Black at-the-money (no-smile) volatility curve. More...

#include <blackatmvolcurve.hpp>

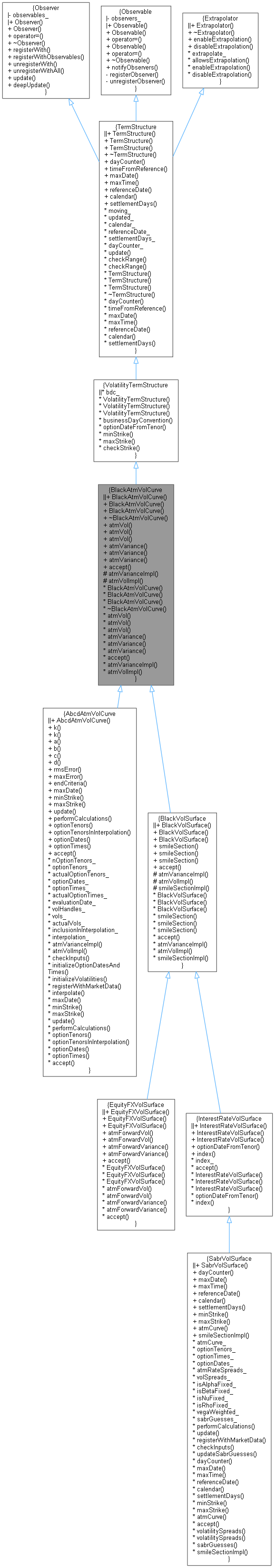

Inheritance diagram for BlackAtmVolCurve:

Inheritance diagram for BlackAtmVolCurve: Collaboration diagram for BlackAtmVolCurve:

Collaboration diagram for BlackAtmVolCurve:Public Member Functions | |

Constructors | |

See the TermStructure documentation for issues regarding constructors. | |

| BlackAtmVolCurve (BusinessDayConvention bdc=Following, const DayCounter &dc=DayCounter()) | |

| default constructor More... | |

| BlackAtmVolCurve (const Date &referenceDate, const Calendar &cal=Calendar(), BusinessDayConvention bdc=Following, const DayCounter &dc=DayCounter()) | |

| initialize with a fixed reference date More... | |

| BlackAtmVolCurve (Natural settlementDays, const Calendar &, BusinessDayConvention bdc=Following, const DayCounter &dc=DayCounter()) | |

| calculate the reference date based on the global evaluation date More... | |

| ~BlackAtmVolCurve () override=default | |

Black at-the-money spot volatility | |

| Volatility | atmVol (const Period &optionTenor, bool extrapolate=false) const |

| spot at-the-money volatility More... | |

| Volatility | atmVol (const Date &maturity, bool extrapolate=false) const |

| spot at-the-money volatility More... | |

| Volatility | atmVol (Time maturity, bool extrapolate=false) const |

| spot at-the-money volatility More... | |

| Real | atmVariance (const Period &optionTenor, bool extrapolate=false) const |

| spot at-the-money variance More... | |

| Real | atmVariance (const Date &maturity, bool extrapolate=false) const |

| spot at-the-money variance More... | |

| Real | atmVariance (Time maturity, bool extrapolate=false) const |

| spot at-the-money variance More... | |

Visitability | |

| virtual void | accept (AcyclicVisitor &) |

Public Member Functions inherited from VolatilityTermStructure Public Member Functions inherited from VolatilityTermStructure | |

| VolatilityTermStructure (BusinessDayConvention bdc, const DayCounter &dc=DayCounter()) | |

| VolatilityTermStructure (const Date &referenceDate, const Calendar &cal, BusinessDayConvention bdc, const DayCounter &dc=DayCounter()) | |

| initialize with a fixed reference date More... | |

| VolatilityTermStructure (Natural settlementDays, const Calendar &cal, BusinessDayConvention bdc, const DayCounter &dc=DayCounter()) | |

