|

|

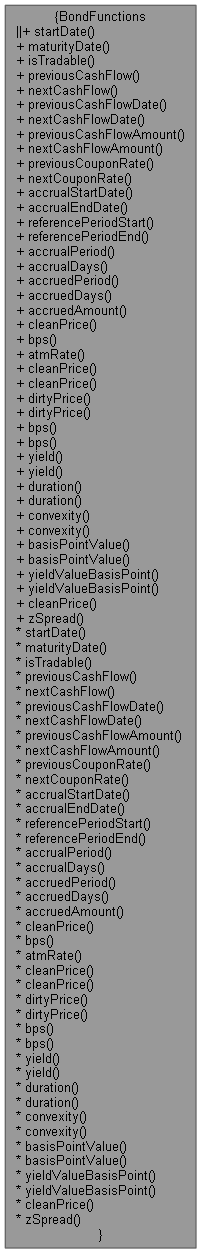

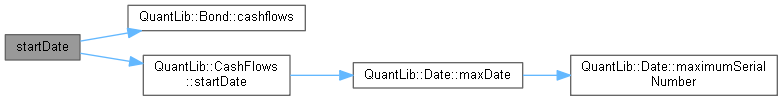

| static Date | startDate (const Bond &bond) |

| |

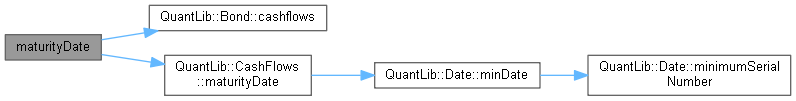

| static Date | maturityDate (const Bond &bond) |

| |

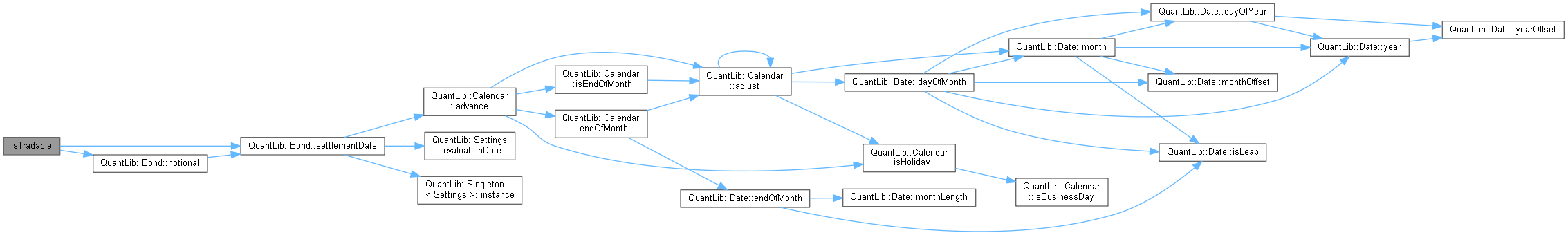

