#include <cvaswapengine.hpp>

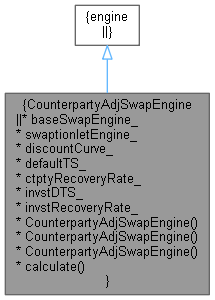

Inheritance diagram for CounterpartyAdjSwapEngine:

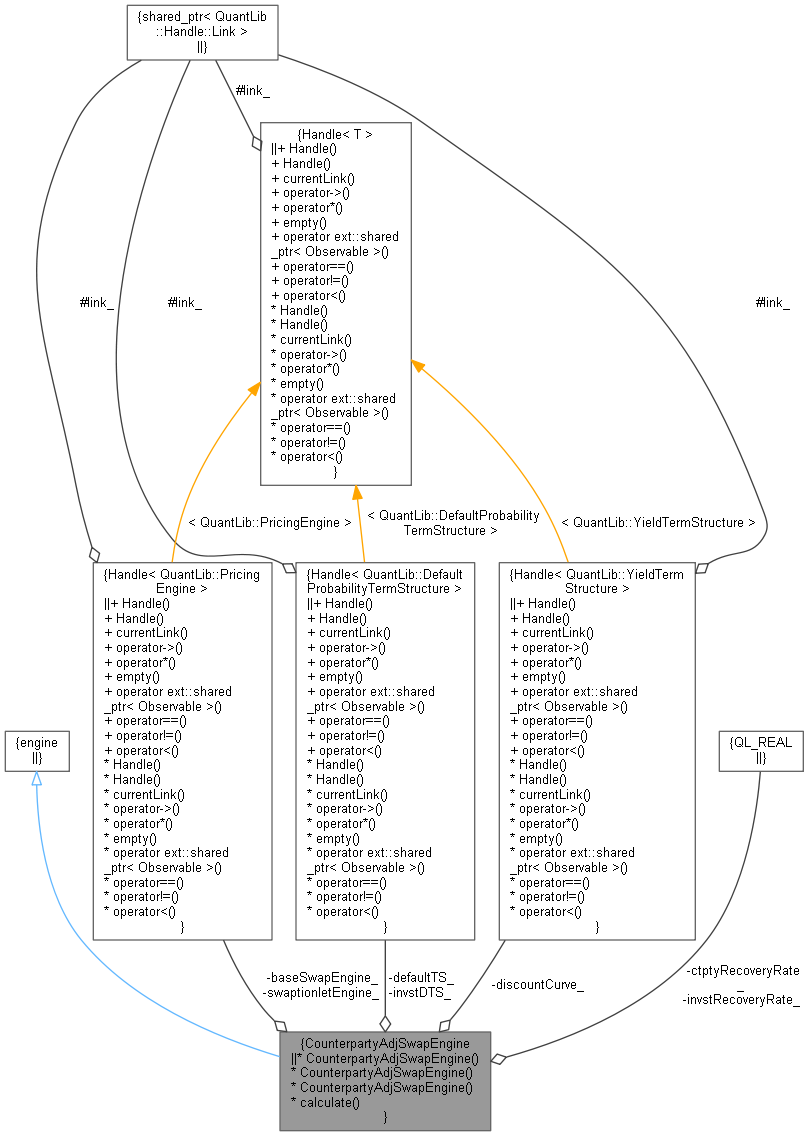

Inheritance diagram for CounterpartyAdjSwapEngine: Collaboration diagram for CounterpartyAdjSwapEngine:

Collaboration diagram for CounterpartyAdjSwapEngine:Detailed Description

Bilateral (CVA and DVA) default adjusted vanilla swap pricing engine. Collateral is not considered. No wrong way risk is considered (rates and counterparty default are uncorrelated). Based on: Sorensen, E.H. and Bollier, T.F., Pricing swap default risk. Financial Analysts Journal, 1994, 50, 23–33 Also see sect. II-5 in: Risk Neutral Pricing of Counterparty Risk D. Brigo, M. Masetti, 2004 or in sections 3 and 4 of "A Formula for Interest Rate Swaps Valuation under Counterparty Risk in presence of Netting Agreements" D. Brigo and M. Masetti; May 4, 2005

to do: Compute fair rate through iteration instead of the current approximation . to do: write Issuer based constructors (event type) to do: Check consistency between option engine discount and the one given

Definition at line 49 of file cvaswapengine.hpp.

Constructor & Destructor Documentation

◆ CounterpartyAdjSwapEngine() [1/3]

| CounterpartyAdjSwapEngine | ( | const Handle< YieldTermStructure > & | discountCurve, |

| const Handle< PricingEngine > & | swaptionEngine, | ||

| const Handle< DefaultProbabilityTermStructure > & | ctptyDTS, | ||

| Real | ctptyRecoveryRate, | ||

| const Handle< DefaultProbabilityTermStructure > & | invstDTS = Handle<DefaultProbabilityTermStructure>(), |

||

| Real | invstRecoveryRate = 0.999 |

||

| ) |

Creates the engine from an arbitrary swaption engine. If the investor default model is not given a default free one is assumed.