| calculate the reference date based on the global evaluation date More... | |

| virtual BusinessDayConvention | businessDayConvention () const |

| the business day convention used in tenor to date conversion More... | |

| Date | optionDateFromTenor (const Period &) const |

| period/date conversion More... | |

| virtual Rate | minStrike () const =0 |

| the minimum strike for which the term structure can return vols More... | |

| virtual Rate | maxStrike () const =0 |

| the maximum strike for which the term structure can return vols More... | |

Public Member Functions inherited from TermStructure Public Member Functions inherited from TermStructure | |

| TermStructure (DayCounter dc=DayCounter()) | |

| default constructor More... | |

| TermStructure (const Date &referenceDate, Calendar calendar=Calendar(), DayCounter dc=DayCounter()) | |

| initialize with a fixed reference date More... | |

| TermStructure (Natural settlementDays, Calendar, DayCounter dc=DayCounter()) | |

| calculate the reference date based on the global evaluation date More... | |

| ~TermStructure () override=default | |

| virtual DayCounter | dayCounter () const |

| the day counter used for date/time conversion More... | |

| Time | timeFromReference (const Date &date) const |

| date/time conversion More... | |

| virtual Date | maxDate () const =0 |

| the latest date for which the curve can return values More... | |

| virtual Time | maxTime () const |

| the latest time for which the curve can return values More... | |

| virtual const Date & | referenceDate () const |

| the date at which discount = 1.0 and/or variance = 0.0 More... | |

| virtual Calendar | calendar () const |

| the calendar used for reference and/or option date calculation More... | |

| virtual Natural | settlementDays () const |

| the settlementDays used for reference date calculation More... | |

| void | update () override |

Public Member Functions inherited from Observer Public Member Functions inherited from Observer | |

| Observer ()=default | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| virtual | ~Observer () |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | update ()=0 |

| virtual void | deepUpdate () |

Public Member Functions inherited from Observable Public Member Functions inherited from Observable | |

| Observable ()=default | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| virtual | ~Observable ()=default |

| void | notifyObservers () |

Public Member Functions inherited from Extrapolator Public Member Functions inherited from Extrapolator | |

| Extrapolator ()=default | |

| virtual | ~Extrapolator ()=default |

| void | enableExtrapolation (bool b=true) |

| enable extrapolation in subsequent calls More... | |

| void | disableExtrapolation (bool b=true) |

| disable extrapolation in subsequent calls More... | |

| bool | allowsExtrapolation () const |

| tells whether extrapolation is enabled More... | |

Protected Member Functions | |

Calculations | |

These methods must be implemented in derived classes to perform the actual volatility calculations. When they are called, range check has already been performed; therefore, they must assume that extrapolation is required. | |

| virtual Real | atmVarianceImpl (Time t) const =0 |

| spot at-the-money variance calculation More... | |

| virtual Volatility | atmVolImpl (Time t) const =0 |

| spot at-the-money volatility calculation More... | |

Protected Member Functions inherited from VolatilityTermStructure Protected Member Functions inherited from VolatilityTermStructure | |

| void | checkStrike (Rate strike, bool extrapolate) const |

| strike-range check More... | |

Protected Member Functions inherited from TermStructure Protected Member Functions inherited from TermStructure | |

| void | checkRange (const Date &d, bool extrapolate) const |

| date-range check More... | |

| void | checkRange (Time t, bool extrapolate) const |

| time-range check More... | |

Additional Inherited Members | |

Public Types inherited from Observer Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

Protected Attributes inherited from TermStructure Protected Attributes inherited from TermStructure | |

| bool | moving_ = false |

| bool | updated_ = true |

| Calendar | calendar_ |

Detailed Description

Black at-the-money (no-smile) volatility curve.

This abstract class defines the interface of concrete Black at-the-money (no-smile) volatility curves which will be derived from this one.

Volatilities are assumed to be expressed on an annual basis.

Definition at line 40 of file blackatmvolcurve.hpp.

Constructor & Destructor Documentation

◆ BlackAtmVolCurve() [1/3]

| BlackAtmVolCurve | ( | BusinessDayConvention | bdc = Following, |

| const DayCounter & | dc = DayCounter() |

||

| ) |

default constructor

- Warning:

- term structures initialized by means of this constructor must manage their own reference date by overriding the referenceDate() method.

Definition at line 24 of file blackatmvolcurve.cpp.

