Base bond class. More...

#include <bond.hpp>

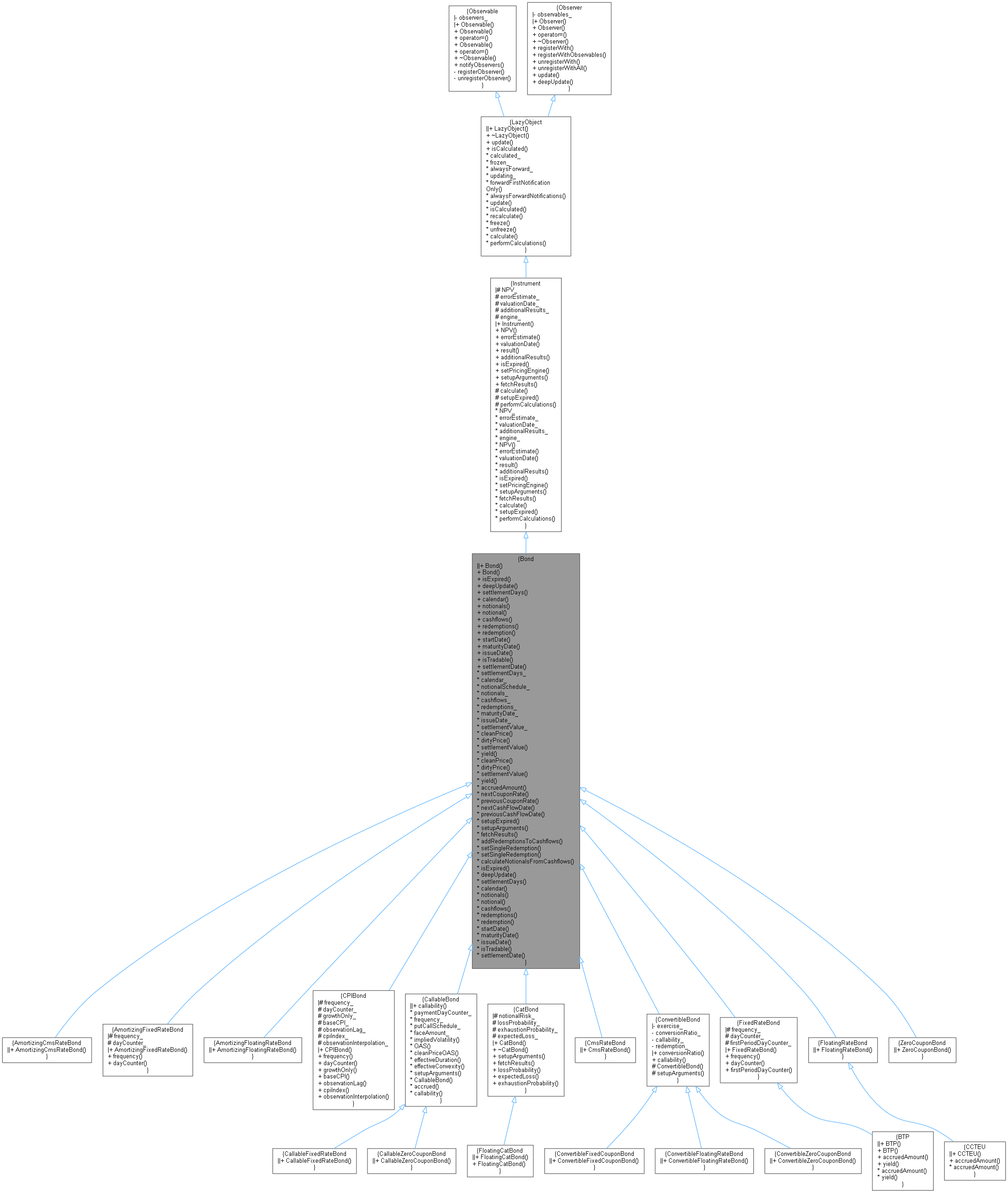

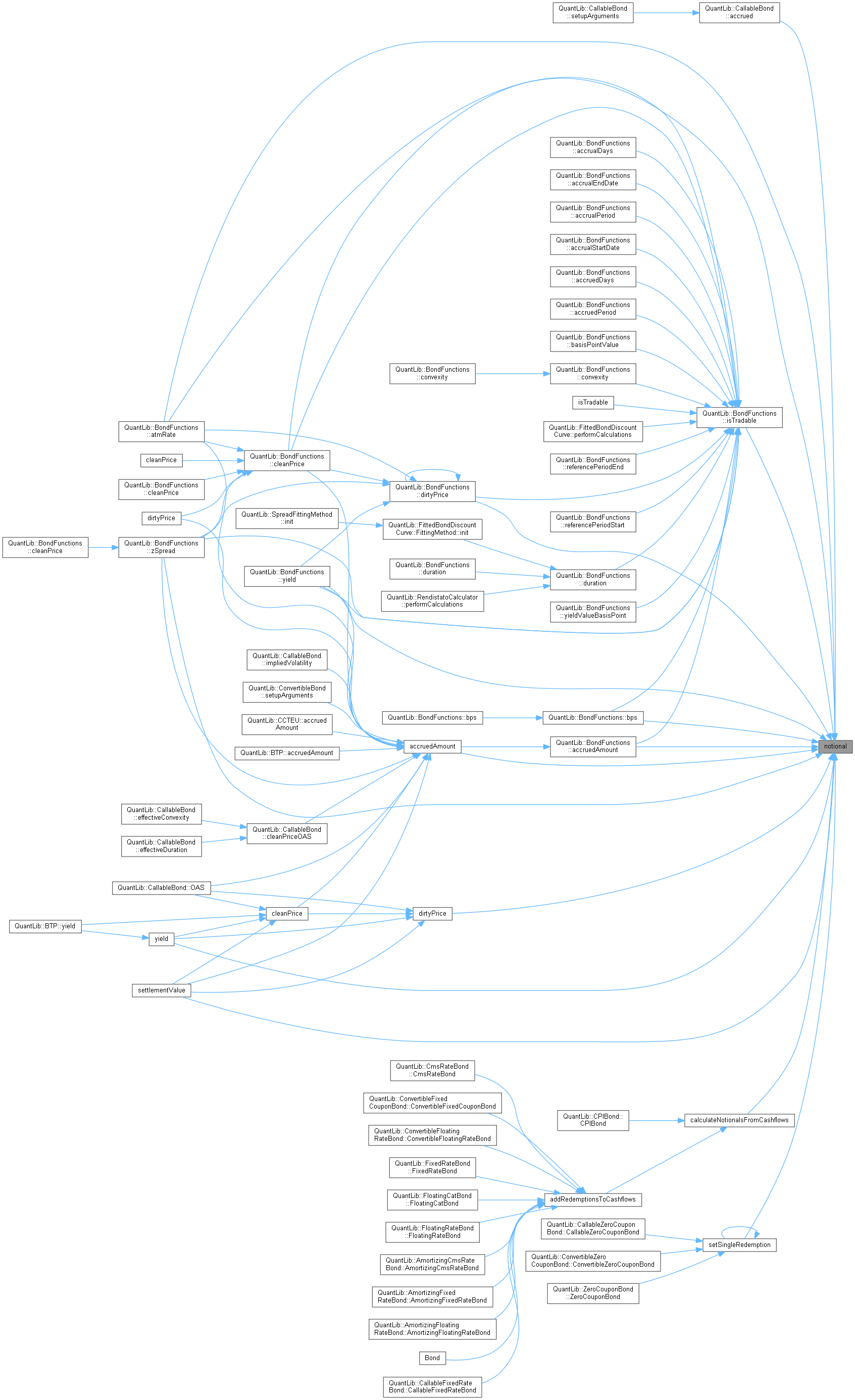

Inheritance diagram for Bond:

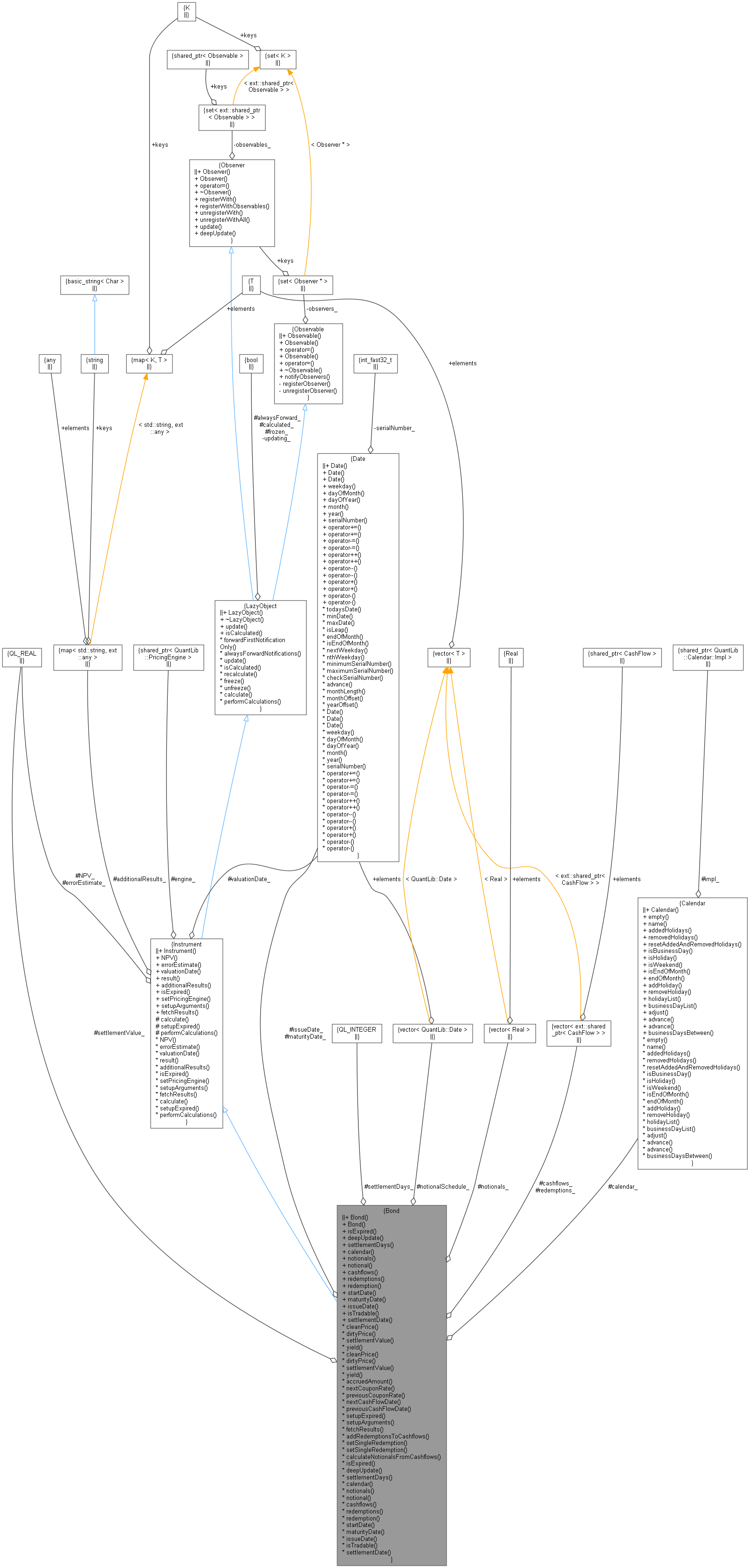

Inheritance diagram for Bond: Collaboration diagram for Bond:

Collaboration diagram for Bond:Classes | |

| class | arguments |

| class | engine |

| class | Price |

| Bond price information. More... | |

| class | results |

Public Member Functions | |

| Bond (Natural settlementDays, Calendar calendar, const Date &issueDate=Date(), const Leg &coupons=Leg()) | |

| constructor for amortizing or non-amortizing bonds. More... | |

| Bond (Natural settlementDays, Calendar calendar, Real faceAmount, const Date &maturityDate, const Date &issueDate=Date(), const Leg &cashflows=Leg()) | |

| old constructor for non amortizing bonds. More... | |

Instrument interface | |

| bool | isExpired () const override |

| returns whether the instrument might have value greater than zero. More... | |

Observable interface | |

| void | deepUpdate () override |

Inspectors | |

| Natural | settlementDays () const |

| const Calendar & | calendar () const |

| const std::vector< Real > & | notionals () const |

| virtual Real | notional (Date d=Date()) const |

| const Leg & | cashflows () const |

| const Leg & | redemptions () const |

| const ext::shared_ptr< CashFlow > & | redemption () const |

| Date | startDate () const |

| Date | maturityDate () const |

| Date | issueDate () const |

| bool | isTradable (Date d=Date()) const |

| Date | settlementDate (Date d=Date()) const |

Public Member Functions inherited from Instrument Public Member Functions inherited from Instrument | |

| Instrument () | |

| Real | NPV () const |

| returns the net present value of the instrument. More... | |

| Real | errorEstimate () const |

| returns the error estimate on the NPV when available. More... | |

| const Date & | valuationDate () const |

| returns the date the net present value refers to. More... | |

| template<typename T > | |

| T | result (const std::string &tag) const |

| returns any additional result returned by the pricing engine. More... | |

| const std::map< std::string, ext::any > & | additionalResults () const |

| returns all additional result returned by the pricing engine. More... | |

| void | setPricingEngine (const ext::shared_ptr< PricingEngine > &) |

| set the pricing engine to be used. More... | |

Public Member Functions inherited from LazyObject Public Member Functions inherited from LazyObject | |

| LazyObject () | |

| ~LazyObject () override=default | |

| void | update () override |

| bool | isCalculated () const |

| void | forwardFirstNotificationOnly () |

| void | alwaysForwardNotifications () |

| void | recalculate () |

| void | freeze () |

| void | unfreeze () |

Public Member Functions inherited from Observable Public Member Functions inherited from Observable | |

| Observable ()=default | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| virtual | ~Observable ()=default |

| void | notifyObservers () |

Public Member Functions inherited from Observer Public Member Functions inherited from Observer | |

| Observer ()=default | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| virtual | ~Observer () |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | update ()=0 |

| virtual void | deepUpdate () |

Calculations | |

| Natural | settlementDays_ |

| Calendar | calendar_ |

| std::vector< Date > | notionalSchedule_ |

| std::vector< Real > | notionals_ |

| Leg | cashflows_ |

| Leg | redemptions_ |

| Date | maturityDate_ |

| Date | issueDate_ |

| Real | settlementValue_ |

| Real | cleanPrice () const |

| theoretical clean price More... | |

| Real | dirtyPrice () const |

| theoretical dirty price More... | |

| Real | settlementValue () const |

| theoretical settlement value More... | |

| Rate | yield (const DayCounter &dc, Compounding comp, Frequency freq, Real accuracy=1.0e-8, Size maxEvaluations=100, Real guess=0.05, Bond::Price::Type priceType=Bond::Price::Clean) const |

| theoretical bond yield More... | |

| Real | cleanPrice (Rate yield, const DayCounter &dc, Compounding comp, Frequency freq, Date settlementDate=Date()) const |

| clean price given a yield and settlement date More... | |

| Real | dirtyPrice (Rate yield, const DayCounter &dc, Compounding comp, Frequency freq, Date settlementDate=Date()) const |

| dirty price given a yield and settlement date More... | |

| Real | settlementValue (Real cleanPrice) const |

| settlement value as a function of the clean price More... | |

| Rate | yield (Bond::Price price, const DayCounter &dc, Compounding comp, Frequency freq, Date settlementDate=Date(), Real accuracy=1.0e-8, Size maxEvaluations=100, Real guess=0.05) const |

| yield given a price and settlement date More... | |

| virtual Real | accruedAmount (Date d=Date()) const |

| accrued amount at a given date More... | |

| virtual Rate | nextCouponRate (Date d=Date()) const |

| Rate | previousCouponRate (Date d=Date()) const |

| Previous coupon already paid at a given date. More... | |

| Date | nextCashFlowDate (Date d=Date()) const |

| Date | previousCashFlowDate (Date d=Date()) const |

| void | setupExpired () const override |

| void | setupArguments (PricingEngine::arguments *) const override |

| void | fetchResults (const PricingEngine::results *) const override |

| void | addRedemptionsToCashflows (const std::vector< Real > &redemptions=std::vector< Real >()) |

| void | setSingleRedemption (Real notional, Real redemption, const Date &date) |

| void | setSingleRedemption (Real notional, const ext::shared_ptr< CashFlow > &redemption) |

| void | calculateNotionalsFromCashflows () |

Additional Inherited Members | |

Public Types inherited from Observer Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

Protected Member Functions inherited from Instrument Protected Member Functions inherited from Instrument | |

| void | calculate () const override |

| void | performCalculations () const override |

Protected Member Functions inherited from LazyObject Protected Member Functions inherited from LazyObject | |

Protected Attributes inherited from Instrument Protected Attributes inherited from Instrument | |

| Real | NPV_ |

| Real | errorEstimate_ |

| Date | valuationDate_ |

| std::map< std::string, ext::any > | additionalResults_ |

| ext::shared_ptr< PricingEngine > | engine_ |

Protected Attributes inherited from LazyObject Protected Attributes inherited from LazyObject | |

| bool | calculated_ = false |

| bool | frozen_ = false |

| bool | alwaysForward_ |

Detailed Description

Base bond class.

Derived classes must fill the uninitialized data members.

- Warning:

- Most methods assume that the cash flows are stored sorted by date, the redemption(s) being after any cash flow at the same date. In particular, if there's one single redemption, it must be the last cash flow,

- Tests:

- price/yield calculations are cross-checked for consistency.

- price/yield calculations are checked against known good values.

- Examples

- FittedBondCurve.cpp.

Constructor & Destructor Documentation

◆ Bond() [1/2]

◆ Bond() [2/2]

Member Function Documentation

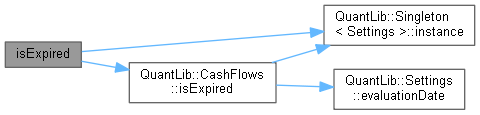

◆ isExpired()

|

overridevirtual |

returns whether the instrument might have value greater than zero.

Implements Instrument.

Definition at line 104 of file bond.cpp.

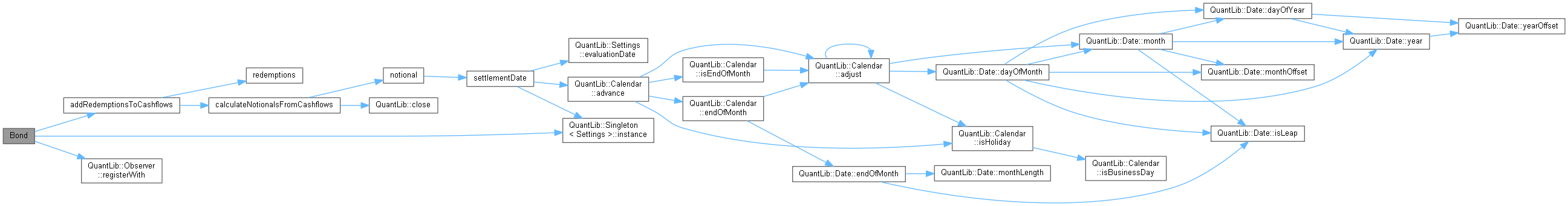

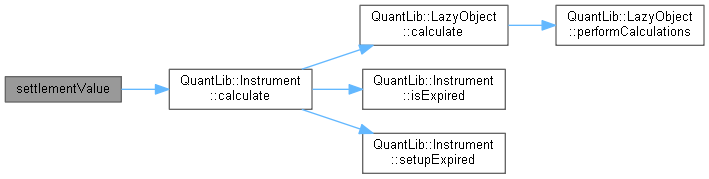

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

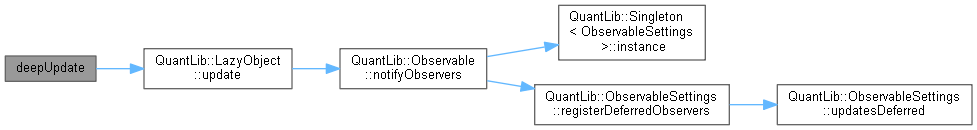

Here is the caller graph for this function:◆ deepUpdate()

|

overridevirtual |

This method allows to explicitly update the instance itself and nested observers. If notifications are disabled a call to this method ensures an update of such nested observers. It should be implemented in derived classes whenever applicable

Reimplemented from Observer.

Definition at line 356 of file bond.cpp.

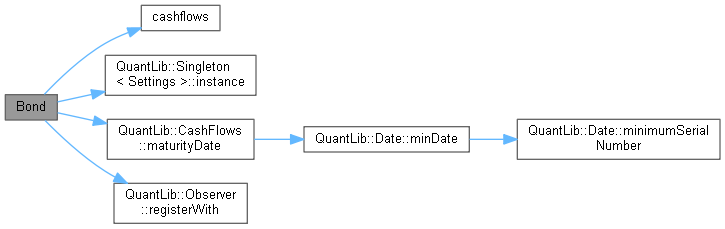

Here is the call graph for this function:

Here is the call graph for this function:◆ settlementDays()

◆ calendar()

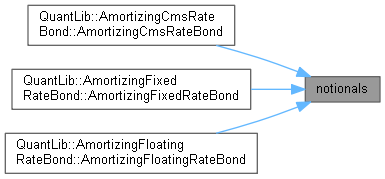

◆ notionals()

| const std::vector< Real > & notionals | ( | ) | const |

◆ notional()

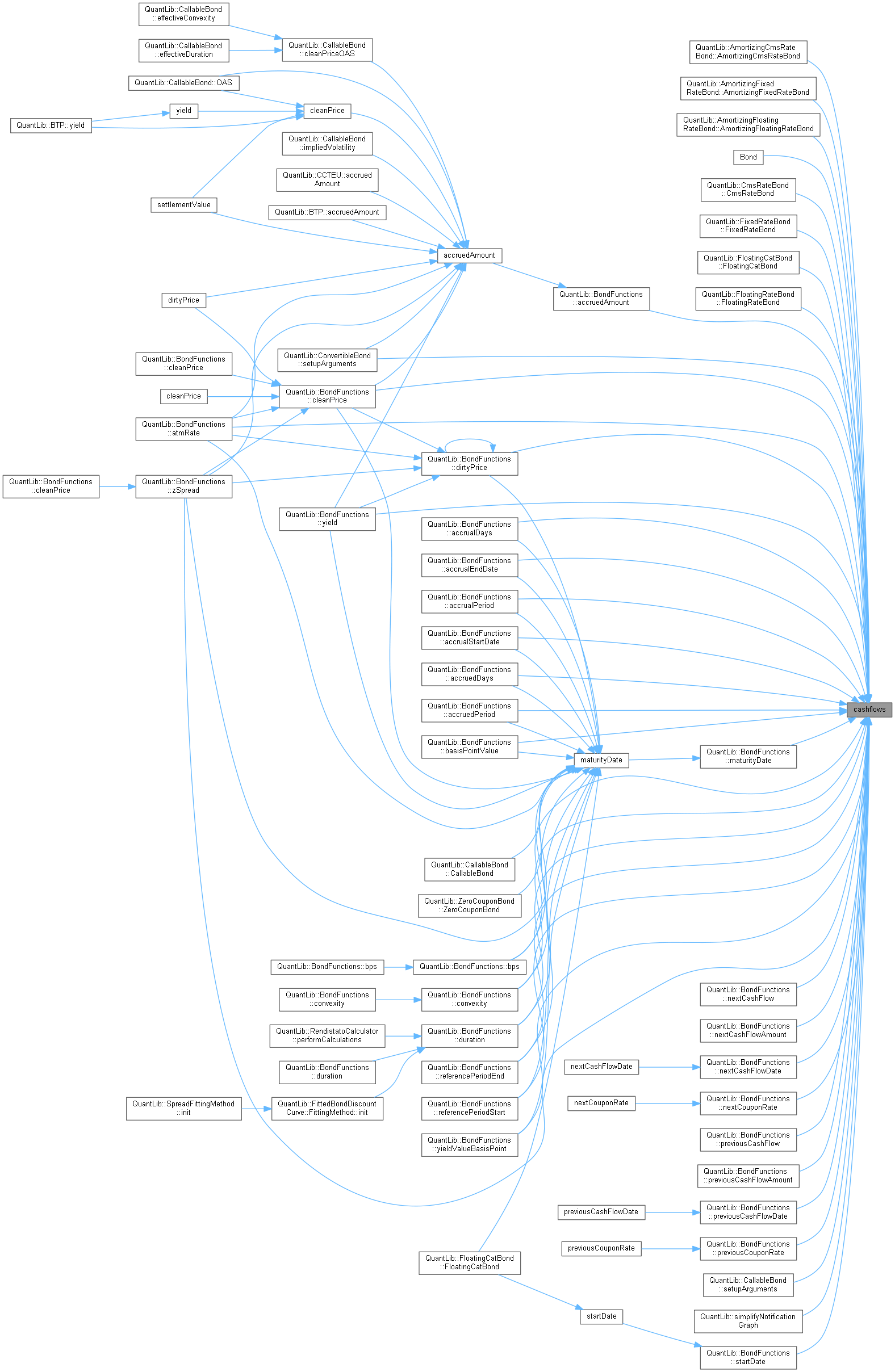

◆ cashflows()

| const Leg & cashflows | ( | ) | const |

◆ redemptions()

| const Leg & redemptions | ( | ) | const |

◆ redemption()

| const ext::shared_ptr< CashFlow > & redemption | ( | ) | const |

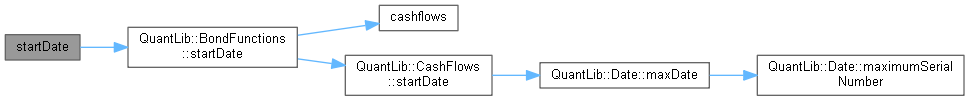

◆ startDate()

| Date startDate | ( | ) | const |

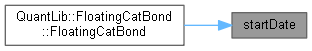

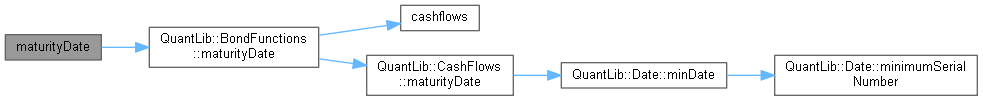

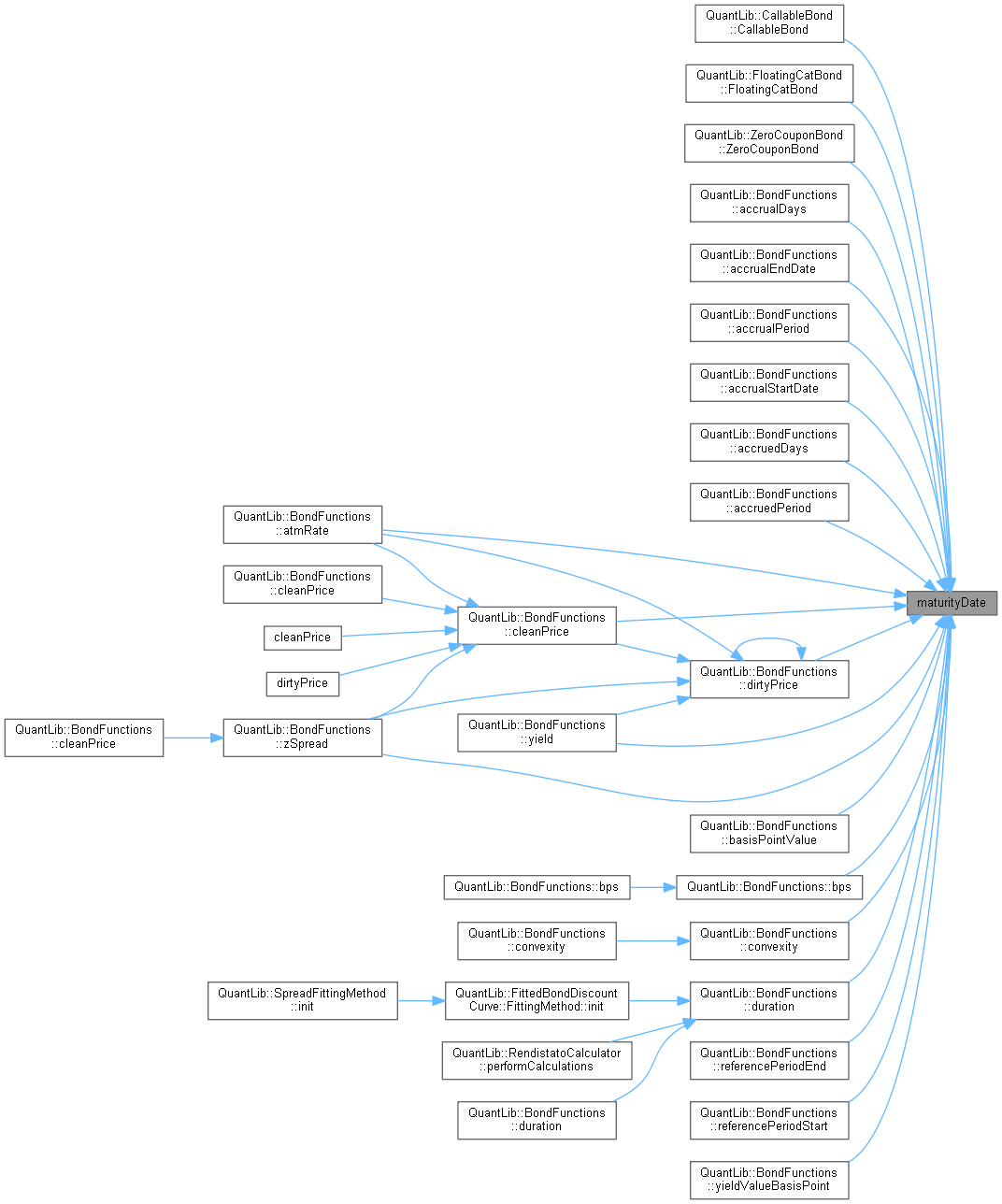

◆ maturityDate()

| Date maturityDate | ( | ) | const |

◆ issueDate()

| Date issueDate | ( | ) | const |

◆ isTradable()

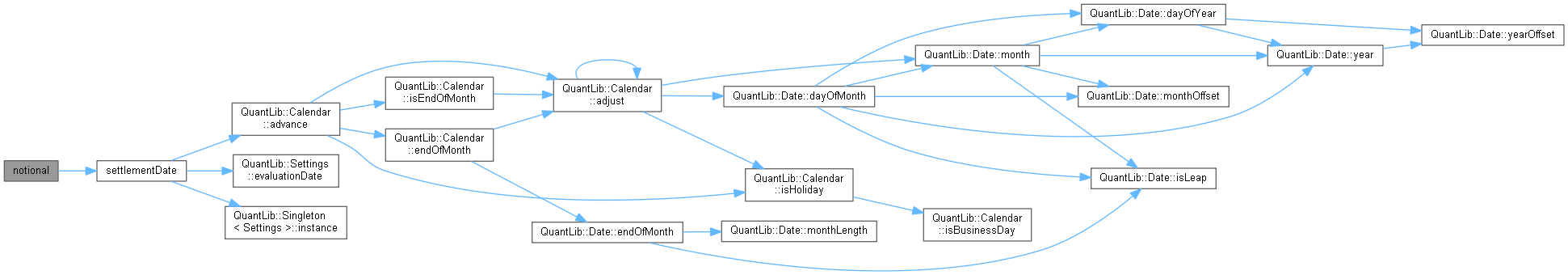

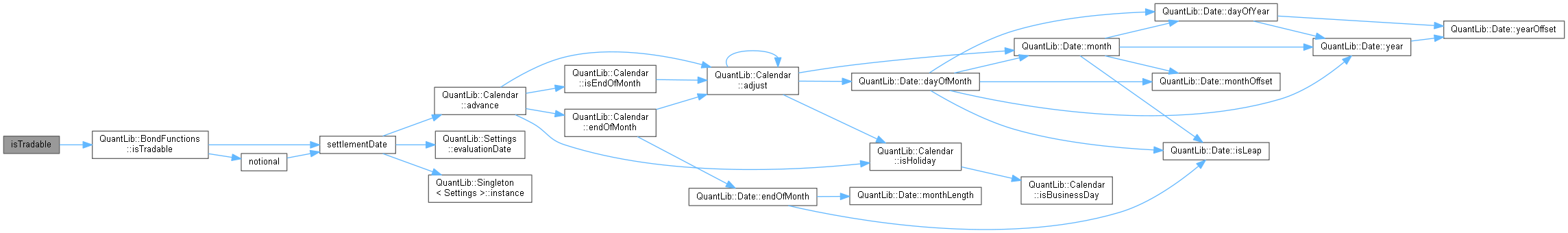

◆ settlementDate()

◆ cleanPrice() [1/2]

| Real cleanPrice | ( | ) | const |

theoretical clean price

The default bond settlement is used for calculation.

- Warning:

- the theoretical price calculated from a flat term structure might differ slightly from the price calculated from the corresponding yield by means of the other overload of this function. If the price from a constant yield is desired, it is advisable to use such other overload.

- Examples

- Bonds.cpp.

Definition at line 175 of file bond.cpp.

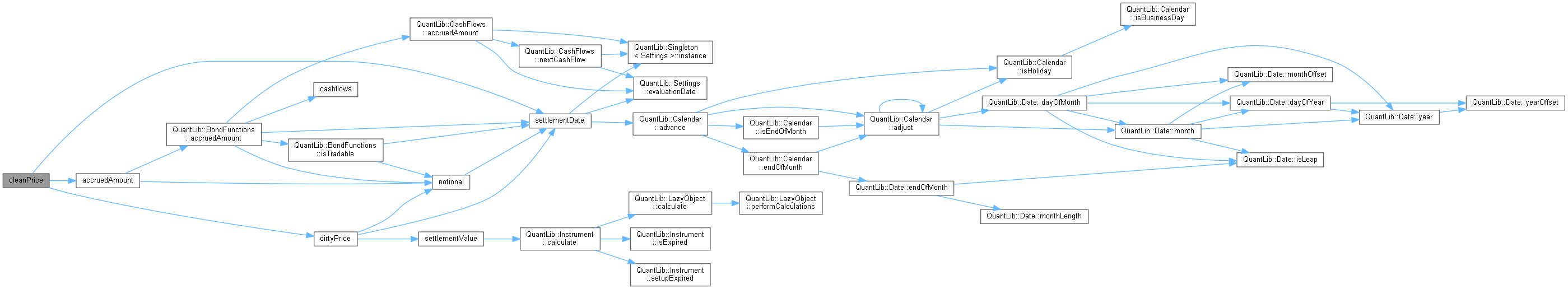

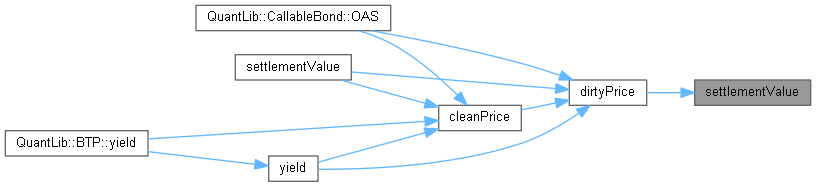

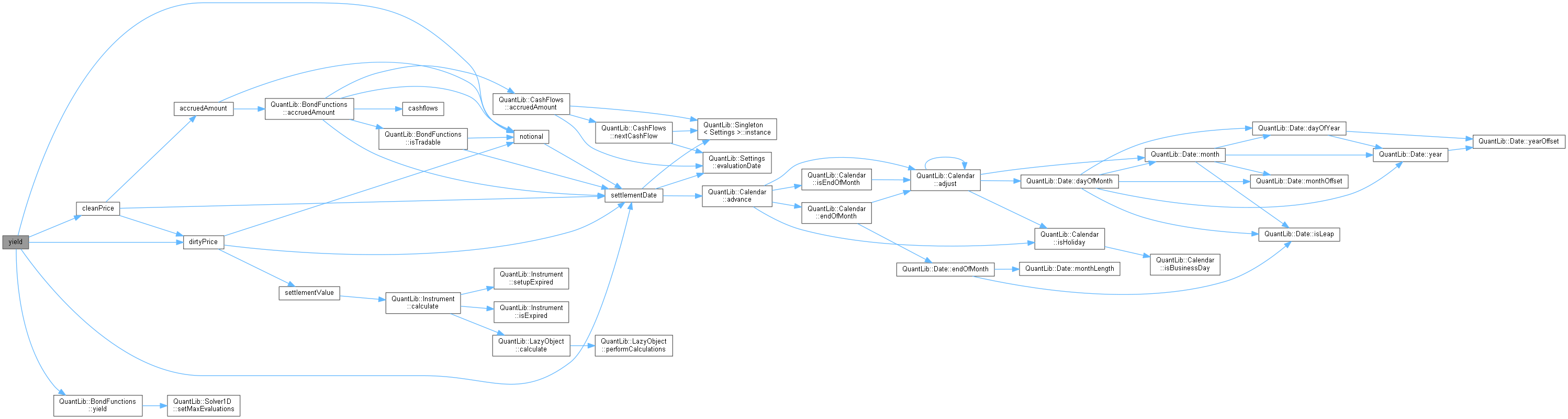

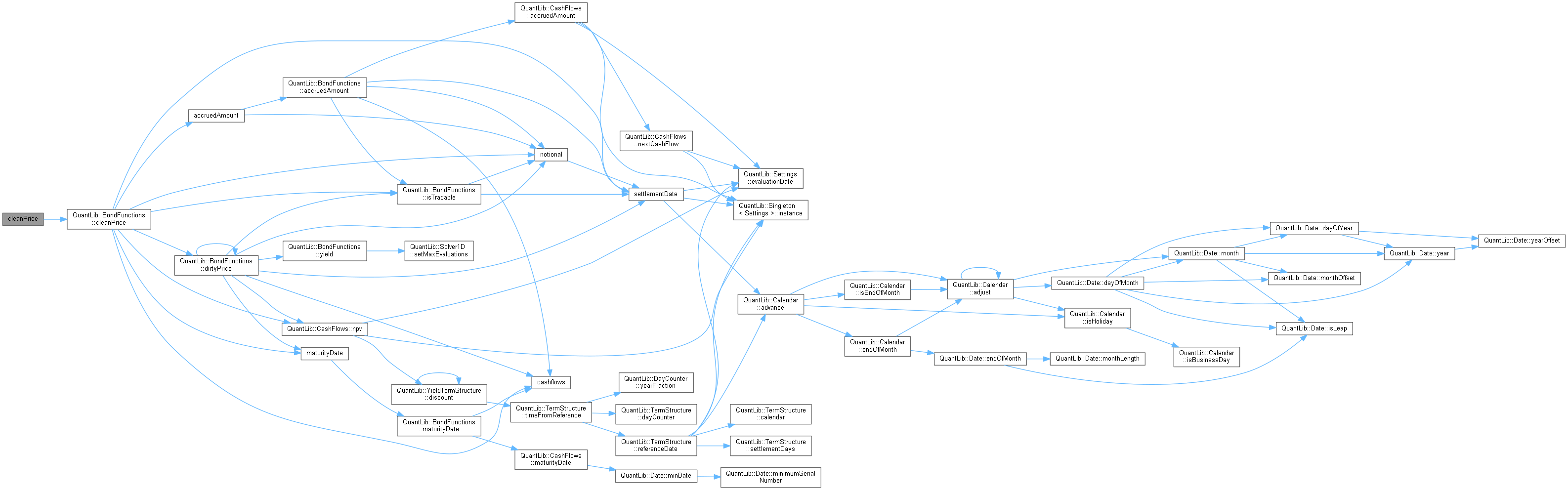

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ dirtyPrice() [1/2]

| Real dirtyPrice | ( | ) | const |

theoretical dirty price

The default bond settlement is used for calculation.

- Warning:

- the theoretical price calculated from a flat term structure might differ slightly from the price calculated from the corresponding yield by means of the other overload of this function. If the price from a constant yield is desired, it is advisable to use such other overload.

- Examples

- Bonds.cpp.

Definition at line 179 of file bond.cpp.

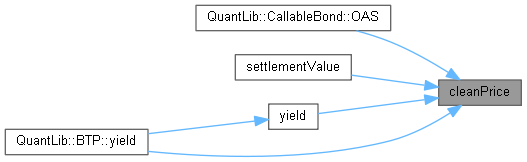

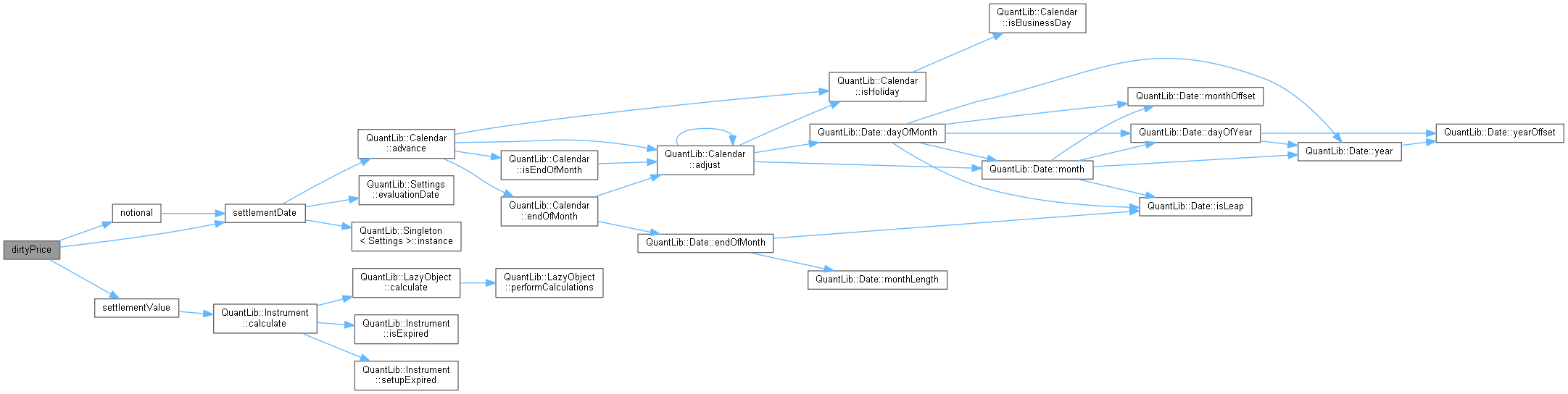

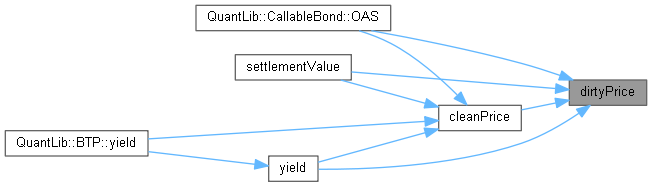

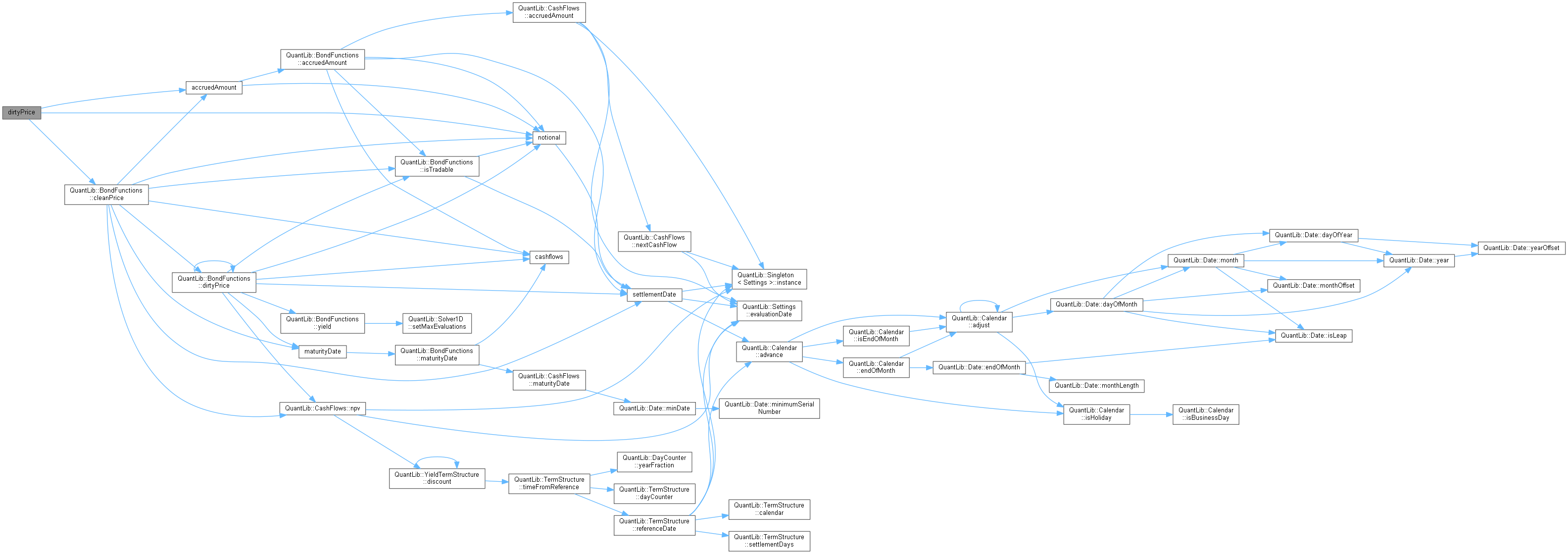

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ settlementValue() [1/2]

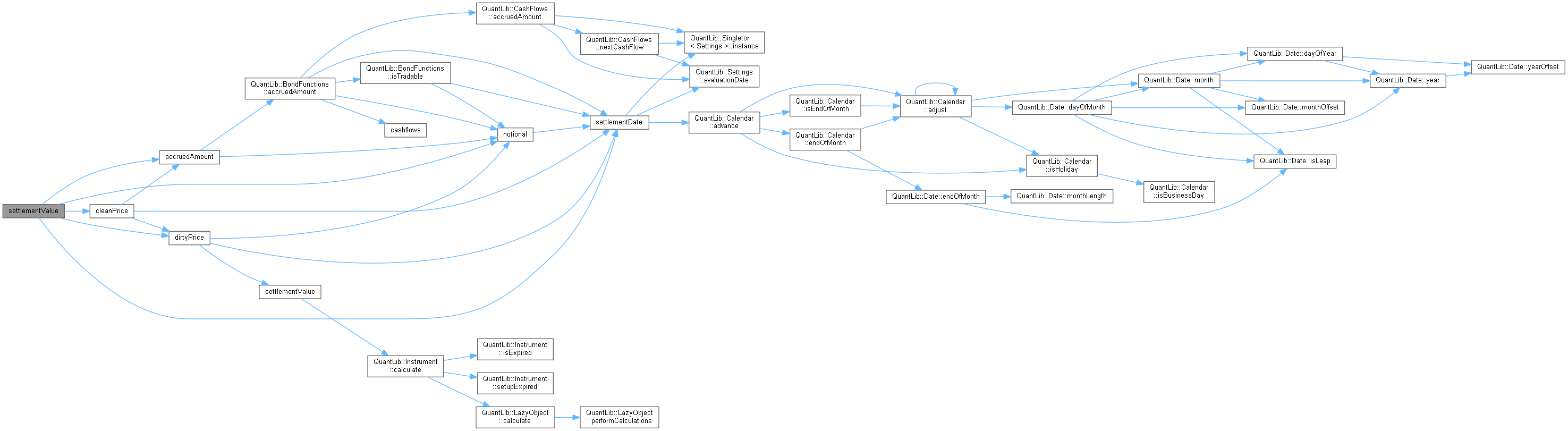

| Real settlementValue | ( | ) | const |

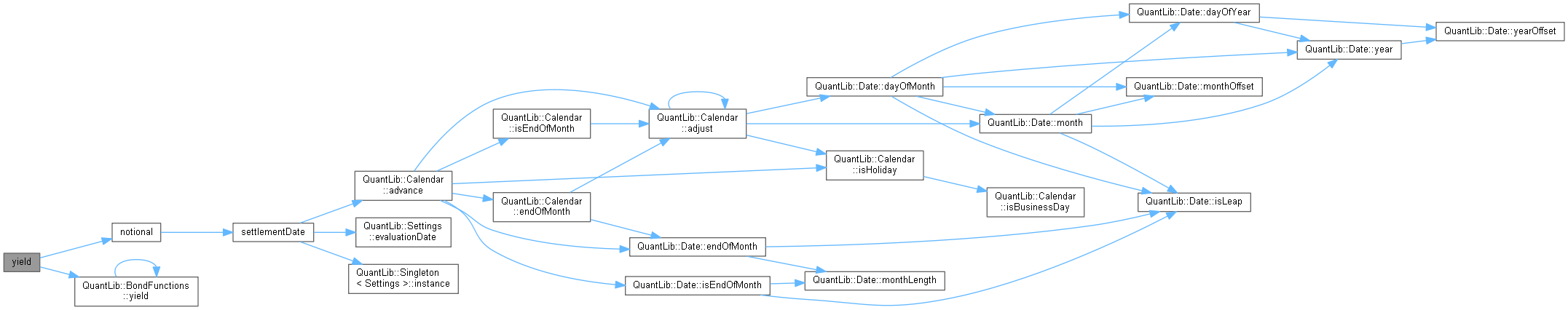

◆ yield() [1/2]

| Rate yield | ( | const DayCounter & | dc, |

| Compounding | comp, | ||

| Frequency | freq, | ||

| Real | accuracy = 1.0e-8, |

||

| Size | maxEvaluations = 100, |

||

| Real | guess = 0.05, |

||

| Bond::Price::Type | priceType = Bond::Price::Clean |

||

| ) | const |

◆ cleanPrice() [2/2]

| Real cleanPrice | ( | Rate | yield, |

| const DayCounter & | dc, | ||

| Compounding | comp, | ||

| Frequency | freq, | ||

| Date | settlementDate = Date() |

||

| ) | const |

◆ dirtyPrice() [2/2]

| Real dirtyPrice | ( | Rate | yield, |

| const DayCounter & | dc, | ||

| Compounding | comp, | ||

| Frequency | freq, | ||

| Date | settlementDate = Date() |

||

| ) | const |

◆ settlementValue() [2/2]

◆ yield() [2/2]

| Rate yield | ( | Bond::Price | price, |

| const DayCounter & | dc, | ||

| Compounding | comp, | ||

| Frequency | freq, | ||

| Date | settlementDate = Date(), |

||

| Real | accuracy = 1.0e-8, |

||

| Size | maxEvaluations = 100, |

||

| Real | guess = 0.05 |

||

| ) | const |

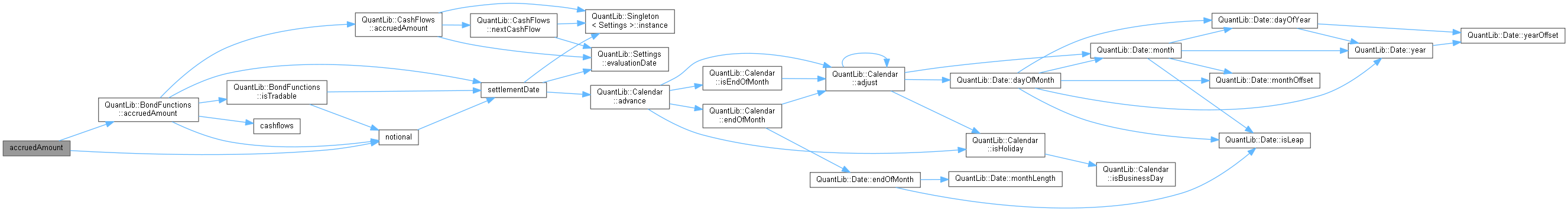

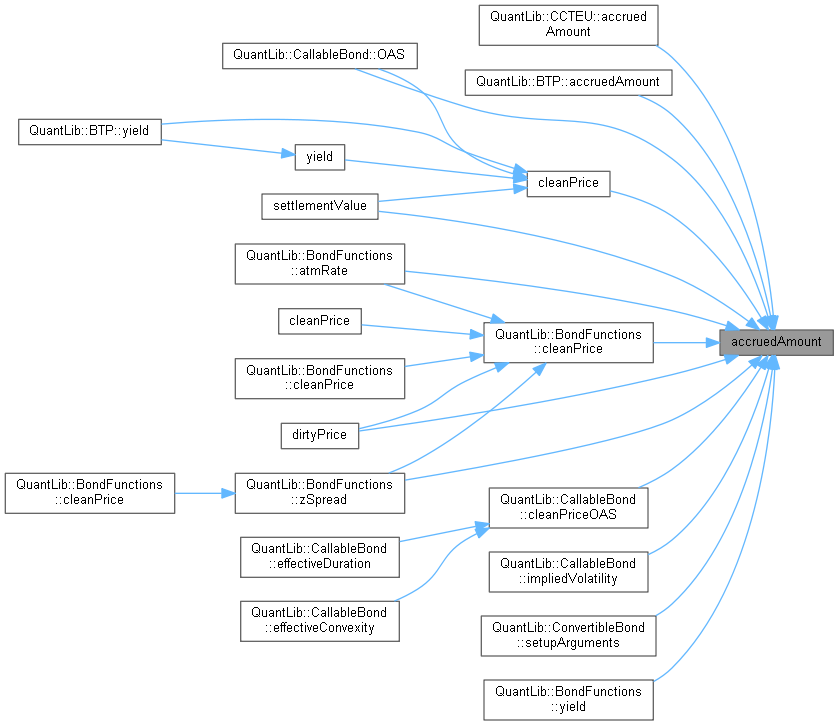

◆ accruedAmount()

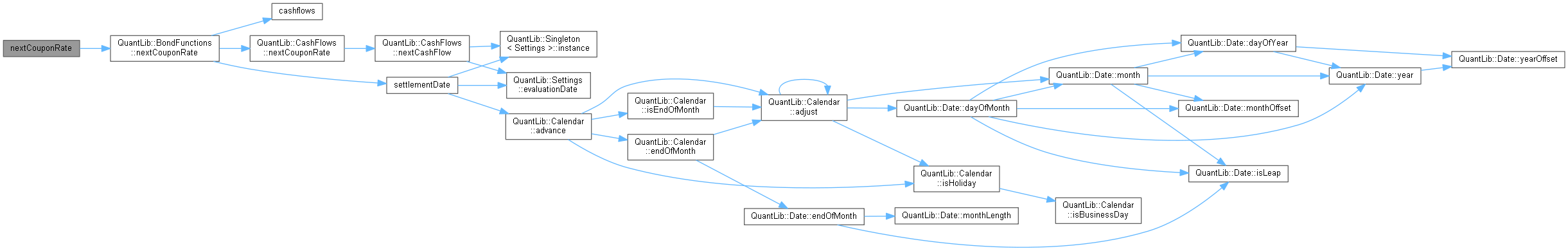

◆ nextCouponRate()

Expected next coupon: depending on (the bond and) the given date the coupon can be historic, deterministic or expected in a stochastic sense. When the bond settlement date is used the coupon is the already-fixed not-yet-paid one.

The current bond settlement is used if no date is given.

- Examples

- Bonds.cpp.

Definition at line 264 of file bond.cpp.

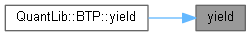

Here is the call graph for this function:

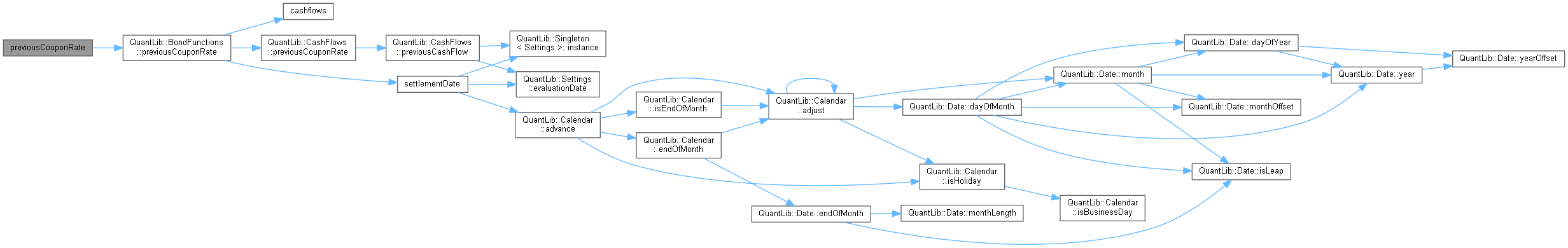

Here is the call graph for this function:◆ previousCouponRate()

Previous coupon already paid at a given date.

Expected previous coupon: depending on (the bond and) the given date the coupon can be historic, deterministic or expected in a stochastic sense. When the bond settlement date is used the coupon is the last paid one.

The current bond settlement is used if no date is given.

- Examples

- Bonds.cpp.

Definition at line 268 of file bond.cpp.

Here is the call graph for this function:

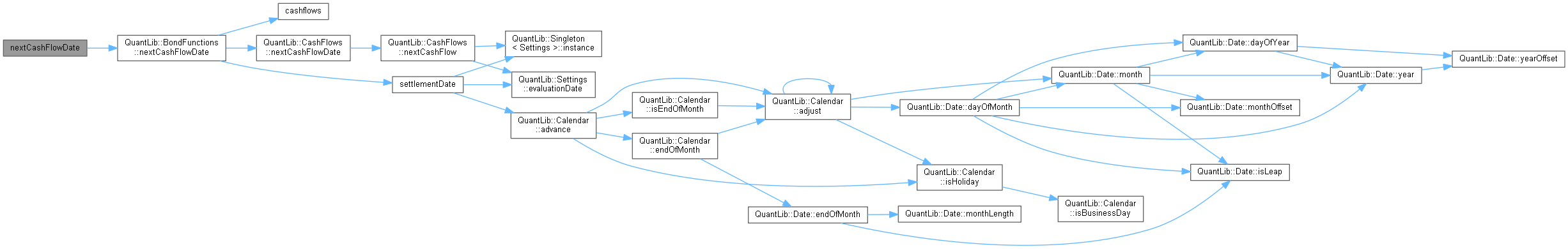

Here is the call graph for this function:◆ nextCashFlowDate()

◆ previousCashFlowDate()

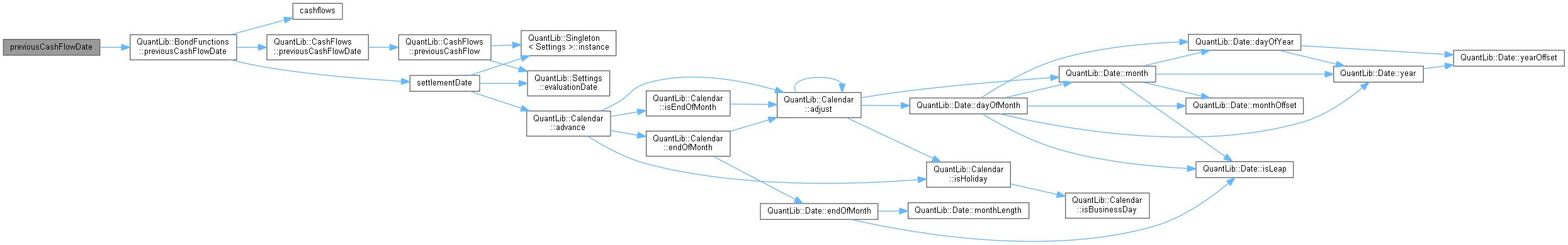

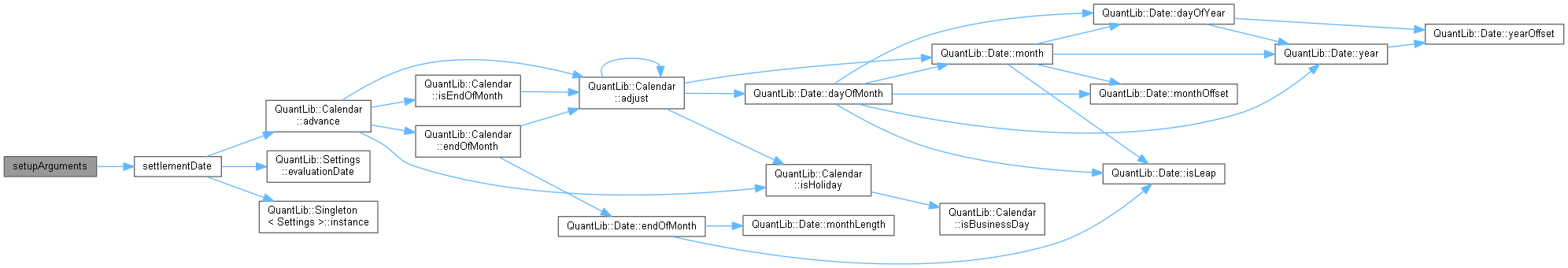

◆ setupExpired()

|

overrideprotectedvirtual |

This method must leave the instrument in a consistent state when the expiration condition is met.

Reimplemented from Instrument.

Definition at line 280 of file bond.cpp.

Here is the call graph for this function:

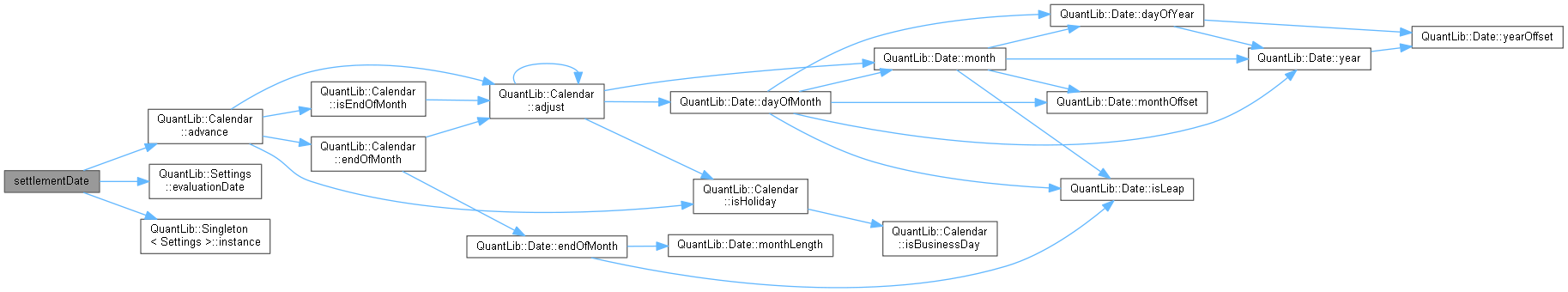

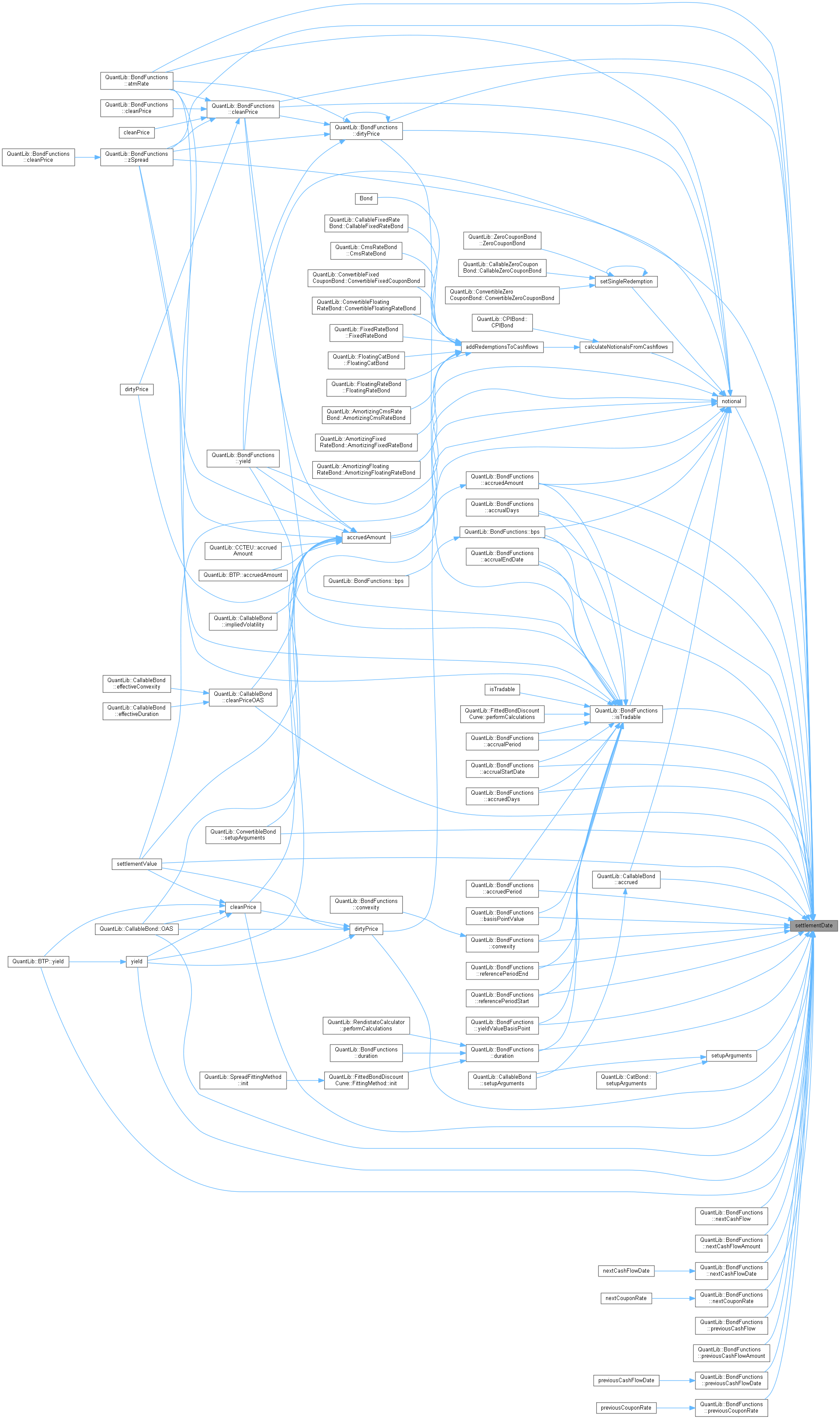

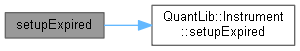

Here is the call graph for this function:◆ setupArguments()

|

overrideprotectedvirtual |

When a derived argument structure is defined for an instrument, this method should be overridden to fill it. This is mandatory in case a pricing engine is used.

Reimplemented from Instrument.

Reimplemented in ConvertibleBond.

Definition at line 285 of file bond.cpp.

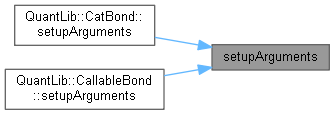

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ fetchResults()

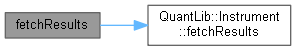

|

overrideprotectedvirtual |

When a derived result structure is defined for an instrument, this method should be overridden to read from it. This is mandatory in case a pricing engine is used.

Reimplemented from Instrument.

Definition at line 294 of file bond.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

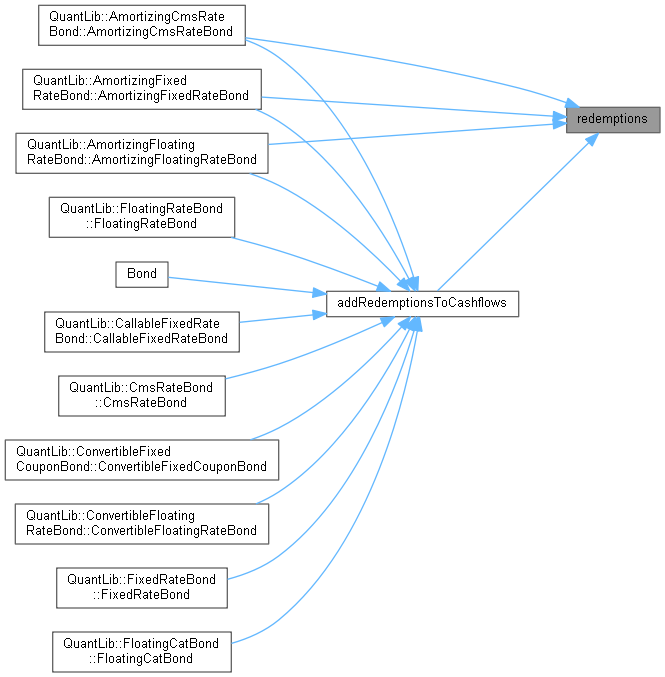

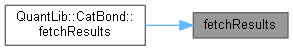

Here is the caller graph for this function:◆ addRedemptionsToCashflows()

|

protected |

This method can be called by derived classes in order to build redemption payments from the existing cash flows. It must be called after setting up the cashflows_ vector and will fill the notionalSchedule_, notionals_, and redemptions_ data members.

If given, the elements of the redemptions vector will multiply the amount of the redemption cash flow. The elements will be taken in base 100, i.e., a redemption equal to 100 does not modify the amount.

- Precondition

- The cashflows_ vector must contain at least one coupon and must be sorted by date.

Definition at line 304 of file bond.cpp.

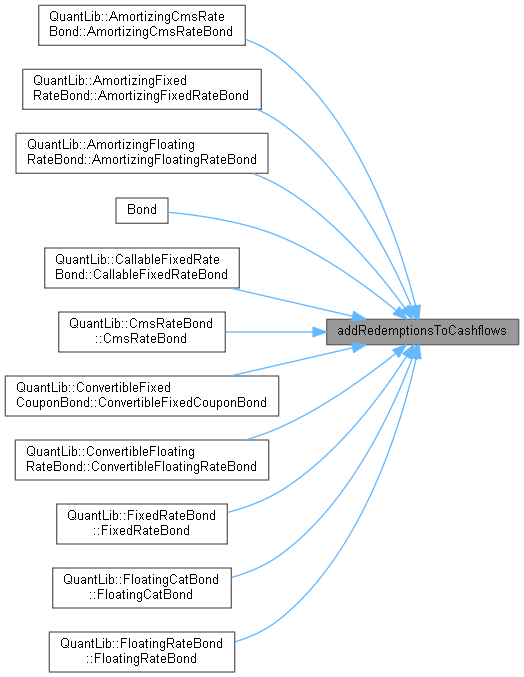

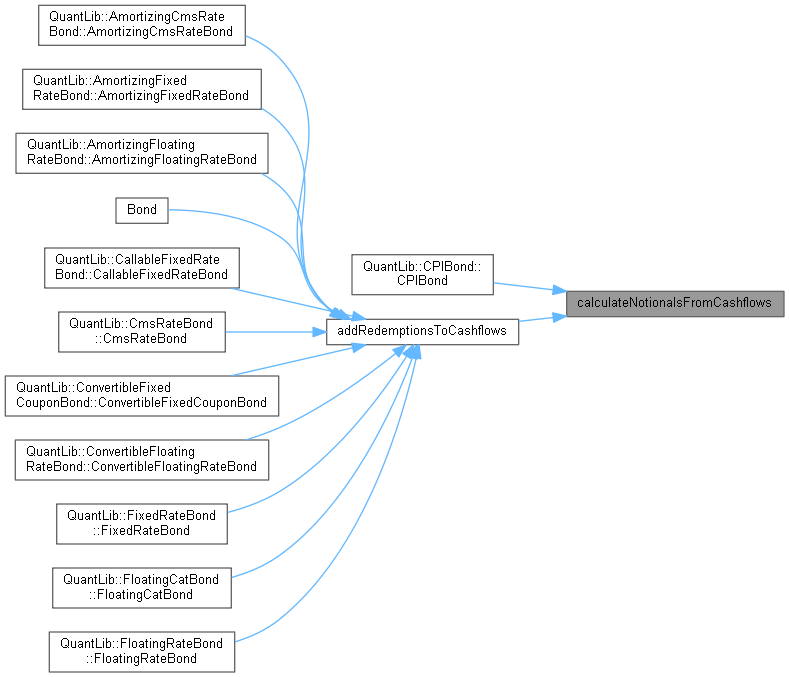

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

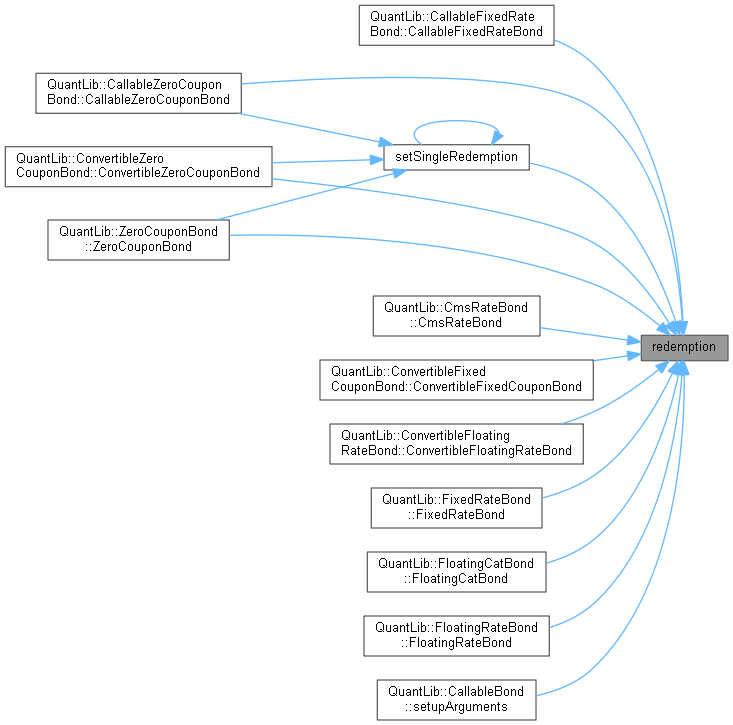

Here is the caller graph for this function:◆ setSingleRedemption() [1/2]

This method can be called by derived classes in order to build a bond with a single redemption payment. It will fill the notionalSchedule_, notionals_, and redemptions_ data members.

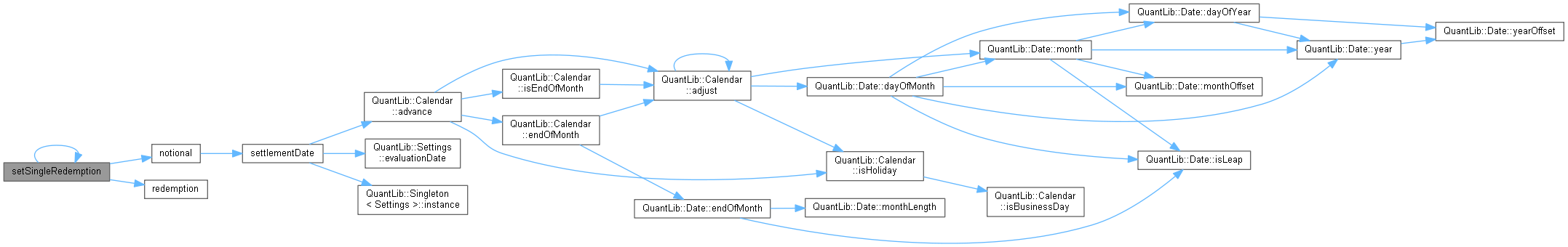

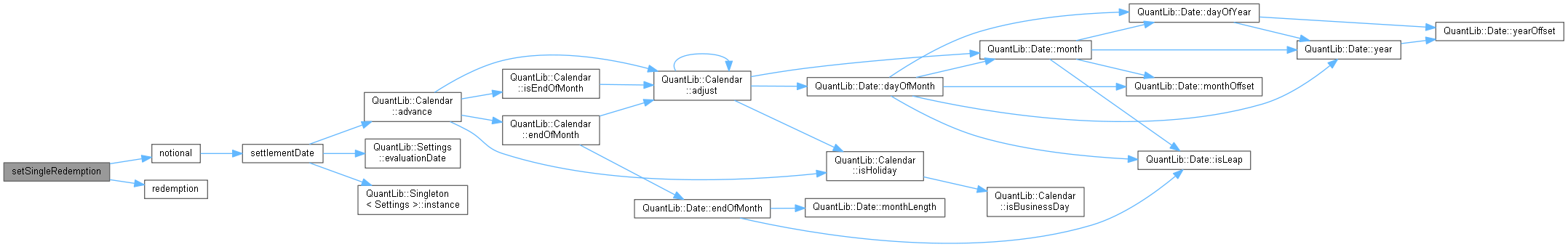

Definition at line 331 of file bond.cpp.

Here is the call graph for this function:

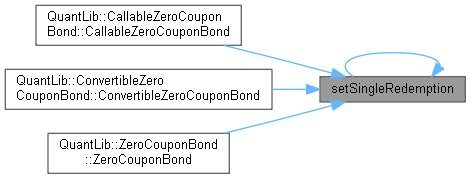

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ setSingleRedemption() [2/2]

◆ calculateNotionalsFromCashflows()

|

protected |

used internally to collect notional information from the coupons. It should not be called by derived classes, unless they already provide redemption cash flows (in which case they must set up the redemptions_ data member independently). It will fill the notionalSchedule_ and notionals_ data members.

Definition at line 363 of file bond.cpp.

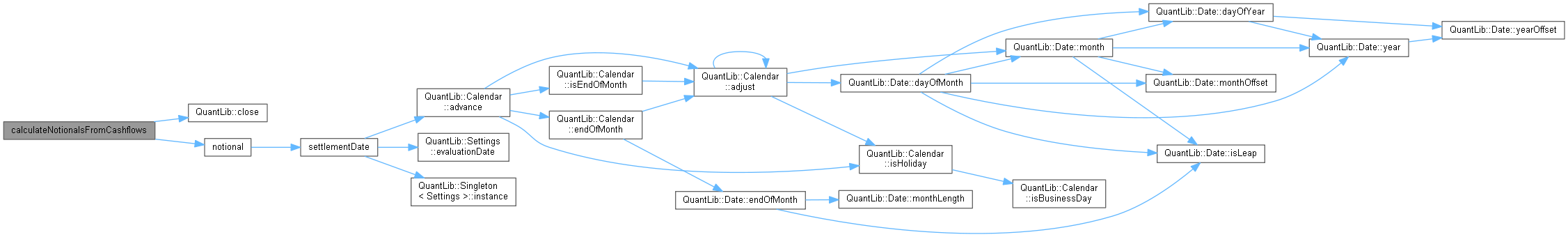

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function: