empirical-distribution risk measures More...

#include <riskstatistics.hpp>

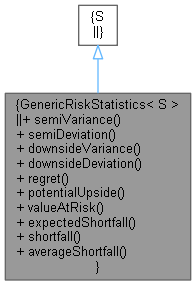

Inheritance diagram for GenericRiskStatistics< S >:

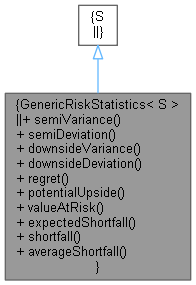

Inheritance diagram for GenericRiskStatistics< S >: Collaboration diagram for GenericRiskStatistics< S >:

Collaboration diagram for GenericRiskStatistics< S >:Public Types | |

| typedef S::value_type | value_type |

Public Member Functions | |

| Real | semiVariance () const |

| Real | semiDeviation () const |

| Real | downsideVariance () const |

| Real | downsideDeviation () const |

| Real | regret (Real target) const |

| Real | potentialUpside (Real percentile) const |

| potential upside (the reciprocal of VAR) at a given percentile More... | |

| Real | valueAtRisk (Real percentile) const |

| value-at-risk at a given percentile More... | |

| Real | expectedShortfall (Real percentile) const |

| expected shortfall at a given percentile More... | |

| Real | shortfall (Real target) const |

| Real | averageShortfall (Real target) const |

Detailed Description

class QuantLib::GenericRiskStatistics< S >

empirical-distribution risk measures

This class wraps a somewhat generic statistic tool and adds a number of risk measures (e.g.: value-at-risk, expected shortfall, etc.) based on the data distribution as reported by the underlying statistic tool.

- Examples

- DiscreteHedging.cpp, and MarketModels.cpp.

Definition at line 41 of file riskstatistics.hpp.

Member Typedef Documentation

◆ value_type

| typedef S::value_type value_type |

Definition at line 43 of file riskstatistics.hpp.

Member Function Documentation

◆ semiVariance()

| Real semiVariance |

returns the variance of observations below the mean,

\[ \frac{N}{N-1} \mathrm{E}\left[ (x-\langle x \rangle)^2 \;|\; x < \langle x \rangle \right]. \]

See Markowitz (1959).

Definition at line 130 of file riskstatistics.hpp.

◆ semiDeviation()

| Real semiDeviation |

returns the semi deviation, defined as the square root of the semi variance.

Definition at line 135 of file riskstatistics.hpp.

◆ downsideVariance()

| Real downsideVariance |

returns the variance of observations below 0.0,

\[ \frac{N}{N-1} \mathrm{E}\left[ x^2 \;|\; x < 0\right]. \]

Definition at line 140 of file riskstatistics.hpp.

◆ downsideDeviation()

| Real downsideDeviation |

returns the downside deviation, defined as the square root of the downside variance.

Definition at line 145 of file riskstatistics.hpp.

◆ regret()

returns the variance of observations below target,

\[ \frac{N}{N-1} \mathrm{E}\left[ (x-t)^2 \;|\; x < t \right]. \]

See Dembo and Freeman, "The Rules Of Risk", Wiley (2001).

Definition at line 152 of file riskstatistics.hpp.

◆ potentialUpside()

potential upside (the reciprocal of VAR) at a given percentile

- Precondition

- percentile must be in range [90%-100%)

Definition at line 169 of file riskstatistics.hpp.

◆ valueAtRisk()

value-at-risk at a given percentile

- Precondition

- percentile must be in range [90%-100%)

Definition at line 180 of file riskstatistics.hpp.

◆ expectedShortfall()

expected shortfall at a given percentile

returns the expected loss in case that the loss exceeded a VaR threshold,

\[ \mathrm{E}\left[ x \;|\; x < \mathrm{VaR}(p) \right], \]

that is the average of observations below the given percentile \( p \). Also know as conditional value-at-risk.

See Artzner, Delbaen, Eber and Heath, "Coherent measures of risk", Mathematical Finance 9 (1999)

- Precondition

- percentile must be in range [90%-100%)

Definition at line 191 of file riskstatistics.hpp.

◆ shortfall()

probability of missing the given target, defined as

\[ \mathrm{E}\left[ \Theta \;|\; (-\infty,\infty) \right] \]

where

\[ \Theta(x) = \left\{ \begin{array}{ll} 1 & x < t \\ 0 & x \geq t \end{array} \right. \]

Definition at line 208 of file riskstatistics.hpp.

◆ averageShortfall()

averaged shortfallness, defined as

\[ \mathrm{E}\left[ t-x \;|\; x<t \right] \]

Definition at line 214 of file riskstatistics.hpp.