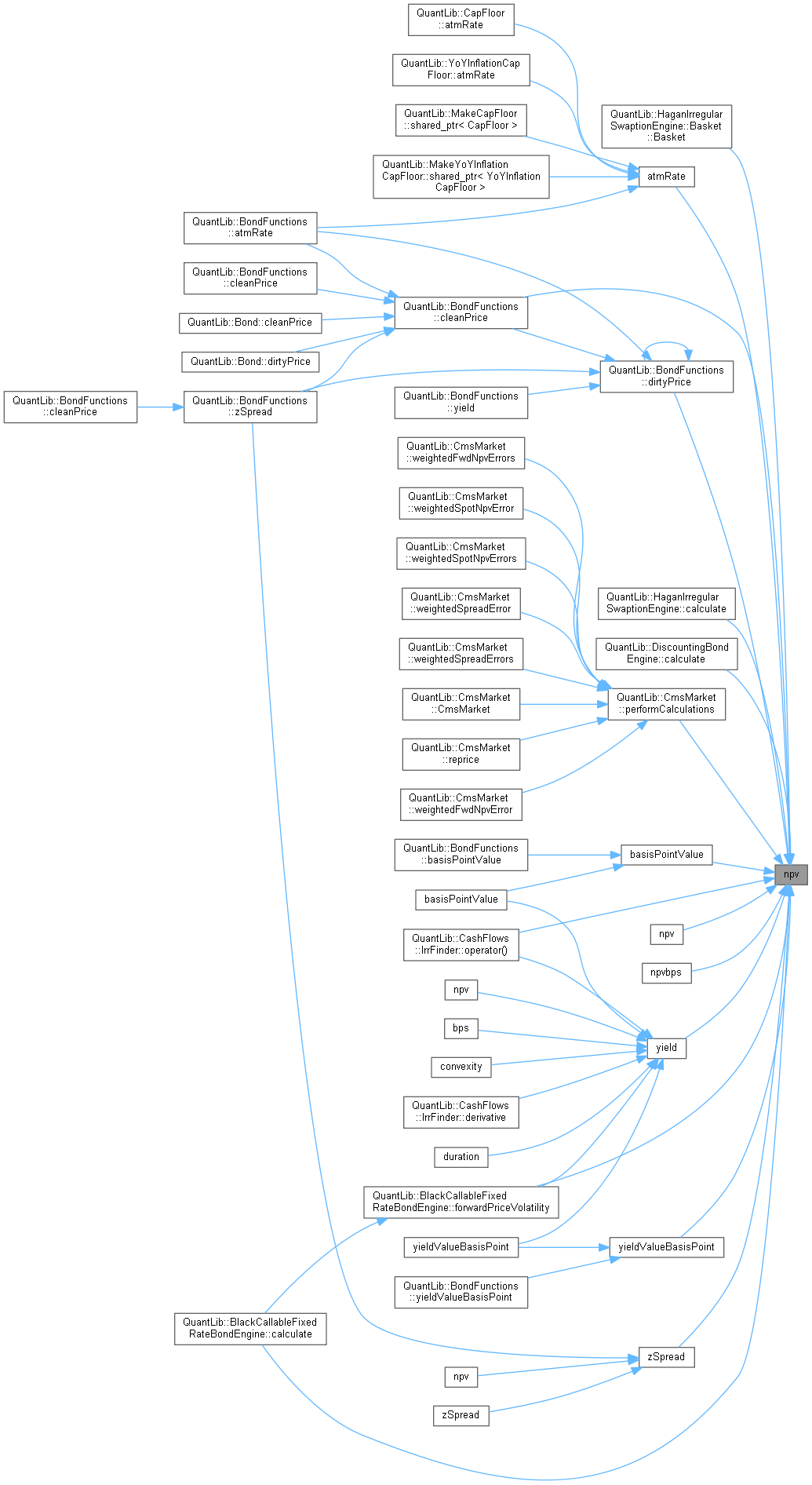

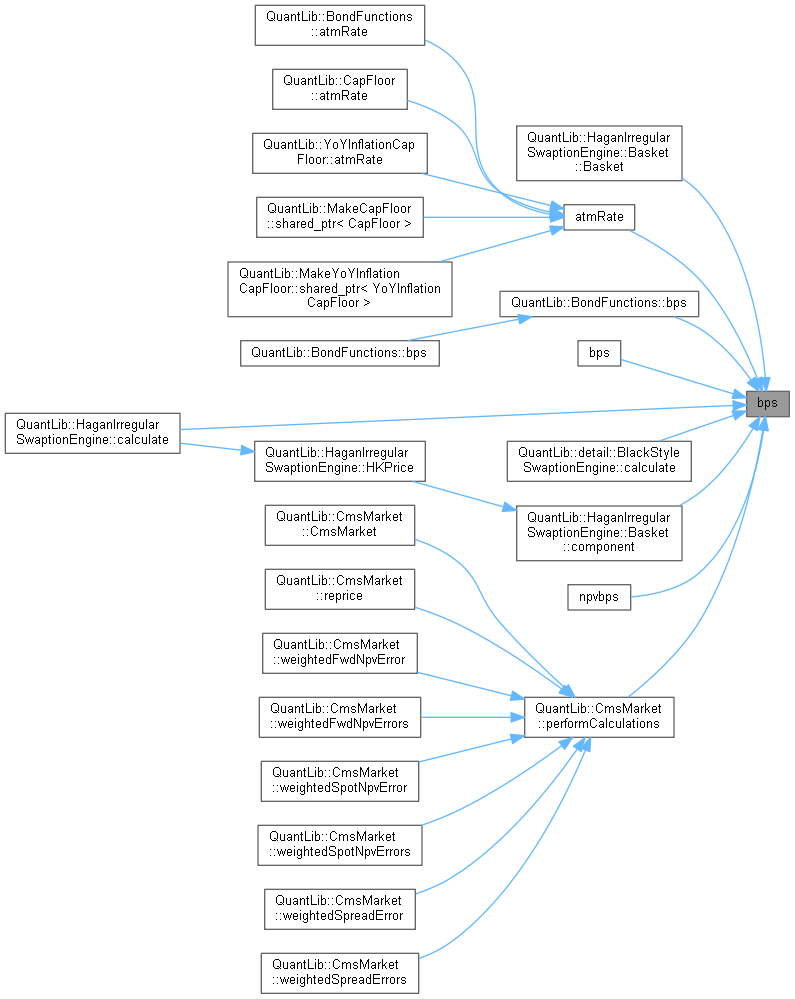

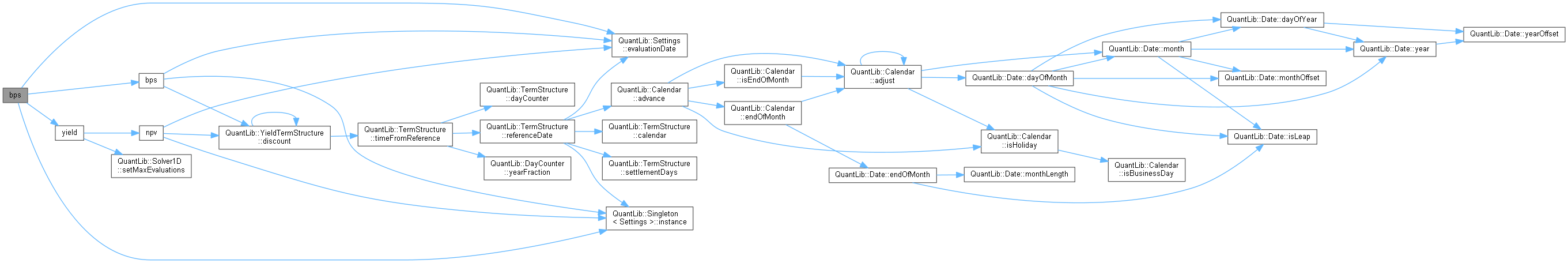

Here is the caller graph for this function:◆ bps() [1/3]

|

static |

Basis-point sensitivity of the cash flows.

The result is the change in NPV due to a uniform 1-basis-point change in the rate paid by the cash flows. The change