- Parameters

-

discountCurve Used in pricing. swaptionEngine Determines the volatility and thus the exposure model. ctptyDTS Counterparty default curve. ctptyRecoveryRate Counterparty recovey rate. invstDTS Investor (swap holder) default curve. invstRecoveryRate Investor recovery rate.

Definition at line 33 of file cvaswapengine.cpp.

◆ CounterpartyAdjSwapEngine() [2/3]

| CounterpartyAdjSwapEngine | ( | const Handle< YieldTermStructure > & | discountCurve, |

| Volatility | blackVol, | ||

| const Handle< DefaultProbabilityTermStructure > & | ctptyDTS, | ||

| Real | ctptyRecoveryRate, | ||

| const Handle< DefaultProbabilityTermStructure > & | invstDTS = Handle<DefaultProbabilityTermStructure>(), |

||

| Real | invstRecoveryRate = 0.999 |

||

| ) |

Creates an engine with a black volatility model for the exposure. If the investor default model is not given a default free one is assumed.

- Parameters

-

discountCurve Used in pricing. blackVol Black volatility used in the exposure model. ctptyDTS Counterparty default curve. ctptyRecoveryRate Counterparty recovey rate. invstDTS Investor (swap holder) default curve. invstRecoveryRate Investor recovery rate.

Definition at line 57 of file cvaswapengine.cpp.

◆ CounterpartyAdjSwapEngine() [3/3]

| CounterpartyAdjSwapEngine | ( | const Handle< YieldTermStructure > & | discountCurve, |

| const Handle< Quote > & | blackVol, | ||

| const Handle< DefaultProbabilityTermStructure > & | ctptyDTS, | ||

| Real | ctptyRecoveryRate, | ||

| const Handle< DefaultProbabilityTermStructure > & | invstDTS = Handle<DefaultProbabilityTermStructure>(), |

||

| Real | invstRecoveryRate = 0.999 |

||

| ) |

Creates an engine with a black volatility model for the exposure. The volatility is given as a quote. If the investor default model is not given a default free one is assumed.

- Parameters

-

discountCurve Used in pricing. blackVol Black volatility used in the exposure model. ctptyDTS Counterparty default curve. ctptyRecoveryRate Counterparty recovey rate. invstDTS Investor (swap holder) default curve. invstRecoveryRate Investor recovery rate.

Definition at line 82 of file cvaswapengine.cpp.

Member Function Documentation

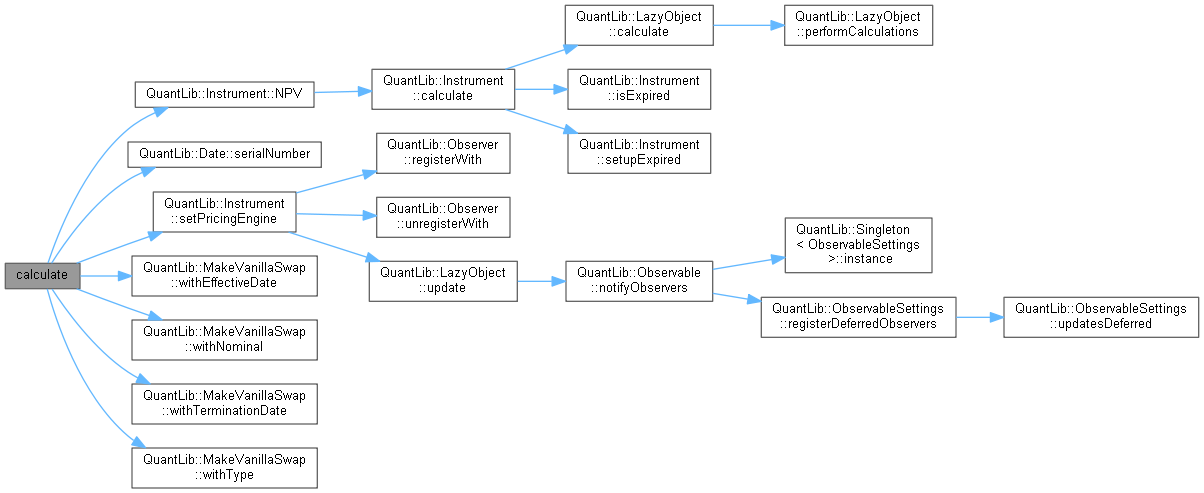

◆ calculate()

|

override |

Member Data Documentation

◆ baseSwapEngine_

|

private |

Definition at line 114 of file cvaswapengine.hpp.

◆ swaptionletEngine_

|

private |

Definition at line 115 of file cvaswapengine.hpp.

◆ discountCurve_

|

private |

Definition at line 116 of file cvaswapengine.hpp.

◆ defaultTS_

|

private |

Definition at line 117 of file cvaswapengine.hpp.

◆ ctptyRecoveryRate_

|

private |

Definition at line 118 of file cvaswapengine.hpp.

◆ invstDTS_

|

private |

Definition at line 119 of file cvaswapengine.hpp.

◆ invstRecoveryRate_

|

private |

Definition at line 120 of file cvaswapengine.hpp.