floating-rate cat bond (possibly capped and/or floored) More...

#include <catbond.hpp>

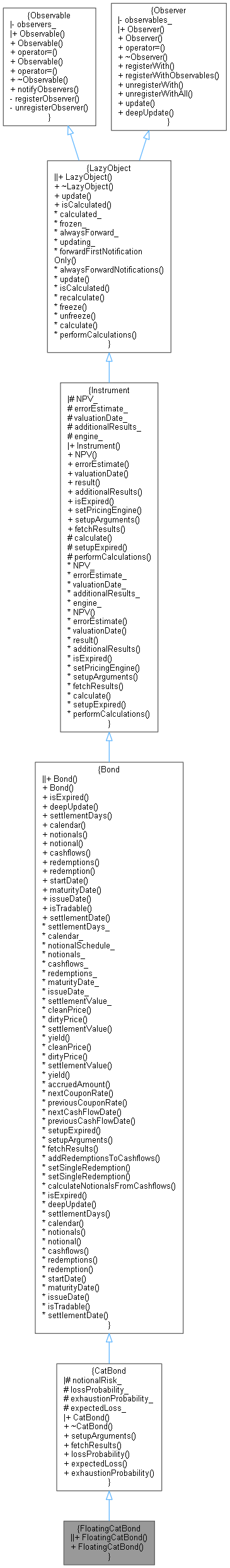

Inheritance diagram for FloatingCatBond:

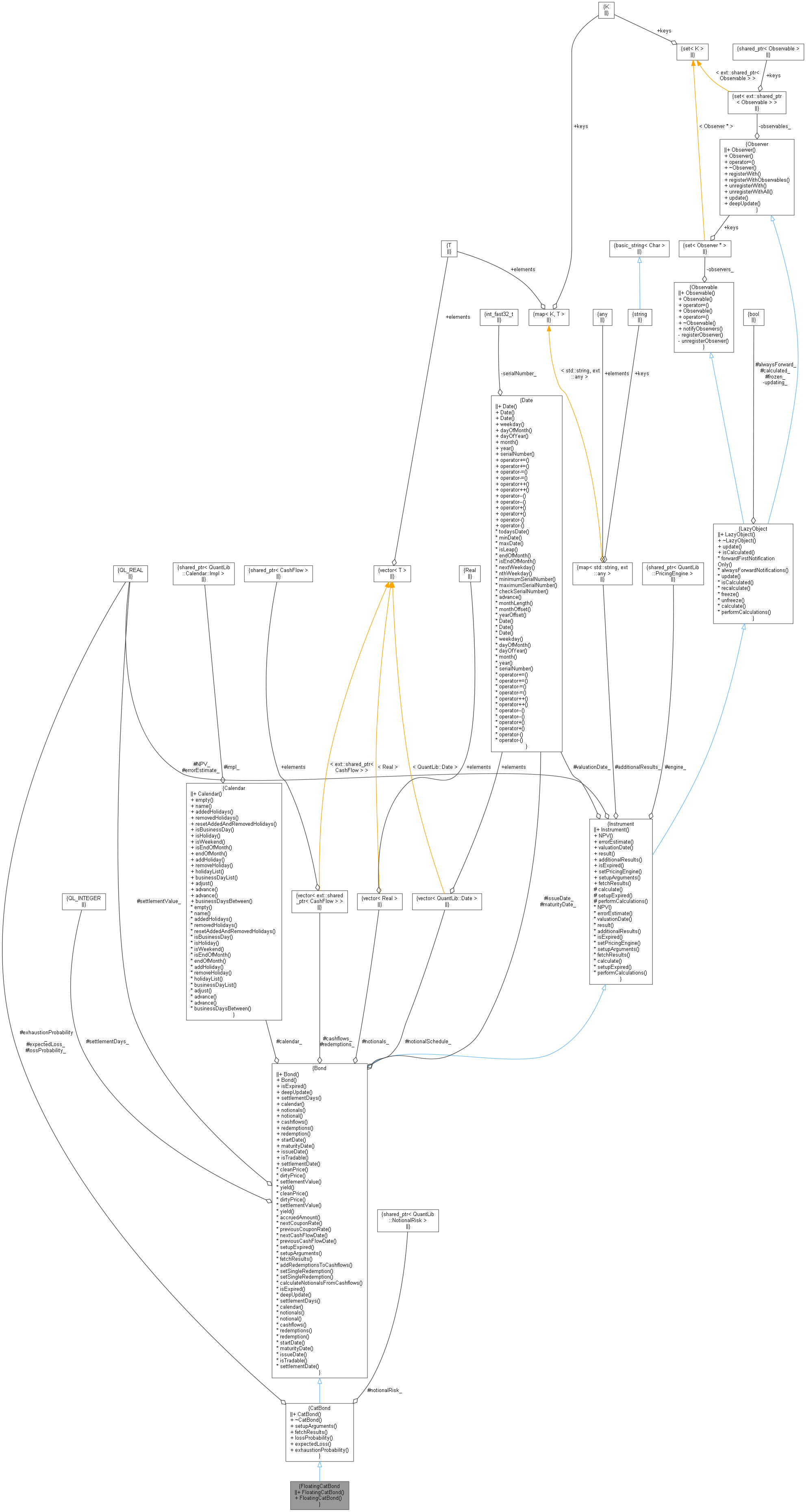

Inheritance diagram for FloatingCatBond: Collaboration diagram for FloatingCatBond:

Collaboration diagram for FloatingCatBond:Public Member Functions | |

| FloatingCatBond (Natural settlementDays, Real faceAmount, Schedule schedule, const ext::shared_ptr< IborIndex > &iborIndex, const DayCounter &accrualDayCounter, const ext::shared_ptr< NotionalRisk > ¬ionalRisk, BusinessDayConvention paymentConvention=Following, Natural fixingDays=Null< Natural >(), const std::vector< Real > &gearings=std::vector< Real >(1, 1.0), const std::vector< Spread > &spreads=std::vector< Spread >(1, 0.0), const std::vector< Rate > &caps=std::vector< Rate >(), const std::vector< Rate > &floors=std::vector< Rate >(), bool inArrears=false, Real redemption=100.0, const Date &issueDate=Date()) | |

| FloatingCatBond (Natural settlementDays, Real faceAmount, const Date &startDate, const Date &maturityDate, Frequency couponFrequency, const Calendar &calendar, const ext::shared_ptr< IborIndex > &iborIndex, const DayCounter &accrualDayCounter, const ext::shared_ptr< NotionalRisk > ¬ionalRisk, BusinessDayConvention accrualConvention=Following, BusinessDayConvention paymentConvention=Following, Natural fixingDays=Null< Natural >(), const std::vector< Real > &gearings=std::vector< Real >(1, 1.0), const std::vector< Spread > &spreads=std::vector< Spread >(1, 0.0), const std::vector< Rate > &caps=std::vector< Rate >(), const std::vector< Rate > &floors=std::vector< Rate >(), bool inArrears=false, Real redemption=100.0, const Date &issueDate=Date(), const Date &stubDate=Date(), DateGeneration::Rule rule=DateGeneration::Backward, bool endOfMonth=false) | |

Public Member Functions inherited from CatBond Public Member Functions inherited from CatBond | |

| CatBond (Natural settlementDays, const Calendar &calendar, const Date &issueDate, ext::shared_ptr< NotionalRisk > notionalRisk) | |

| ~CatBond () override=default | |

| void | setupArguments (PricingEngine::arguments *) const override |

| void | fetchResults (const PricingEngine::results *) const override |

| Real | lossProbability () const |

| Real | expectedLoss () const |

| Real | exhaustionProbability () const |

Public Member Functions inherited from Bond Public Member Functions inherited from Bond | |

| Bond (Natural settlementDays, Calendar calendar, const Date &issueDate=Date(), const Leg &coupons=Leg()) | |

| constructor for amortizing or non-amortizing bonds. More... | |

| Bond (Natural settlementDays, Calendar calendar, Real faceAmount, const Date &maturityDate, const Date &issueDate=Date(), const Leg &cashflows=Leg()) | |

| old constructor for non amortizing bonds. More... | |

| bool | isExpired () const override |

| returns whether the instrument might have value greater than zero. More... | |

| void | deepUpdate () override |

| Natural | settlementDays () const |

| const Calendar & | calendar () const |

| const std::vector< Real > & | notionals () const |

| virtual Real | notional (Date d=Date()) const |

| const Leg & | cashflows () const |

| const Leg & | redemptions () const |

| const ext::shared_ptr< CashFlow > & | redemption () const |

| Date | startDate () const |

| Date | maturityDate () const |

| Date | issueDate () const |

| bool | isTradable (Date d=Date()) const |

| Date | settlementDate (Date d=Date()) const |

| Real | cleanPrice () const |

| theoretical clean price More... | |

| Real | dirtyPrice () const |

| theoretical dirty price More... | |

| Real | settlementValue () const |

| theoretical settlement value More... | |

| Rate | yield (const DayCounter &dc, Compounding comp, Frequency freq, Real accuracy=1.0e-8, Size maxEvaluations=100, Real guess=0.05, Bond::Price::Type priceType=Bond::Price::Clean) const |

| theoretical bond yield More... | |

| Real | cleanPrice (Rate yield, const DayCounter &dc, Compounding comp, Frequency freq, Date settlementDate=Date()) const |

| clean price given a yield and settlement date More... | |

| Real | dirtyPrice (Rate yield, const DayCounter &dc, Compounding comp, Frequency freq, Date settlementDate=Date()) const |

| dirty price given a yield and settlement date More... | |

| Real | settlementValue (Real cleanPrice) const |

| settlement value as a function of the clean price More... | |

| Rate | yield (Bond::Price price, const DayCounter &dc, Compounding comp, Frequency freq, Date settlementDate=Date(), Real accuracy=1.0e-8, Size maxEvaluations=100, Real guess=0.05) const |

| yield given a price and settlement date More... | |

| virtual Real | accruedAmount (Date d=Date()) const |

| accrued amount at a given date More... | |

| virtual Rate | nextCouponRate (Date d=Date()) const |

| Rate | previousCouponRate (Date d=Date()) const |

| Previous coupon already paid at a given date. More... | |

| Date | nextCashFlowDate (Date d=Date()) const |

| Date | previousCashFlowDate (Date d=Date()) const |

Public Member Functions inherited from Instrument Public Member Functions inherited from Instrument | |

| Instrument () | |

| Real | NPV () const |

| returns the net present value of the instrument. More... | |

| Real | errorEstimate () const |

| returns the error estimate on the NPV when available. More... | |

| const Date & | valuationDate () const |

| returns the date the net present value refers to. More... | |

| template<typename T > | |

| T | result (const std::string &tag) const |

| returns any additional result returned by the pricing engine. More... | |

| const std::map< std::string, ext::any > & | additionalResults () const |

| returns all additional result returned by the pricing engine. More... | |

| void | setPricingEngine (const ext::shared_ptr< PricingEngine > &) |

| set the pricing engine to be used. More... | |

Public Member Functions inherited from LazyObject Public Member Functions inherited from LazyObject | |

| LazyObject () | |

| ~LazyObject () override=default | |

| void | update () override |

| bool | isCalculated () const |

| void | forwardFirstNotificationOnly () |

| void | alwaysForwardNotifications () |

| void | recalculate () |

| void | freeze () |

| void | unfreeze () |

Public Member Functions inherited from Observable Public Member Functions inherited from Observable | |

| Observable ()=default | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| virtual | ~Observable ()=default |

| void | notifyObservers () |

Public Member Functions inherited from Observer Public Member Functions inherited from Observer | |

| Observer ()=default | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| virtual | ~Observer () |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | update ()=0 |

| virtual void | deepUpdate () |

Additional Inherited Members | |

Public Types inherited from Observer Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

Protected Member Functions inherited from Bond Protected Member Functions inherited from Bond | |

| void | setupExpired () const override |

| void | setupArguments (PricingEngine::arguments *) const override |

| void | fetchResults (const PricingEngine::results *) const override |

| void | addRedemptionsToCashflows (const std::vector< Real > &redemptions=std::vector< Real >()) |

| void | setSingleRedemption (Real notional, Real redemption, const Date &date) |

| void | setSingleRedemption (Real notional, const ext::shared_ptr< CashFlow > &redemption) |

| void | calculateNotionalsFromCashflows () |

Protected Member Functions inherited from Instrument Protected Member Functions inherited from Instrument | |

| void | calculate () const override |

| void | performCalculations () const override |

Protected Member Functions inherited from LazyObject Protected Member Functions inherited from LazyObject | |

Protected Attributes inherited from CatBond Protected Attributes inherited from CatBond | |

| ext::shared_ptr< NotionalRisk > | notionalRisk_ |

| Real | lossProbability_ |

| Real | exhaustionProbability_ |

| Real | expectedLoss_ |

Protected Attributes inherited from Bond Protected Attributes inherited from Bond | |

| Natural | settlementDays_ |

| Calendar | calendar_ |

| std::vector< Date > | notionalSchedule_ |

| std::vector< Real > | notionals_ |

| Leg | cashflows_ |

| Leg | redemptions_ |

| Date | maturityDate_ |

| Date | issueDate_ |

| Real | settlementValue_ |

Protected Attributes inherited from Instrument Protected Attributes inherited from Instrument | |

| Real | NPV_ |

| Real | errorEstimate_ |

| Date | valuationDate_ |

| std::map< std::string, ext::any > | additionalResults_ |

| ext::shared_ptr< PricingEngine > | engine_ |

Protected Attributes inherited from LazyObject Protected Attributes inherited from LazyObject | |

| bool | calculated_ = false |

| bool | frozen_ = false |

| bool | alwaysForward_ |

Detailed Description

floating-rate cat bond (possibly capped and/or floored)

- Tests:

- calculations are tested by checking results against cached values.

Definition at line 93 of file catbond.hpp.

Constructor & Destructor Documentation

◆ FloatingCatBond() [1/2]

| FloatingCatBond | ( | Natural | settlementDays, |

| Real | faceAmount, | ||

| Schedule | schedule, | ||

| const ext::shared_ptr< IborIndex > & | iborIndex, | ||

| const DayCounter & | accrualDayCounter, | ||

| const ext::shared_ptr< NotionalRisk > & | notionalRisk, | ||

| BusinessDayConvention | paymentConvention = Following, |

||

| Natural | fixingDays = Null<Natural>(), |

||

| const std::vector< Real > & | gearings = std::vector<Real>(1, 1.0), |

||

| const std::vector< Spread > & | spreads = std::vector<Spread>(1, 0.0), |

||

| const std::vector< Rate > & | caps = std::vector<Rate>(), |

||

| const std::vector< Rate > & | floors = std::vector<Rate>(), |

||

| bool | inArrears = false, |

||

| Real | redemption = 100.0, |

||

| const Date & | issueDate = Date() |

||

| ) |

◆ FloatingCatBond() [2/2]

| FloatingCatBond | ( | Natural | settlementDays, |

| Real | faceAmount, | ||

| const Date & | startDate, | ||

| const Date & | maturityDate, | ||

| Frequency | couponFrequency, | ||

| const Calendar & | calendar, | ||

| const ext::shared_ptr< IborIndex > & | iborIndex, | ||

| const DayCounter & | accrualDayCounter, | ||

| const ext::shared_ptr< NotionalRisk > & | notionalRisk, | ||

| BusinessDayConvention | accrualConvention = Following, |

||

| BusinessDayConvention | paymentConvention = Following, |

||

| Natural | fixingDays = Null<Natural>(), |

||

| const std::vector< Real > & | gearings = std::vector<Real>(1, 1.0), |

||

| const std::vector< Spread > & | spreads = std::vector<Spread>(1, 0.0), |

||

| const std::vector< Rate > & | caps = std::vector<Rate>(), |

||

| const std::vector< Rate > & | floors = std::vector<Rate>(), |

||

| bool | inArrears = false, |

||

| Real | redemption = 100.0, |

||

| const Date & | issueDate = Date(), |

||

| const Date & | stubDate = Date(), |

||

| DateGeneration::Rule | rule = DateGeneration::Backward, |

||

| bool | endOfMonth = false |

||

| ) |