for each coupon is discounted according to the given term structure.

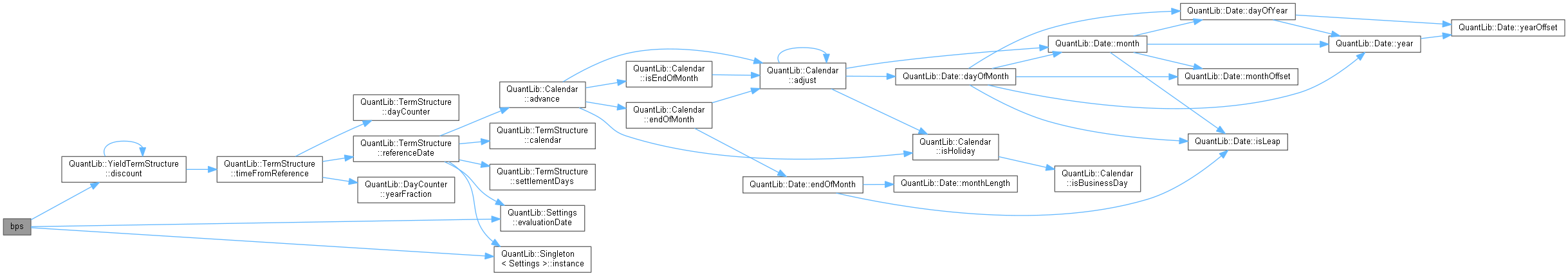

Definition at line 450 of file cashflows.cpp.

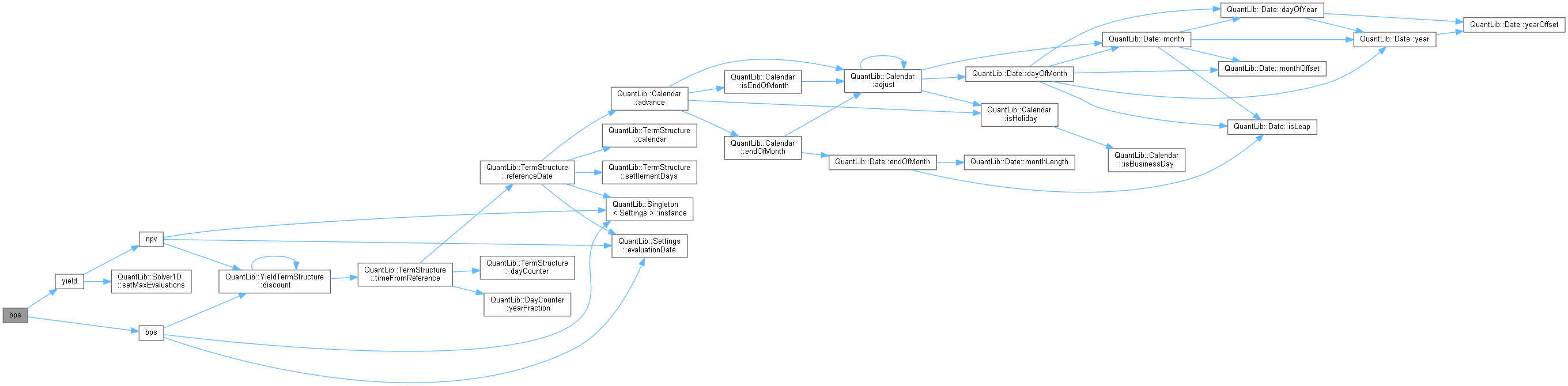

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

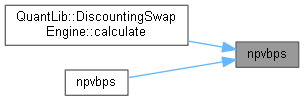

Here is the caller graph for this function:◆ npvbps()

