Constrained market-model evolver. More...

#include <constrainedevolver.hpp>

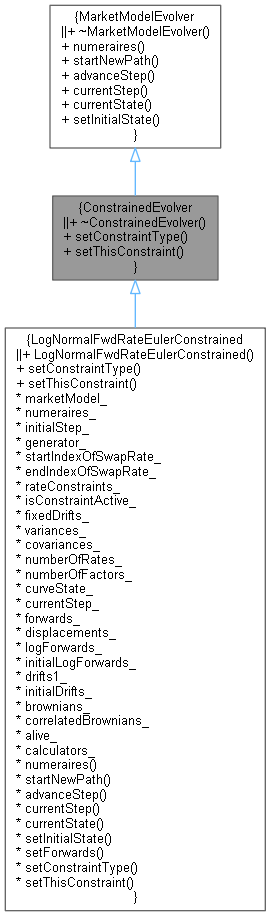

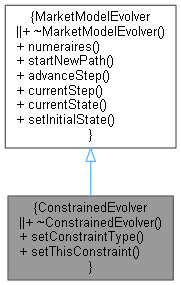

Inheritance diagram for ConstrainedEvolver:

Inheritance diagram for ConstrainedEvolver: Collaboration diagram for ConstrainedEvolver:

Collaboration diagram for ConstrainedEvolver:Public Member Functions | |

| ~ConstrainedEvolver () override=default | |

| virtual void | setConstraintType (const std::vector< Size > &startIndexOfSwapRate, const std::vector< Size > &EndIndexOfSwapRate)=0 |

| call once More... | |

| virtual void | setThisConstraint (const std::vector< Rate > &rateConstraints, const std::valarray< bool > &isConstraintActive)=0 |

| call before each path More... | |

Public Member Functions inherited from MarketModelEvolver Public Member Functions inherited from MarketModelEvolver | |

| virtual | ~MarketModelEvolver ()=default |

| virtual const std::vector< Size > & | numeraires () const =0 |

| virtual Real | startNewPath ()=0 |

| virtual Real | advanceStep ()=0 |

| virtual Size | currentStep () const =0 |

| virtual const CurveState & | currentState () const =0 |

| virtual void | setInitialState (const CurveState &)=0 |

Detailed Description

Constrained market-model evolver.

Abstract base class. Requires extra methods above that of marketmodelevolver to let you fix rates via importance sampling.

The evolver does the actual gritty work of evolving the forward rates from one time to the next.

This is intended to be used for the Fries-Joshi proxy simulation approach to Greeks

Definition at line 39 of file constrainedevolver.hpp.

Constructor & Destructor Documentation

◆ ~ConstrainedEvolver()

|

overridedefault |

Member Function Documentation

◆ setConstraintType()

|

pure virtual |

call once

Implemented in LogNormalFwdRateEulerConstrained.

◆ setThisConstraint()

|

pure virtual |

call before each path

Implemented in LogNormalFwdRateEulerConstrained.