Synthetic Collateralized Debt Obligation. More...

#include <syntheticcdo.hpp>

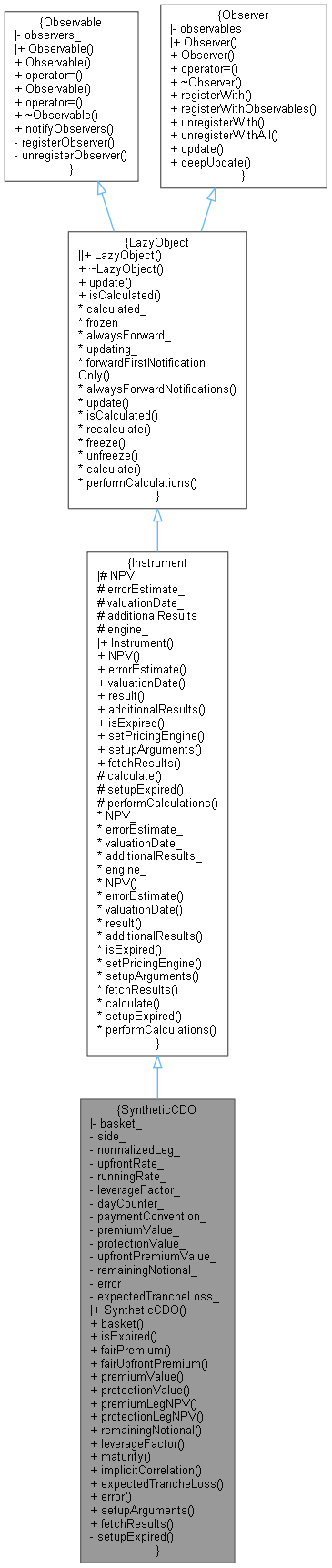

Inheritance diagram for SyntheticCDO:

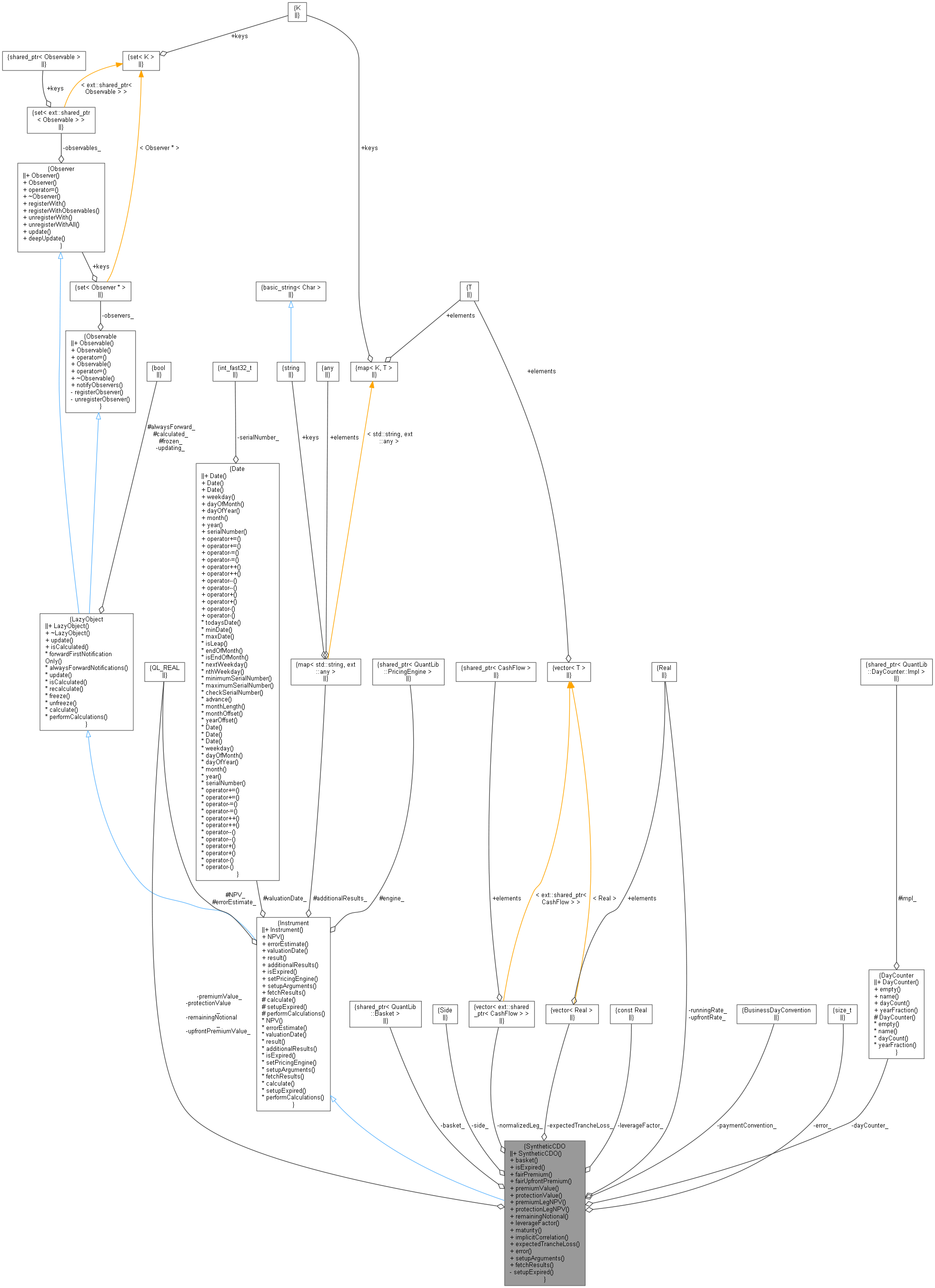

Inheritance diagram for SyntheticCDO: Collaboration diagram for SyntheticCDO:

Collaboration diagram for SyntheticCDO:Classes | |

| class | arguments |

| class | engine |

| CDO base engine. More... | |

| class | results |

Public Member Functions | |

| SyntheticCDO (const ext::shared_ptr< Basket > &basket, Protection::Side side, Schedule schedule, Rate upfrontRate, Rate runningRate, const DayCounter &dayCounter, BusinessDayConvention paymentConvention, ext::optional< Real > notional=ext::nullopt) | |

| const ext::shared_ptr< Basket > & | basket () const |

| bool | isExpired () const override |

| returns whether the instrument might have value greater than zero. More... | |

| Rate | fairPremium () const |

| Rate | fairUpfrontPremium () const |

| Rate | premiumValue () const |

| Rate | protectionValue () const |

| Real | premiumLegNPV () const |

| Real | protectionLegNPV () const |

| Real | remainingNotional () const |

| Real | leverageFactor () const |

| const Date & | maturity () const |

| Last protection date. More... | |

| Real | implicitCorrelation (const std::vector< Real > &recoveries, const Handle< YieldTermStructure > &discountCurve, Real targetNPV=0., Real accuracy=1.0e-3) const |

| std::vector< Real > | expectedTrancheLoss () const |

| Size | error () const |

| void | setupArguments (PricingEngine::arguments *) const override |

| void | fetchResults (const PricingEngine::results *) const override |

Public Member Functions inherited from Instrument Public Member Functions inherited from Instrument | |

| Instrument () | |

| Real | NPV () const |

| returns the net present value of the instrument. More... | |

| Real | errorEstimate () const |

| returns the error estimate on the NPV when available. More... | |

| const Date & | valuationDate () const |

| returns the date the net present value refers to. More... | |

| template<typename T > | |

| T | result (const std::string &tag) const |

| returns any additional result returned by the pricing engine. More... | |

| const std::map< std::string, ext::any > & | additionalResults () const |

| returns all additional result returned by the pricing engine. More... | |

| void | setPricingEngine (const ext::shared_ptr< PricingEngine > &) |

| set the pricing engine to be used. More... | |

Public Member Functions inherited from LazyObject Public Member Functions inherited from LazyObject | |

| LazyObject () | |

| ~LazyObject () override=default | |

| void | update () override |

| bool | isCalculated () const |

| void | forwardFirstNotificationOnly () |

| void | alwaysForwardNotifications () |

| void | recalculate () |

| void | freeze () |

| void | unfreeze () |

Public Member Functions inherited from Observable Public Member Functions inherited from Observable | |

| Observable ()=default | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| virtual | ~Observable ()=default |

| void | notifyObservers () |

Public Member Functions inherited from Observer Public Member Functions inherited from Observer | |

| Observer ()=default | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| virtual | ~Observer () |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | update ()=0 |

| virtual void | deepUpdate () |

Private Member Functions | |

| void | setupExpired () const override |

Private Attributes | |

| ext::shared_ptr< Basket > | basket_ |

| Protection::Side | side_ |

| Leg | normalizedLeg_ |

| Rate | upfrontRate_ |

| Rate | runningRate_ |

| const Real | leverageFactor_ |

| DayCounter | dayCounter_ |

| BusinessDayConvention | paymentConvention_ |

| Real | premiumValue_ |

| Real | protectionValue_ |

| Real | upfrontPremiumValue_ |

| Real | remainingNotional_ |

| Size | error_ |

| std::vector< Real > | expectedTrancheLoss_ |

Additional Inherited Members | |

Public Types inherited from Observer Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

Protected Member Functions inherited from Instrument Protected Member Functions inherited from Instrument | |

| void | calculate () const override |

| void | performCalculations () const override |

Protected Member Functions inherited from LazyObject Protected Member Functions inherited from LazyObject | |

Protected Attributes inherited from Instrument Protected Attributes inherited from Instrument | |

| Real | NPV_ |

| Real | errorEstimate_ |

| Date | valuationDate_ |

| std::map< std::string, ext::any > | additionalResults_ |

| ext::shared_ptr< PricingEngine > | engine_ |

Protected Attributes inherited from LazyObject Protected Attributes inherited from LazyObject | |

| bool | calculated_ = false |

| bool | frozen_ = false |

| bool | alwaysForward_ |

Detailed Description

Synthetic Collateralized Debt Obligation.

The instrument prices a mezzanine CDO tranche with loss given default between attachment point \( D_1\) and detachment point \( D_2 > D_1 \).

For purchased protection, the instrument value is given by the difference of the protection value \( V_1 \) and premium value \( V_2 \),

\[ V = V_1 - V_2. \]

The protection leg is priced as follows:

- Build the probability distribution for volume of defaults \( L \) (before recovery) or Loss Given Default \( LGD = (1-r)\,L \) at times/dates \( t_i, i=1, ..., N\) (premium schedule times with intermediate steps)

- Determine the expected value \( E_i = E_{t_i}\,\left[Pay(LGD)\right] \) of the protection payoff \( Pay(LGD) \) at each time \( t_i\) where

\[ Pay(L) = min (D_1, LGD) - min (D_2, LGD) = \left\{ \begin{array}{lcl} \displaystyle 0 &;& LGD < D_1 \\ \displaystyle LGD - D_1 &;& D_1 \leq LGD \leq D_2 \\ \displaystyle D_2 - D_1 &;& LGD > D_2 \end{array} \right. \]

- The protection value is then calculated as

\[ V_1 \:=\: \sum_{i=1}^N (E_i - E_{i-1}) \cdot d_i \]

where \( d_i\) is the discount factor at time/date \( t_i \)

The premium is paid on the protected notional amount, initially \( D_2 - D_1. \) This notional amount is reduced by the expected protection payments \( E_i \) at times \( t_i, \) so that the premium value is calculated as

\[ V_2 =m \, \cdot \sum_{i=1}^N \,(D_2 - D_1 - E_i) \cdot \Delta_{i-1,i}\,d_i \]

where \( m \) is the premium rate, \( \Delta_{i-1, i}\) is the day count fraction between date/time \( t_{i-1}\) and \( t_i.\)

The construction of the portfolio loss distribution \( E_i \) is based on the probability bucketing algorithm described in

John Hull and Alan White, "Valuation of a CDO and nth to default CDS without Monte Carlo simulation", Journal of Derivatives 12, 2, 2004

The pricing algorithm allows for varying notional amounts and default termstructures of the underlyings.

Definition at line 104 of file syntheticcdo.hpp.

Constructor & Destructor Documentation

◆ SyntheticCDO()

| SyntheticCDO | ( | const ext::shared_ptr< Basket > & | basket, |

| Protection::Side | side, | ||

| Schedule | schedule, | ||

| Rate | upfrontRate, | ||

| Rate | runningRate, | ||

| const DayCounter & | dayCounter, | ||

| BusinessDayConvention | paymentConvention, | ||

| ext::optional< Real > | notional = ext::nullopt |

||

| ) |

If the notional exceeds the basket inception tranche notional, the cdo is leveraged by that factor.

Definition at line 36 of file syntheticcdo.cpp.

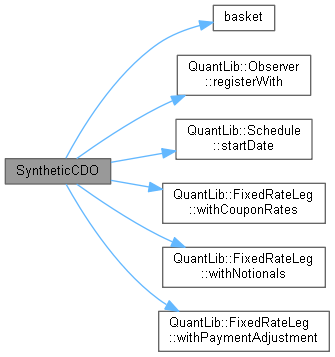

Here is the call graph for this function:

Here is the call graph for this function:Member Function Documentation

◆ basket()

| const ext::shared_ptr< Basket > & basket | ( | ) | const |

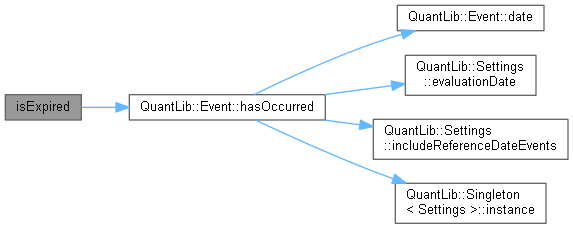

◆ isExpired()

|

overridevirtual |

returns whether the instrument might have value greater than zero.

Implements Instrument.

Definition at line 131 of file syntheticcdo.cpp.

Here is the call graph for this function:

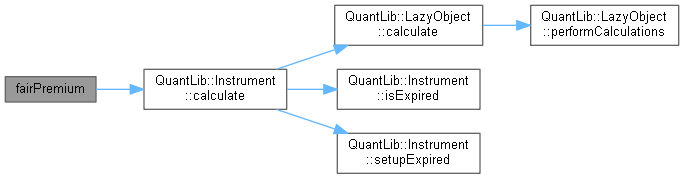

Here is the call graph for this function:◆ fairPremium()

| Rate fairPremium | ( | ) | const |

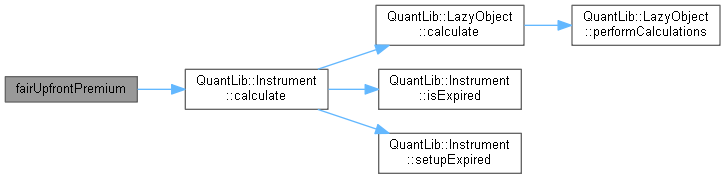

◆ fairUpfrontPremium()

| Rate fairUpfrontPremium | ( | ) | const |

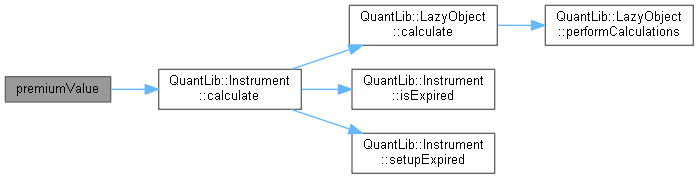

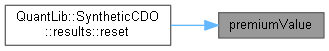

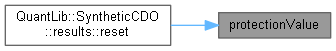

◆ premiumValue()

| Rate premiumValue | ( | ) | const |

Definition at line 87 of file syntheticcdo.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

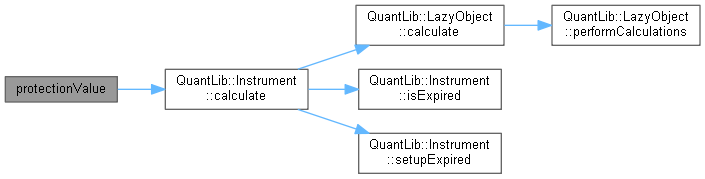

Here is the caller graph for this function:◆ protectionValue()

| Rate protectionValue | ( | ) | const |

Definition at line 92 of file syntheticcdo.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

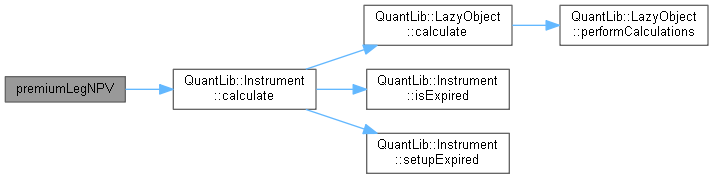

Here is the caller graph for this function:◆ premiumLegNPV()

| Real premiumLegNPV | ( | ) | const |

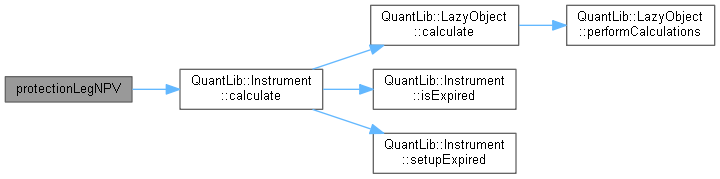

◆ protectionLegNPV()

| Real protectionLegNPV | ( | ) | const |

◆ remainingNotional()

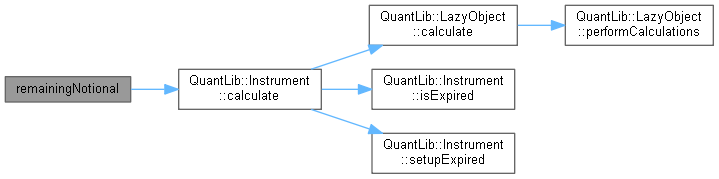

| Real remainingNotional | ( | ) | const |

Total outstanding tranche notional, not wiped out

Definition at line 138 of file syntheticcdo.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ leverageFactor()

| Real leverageFactor | ( | ) | const |

The number of times the contract contains the portfolio tranched notional.

Definition at line 143 of file syntheticcdo.hpp.

◆ maturity()

| const Date & maturity | ( | ) | const |

Last protection date.

Definition at line 147 of file syntheticcdo.hpp.

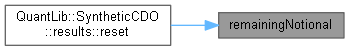

◆ implicitCorrelation()

| Real implicitCorrelation | ( | const std::vector< Real > & | recoveries, |

| const Handle< YieldTermStructure > & | discountCurve, | ||

| Real | targetNPV = 0., |

||

| Real | accuracy = 1.0e-3 |

||

| ) | const |

The Gaussian Copula LHP implied correlation that makes the contract zero value. This is for a flat correlation along time and portfolio loss level.

Definition at line 229 of file syntheticcdo.cpp.

Here is the call graph for this function:

Here is the call graph for this function:◆ expectedTrancheLoss()

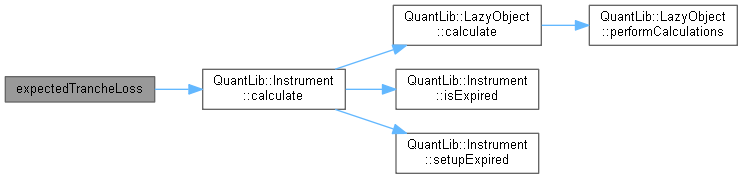

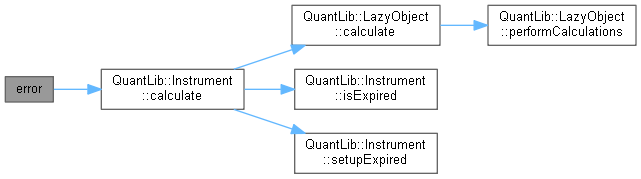

| std::vector< Real > expectedTrancheLoss | ( | ) | const |

Expected tranche loss for all payment dates

Definition at line 121 of file syntheticcdo.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

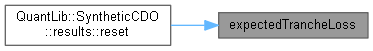

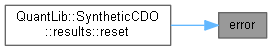

Here is the caller graph for this function:◆ error()

| Size error | ( | ) | const |

Definition at line 126 of file syntheticcdo.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ setupArguments()

|

overridevirtual |

When a derived argument structure is defined for an instrument, this method should be overridden to fill it. This is mandatory in case a pricing engine is used.

Reimplemented from Instrument.

Definition at line 143 of file syntheticcdo.cpp.

Here is the caller graph for this function:

Here is the caller graph for this function:◆ fetchResults()

|

overridevirtual |

When a derived result structure is defined for an instrument, this method should be overridden to read from it. This is mandatory in case a pricing engine is used.

Reimplemented from Instrument.

Definition at line 157 of file syntheticcdo.cpp.

Here is the call graph for this function:

Here is the call graph for this function:◆ setupExpired()

|

overrideprivatevirtual |

This method must leave the instrument in a consistent state when the expiration condition is met.

Reimplemented from Instrument.

Definition at line 171 of file syntheticcdo.cpp.

Here is the call graph for this function:

Here is the call graph for this function:Member Data Documentation

◆ basket_

|

private |

Definition at line 172 of file syntheticcdo.hpp.

◆ side_

|

private |

Definition at line 173 of file syntheticcdo.hpp.

◆ normalizedLeg_

|

private |

Definition at line 174 of file syntheticcdo.hpp.

◆ upfrontRate_

|

private |

Definition at line 176 of file syntheticcdo.hpp.

◆ runningRate_

|

private |

Definition at line 177 of file syntheticcdo.hpp.

◆ leverageFactor_

|

private |

Definition at line 178 of file syntheticcdo.hpp.

◆ dayCounter_

|

private |

Definition at line 179 of file syntheticcdo.hpp.

◆ paymentConvention_

|

private |

Definition at line 180 of file syntheticcdo.hpp.

◆ premiumValue_

|

mutableprivate |

Definition at line 182 of file syntheticcdo.hpp.

◆ protectionValue_

|

mutableprivate |

Definition at line 183 of file syntheticcdo.hpp.

◆ upfrontPremiumValue_

|

mutableprivate |

Definition at line 184 of file syntheticcdo.hpp.

◆ remainingNotional_

|

mutableprivate |

Definition at line 185 of file syntheticcdo.hpp.

◆ error_

|

mutableprivate |

Definition at line 186 of file syntheticcdo.hpp.

◆ expectedTrancheLoss_

|

mutableprivate |

Definition at line 187 of file syntheticcdo.hpp.