|

static |

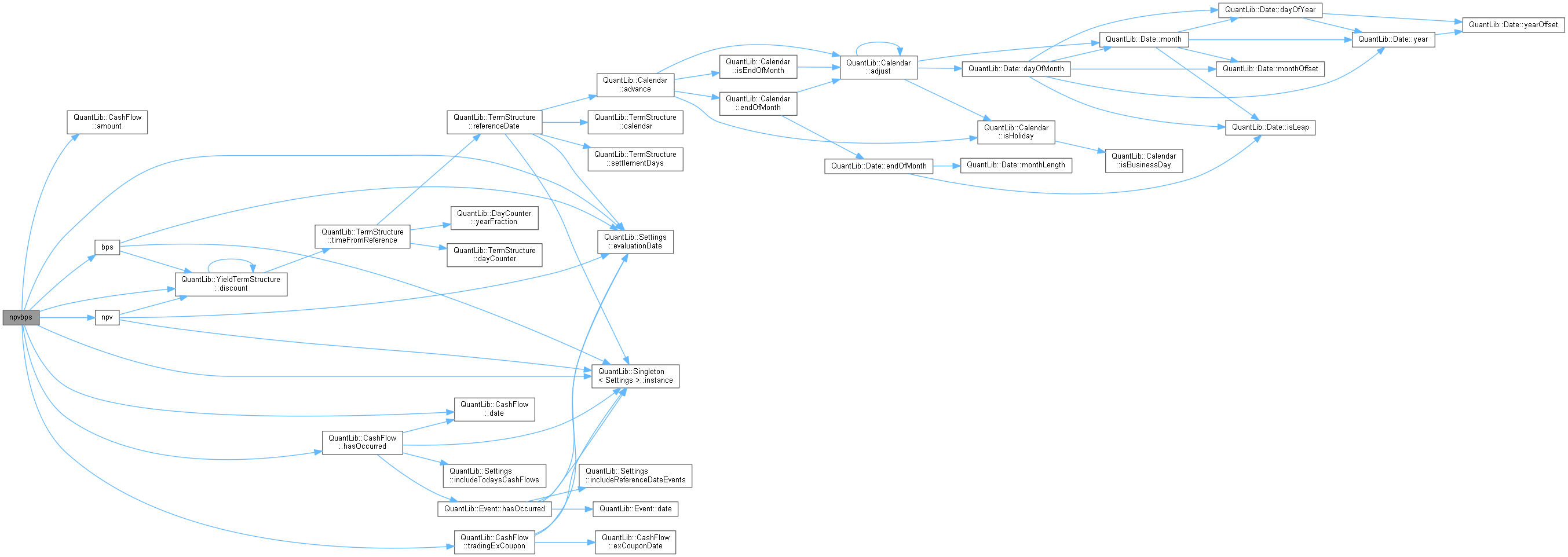

NPV and BPS of the cash flows.

The NPV and BPS of the cash flows calculated together for performance reason

Definition at line 473 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

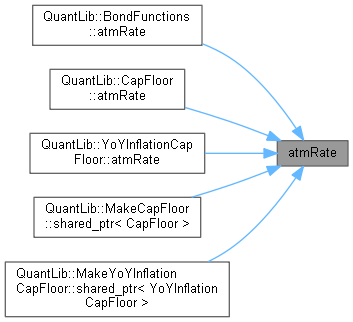

Here is the caller graph for this function:◆ atmRate()

|

static |

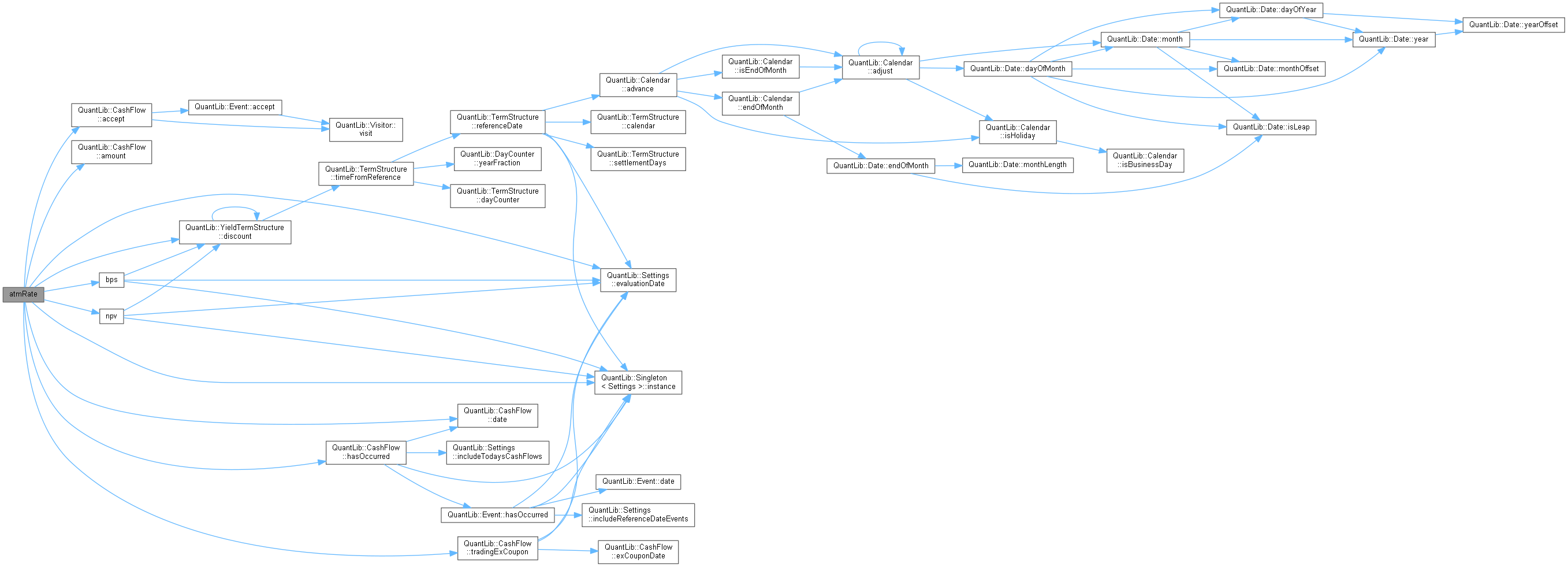

At-the-money rate of the cash flows.

The result is the fixed rate for which a fixed rate cash flow vector, equivalent to the input vector, has the required NPV according to the given term structure. If the required NPV is not given, the input cash flow vector's NPV is used instead.

Definition at line 510 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ npv() [2/4]

|

static |

NPV of the cash flows.

The IRR is the interest rate at which the NPV of the cash flows equals the dirty price.

The NPV is the sum of the cash flows, each discounted according to the given constant interest rate. The result is affected by the choice of the interest-rate compounding and the relative frequency and day counter.

Definition at line 812 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function:◆ npv() [3/4]

◆ bps() [2/3]

|

static |

Basis-point sensitivity of the cash flows.

The result is the change in NPV due to a uniform 1-basis-point change in the rate paid by the cash flows. The change for each coupon is discounted according to the given constant interest rate. The result is affected by the choice of the interest-rate compounding and the relative frequency and day counter.

Definition at line 869 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function:◆ bps() [3/3]

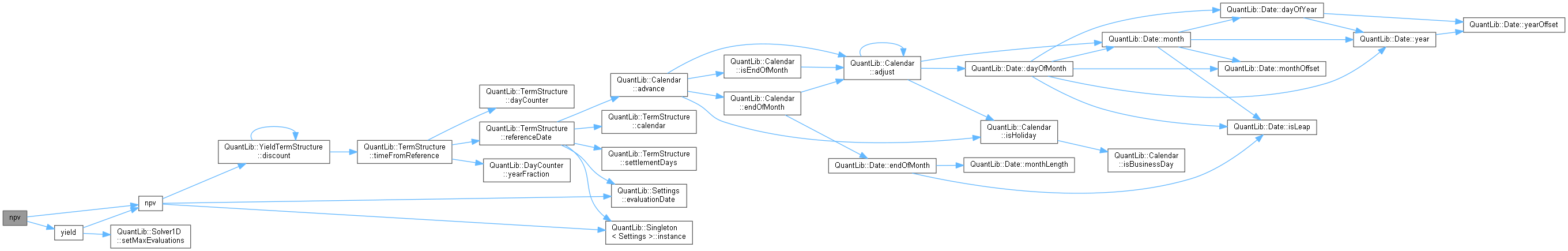

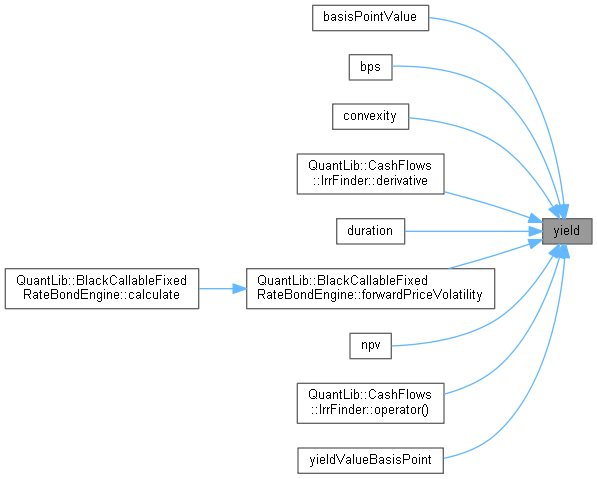

◆ yield() [1/2]

|

static |

Implied internal rate of return.

The function verifies the theoretical existence of an IRR and numerically establishes the IRR to the desired precision.

Definition at line 904 of file cashflows.cpp.

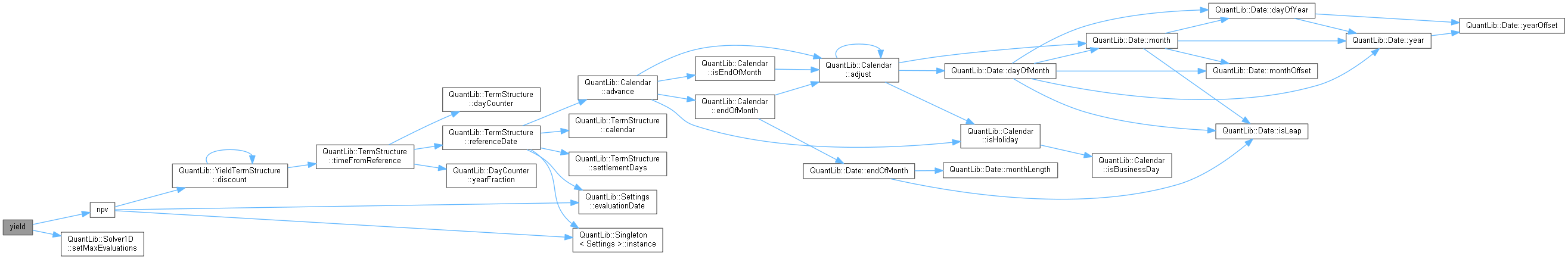

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ yield() [2/2]

◆ duration() [1/2]

|

static |

Cash-flow duration.

