Credit default swap. More...

#include <creditdefaultswap.hpp>

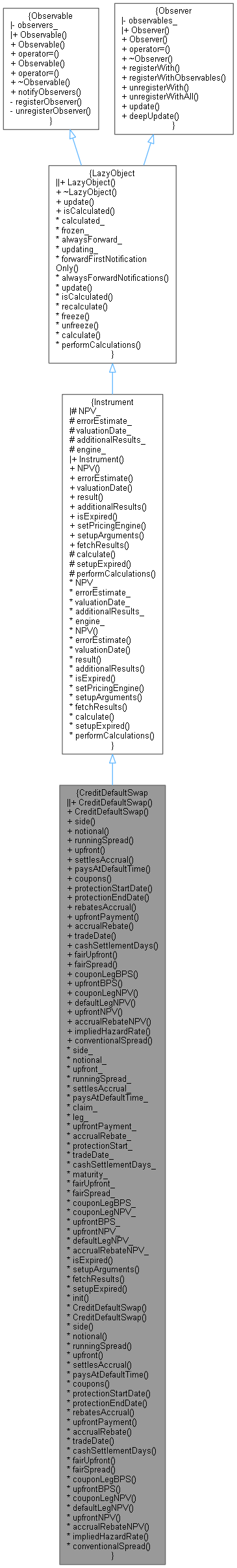

Inheritance diagram for CreditDefaultSwap:

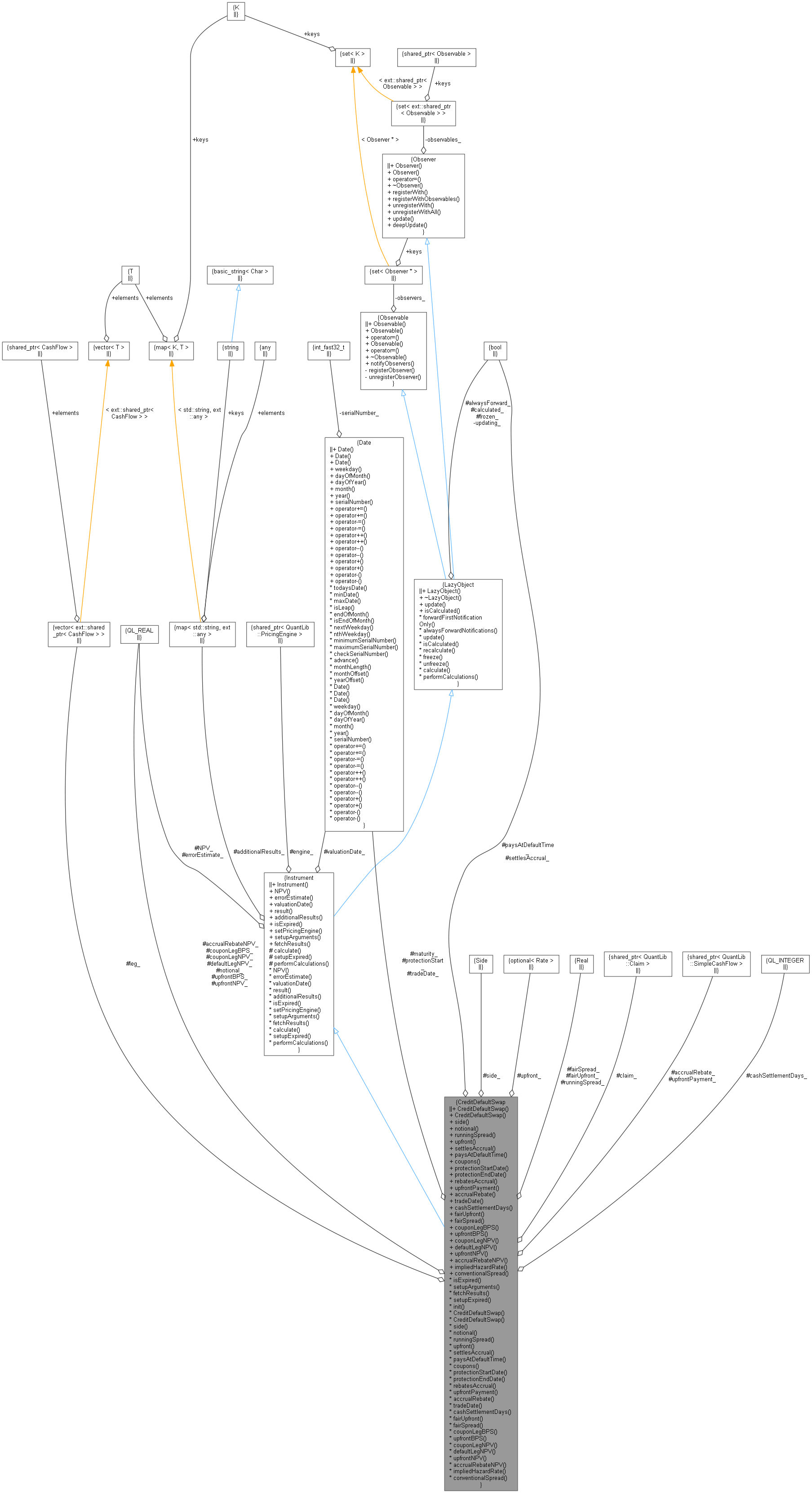

Inheritance diagram for CreditDefaultSwap: Collaboration diagram for CreditDefaultSwap:

Collaboration diagram for CreditDefaultSwap:Classes | |

| class | arguments |

| class | engine |

| class | results |

Public Types | |

| enum | PricingModel { Midpoint , ISDA } |

Public Types inherited from Observer Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

Public Member Functions | |

Constructors | |

| CreditDefaultSwap (Protection::Side side, Real notional, Rate spread, const Schedule &schedule, BusinessDayConvention paymentConvention, const DayCounter &dayCounter, bool settlesAccrual=true, bool paysAtDefaultTime=true, const Date &protectionStart=Date(), ext::shared_ptr< Claim >=ext::shared_ptr< Claim >(), const DayCounter &lastPeriodDayCounter=DayCounter(), bool rebatesAccrual=true, const Date &tradeDate=Date(), Natural cashSettlementDays=3) | |

| CDS quoted as running-spread only. More... | |

| CreditDefaultSwap (Protection::Side side, Real notional, Rate upfront, Rate spread, const Schedule &schedule, BusinessDayConvention paymentConvention, const DayCounter &dayCounter, bool settlesAccrual=true, bool paysAtDefaultTime=true, const Date &protectionStart=Date(), const Date &upfrontDate=Date(), ext::shared_ptr< Claim >=ext::shared_ptr< Claim >(), const DayCounter &lastPeriodDayCounter=DayCounter(), bool rebatesAccrual=true, const Date &tradeDate=Date(), Natural cashSettlementDays=3) | |

| CDS quoted as upfront and running spread. More... | |

Inspectors | |

| Protection::Side | side () const |

| Real | notional () const |

| Rate | runningSpread () const |

| ext::optional< Rate > | upfront () const |

| bool | settlesAccrual () const |

| bool | paysAtDefaultTime () const |

| const Leg & | coupons () const |

| const Date & | protectionStartDate () const |

| The first date for which defaults will trigger the contract. More... | |

| const Date & | protectionEndDate () const |

| The last date for which defaults will trigger the contract. More... | |

| bool | rebatesAccrual () const |

| const ext::shared_ptr< SimpleCashFlow > & | upfrontPayment () const |

| const ext::shared_ptr< SimpleCashFlow > & | accrualRebate () const |

| const Date & | tradeDate () const |

| Natural | cashSettlementDays () const |

Results | |

| Rate | fairUpfront () const |

| Rate | fairSpread () const |

| Real | couponLegBPS () const |

| Real | upfrontBPS () const |

| Real | couponLegNPV () const |

| Real | defaultLegNPV () const |

| Real | upfrontNPV () const |

| Real | accrualRebateNPV () const |

| Rate | impliedHazardRate (Real targetNPV, const Handle< YieldTermStructure > &discountCurve, const DayCounter &dayCounter, Real recoveryRate=0.4, Real accuracy=1.0e-8, PricingModel model=Midpoint) const |

| Implied hazard rate calculation. More... | |

| Rate | conventionalSpread (Real conventionalRecovery, const Handle< YieldTermStructure > &discountCurve, const DayCounter &dayCounter, PricingModel model=Midpoint) const |

| Conventional/standard upfront-to-spread conversion. More... | |

Public Member Functions inherited from Instrument Public Member Functions inherited from Instrument | |

| Instrument () | |

| Real | NPV () const |

| returns the net present value of the instrument. More... | |

| Real | errorEstimate () const |

| returns the error estimate on the NPV when available. More... | |

| const Date & | valuationDate () const |

| returns the date the net present value refers to. More... | |

| template<typename T > | |

| T | result (const std::string &tag) const |

| returns any additional result returned by the pricing engine. More... | |

| const std::map< std::string, ext::any > & | additionalResults () const |

| returns all additional result returned by the pricing engine. More... | |

| void | setPricingEngine (const ext::shared_ptr< PricingEngine > &) |

| set the pricing engine to be used. More... | |

Public Member Functions inherited from LazyObject Public Member Functions inherited from LazyObject | |

| LazyObject () | |

| ~LazyObject () override=default | |

| void | update () override |

| bool | isCalculated () const |

| void | forwardFirstNotificationOnly () |

| void | alwaysForwardNotifications () |

| void | recalculate () |

| void | freeze () |

| void | unfreeze () |

Public Member Functions inherited from Observable Public Member Functions inherited from Observable | |

| Observable ()=default | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| virtual | ~Observable ()=default |

| void | notifyObservers () |

Public Member Functions inherited from Observer Public Member Functions inherited from Observer | |

| Observer ()=default | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| virtual | ~Observer () |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | update ()=0 |

| virtual void | deepUpdate () |

Additional Inherited Members | |

Protected Member Functions inherited from Instrument Protected Member Functions inherited from Instrument | |

| void | calculate () const override |

| void | performCalculations () const override |

Protected Member Functions inherited from LazyObject Protected Member Functions inherited from LazyObject | |

Protected Attributes inherited from Instrument Protected Attributes inherited from Instrument | |

| Real | NPV_ |

| Real | errorEstimate_ |

| Date | valuationDate_ |

| std::map< std::string, ext::any > | additionalResults_ |

| ext::shared_ptr< PricingEngine > | engine_ |

Protected Attributes inherited from LazyObject Protected Attributes inherited from LazyObject | |

| bool | calculated_ = false |

| bool | frozen_ = false |

| bool | alwaysForward_ |

Detailed Description

Credit default swap.

- Note

- This instrument currently assumes that the issuer did not default until today's date.

- Warning:

- if

Settings::includeReferenceDateCashFlows()is set totrue, payments occurring at the settlement date of the swap might be included in the NPV and therefore affect the fair-spread calculation. This might not be what you want.

- Warning:

- conventionalSpread (and impliedHazardRate) by default use the mid-point engine, which is not ISDA conform.

- Examples

- CDS.cpp.

Definition at line 56 of file creditdefaultswap.hpp.

Member Enumeration Documentation

◆ PricingModel

| enum PricingModel |

| Enumerator | |

|---|---|

| Midpoint | |

| ISDA | |

Definition at line 61 of file creditdefaultswap.hpp.

Constructor & Destructor Documentation

◆ CreditDefaultSwap() [1/2]

| CreditDefaultSwap | ( | Protection::Side | side, |

| Real | notional, | ||

| Rate | spread, | ||

| const Schedule & | schedule, | ||

| BusinessDayConvention | paymentConvention, | ||

| const DayCounter & | dayCounter, | ||

| bool | settlesAccrual = true, |

||

| bool | paysAtDefaultTime = true, |

||

| const Date & | protectionStart = Date(), |

||

| ext::shared_ptr< Claim > | claim = ext::shared_ptr<Claim>(), |

||

| const DayCounter & | lastPeriodDayCounter = DayCounter(), |

||

| bool | rebatesAccrual = true, |

||

| const Date & | tradeDate = Date(), |

||

| Natural | cashSettlementDays = 3 |

||

| ) |

CDS quoted as running-spread only.

- Parameters

-

side Whether the protection is bought or sold. notional Notional value spread Running spread in fractional units. schedule Coupon schedule. paymentConvention Business-day convention for payment-date adjustment. dayCounter Day-count convention for accrual. settlesAccrual Whether or not the accrued coupon is due in the event of a default. paysAtDefaultTime If set to true, any payments triggered by a default event are due at default time. If set to false, they are due at the end of the accrual period. protectionStart The first date where a default event will trigger the contract. Before the CDS Big Bang 2009, this was typically trade date (T) + 1 calendar day. After the CDS Big Bang 2009, protection is typically effective immediately i.e. on trade date so this is what should be entered for protection start. Notice that there is no default lookback period and protection start here. In the way it determines the dirty amount it is more like the trade execution date. lastPeriodDayCounter Day-count convention for accrual in last period rebatesAccrual The protection seller pays the accrued scheduled current coupon at the start of the contract. The rebate date is not provided but computed to be two days after protection start. tradeDate The contract's trade date. It will be used with the cashSettlementDaysto determine the date on which the cash settlement amount is paid. If not given, the trade date is guessed from the protection start date andscheduledate generation rule.cashSettlementDays The number of business days from tradeDateto cash settlement date.

Definition at line 39 of file creditdefaultswap.cpp.

Here is the call graph for this function:

Here is the call graph for this function:◆ CreditDefaultSwap() [2/2]

| CreditDefaultSwap | ( | Protection::Side | side, |

| Real | notional, | ||

| Rate | upfront, | ||

| Rate | spread, | ||

| const Schedule & | schedule, | ||

| BusinessDayConvention | paymentConvention, | ||

| const DayCounter & | dayCounter, | ||

| bool | settlesAccrual = true, |

||

| bool | paysAtDefaultTime = true, |

||

| const Date & | protectionStart = Date(), |

||

| const Date & | upfrontDate = Date(), |

||

| ext::shared_ptr< Claim > | claim = ext::shared_ptr<Claim>(), |

||

| const DayCounter & | lastPeriodDayCounter = DayCounter(), |

||

| bool | rebatesAccrual = true, |

||

| const Date & | tradeDate = Date(), |

||

| Natural | cashSettlementDays = 3 |

||

| ) |

CDS quoted as upfront and running spread.

- Parameters

-

side Whether the protection is bought or sold. notional Notional value upfront Upfront in fractional units. spread Running spread in fractional units. schedule Coupon schedule. paymentConvention Business-day convention for payment-date adjustment. dayCounter Day-count convention for accrual. settlesAccrual Whether or not the accrued coupon is due in the event of a default. paysAtDefaultTime If set to true, any payments triggered by a default event are due at default time. If set to false, they are due at the end of the accrual period. protectionStart The first date where a default event will trigger the contract. Before the CDS Big Bang 2009, this was typically trade date (T) + 1 calendar day. After the CDS Big Bang 2009, protection is typically effective immediately i.e. on trade date so this is what should be entered for protection start. Notice that there is no default lookback period and protection start here. In the way it determines the dirty amount it is more like the trade execution date. upfrontDate Settlement date for the upfront and accrual rebate (if any) payments. Typically T+3, this is also the default value. lastPeriodDayCounter Day-count convention for accrual in last period rebatesAccrual The protection seller pays the accrued scheduled current coupon at the start of the contract. The rebate date is not provided but computed to be two days after protection start. tradeDate The contract's trade date. It will be used with the cashSettlementDaysto determine the date on which the cash settlement amount is paid ifupfrontDateis empty. If not given, the trade date is guessed from the protection start date andscheduledate generation rule.cashSettlementDays The number of business days from tradeDateto cash settlement date.

Definition at line 62 of file creditdefaultswap.cpp.

Here is the call graph for this function:

Here is the call graph for this function:Member Function Documentation

◆ isExpired()

|

overridevirtual |

returns whether the instrument might have value greater than zero.

Implements Instrument.

Definition at line 207 of file creditdefaultswap.cpp.

◆ setupArguments()

|

overridevirtual |

When a derived argument structure is defined for an instrument, this method should be overridden to fill it. This is mandatory in case a pricing engine is used.

Reimplemented from Instrument.

Definition at line 222 of file creditdefaultswap.cpp.

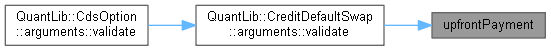

Here is the caller graph for this function:

Here is the caller graph for this function:◆ fetchResults()

|

overridevirtual |

When a derived result structure is defined for an instrument, this method should be overridden to read from it. This is mandatory in case a pricing engine is used.

Reimplemented from Instrument.

Definition at line 242 of file creditdefaultswap.cpp.

Here is the call graph for this function:

Here is the call graph for this function:◆ side()

| Protection::Side side | ( | ) | const |

◆ notional()

| Real notional | ( | ) | const |

◆ runningSpread()

| Rate runningSpread | ( | ) | const |

Definition at line 186 of file creditdefaultswap.cpp.

◆ upfront()

| ext::optional< Rate > upfront | ( | ) | const |

Definition at line 190 of file creditdefaultswap.cpp.

◆ settlesAccrual()

| bool settlesAccrual | ( | ) | const |

Definition at line 194 of file creditdefaultswap.cpp.

◆ paysAtDefaultTime()

| bool paysAtDefaultTime | ( | ) | const |

Definition at line 198 of file creditdefaultswap.cpp.

◆ coupons()

| const Leg & coupons | ( | ) | const |

Definition at line 202 of file creditdefaultswap.cpp.

◆ protectionStartDate()

| const Date & protectionStartDate | ( | ) | const |

The first date for which defaults will trigger the contract.

Definition at line 426 of file creditdefaultswap.cpp.

◆ protectionEndDate()

| const Date & protectionEndDate | ( | ) | const |

The last date for which defaults will trigger the contract.

Definition at line 430 of file creditdefaultswap.cpp.

◆ rebatesAccrual()

| bool rebatesAccrual | ( | ) | const |

◆ upfrontPayment()

| const ext::shared_ptr< SimpleCashFlow > & upfrontPayment | ( | ) | const |

◆ accrualRebate()

| const ext::shared_ptr< SimpleCashFlow > & accrualRebate | ( | ) | const |

Definition at line 439 of file creditdefaultswap.cpp.

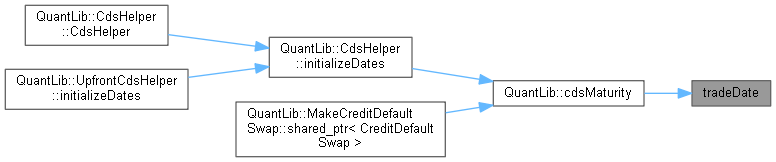

◆ tradeDate()

| const Date & tradeDate | ( | ) | const |

◆ cashSettlementDays()

| Natural cashSettlementDays | ( | ) | const |

Definition at line 447 of file creditdefaultswap.cpp.

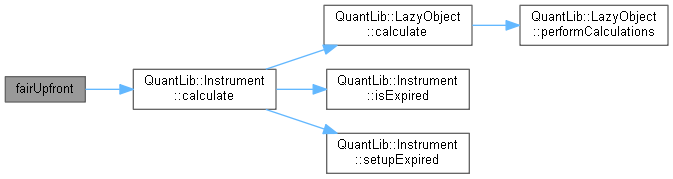

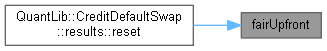

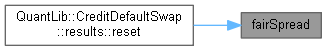

◆ fairUpfront()

| Rate fairUpfront | ( | ) | const |

Returns the upfront spread that, given the running spread and the quoted recovery rate, will make the instrument have an NPV of 0.

Definition at line 259 of file creditdefaultswap.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

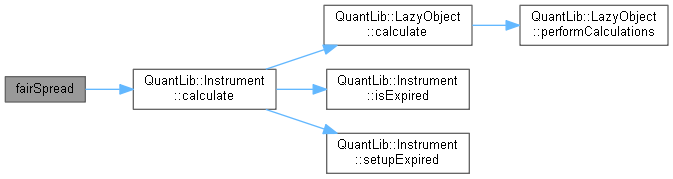

Here is the caller graph for this function:◆ fairSpread()

| Rate fairSpread | ( | ) | const |

Returns the running spread that, given the quoted recovery rate, will make the running-only CDS have an NPV of 0.

- Note

- This calculation does not take any upfront into account, even if one was given.

- Examples

- CDS.cpp.

Definition at line 266 of file creditdefaultswap.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

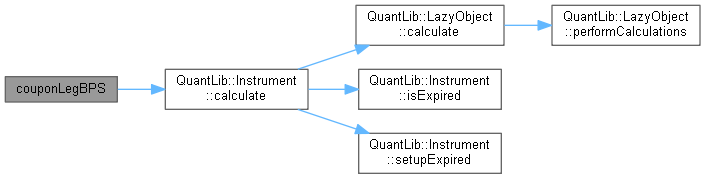

Here is the caller graph for this function:◆ couponLegBPS()

| Real couponLegBPS | ( | ) | const |

Returns the variation of the fixed-leg value given a one-basis-point change in the running spread.

Definition at line 273 of file creditdefaultswap.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ upfrontBPS()

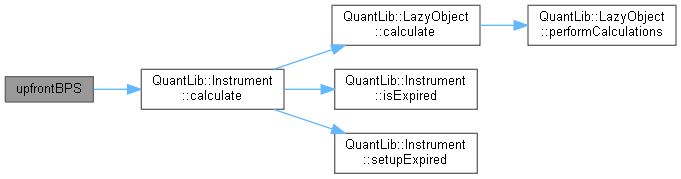

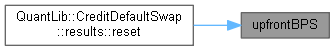

| Real upfrontBPS | ( | ) | const |

Definition at line 301 of file creditdefaultswap.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ couponLegNPV()

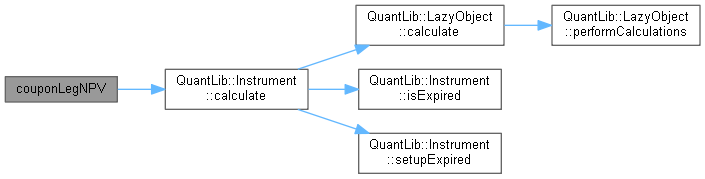

| Real couponLegNPV | ( | ) | const |

- Examples

- CDS.cpp.

Definition at line 280 of file creditdefaultswap.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ defaultLegNPV()

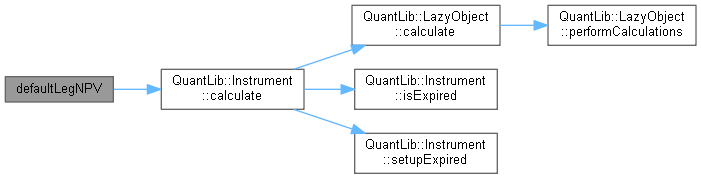

| Real defaultLegNPV | ( | ) | const |

- Examples

- CDS.cpp.

Definition at line 287 of file creditdefaultswap.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ upfrontNPV()

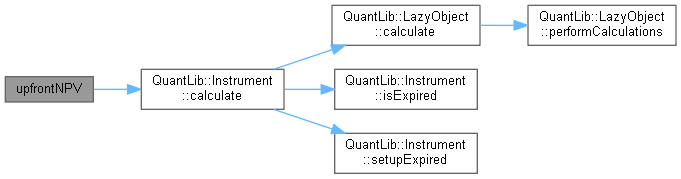

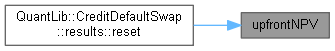

| Real upfrontNPV | ( | ) | const |

Definition at line 294 of file creditdefaultswap.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ accrualRebateNPV()

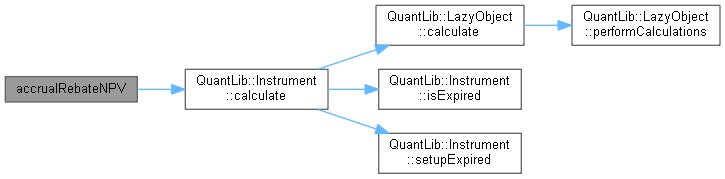

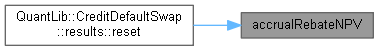

| Real accrualRebateNPV | ( | ) | const |

Definition at line 308 of file creditdefaultswap.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ impliedHazardRate()

| Rate impliedHazardRate | ( | Real | targetNPV, |

| const Handle< YieldTermStructure > & | discountCurve, | ||

| const DayCounter & | dayCounter, | ||

| Real | recoveryRate = 0.4, |

||

| Real | accuracy = 1.0e-8, |

||

| PricingModel | model = Midpoint |

||

| ) | const |

Implied hazard rate calculation.

- Note

- This method performs the calculation with the instrument characteristics. It will coincide with the ISDA calculation if your object has the standard characteristics. Notably:

- The calendar should have no bank holidays, just weekends.

- The yield curve should be LIBOR piecewise constant in fwd rates, with a discount factor of 1 on the calculation date, which coincides with the trade date.

- Convention should be Following for yield curve and contract cashflows.

- The CDS should pay accrued and mature on standard IMM dates, settle on trade date +1 and upfront settle on trade date +3.

Definition at line 340 of file creditdefaultswap.cpp.

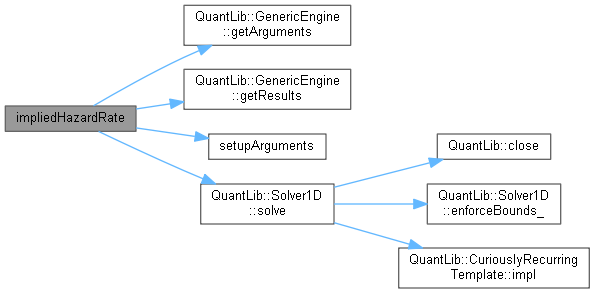

Here is the call graph for this function:

Here is the call graph for this function:◆ conventionalSpread()

| Rate conventionalSpread | ( | Real | conventionalRecovery, |

| const Handle< YieldTermStructure > & | discountCurve, | ||

| const DayCounter & | dayCounter, | ||

| PricingModel | model = Midpoint |

||

| ) | const |

Conventional/standard upfront-to-spread conversion.

Under a standard ISDA model and a set of standardised instrument characteristics, it is the running only quoted spread that will make a CDS contract have an NPV of 0 when quoted for that running only spread. Refer to: "ISDA Standard CDS converter specification." May 2009.

The conventional recovery rate to apply in the calculation is as specified by ISDA, not necessarily equal to the market-quoted one. It is typically 0.4 for SeniorSec and 0.2 for subordinate.

- Note

- The conversion employs a flat hazard rate. As a result, you will not recover the market quotes.

-

This method performs the calculation with the instrument characteristics. It will coincide with the ISDA calculation if your object has the standard characteristics. Notably:

- The calendar should have no bank holidays, just weekends.

- The yield curve should be LIBOR piecewise constant in fwd rates, with a discount factor of 1 on the calculation date, which coincides with the trade date.

- Convention should be Following for yield curve and contract cashflows.

- The CDS should pay accrued and mature on standard IMM dates, settle on trade date +1 and upfront settle on trade date +3.

Definition at line 383 of file creditdefaultswap.cpp.

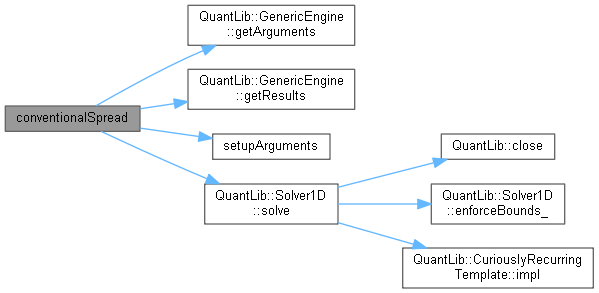

Here is the call graph for this function:

Here is the call graph for this function:◆ setupExpired()

|

overrideprotectedvirtual |

This method must leave the instrument in a consistent state when the expiration condition is met.

Reimplemented from Instrument.

Definition at line 215 of file creditdefaultswap.cpp.

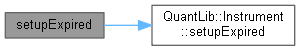

Here is the call graph for this function:

Here is the call graph for this function:◆ init()

|

private |

Shared initialisation.

Definition at line 87 of file creditdefaultswap.cpp.

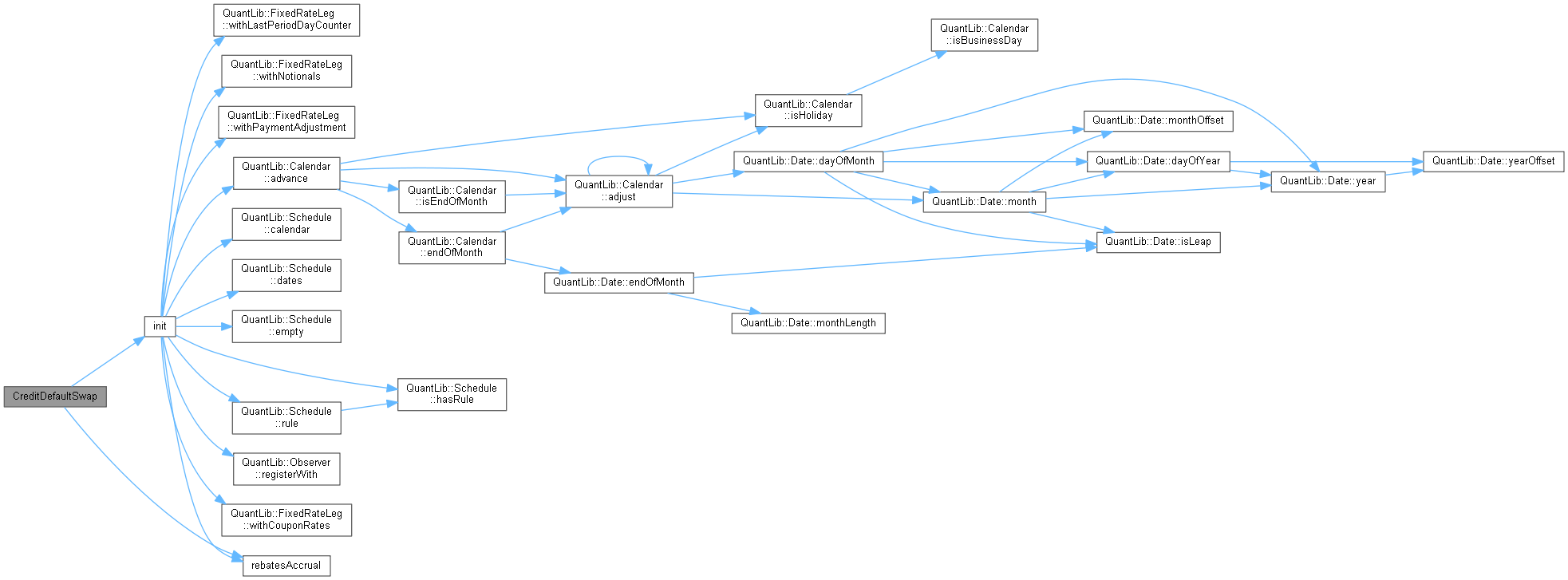

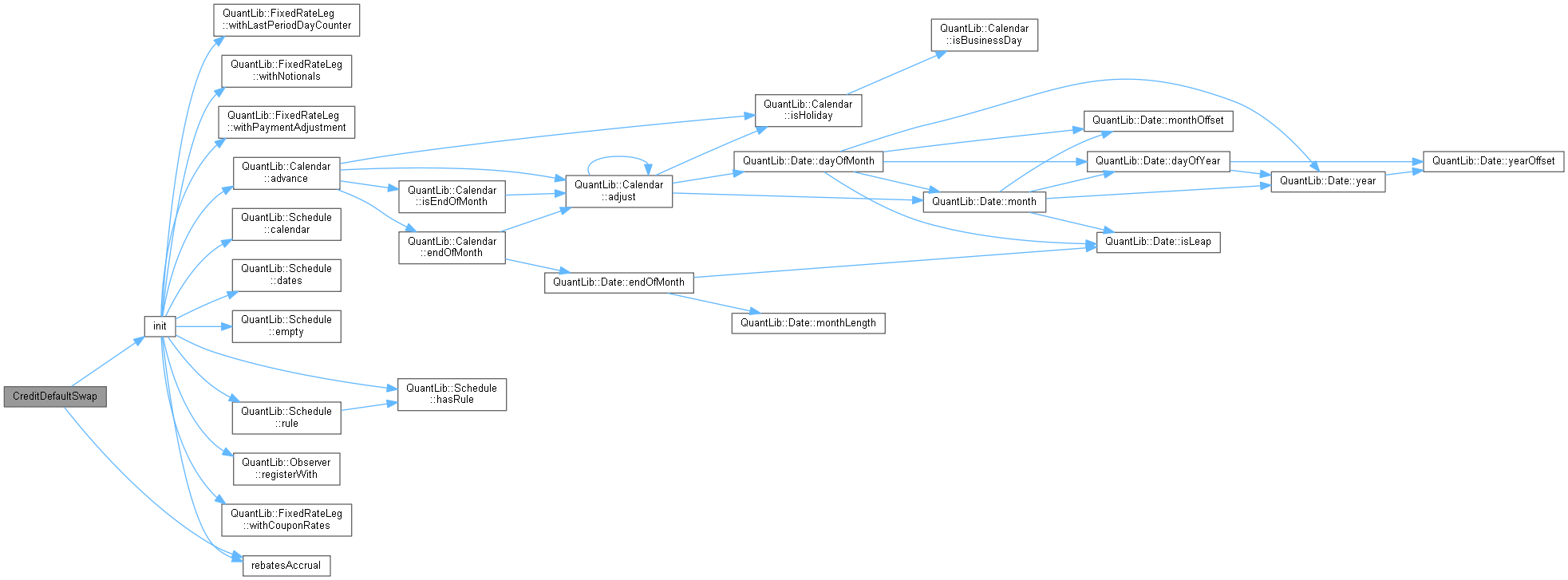

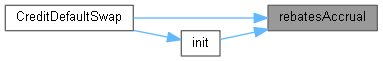

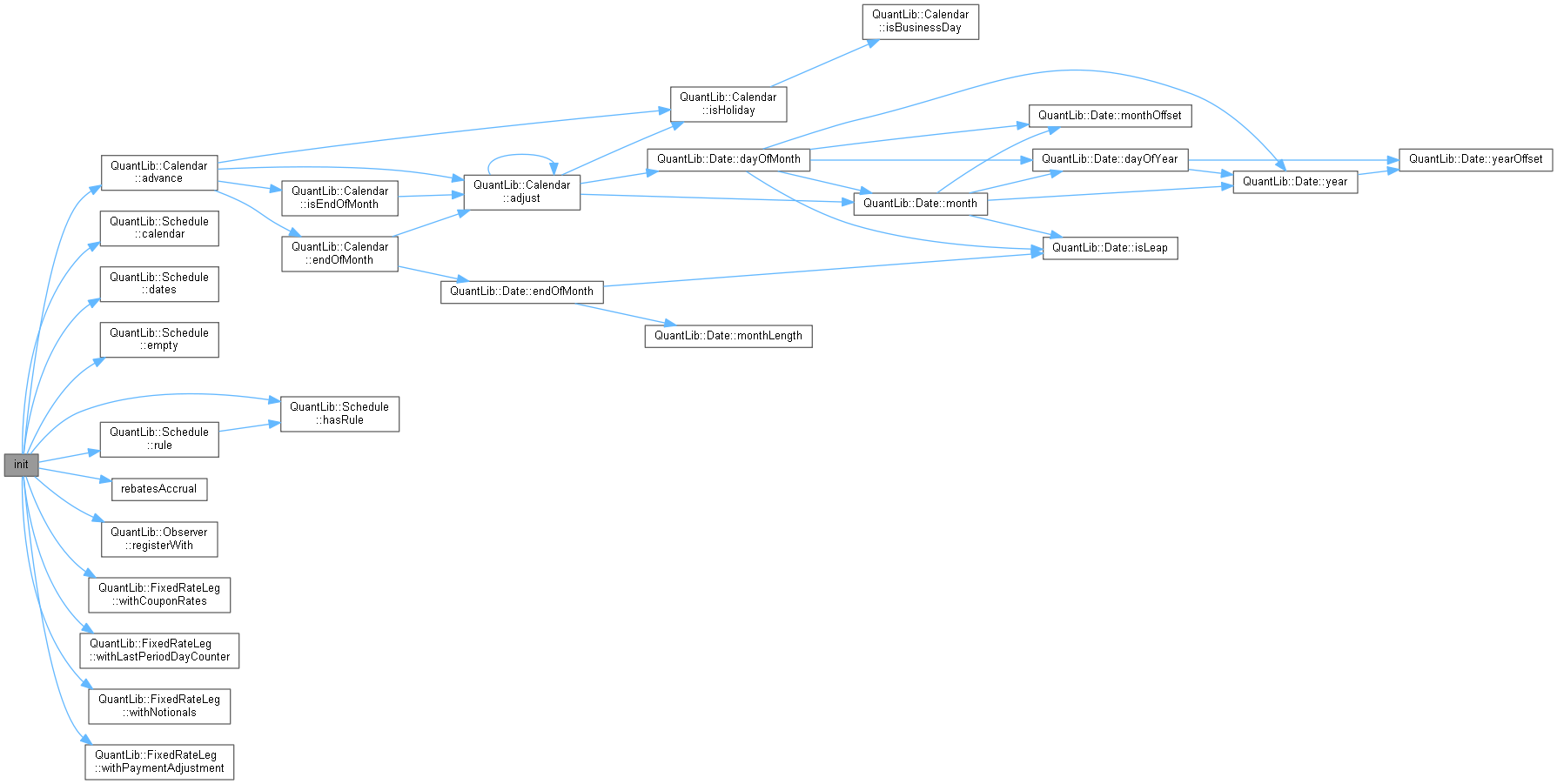

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:Member Data Documentation

◆ side_

|

protected |

Definition at line 283 of file creditdefaultswap.hpp.

◆ notional_

|

protected |

Definition at line 284 of file creditdefaultswap.hpp.

◆ upfront_

|

protected |

Definition at line 285 of file creditdefaultswap.hpp.

◆ runningSpread_

|

protected |

Definition at line 286 of file creditdefaultswap.hpp.

◆ settlesAccrual_

|

protected |

Definition at line 287 of file creditdefaultswap.hpp.

◆ paysAtDefaultTime_

|

protected |

Definition at line 287 of file creditdefaultswap.hpp.

◆ claim_

|

protected |

Definition at line 288 of file creditdefaultswap.hpp.

◆ leg_

|

protected |

Definition at line 289 of file creditdefaultswap.hpp.

◆ upfrontPayment_

|

protected |

Definition at line 290 of file creditdefaultswap.hpp.

◆ accrualRebate_

|

protected |

Definition at line 291 of file creditdefaultswap.hpp.

◆ protectionStart_

|

protected |

Definition at line 292 of file creditdefaultswap.hpp.

◆ tradeDate_

|

protected |

Definition at line 293 of file creditdefaultswap.hpp.

◆ cashSettlementDays_

|

protected |

Definition at line 294 of file creditdefaultswap.hpp.

◆ maturity_

|

protected |

Definition at line 295 of file creditdefaultswap.hpp.

◆ fairUpfront_

|

mutableprotected |

Definition at line 297 of file creditdefaultswap.hpp.

◆ fairSpread_

|

mutableprotected |

Definition at line 298 of file creditdefaultswap.hpp.

◆ couponLegBPS_

|

mutableprotected |

Definition at line 299 of file creditdefaultswap.hpp.

◆ couponLegNPV_

|

protected |

Definition at line 299 of file creditdefaultswap.hpp.

◆ upfrontBPS_

|

mutableprotected |

Definition at line 300 of file creditdefaultswap.hpp.

◆ upfrontNPV_

|

protected |

Definition at line 300 of file creditdefaultswap.hpp.

◆ defaultLegNPV_

|

mutableprotected |

Definition at line 301 of file creditdefaultswap.hpp.

◆ accrualRebateNPV_

|

mutableprotected |

Definition at line 302 of file creditdefaultswap.hpp.