◆ BlackAtmVolCurve() [2/3]

| BlackAtmVolCurve | ( | const Date & | referenceDate, |

| const Calendar & | cal = Calendar(), |

||

| BusinessDayConvention | bdc = Following, |

||

| const DayCounter & | dc = DayCounter() |

||

| ) |

initialize with a fixed reference date

Definition at line 28 of file blackatmvolcurve.cpp.

◆ BlackAtmVolCurve() [3/3]

| BlackAtmVolCurve | ( | Natural | settlementDays, |

| const Calendar & | cal, | ||

| BusinessDayConvention | bdc = Following, |

||

| const DayCounter & | dc = DayCounter() |

||

| ) |

calculate the reference date based on the global evaluation date

Definition at line 34 of file blackatmvolcurve.cpp.

◆ ~BlackAtmVolCurve()

|

overridedefault |

Member Function Documentation

◆ atmVol() [1/3]

| Volatility atmVol | ( | const Period & | optionTenor, |

| bool | extrapolate = false |

||

| ) | const |

spot at-the-money volatility

Definition at line 40 of file blackatmvolcurve.cpp.

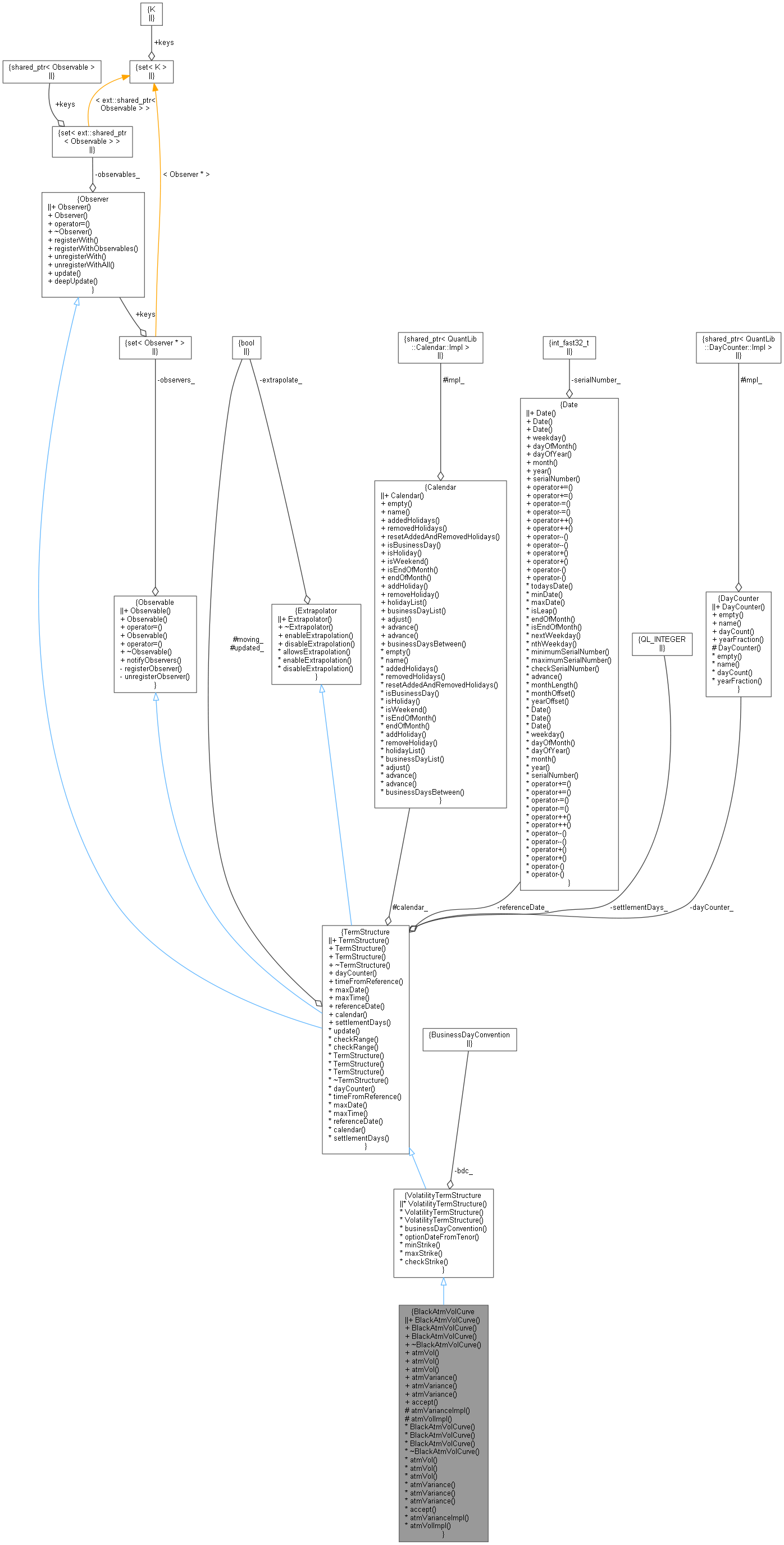

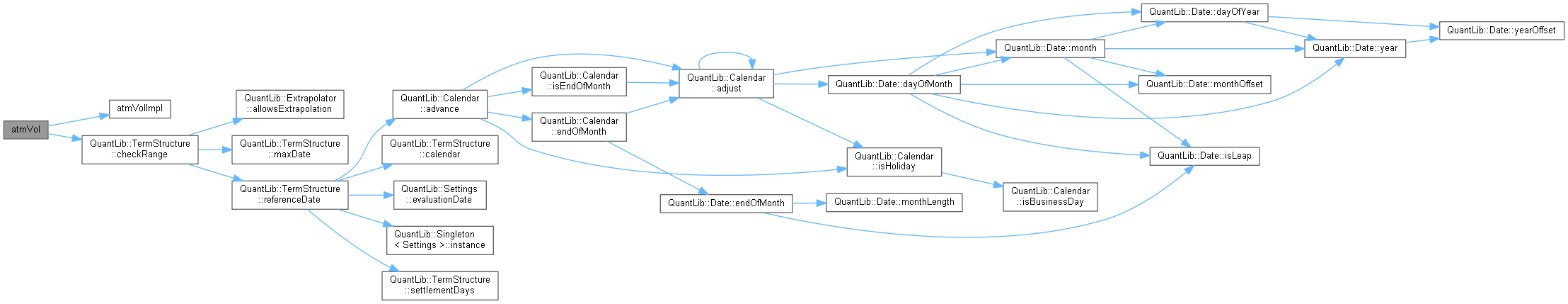

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ atmVol() [2/3]

| Volatility atmVol | ( | const Date & | maturity, |

| bool | extrapolate = false |

||

| ) | const |

spot at-the-money volatility

Definition at line 46 of file blackatmvolcurve.cpp.

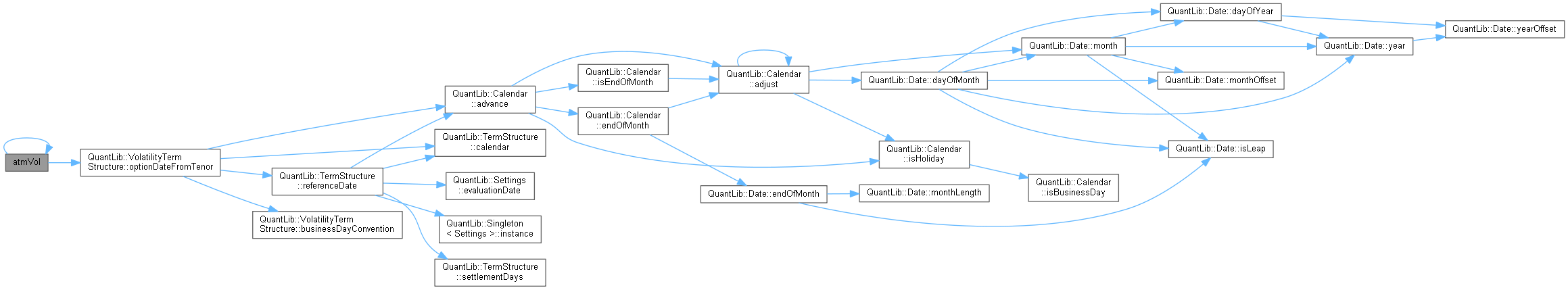

Here is the call graph for this function:

Here is the call graph for this function:◆ atmVol() [3/3]

| Volatility atmVol | ( | Time | maturity, |

| bool | extrapolate = false |

||

| ) | const |

spot at-the-money volatility

Definition at line 52 of file blackatmvolcurve.cpp.

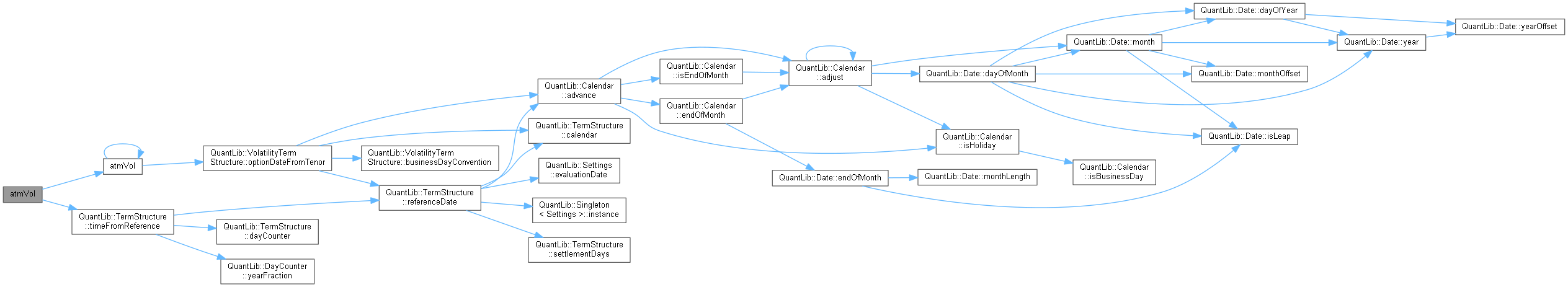

Here is the call graph for this function:

Here is the call graph for this function:◆ atmVariance() [1/3]

spot at-the-money variance

Definition at line 58 of file blackatmvolcurve.cpp.