The simple duration of a string of cash flows is defined as

\[ D_{\mathrm{simple}} = \frac{\sum t_i c_i B(t_i)}{\sum c_i B(t_i)} \]

where \( c_i \) is the amount of the \( i \)-th cash flow, \( t_i \) is its payment time, and \( B(t_i) \) is the corresponding discount according to the passed yield.

The modified duration is defined as

\[ D_{\mathrm{modified}} = -\frac{1}{P} \frac{\partial P}{\partial y} \]

where \( P \) is the present value of the cash flows according to the given IRR \( y \).

The Macaulay duration is defined for a compounded IRR as

\[ D_{\mathrm{Macaulay}} = \left( 1 + \frac{y}{N} \right) D_{\mathrm{modified}} \]

where \( y \) is the IRR and \( N \) is the number of cash flows per year.

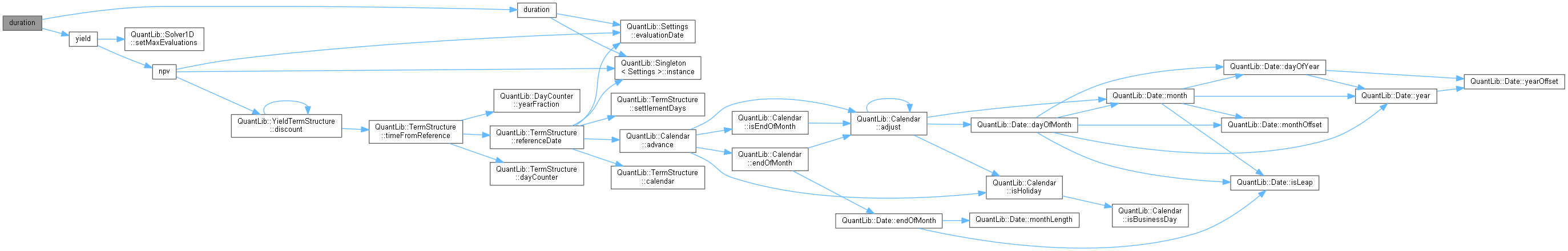

Definition at line 925 of file cashflows.cpp.

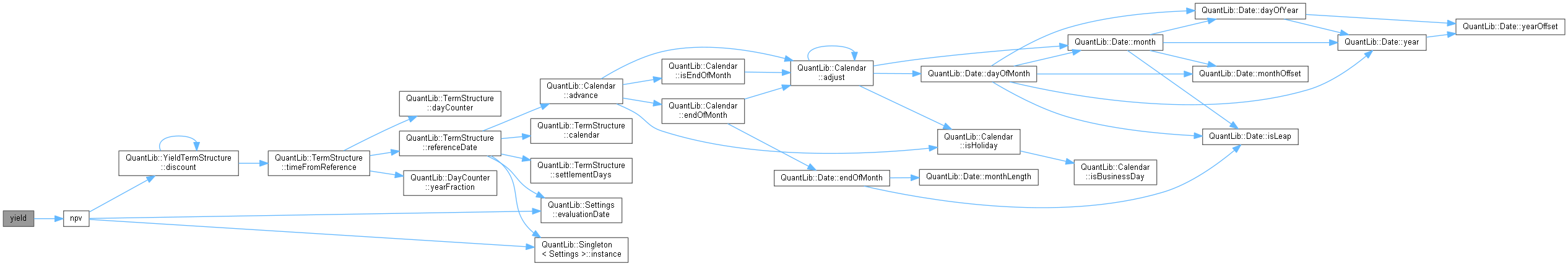

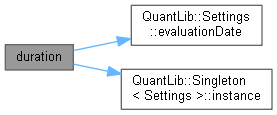

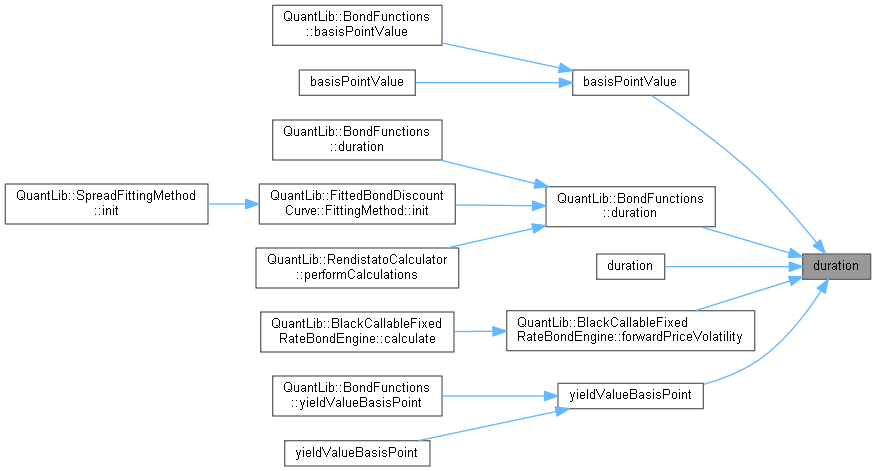

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ duration() [2/2]

|

static |

◆ convexity() [1/2]

|

static |

Cash-flow convexity.

The convexity of a string of cash flows is defined as

\[ C = \frac{1}{P} \frac{\partial^2 P}{\partial y^2} \]

where \( P \) is the present value of the cash flows according to the given IRR \( y \).

Definition at line 974 of file cashflows.cpp.

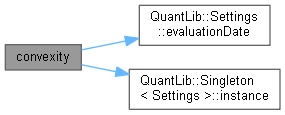

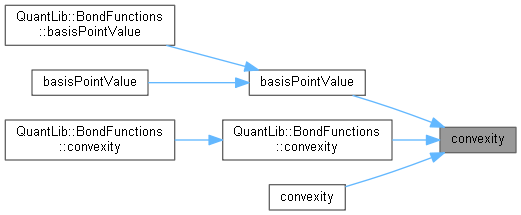

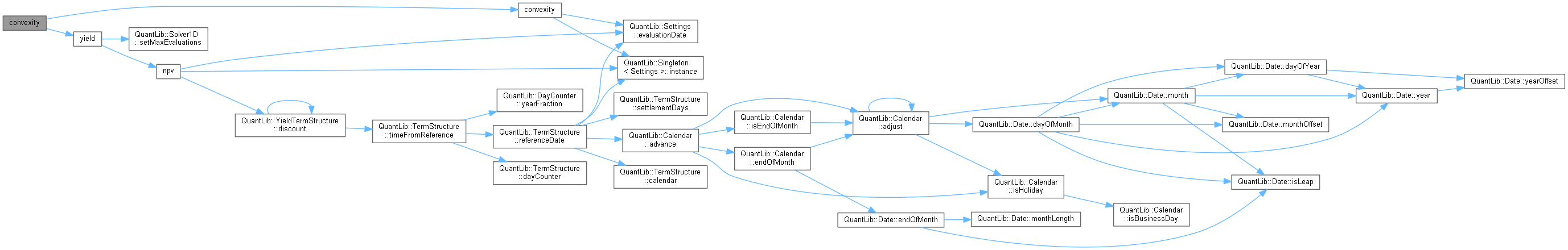

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ convexity() [2/2]

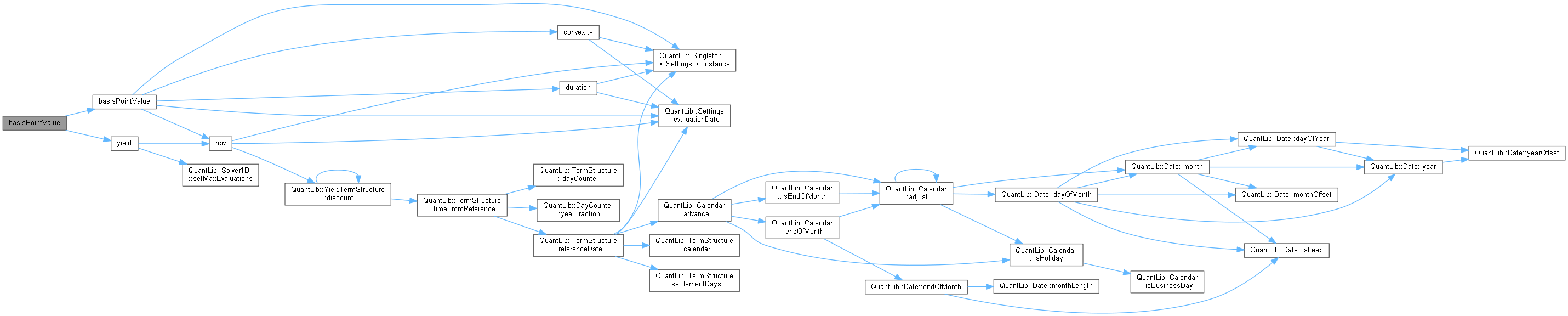

◆ basisPointValue() [1/2]

|

static |

Basis-point value.

Obtained by setting dy = 0.0001 in the 2nd-order Taylor series expansion.

