Garman-Klass volatility model. More...

#include <garmanklass.hpp>

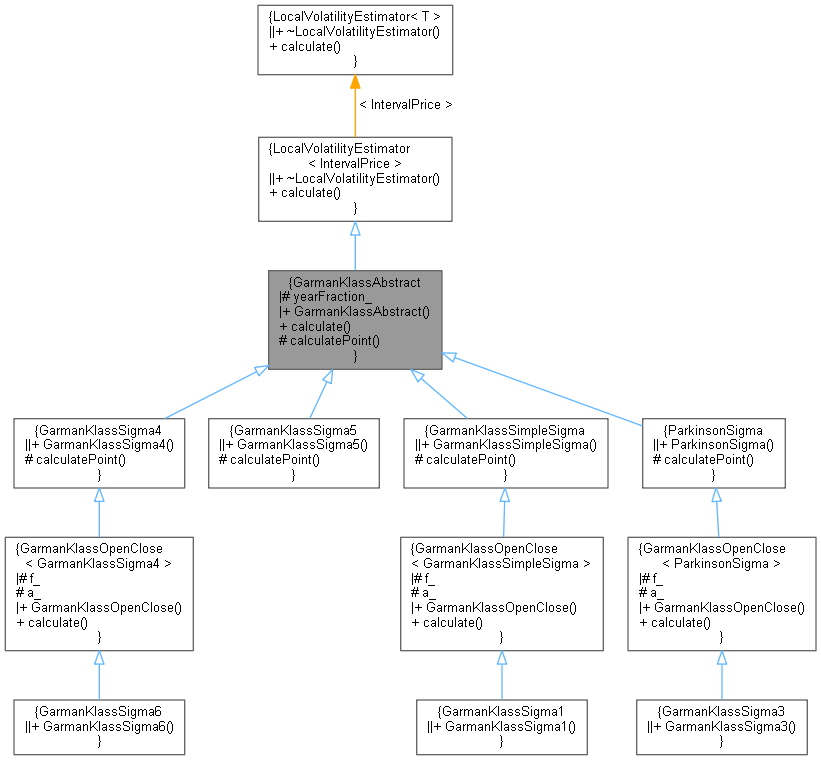

Inheritance diagram for GarmanKlassAbstract:

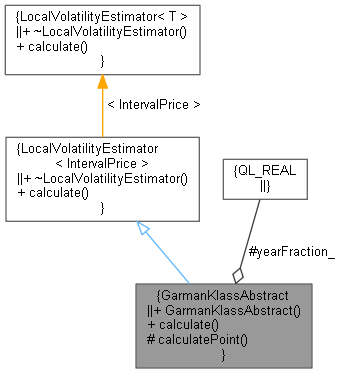

Inheritance diagram for GarmanKlassAbstract: Collaboration diagram for GarmanKlassAbstract:

Collaboration diagram for GarmanKlassAbstract:Public Member Functions | |

| GarmanKlassAbstract (Real y) | |

| TimeSeries< Volatility > | calculate (const TimeSeries< IntervalPrice > "eSeries) override |

Public Member Functions inherited from LocalVolatilityEstimator< IntervalPrice > Public Member Functions inherited from LocalVolatilityEstimator< IntervalPrice > | |

| virtual | ~LocalVolatilityEstimator ()=default |

| virtual TimeSeries< Volatility > | calculate (const TimeSeries< IntervalPrice > "eSeries)=0 |

Protected Member Functions | |

| virtual Real | calculatePoint (const IntervalPrice &p)=0 |

Protected Attributes | |

| Real | yearFraction_ |

Detailed Description

Garman-Klass volatility model.

This class implements a concrete volatility model based on high low formulas using the method of Garman and Klass in their paper "On the Estimation of the Security Price from Historical Data" at http://www.fea.com/resources/pdf/a_estimation_of_security_price.pdf

Volatilities are assumed to be expressed on an annual basis.

Definition at line 41 of file garmanklass.hpp.

Constructor & Destructor Documentation

◆ GarmanKlassAbstract()

|

explicit |

Definition at line 47 of file garmanklass.hpp.

Member Function Documentation

◆ calculatePoint()

|

protectedpure virtual |

Implemented in GarmanKlassSimpleSigma, ParkinsonSigma, GarmanKlassSigma4, and GarmanKlassSigma5.

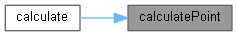

Here is the caller graph for this function:

Here is the caller graph for this function:◆ calculate()

|

overridevirtual |

Implements LocalVolatilityEstimator< IntervalPrice >.

Reimplemented in GarmanKlassOpenClose< GarmanKlassSimpleSigma >, GarmanKlassOpenClose< ParkinsonSigma >, and GarmanKlassOpenClose< GarmanKlassSigma4 >.

Definition at line 49 of file garmanklass.hpp.

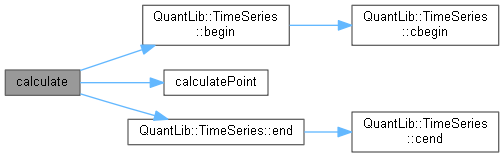

Here is the call graph for this function:

Here is the call graph for this function:Member Data Documentation

◆ yearFraction_

|

protected |

Definition at line 44 of file garmanklass.hpp.