market-model pathwise product More...

#include <ql/models/marketmodels/pathwisemultiproduct.hpp>

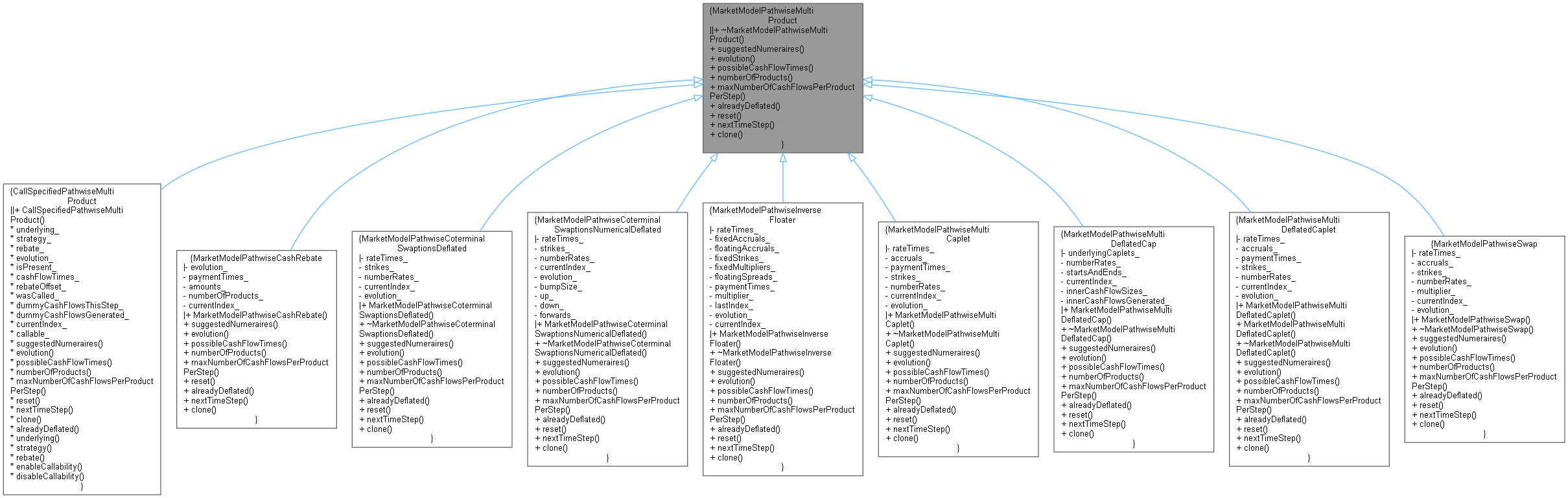

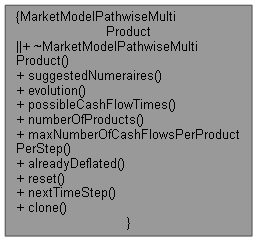

Inheritance diagram for MarketModelPathwiseMultiProduct:

Inheritance diagram for MarketModelPathwiseMultiProduct: Collaboration diagram for MarketModelPathwiseMultiProduct:

Collaboration diagram for MarketModelPathwiseMultiProduct:Classes | |

| struct | CashFlow |

Public Member Functions | |

| virtual | ~MarketModelPathwiseMultiProduct ()=default |

| virtual std::vector< Size > | suggestedNumeraires () const =0 |

| virtual const EvolutionDescription & | evolution () const =0 |

| virtual std::vector< Time > | possibleCashFlowTimes () const =0 |

| virtual Size | numberOfProducts () const =0 |

| virtual Size | maxNumberOfCashFlowsPerProductPerStep () const =0 |

| virtual bool | alreadyDeflated () const =0 |

| virtual void | reset ()=0 |

| during simulation put product at start of path More... | |

| virtual bool | nextTimeStep (const CurveState ¤tState, std::vector< Size > &numberCashFlowsThisStep, std::vector< std::vector< MarketModelPathwiseMultiProduct::CashFlow > > &cashFlowsGenerated)=0 |

| return value indicates whether path is finished, TRUE means done More... | |

| virtual std::unique_ptr< MarketModelPathwiseMultiProduct > | clone () const =0 |

| returns a newly-allocated copy of itself More... | |

Detailed Description

market-model pathwise product

This is the abstract base class that encapsulates the notion of a product: it contains the information that would be in the termsheet of the product.

It's useful to have it be able to do several products simultaneously. The products would have to have the same underlying rate times of course. The class is therefore really encapsulating the notion of a multi-product.

For each time evolved to, it generates the cash flows associated to that time for the state of the yield curve. If one was doing a callable product then this would encompass the product and its exercise strategy.

This class differs from market-model multi-product in that it also returns the derivative of the pay-off with respect to each forward rate

Definition at line 53 of file pathwisemultiproduct.hpp.