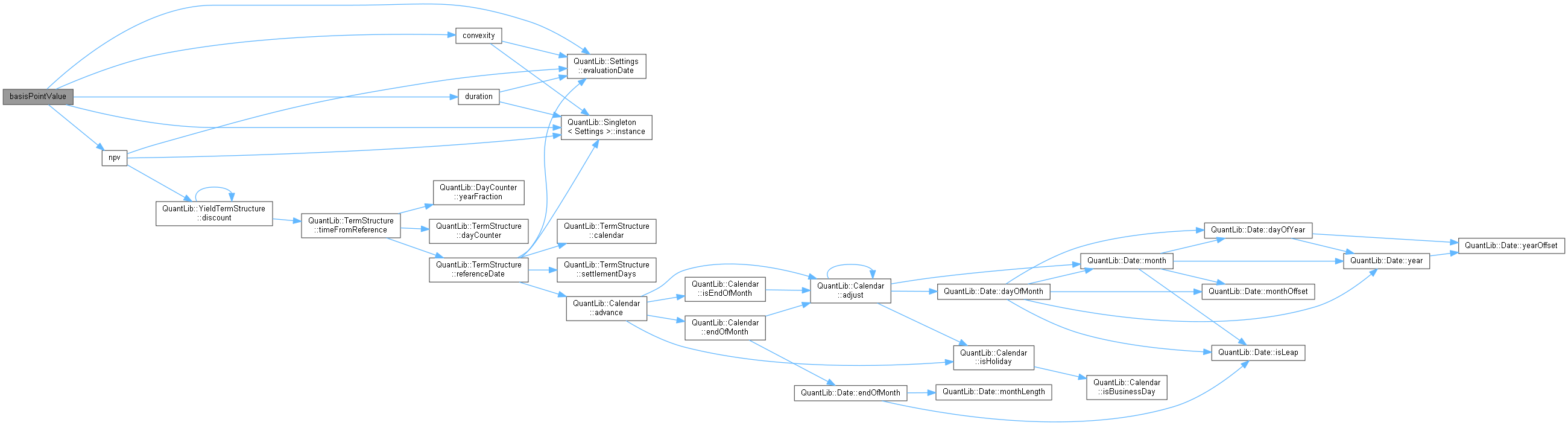

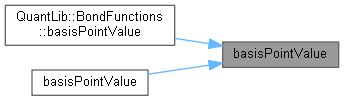

Definition at line 1058 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ basisPointValue() [2/2]

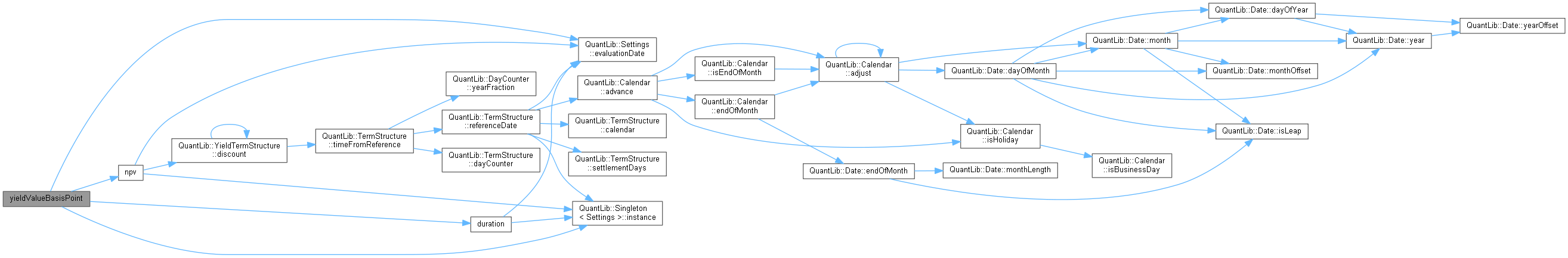

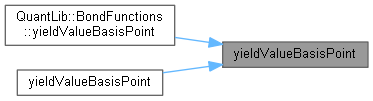

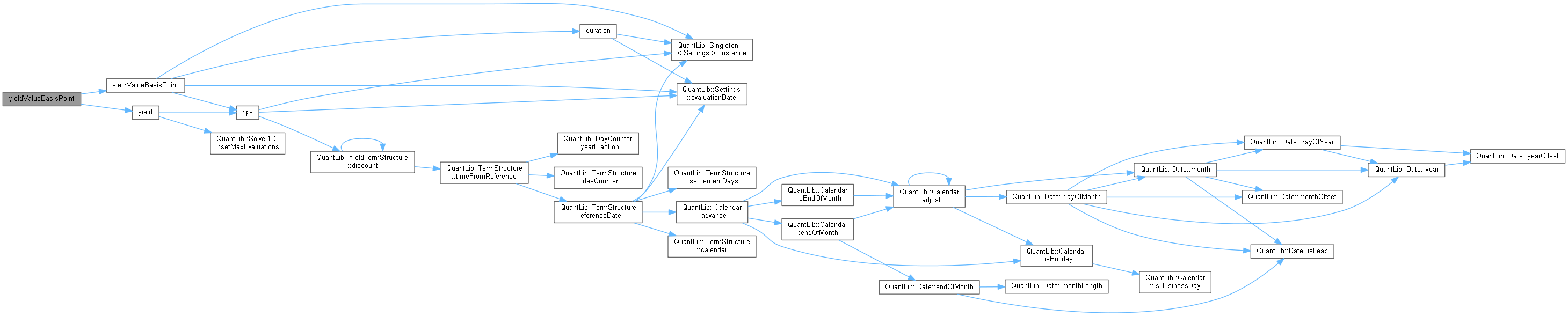

◆ yieldValueBasisPoint() [1/2]

|

static |

Yield value of a basis point.

The yield value of a one basis point change in price is the derivative of the yield with respect to the price multiplied by 0.01

Definition at line 1105 of file cashflows.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ yieldValueBasisPoint() [2/2]

◆ npv() [4/4]

|

static |

NPV of the cash flows.

For details on z-spread refer to: "Credit Spreads Explained", Lehman Brothers European Fixed Income Research - March 2004, D. O'Kane

The NPV is the sum of the cash flows, each discounted according to the z-spreaded term structure. The result is affected by the choice of the z-spread compounding and the relative frequency and day counter.

Definition at line 1194 of file cashflows.cpp.

