Pricing engine for European vanilla options using analytical formulae. More...

#include <analyticeuropeanengine.hpp>

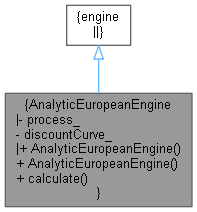

Inheritance diagram for AnalyticEuropeanEngine:

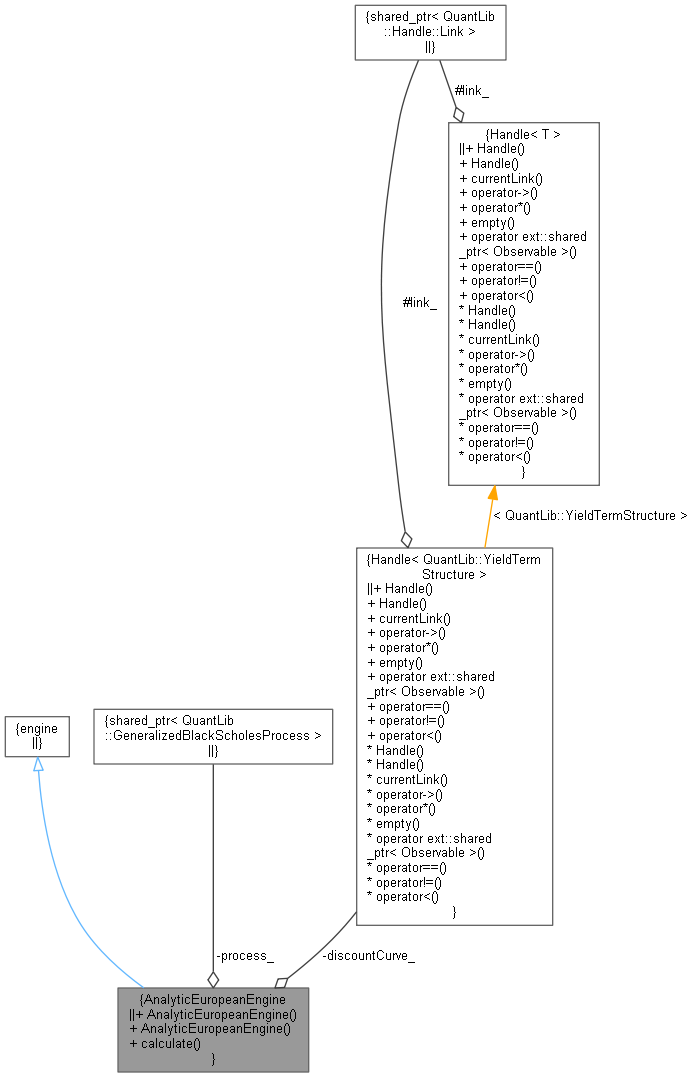

Inheritance diagram for AnalyticEuropeanEngine: Collaboration diagram for AnalyticEuropeanEngine:

Collaboration diagram for AnalyticEuropeanEngine:Public Member Functions | |

| AnalyticEuropeanEngine (ext::shared_ptr< GeneralizedBlackScholesProcess >) | |

| AnalyticEuropeanEngine (ext::shared_ptr< GeneralizedBlackScholesProcess > process, Handle< YieldTermStructure > discountCurve) | |

| void | calculate () const override |

Private Attributes | |

| ext::shared_ptr< GeneralizedBlackScholesProcess > | process_ |

| Handle< YieldTermStructure > | discountCurve_ |

Detailed Description

Pricing engine for European vanilla options using analytical formulae.

- Tests:

- the correctness of the returned value is tested by reproducing results available in literature.

- the correctness of the returned greeks is tested by reproducing results available in literature.

- the correctness of the returned greeks is tested by reproducing numerical derivatives.

- the correctness of the returned implied volatility is tested by using it for reproducing the target value.

- the implied-volatility calculation is tested by checking that it does not modify the option.

- the correctness of the returned value in case of cash-or-nothing digital payoff is tested by reproducing results available in literature.

- the correctness of the returned value in case of asset-or-nothing digital payoff is tested by reproducing results available in literature.

- the correctness of the returned value in case of gap digital payoff is tested by reproducing results available in literature.

- the correctness of the returned greeks in case of cash-or-nothing digital payoff is tested by reproducing numerical derivatives.

Definition at line 61 of file analyticeuropeanengine.hpp.

Constructor & Destructor Documentation

◆ AnalyticEuropeanEngine() [1/2]

|

explicit |

This constructor triggers the usual calculation, in which the risk-free rate in the given process is used for both forecasting and discounting.

Definition at line 28 of file analyticeuropeanengine.cpp.

◆ AnalyticEuropeanEngine() [2/2]

| AnalyticEuropeanEngine | ( | ext::shared_ptr< GeneralizedBlackScholesProcess > | process, |

| Handle< YieldTermStructure > | discountCurve | ||

| ) |

This constructor allows to use a different term structure for discounting the payoff. As usual, the risk-free rate from the given process is used for forecasting the forward price.

Definition at line 34 of file analyticeuropeanengine.cpp.

Member Function Documentation

◆ calculate()

|

override |

Definition at line 42 of file analyticeuropeanengine.cpp.

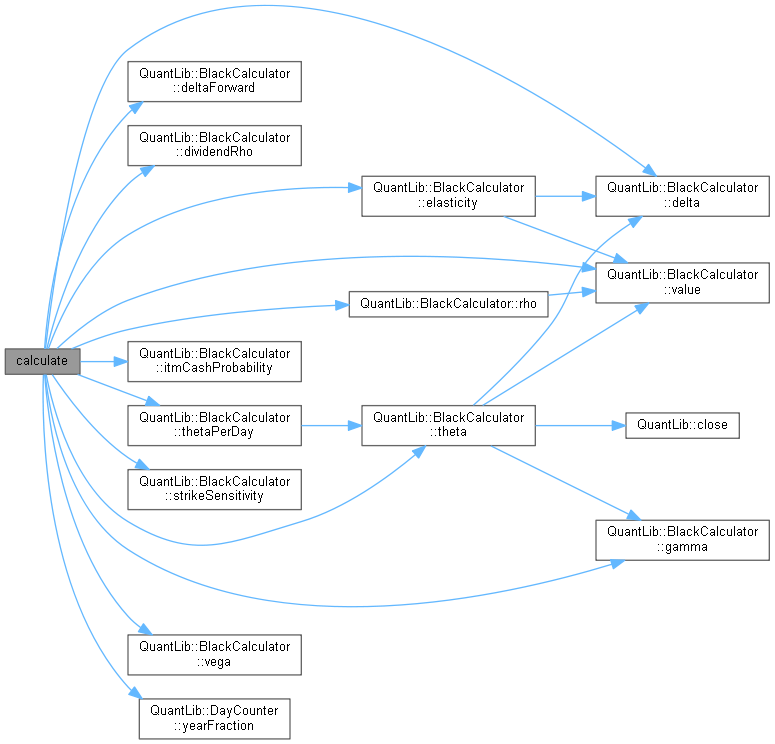

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:Member Data Documentation

◆ process_

|

private |

Definition at line 79 of file analyticeuropeanengine.hpp.

◆ discountCurve_

|

private |

Definition at line 80 of file analyticeuropeanengine.hpp.