Single-factor Hull-White (extended Vasicek) model class. More...

#include <hullwhite.hpp>

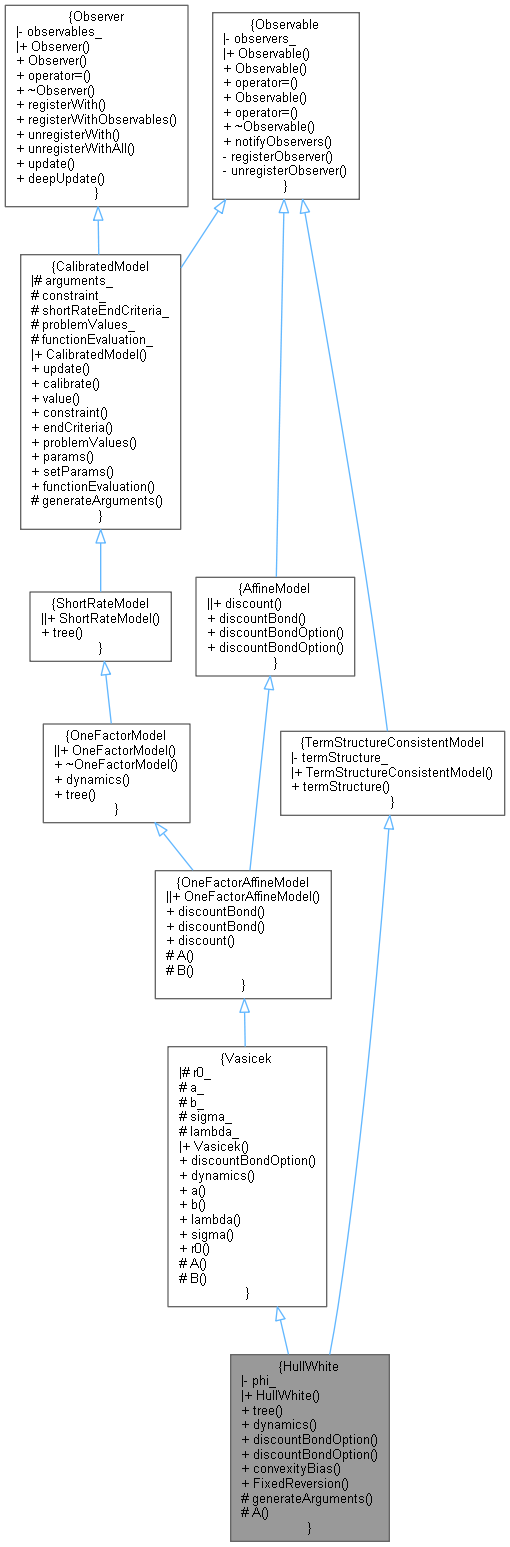

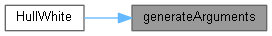

Inheritance diagram for HullWhite:

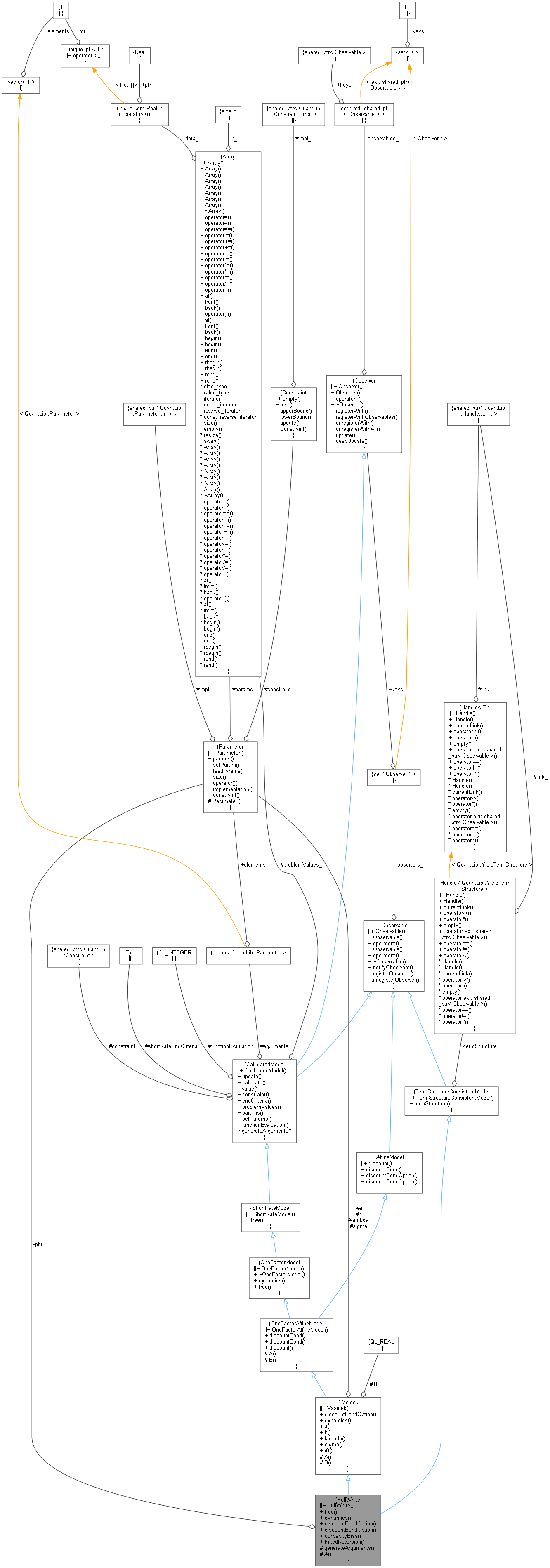

Inheritance diagram for HullWhite: Collaboration diagram for HullWhite:

Collaboration diagram for HullWhite:Classes | |

| class | Dynamics |

| Short-rate dynamics in the Hull-White model. More... | |

| class | FittingParameter |

| Analytical term-structure fitting parameter \( \varphi(t) \). More... | |

Public Member Functions | |

| HullWhite (const Handle< YieldTermStructure > &termStructure, Real a=0.1, Real sigma=0.01) | |

| ext::shared_ptr< Lattice > | tree (const TimeGrid &grid) const override |

| Return by default a trinomial recombining tree. More... | |

| ext::shared_ptr< ShortRateDynamics > | dynamics () const override |

| returns the short-rate dynamics More... | |

| Real | discountBondOption (Option::Type type, Real strike, Time maturity, Time bondMaturity) const override |

| Real | discountBondOption (Option::Type type, Real strike, Time maturity, Time bondStart, Time bondMaturity) const override |

Public Member Functions inherited from Vasicek Public Member Functions inherited from Vasicek | |

| Vasicek (Rate r0=0.05, Real a=0.1, Real b=0.05, Real sigma=0.01, Real lambda=0.0) | |

| Real | discountBondOption (Option::Type type, Real strike, Time maturity, Time bondMaturity) const override |

| ext::shared_ptr< ShortRateDynamics > | dynamics () const override |

| returns the short-rate dynamics More... | |

| Real | a () const |

| Real | b () const |

| Real | lambda () const |

| Real | sigma () const |

| Real | r0 () const |

Public Member Functions inherited from OneFactorAffineModel Public Member Functions inherited from OneFactorAffineModel | |

| OneFactorAffineModel (Size nArguments) | |

| Real | discountBond (Time now, Time maturity, Array factors) const override |

| Real | discountBond (Time now, Time maturity, Rate rate) const |

| DiscountFactor | discount (Time t) const override |

| Implied discount curve. More... | |

Public Member Functions inherited from OneFactorModel Public Member Functions inherited from OneFactorModel | |

| OneFactorModel (Size nArguments) | |

| ~OneFactorModel () override=default | |

| virtual ext::shared_ptr< ShortRateDynamics > | dynamics () const =0 |

| returns the short-rate dynamics More... | |

| ext::shared_ptr< Lattice > | tree (const TimeGrid &grid) const override |

| Return by default a trinomial recombining tree. More... | |

Public Member Functions inherited from ShortRateModel Public Member Functions inherited from ShortRateModel | |

| ShortRateModel (Size nArguments) | |

| virtual ext::shared_ptr< Lattice > | tree (const TimeGrid &) const =0 |

Public Member Functions inherited from CalibratedModel Public Member Functions inherited from CalibratedModel | |

| CalibratedModel (Size nArguments) | |

| void | update () override |

| virtual void | calibrate (const std::vector< ext::shared_ptr< CalibrationHelper > > &, OptimizationMethod &method, const EndCriteria &endCriteria, const Constraint &constraint=Constraint(), const std::vector< Real > &weights=std::vector< Real >(), const std::vector< bool > &fixParameters=std::vector< bool >()) |

| Calibrate to a set of market instruments (usually caps/swaptions) More... | |

| Real | value (const Array ¶ms, const std::vector< ext::shared_ptr< CalibrationHelper > > &) |

| const ext::shared_ptr< Constraint > & | constraint () const |

| EndCriteria::Type | endCriteria () const |

| Returns end criteria result. More... | |

| const Array & | problemValues () const |

| Returns the problem values. More... | |

| Array | params () const |

| Returns array of arguments on which calibration is done. More... | |

| virtual void | setParams (const Array ¶ms) |

| Integer | functionEvaluation () const |

Public Member Functions inherited from Observer Public Member Functions inherited from Observer | |

| Observer ()=default | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| virtual | ~Observer () |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | update ()=0 |

| virtual void | deepUpdate () |

Public Member Functions inherited from Observable Public Member Functions inherited from Observable | |

| Observable ()=default | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| virtual | ~Observable ()=default |

| void | notifyObservers () |

| virtual DiscountFactor | discount (Time t) const =0 |

| Implied discount curve. More... | |

| virtual Real | discountBond (Time now, Time maturity, Array factors) const =0 |

| virtual Real | discountBondOption (Option::Type type, Real strike, Time maturity, Time bondMaturity) const =0 |

| virtual Real | discountBondOption (Option::Type type, Real strike, Time maturity, Time bondStart, Time bondMaturity) const |

Public Member Functions inherited from TermStructureConsistentModel Public Member Functions inherited from TermStructureConsistentModel | |

| TermStructureConsistentModel (Handle< YieldTermStructure > termStructure) | |

| const Handle< YieldTermStructure > & | termStructure () const |

Static Public Member Functions | |

| static Rate | convexityBias (Real futurePrice, Time t, Time T, Real sigma, Real a) |

| static std::vector< bool > | FixedReversion () |

Protected Member Functions | |

| void | generateArguments () override |

| Real | A (Time t, Time T) const override |

Protected Member Functions inherited from Vasicek Protected Member Functions inherited from Vasicek | |

| Real | A (Time t, Time T) const override |

| Real | B (Time t, Time T) const override |

| virtual Real | A (Time t, Time T) const =0 |

| virtual Real | B (Time t, Time T) const =0 |

| virtual void | generateArguments () |

Private Attributes | |

| Parameter | phi_ |

Additional Inherited Members | |

Public Types inherited from Observer Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

Protected Attributes inherited from Vasicek Protected Attributes inherited from Vasicek | |

| Real | r0_ |

| Parameter & | a_ |

| Parameter & | b_ |

| Parameter & | sigma_ |

| Parameter & | lambda_ |

Protected Attributes inherited from CalibratedModel Protected Attributes inherited from CalibratedModel | |

| std::vector< Parameter > | arguments_ |

| ext::shared_ptr< Constraint > | constraint_ |

| EndCriteria::Type | shortRateEndCriteria_ = EndCriteria::None |

| Array | problemValues_ |

| Integer | functionEvaluation_ |

Detailed Description

Single-factor Hull-White (extended Vasicek) model class.

This class implements the standard single-factor Hull-White model defined by

\[ dr_t = (\theta(t) - \alpha r_t)dt + \sigma dW_t \]

where \( \alpha \) and \( \sigma \) are constants.

- Tests:

- calibration results are tested against cached values

- Bug:

- When the term structure is relinked, the r0 parameter of the underlying Vasicek model is not updated.

Definition at line 49 of file hullwhite.hpp.

Constructor & Destructor Documentation

◆ HullWhite()

| HullWhite | ( | const Handle< YieldTermStructure > & | termStructure, |

| Real | a = 0.1, |

||

| Real | sigma = 0.01 |

||

| ) |

Member Function Documentation

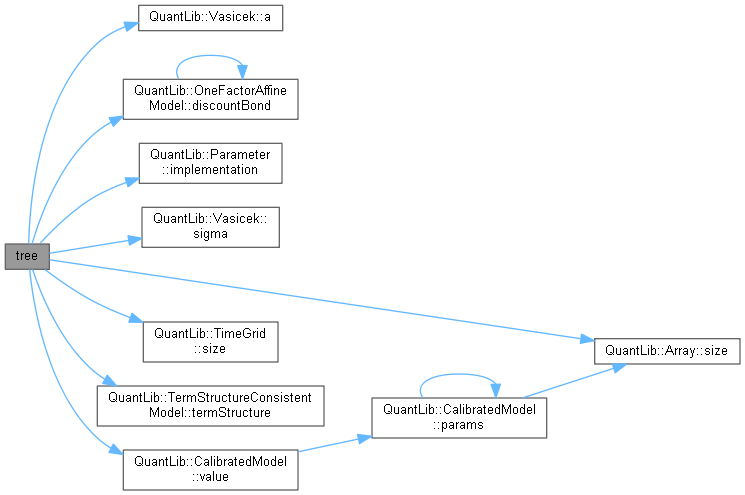

◆ tree()

Return by default a trinomial recombining tree.

Reimplemented from OneFactorModel.

Definition at line 43 of file hullwhite.cpp.

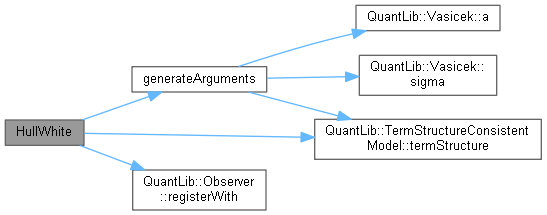

Here is the call graph for this function:

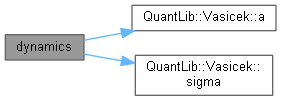

Here is the call graph for this function:◆ dynamics()

|

overridevirtual |

returns the short-rate dynamics

Implements OneFactorModel.

Definition at line 163 of file hullwhite.hpp.

Here is the call graph for this function:

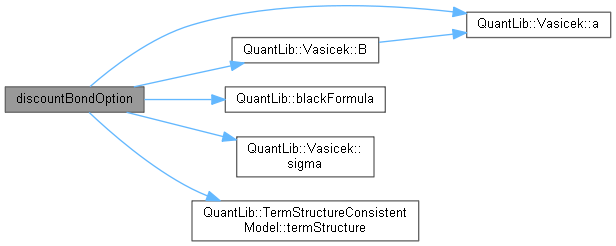

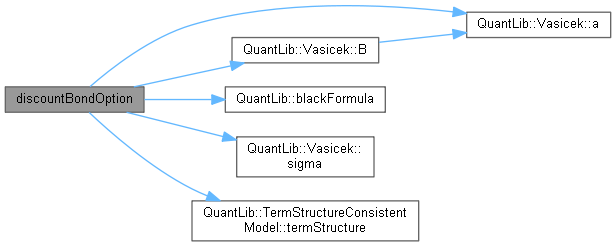

Here is the call graph for this function:◆ discountBondOption() [1/2]

|

overridevirtual |

Implements AffineModel.

Definition at line 89 of file hullwhite.cpp.

Here is the call graph for this function:

Here is the call graph for this function:◆ discountBondOption() [2/2]

|

overridevirtual |

Reimplemented from AffineModel.

Definition at line 107 of file hullwhite.cpp.

Here is the call graph for this function:

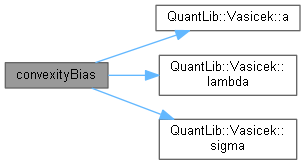

Here is the call graph for this function:◆ convexityBias()

Futures convexity bias (i.e., the difference between futures implied rate and forward rate) calculated as in G. Kirikos, D. Novak, "Convexity Conundrums", Risk Magazine, March 1997.

- Note

- t and T should be expressed in yearfraction using deposit day counter, F_quoted is futures' market price.

Definition at line 133 of file hullwhite.cpp.

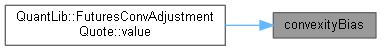

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ FixedReversion()

|

static |

Definition at line 83 of file hullwhite.hpp.

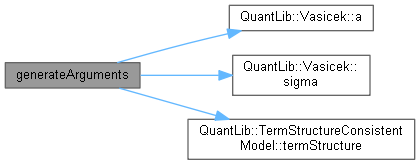

◆ generateArguments()

|

overrideprotectedvirtual |

Reimplemented from CalibratedModel.

Definition at line 85 of file hullwhite.cpp.

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ A()

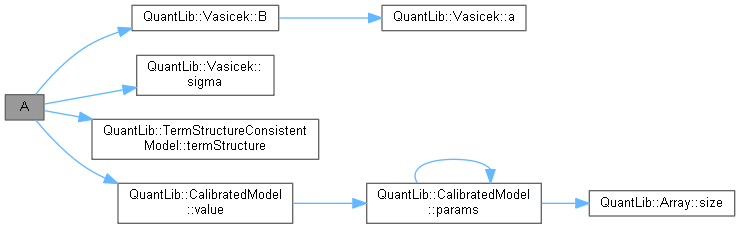

Implements OneFactorAffineModel.

Definition at line 75 of file hullwhite.cpp.

Here is the call graph for this function:

Here is the call graph for this function:Member Data Documentation

◆ phi_

|

private |

Definition at line 98 of file hullwhite.hpp.