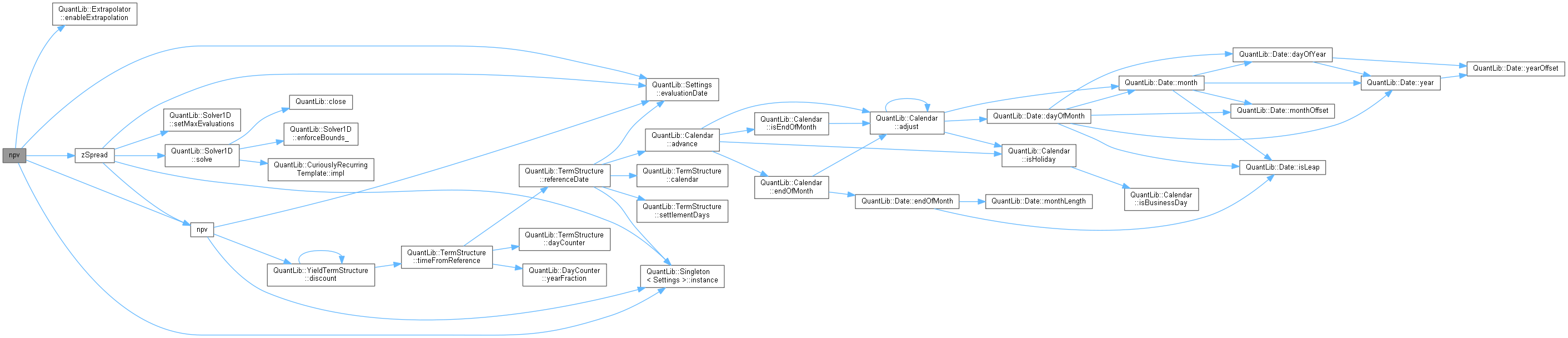

Here is the call graph for this function:

Here is the call graph for this function:◆ zSpread() [1/2]

|

static |

implied Z-spread.

Definition at line 1228 of file cashflows.cpp.

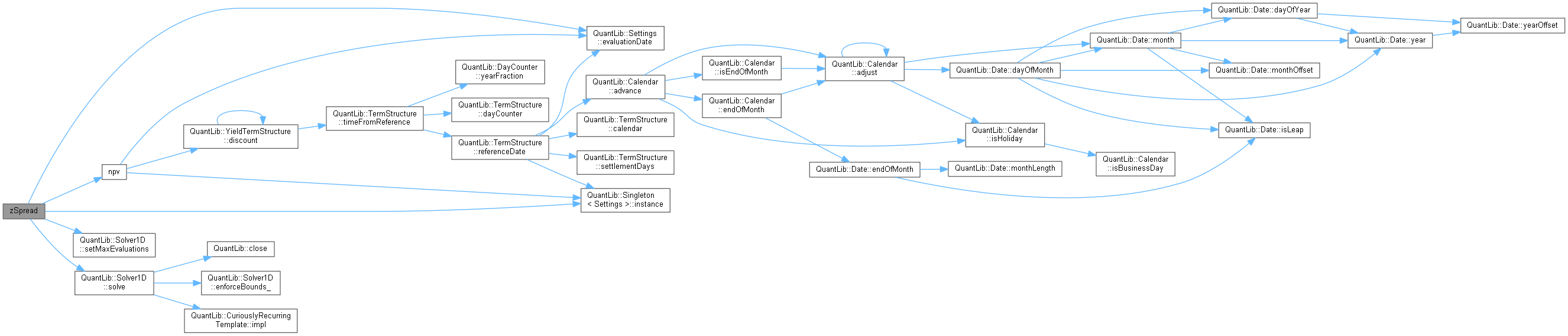

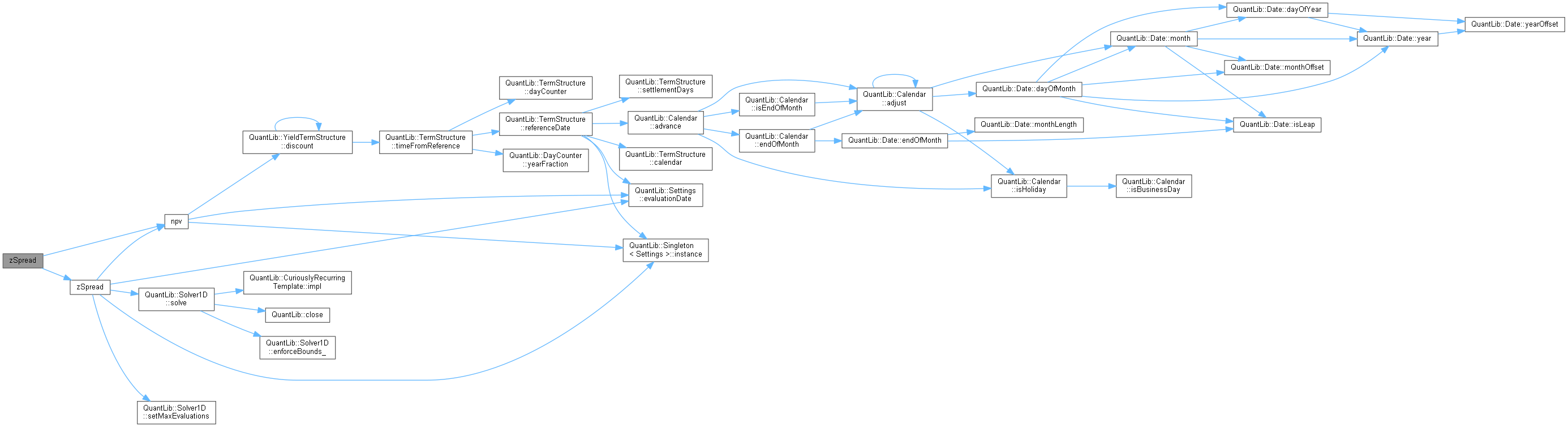

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ zSpread() [2/2]

|

static |

- Deprecated:

- Use the other overload. Deprecated in version 1.35.

Definition at line 432 of file cashflows.hpp.

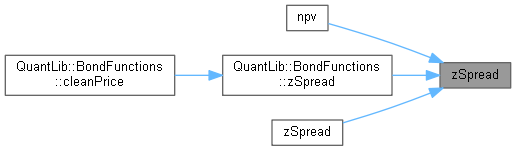

Here is the call graph for this function:

Here is the call graph for this function: