#include <pathwisediscounter.hpp>

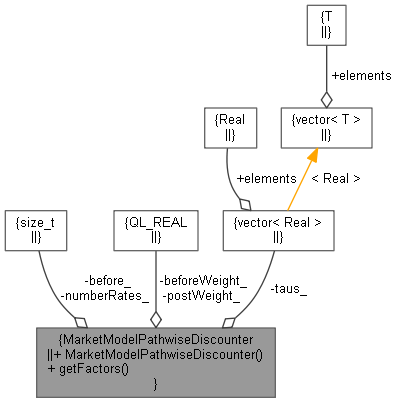

Collaboration diagram for MarketModelPathwiseDiscounter:

Collaboration diagram for MarketModelPathwiseDiscounter:Public Member Functions | |

| MarketModelPathwiseDiscounter (Time paymentTime, const std::vector< Time > &rateTimes) | |

| void | getFactors (const Matrix &LIBORRates, const Matrix &Discounts, Size currentStep, std::vector< Real > &factors) const |

Private Attributes | |

| Size | before_ |

| Size | numberRates_ |

| Real | beforeWeight_ |

| Real | postWeight_ |

| std::vector< Real > | taus_ |

Detailed Description

this class returns the number of units of the discretely compounding money market account that 1 unit of cash at the payment can buy using the LIBOR rates from current step.

It also returns the derivative of this number with respect to each of the rates.

Discounting is purely based on the simulation LIBOR rates, to get a discounting back to zero you need to multiply by the discount factor of t_0.

Definition at line 43 of file pathwisediscounter.hpp.

Constructor & Destructor Documentation

◆ MarketModelPathwiseDiscounter()

| MarketModelPathwiseDiscounter | ( | Time | paymentTime, |

| const std::vector< Time > & | rateTimes | ||

| ) |

Member Function Documentation

◆ getFactors()

| void getFactors | ( | const Matrix & | LIBORRates, |

| const Matrix & | Discounts, | ||

| Size | currentStep, | ||

| std::vector< Real > & | factors | ||

| ) | const |

Definition at line 51 of file pathwisediscounter.cpp.

Member Data Documentation

◆ before_

|

private |

Definition at line 52 of file pathwisediscounter.hpp.

◆ numberRates_

|

private |

Definition at line 53 of file pathwisediscounter.hpp.

◆ beforeWeight_

|

private |

Definition at line 54 of file pathwisediscounter.hpp.

◆ postWeight_

|

private |

Definition at line 55 of file pathwisediscounter.hpp.

◆ taus_

|

private |

Definition at line 56 of file pathwisediscounter.hpp.