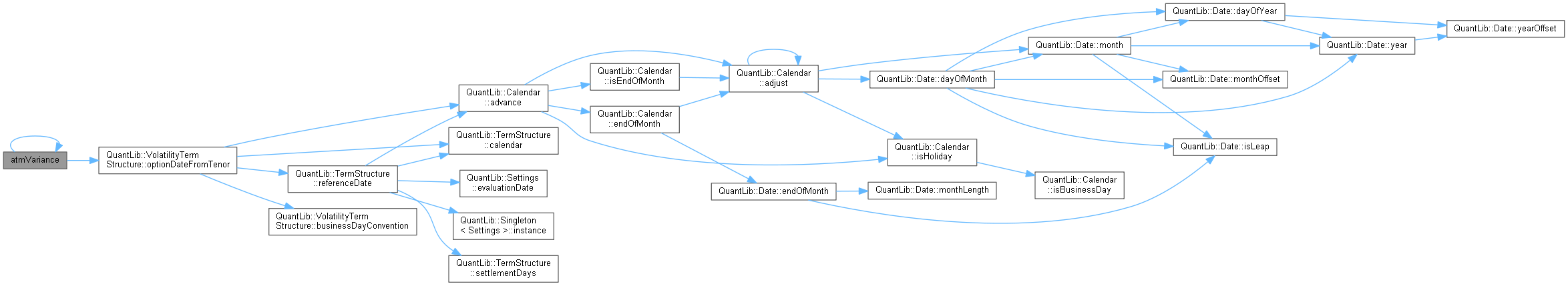

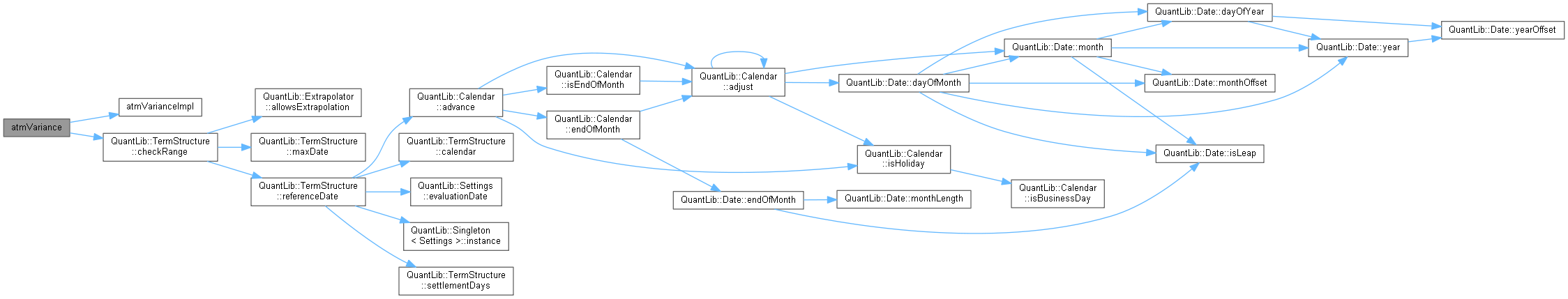

Here is the call graph for this function:

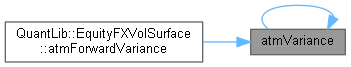

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ atmVariance() [2/3]

spot at-the-money variance

Definition at line 64 of file blackatmvolcurve.cpp.

Here is the call graph for this function:

Here is the call graph for this function:◆ atmVariance() [3/3]

spot at-the-money variance

Definition at line 70 of file blackatmvolcurve.cpp.

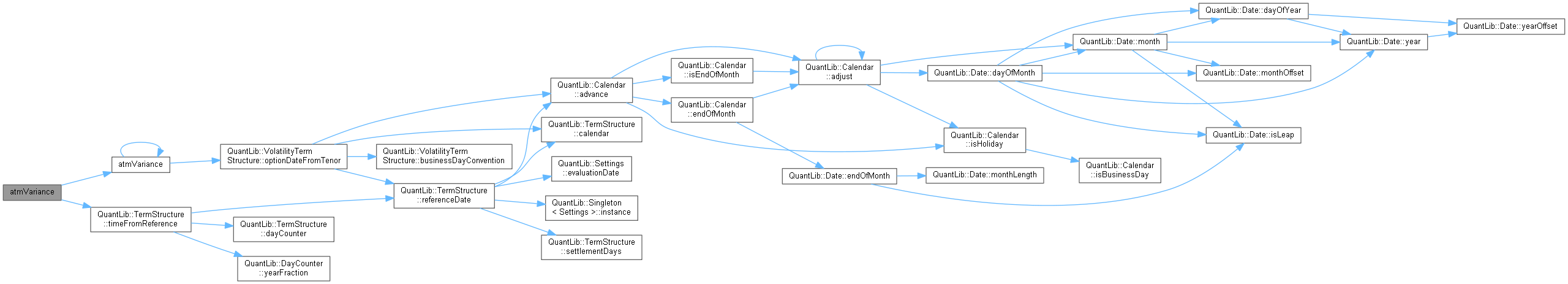

Here is the call graph for this function:

Here is the call graph for this function:◆ accept()

|

virtual |

Reimplemented in AbcdAtmVolCurve, BlackVolSurface, EquityFXVolSurface, InterestRateVolSurface, and SabrVolSurface.

Definition at line 76 of file blackatmvolcurve.cpp.

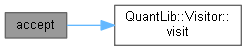

Here is the call graph for this function:

Here is the call graph for this function:◆ atmVarianceImpl()

spot at-the-money variance calculation

Implemented in AbcdAtmVolCurve, and BlackVolSurface.

Here is the caller graph for this function:

Here is the caller graph for this function:◆ atmVolImpl()

|

protectedpure virtual |

spot at-the-money volatility calculation

Implemented in AbcdAtmVolCurve, and BlackVolSurface.

Here is the caller graph for this function:

Here is the caller graph for this function: