collateralized debt obligation More...

#include <cdo.hpp>

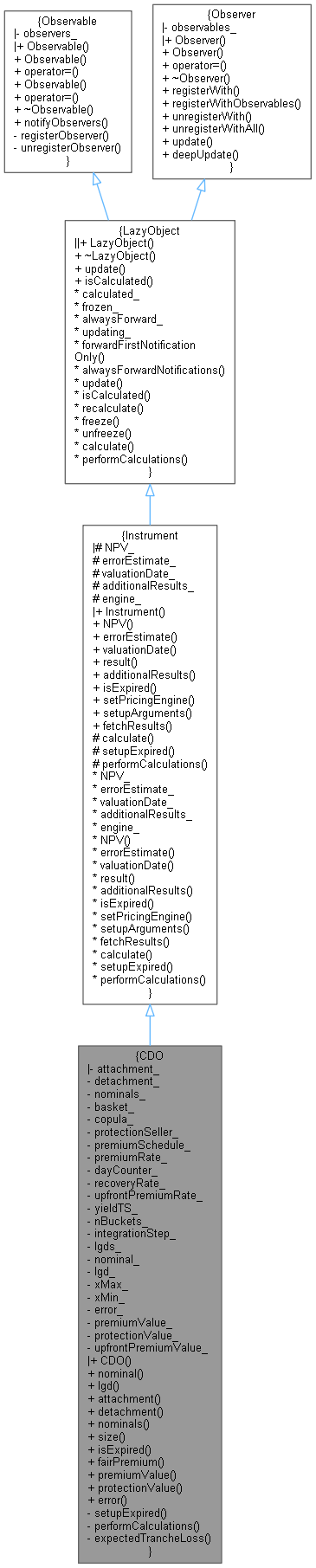

Inheritance diagram for CDO:

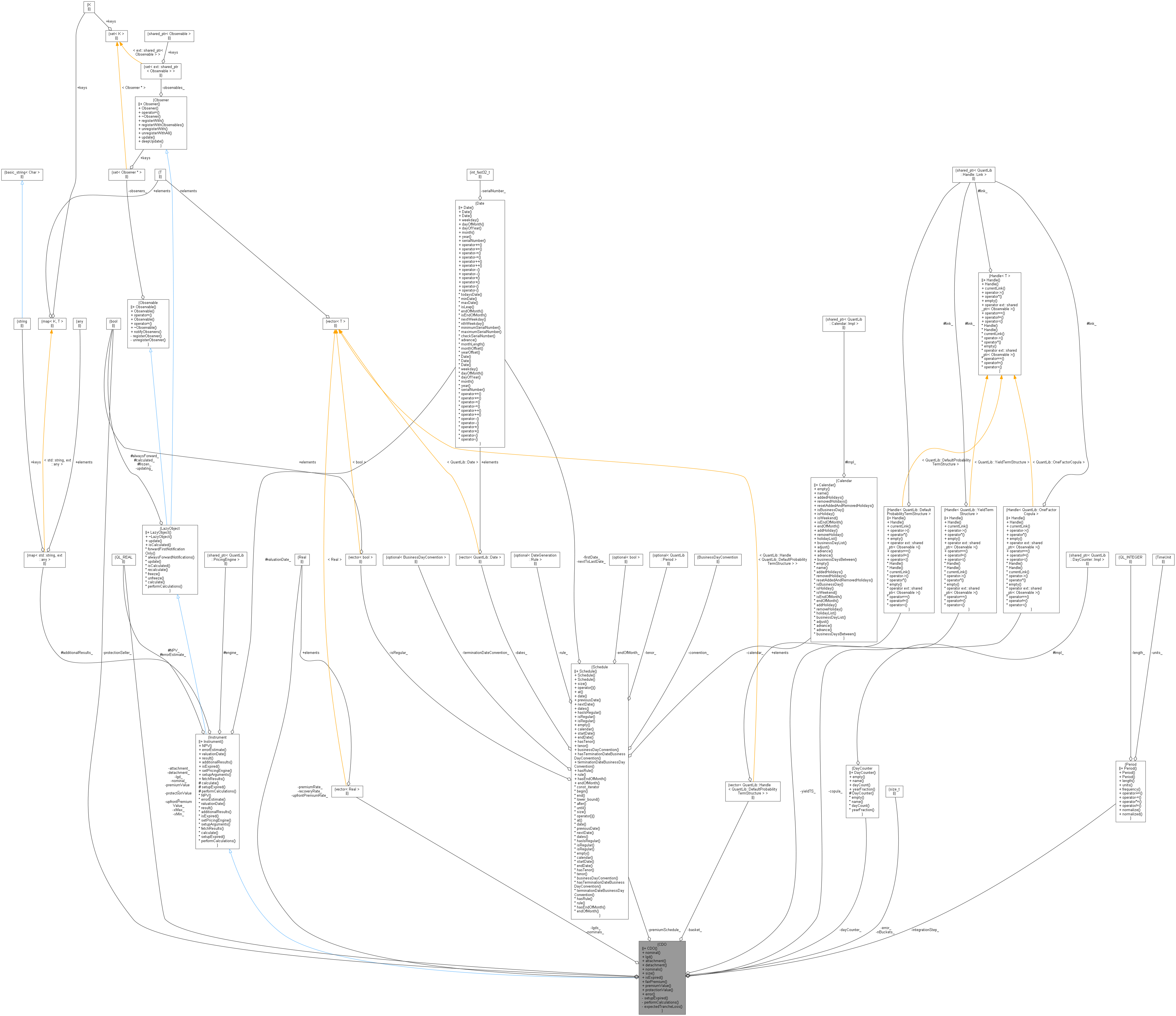

Inheritance diagram for CDO: Collaboration diagram for CDO:

Collaboration diagram for CDO:Public Member Functions | |

| CDO (Real attachment, Real detachment, std::vector< Real > nominals, const std::vector< Handle< DefaultProbabilityTermStructure > > &basket, Handle< OneFactorCopula > copula, bool protectionSeller, Schedule premiumSchedule, Rate premiumRate, DayCounter dayCounter, Rate recoveryRate, Rate upfrontPremiumRate, Handle< YieldTermStructure > yieldTS, Size nBuckets, const Period &integrationStep=Period(10, Years)) | |

| Real | nominal () const |

| Real | lgd () const |

| Real | attachment () const |

| Real | detachment () const |

| std::vector< Real > | nominals () |

| Size | size () |

| bool | isExpired () const override |

| returns whether the instrument might have value greater than zero. More... | |

| Rate | fairPremium () const |

| Rate | premiumValue () const |

| Rate | protectionValue () const |

| Size | error () const |

Public Member Functions inherited from Instrument Public Member Functions inherited from Instrument | |

| Instrument () | |

| Real | NPV () const |

| returns the net present value of the instrument. More... | |

| Real | errorEstimate () const |

| returns the error estimate on the NPV when available. More... | |

| const Date & | valuationDate () const |

| returns the date the net present value refers to. More... | |

| template<typename T > | |

| T | result (const std::string &tag) const |

| returns any additional result returned by the pricing engine. More... | |

| const std::map< std::string, ext::any > & | additionalResults () const |

| returns all additional result returned by the pricing engine. More... | |

| void | setPricingEngine (const ext::shared_ptr< PricingEngine > &) |

| set the pricing engine to be used. More... | |

| virtual void | setupArguments (PricingEngine::arguments *) const |

| virtual void | fetchResults (const PricingEngine::results *) const |

Public Member Functions inherited from LazyObject Public Member Functions inherited from LazyObject | |

| LazyObject () | |

| ~LazyObject () override=default | |

| void | update () override |

| bool | isCalculated () const |

| void | forwardFirstNotificationOnly () |

| void | alwaysForwardNotifications () |

| void | recalculate () |

| void | freeze () |

| void | unfreeze () |

Public Member Functions inherited from Observable Public Member Functions inherited from Observable | |

| Observable ()=default | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| virtual | ~Observable ()=default |

| void | notifyObservers () |

Public Member Functions inherited from Observer Public Member Functions inherited from Observer | |

| Observer ()=default | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| virtual | ~Observer () |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | update ()=0 |

| virtual void | deepUpdate () |

Private Member Functions | |

| void | setupExpired () const override |

| void | performCalculations () const override |

| Real | expectedTrancheLoss (Date d) const |

Private Attributes | |

| Real | attachment_ |

| Real | detachment_ |

| std::vector< Real > | nominals_ |

| std::vector< Handle< DefaultProbabilityTermStructure > > | basket_ |

| Handle< OneFactorCopula > | copula_ |

| bool | protectionSeller_ |

| Schedule | premiumSchedule_ |

| Rate | premiumRate_ |

| DayCounter | dayCounter_ |

| Rate | recoveryRate_ |

| Rate | upfrontPremiumRate_ |

| Handle< YieldTermStructure > | yieldTS_ |

| Size | nBuckets_ |

| Period | integrationStep_ |

| std::vector< Real > | lgds_ |

| Real | nominal_ |

| Real | lgd_ |

| Real | xMax_ |

| Real | xMin_ |

| Size | error_ |

| Real | premiumValue_ |

| Real | protectionValue_ |

| Real | upfrontPremiumValue_ |

Additional Inherited Members | |

Public Types inherited from Observer Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

Protected Member Functions inherited from Instrument Protected Member Functions inherited from Instrument | |

| void | calculate () const override |

| void | performCalculations () const override |

Protected Member Functions inherited from LazyObject Protected Member Functions inherited from LazyObject | |

Protected Attributes inherited from Instrument Protected Attributes inherited from Instrument | |

| Real | NPV_ |

| Real | errorEstimate_ |

| Date | valuationDate_ |

| std::map< std::string, ext::any > | additionalResults_ |

| ext::shared_ptr< PricingEngine > | engine_ |

Protected Attributes inherited from LazyObject Protected Attributes inherited from LazyObject | |

| bool | calculated_ = false |

| bool | frozen_ = false |

| bool | alwaysForward_ |

Detailed Description

collateralized debt obligation

The instrument prices a mezzanine CDO tranche with loss given default between attachment point \( D_1\) and detachment point \( D_2 > D_1 \).

For purchased protection, the instrument value is given by the difference of the protection value \( V_1 \) and premium value \( V_2 \),

\[ V = V_1 - V_2. \]

The protection leg is priced as follows:

- Build the probability distribution for volume of defaults \( L \) (before recovery) or Loss Given Default \( LGD = (1-r)\,L \) at times/dates \( t_i, i=1, ..., N\) (premium schedule times with intermediate steps)

- Determine the expected value \( E_i = E_{t_i}\,\left[Pay(LGD)\right] \) of the protection payoff \( Pay(LGD) \) at each time \( t_i\) where

\[ Pay(L) = min (D_1, LGD) - min (D_2, LGD) = \left\{ \begin{array}{lcl} \displaystyle 0 &;& LGD < D_1 \\ \displaystyle LGD - D_1 &;& D_1 \leq LGD \leq D_2 \\ \displaystyle D_2 - D_1 &;& LGD > D_2 \end{array} \right. \]

- The protection value is then calculated as

\[ V_1 \:=\: \sum_{i=1}^N (E_i - E_{i-1}) \cdot d_i \]

where \( d_i\) is the discount factor at time/date \( t_i \)

The premium is paid on the protected notional amount, initially \( D_2 - D_1. \) This notional amount is reduced by the expected protection payments \( E_i \) at times \( t_i, \) so that the premium value is calculated as

\[ V_2 = m \, \cdot \sum_{i=1}^N \,(D_2 - D_1 - E_i) \cdot \Delta_{i-1,i}\,d_i \]

where \( m \) is the premium rate, \( \Delta_{i-1, i}\) is the day count fraction between date/time \( t_{i-1}\) and \( t_i.\)

The construction of the portfolio loss distribution \( E_i \) is based on the probability bucketing algorithm described in

John Hull and Alan White, "Valuation of a CDO and nth to default CDS without Monte Carlo simulation", Journal of Derivatives 12, 2, 2004

The pricing algorithm allows for varying notional amounts and default termstructures of the underlyings.

Constructor & Destructor Documentation

◆ CDO()

| CDO | ( | Real | attachment, |

| Real | detachment, | ||

| std::vector< Real > | nominals, | ||

| const std::vector< Handle< DefaultProbabilityTermStructure > > & | basket, | ||

| Handle< OneFactorCopula > | copula, | ||

| bool | protectionSeller, | ||

| Schedule | premiumSchedule, | ||

| Rate | premiumRate, | ||

| DayCounter | dayCounter, | ||

| Rate | recoveryRate, | ||

| Rate | upfrontPremiumRate, | ||

| Handle< YieldTermStructure > | yieldTS, | ||

| Size | nBuckets, | ||

| const Period & | integrationStep = Period(10, Years) |

||

| ) |

- Parameters

-

attachment fraction of the LGD where protection starts detachment fraction of the LGD where protection ends nominals vector of basket nominal amounts basket default basket represented by a vector of default term structures that allow computing single name default probabilities depending on time copula one-factor copula protectionSeller sold protection if set to true, purchased otherwise premiumSchedule schedule for premium payments premiumRate annual premium rate, e.g. 0.05 for 5% p.a. dayCounter day count convention for the premium rate recoveryRate recovery rate as a fraction upfrontPremiumRate premium as a tranche notional fraction yieldTS yield term structure handle nBuckets number of distribution buckets integrationStep time step for integrating over one premium period; if larger than premium period length, a single step is taken

Definition at line 28 of file cdo.cpp.

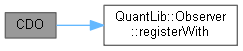

Here is the call graph for this function:

Here is the call graph for this function:Member Function Documentation

◆ nominal()

◆ lgd()

◆ attachment()

◆ detachment()

◆ nominals()

◆ size()

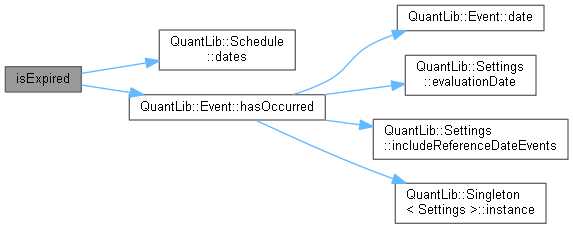

◆ isExpired()

|

overridevirtual |

returns whether the instrument might have value greater than zero.

Implements Instrument.

Definition at line 84 of file cdo.cpp.

Here is the call graph for this function:

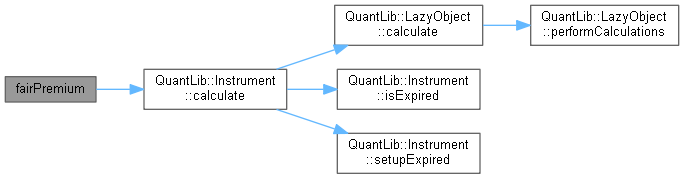

Here is the call graph for this function:◆ fairPremium()

| Rate fairPremium | ( | ) | const |

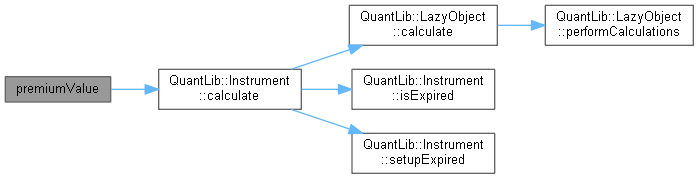

◆ premiumValue()

| Rate premiumValue | ( | ) | const |

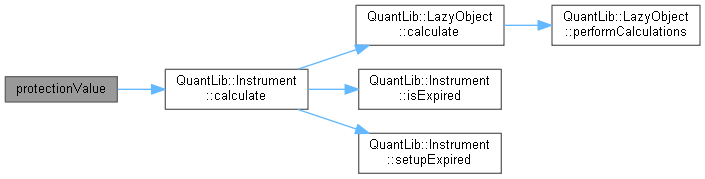

◆ protectionValue()

| Rate protectionValue | ( | ) | const |

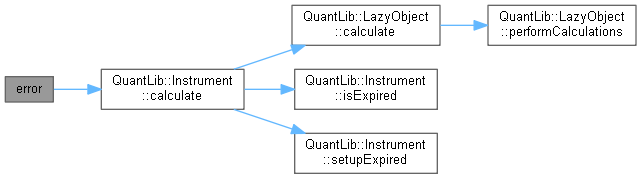

◆ error()

| Size error | ( | ) | const |

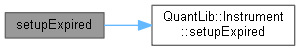

◆ setupExpired()

|

overrideprivatevirtual |

This method must leave the instrument in a consistent state when the expiration condition is met.

Reimplemented from Instrument.

Definition at line 90 of file cdo.cpp.

Here is the call graph for this function:

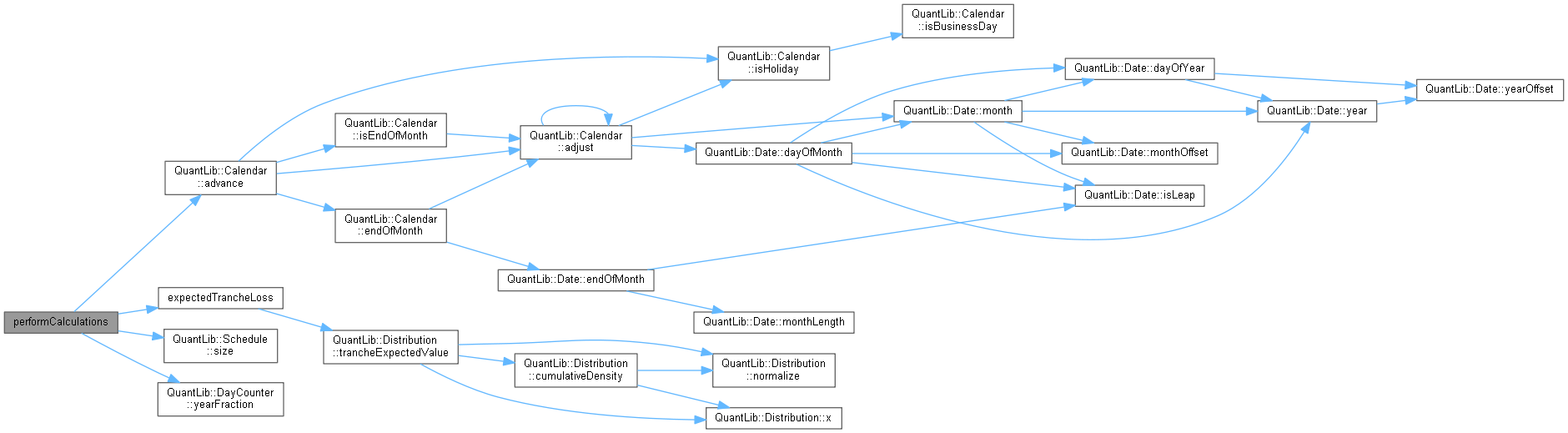

Here is the call graph for this function:◆ performCalculations()

|

overrideprivatevirtual |

This method must implement any calculations which must be (re)done in order to calculate the desired results.

Implements LazyObject.

Definition at line 118 of file cdo.cpp.

Here is the call graph for this function:

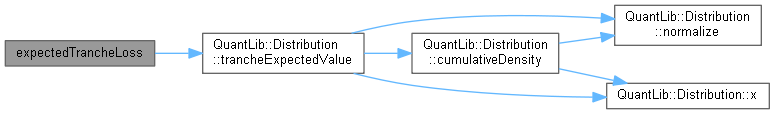

Here is the call graph for this function:◆ expectedTrancheLoss()

Member Data Documentation

◆ attachment_

◆ detachment_

◆ nominals_

◆ basket_

|

private |

◆ copula_

|

private |

◆ protectionSeller_

◆ premiumSchedule_

◆ premiumRate_

◆ dayCounter_

|

private |

◆ recoveryRate_

◆ upfrontPremiumRate_

◆ yieldTS_

|

private |