Constructor & Destructor Documentation

◆ ~MarketModelPathwiseMultiProduct()

|

virtualdefault |

Member Function Documentation

◆ suggestedNumeraires()

|

pure virtual |

Implemented in CallSpecifiedPathwiseMultiProduct, MarketModelPathwiseMultiCaplet, MarketModelPathwiseMultiDeflatedCaplet, MarketModelPathwiseMultiDeflatedCap, MarketModelPathwiseCashRebate, MarketModelPathwiseInverseFloater, MarketModelPathwiseSwap, MarketModelPathwiseCoterminalSwaptionsDeflated, and MarketModelPathwiseCoterminalSwaptionsNumericalDeflated.

◆ evolution()

|

pure virtual |

Implemented in CallSpecifiedPathwiseMultiProduct, MarketModelPathwiseMultiCaplet, MarketModelPathwiseMultiDeflatedCaplet, MarketModelPathwiseMultiDeflatedCap, MarketModelPathwiseCashRebate, MarketModelPathwiseInverseFloater, MarketModelPathwiseSwap, MarketModelPathwiseCoterminalSwaptionsDeflated, and MarketModelPathwiseCoterminalSwaptionsNumericalDeflated.

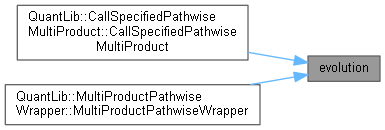

Here is the caller graph for this function:

Here is the caller graph for this function:◆ possibleCashFlowTimes()

|

pure virtual |

Implemented in CallSpecifiedPathwiseMultiProduct, MarketModelPathwiseMultiCaplet, MarketModelPathwiseMultiDeflatedCaplet, MarketModelPathwiseMultiDeflatedCap, MarketModelPathwiseCashRebate, MarketModelPathwiseInverseFloater, MarketModelPathwiseSwap, MarketModelPathwiseCoterminalSwaptionsDeflated, and MarketModelPathwiseCoterminalSwaptionsNumericalDeflated.

◆ numberOfProducts()

|

pure virtual |

Implemented in CallSpecifiedPathwiseMultiProduct, MarketModelPathwiseMultiCaplet, MarketModelPathwiseMultiDeflatedCaplet, MarketModelPathwiseMultiDeflatedCap, MarketModelPathwiseCashRebate, MarketModelPathwiseInverseFloater, MarketModelPathwiseSwap, MarketModelPathwiseCoterminalSwaptionsDeflated, and MarketModelPathwiseCoterminalSwaptionsNumericalDeflated.

◆ maxNumberOfCashFlowsPerProductPerStep()

|

pure virtual |

Implemented in CallSpecifiedPathwiseMultiProduct, MarketModelPathwiseMultiCaplet, MarketModelPathwiseMultiDeflatedCaplet, MarketModelPathwiseMultiDeflatedCap, MarketModelPathwiseCashRebate, MarketModelPathwiseInverseFloater, MarketModelPathwiseSwap, MarketModelPathwiseCoterminalSwaptionsDeflated, and MarketModelPathwiseCoterminalSwaptionsNumericalDeflated.

◆ alreadyDeflated()

|

pure virtual |

Implemented in CallSpecifiedPathwiseMultiProduct, MarketModelPathwiseMultiCaplet, MarketModelPathwiseMultiDeflatedCaplet, MarketModelPathwiseMultiDeflatedCap, MarketModelPathwiseCashRebate, MarketModelPathwiseInverseFloater, MarketModelPathwiseSwap, MarketModelPathwiseCoterminalSwaptionsDeflated, and MarketModelPathwiseCoterminalSwaptionsNumericalDeflated.

◆ reset()

|

pure virtual |

during simulation put product at start of path

Implemented in CallSpecifiedPathwiseMultiProduct, MarketModelPathwiseMultiCaplet, MarketModelPathwiseMultiDeflatedCaplet, MarketModelPathwiseMultiDeflatedCap, MarketModelPathwiseCashRebate, MarketModelPathwiseInverseFloater, MarketModelPathwiseSwap, MarketModelPathwiseCoterminalSwaptionsDeflated, and MarketModelPathwiseCoterminalSwaptionsNumericalDeflated.

◆ nextTimeStep()

|

pure virtual |

return value indicates whether path is finished, TRUE means done

Implemented in CallSpecifiedPathwiseMultiProduct, MarketModelPathwiseMultiCaplet, MarketModelPathwiseMultiDeflatedCaplet, MarketModelPathwiseMultiDeflatedCap, MarketModelPathwiseCashRebate, MarketModelPathwiseInverseFloater, MarketModelPathwiseSwap, MarketModelPathwiseCoterminalSwaptionsDeflated, and MarketModelPathwiseCoterminalSwaptionsNumericalDeflated.

◆ clone()

|

pure virtual |

returns a newly-allocated copy of itself

Implemented in CallSpecifiedPathwiseMultiProduct, MarketModelPathwiseMultiCaplet, MarketModelPathwiseMultiDeflatedCaplet, MarketModelPathwiseMultiDeflatedCap, MarketModelPathwiseCashRebate, MarketModelPathwiseInverseFloater, MarketModelPathwiseSwap, MarketModelPathwiseCoterminalSwaptionsDeflated, and MarketModelPathwiseCoterminalSwaptionsNumericalDeflated.