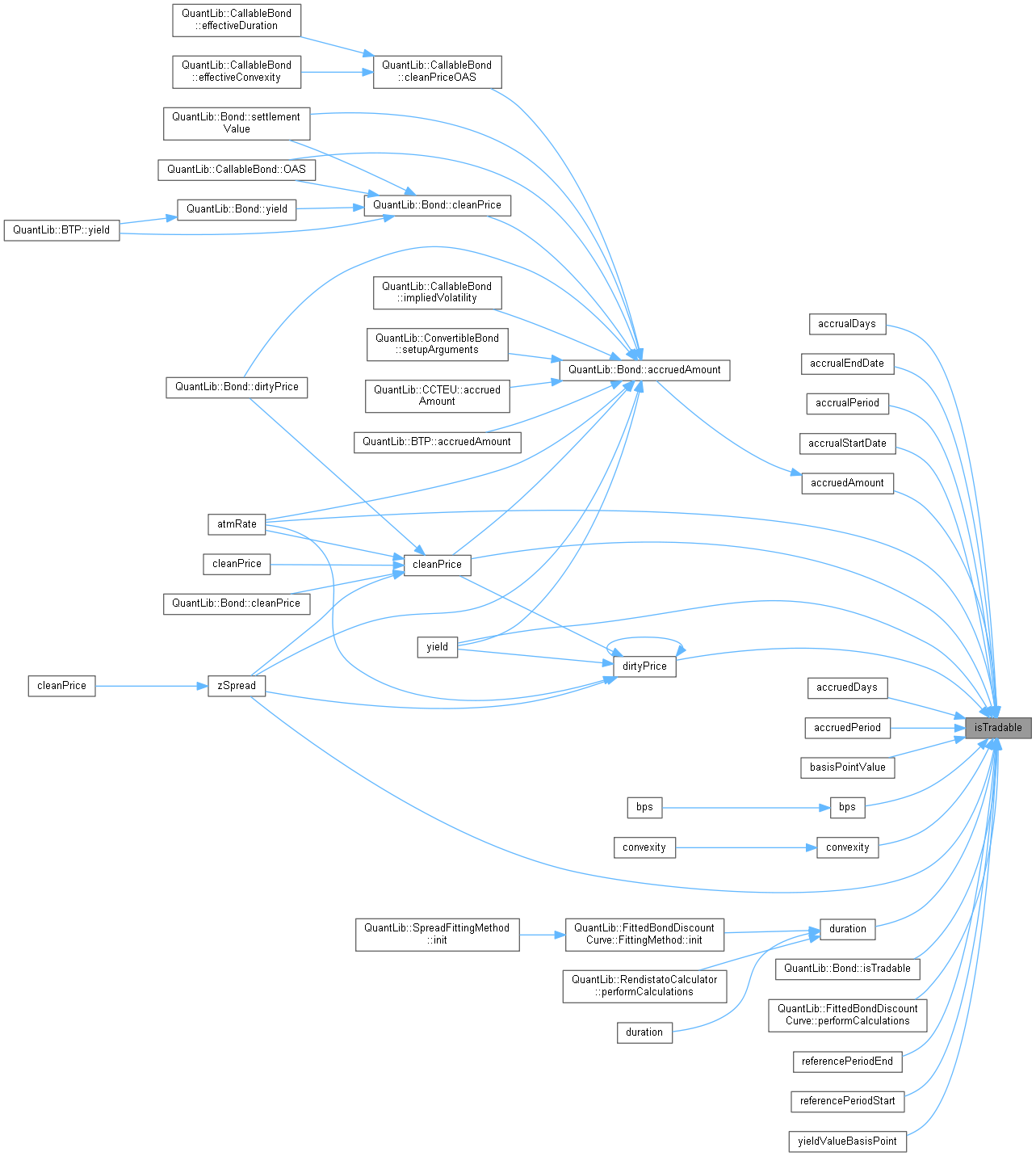

| static bool | isTradable (const Bond &bond, Date settlementDate=Date()) |

| |

|

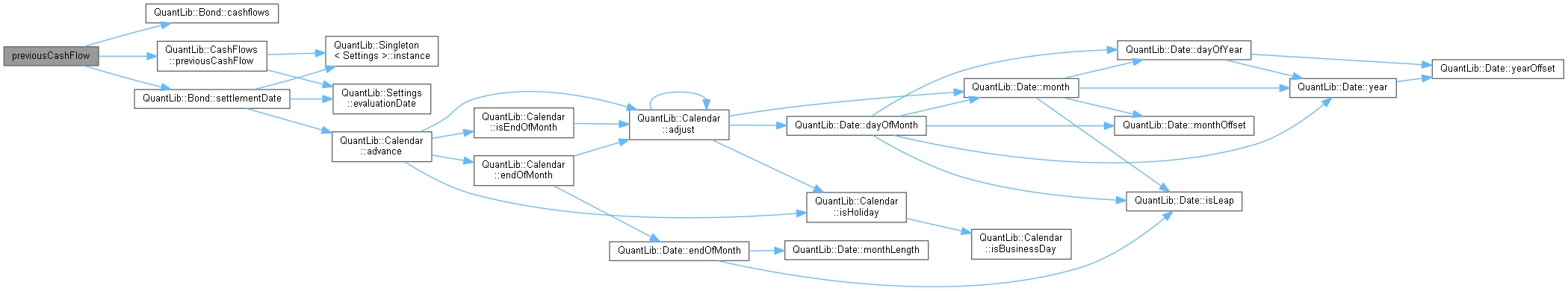

| static Leg::const_reverse_iterator | previousCashFlow (const Bond &bond, Date refDate=Date()) |

| |

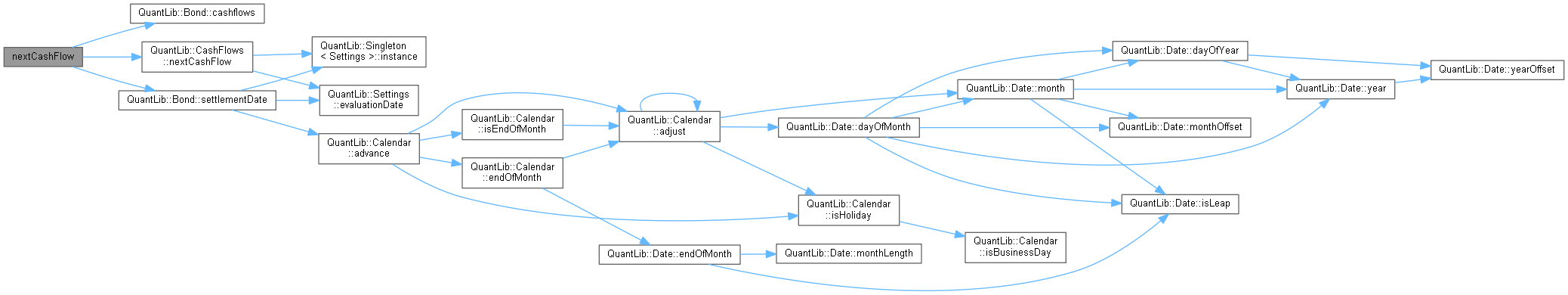

| static Leg::const_iterator | nextCashFlow (const Bond &bond, Date refDate=Date()) |

| |

| static Date | previousCashFlowDate (const Bond &bond, Date refDate=Date()) |

| |

| static Date | nextCashFlowDate (const Bond &bond, Date refDate=Date()) |

| |

| static Real | previousCashFlowAmount (const Bond &bond, Date refDate=Date()) |

| |

| static Real | nextCashFlowAmount (const Bond &bond, Date refDate=Date()) |

| |

|

| static Rate | previousCouponRate (const Bond &bond, Date settlementDate=Date()) |

| |

| static Rate | nextCouponRate (const Bond &bond, Date settlementDate=Date()) |

| |

| static Date | accrualStartDate (const Bond &bond, Date settlementDate=Date()) |

| |

| static Date | accrualEndDate (const Bond &bond, Date settlementDate=Date()) |

| |

| static Date | referencePeriodStart (const Bond &bond, Date settlementDate=Date()) |

| |

| static Date | referencePeriodEnd (const Bond &bond, Date settlementDate=Date()) |

| |

| static Time | accrualPeriod (const Bond &bond, Date settlementDate=Date()) |

| |

| static Date::serial_type | accrualDays (const Bond &bond, Date settlementDate=Date()) |

| |

| static Time | accruedPeriod (const Bond &bond, Date settlementDate=Date()) |

| |

| static Date::serial_type | accruedDays (const Bond &bond, Date settlementDate=Date()) |

| |

| static Real | accruedAmount (const Bond &bond, Date settlementDate=Date()) |

| |

|

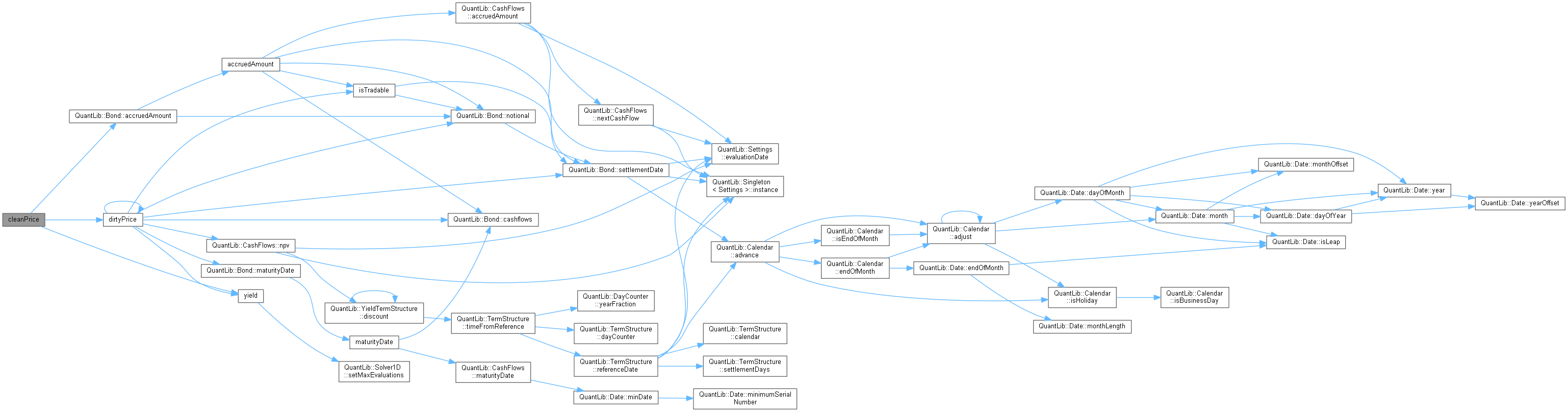

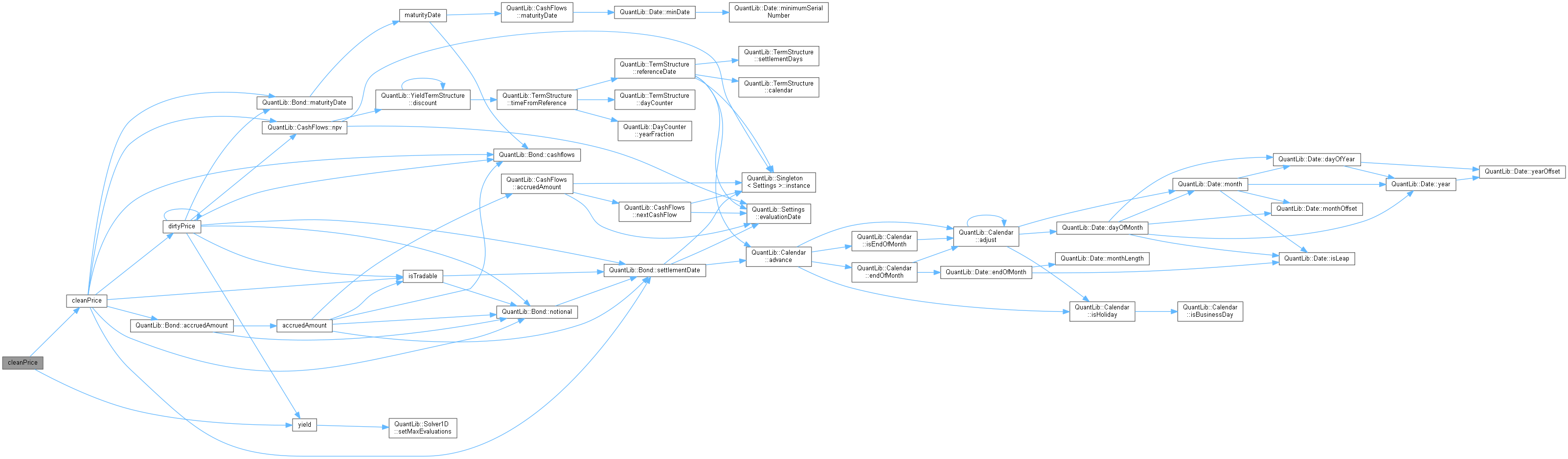

| static Real | cleanPrice (const Bond &bond, const YieldTermStructure &discountCurve, Date settlementDate=Date()) |

| |

| static Real | dirtyPrice (const Bond &bond, const YieldTermStructure &discountCurve, Date settlementDate=Date()) |

| |

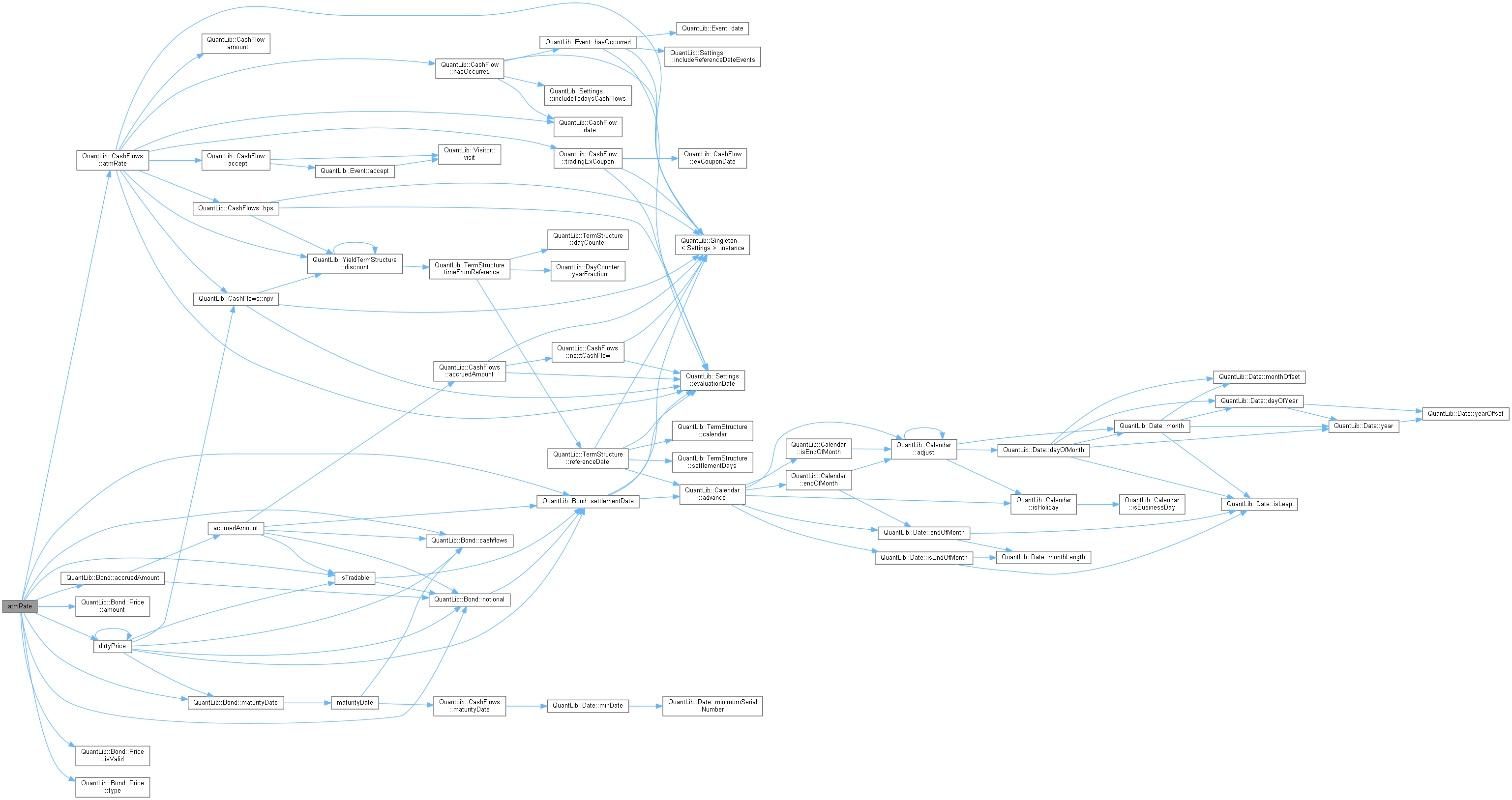

| static Real | bps (const Bond &bond, const YieldTermStructure &discountCurve, Date settlementDate=Date()) |

| |

| static Rate | atmRate (const Bond &bond, const YieldTermStructure &discountCurve, Date settlementDate=Date(), Bond::Price price={}) |

| |

|

| static Real | cleanPrice (const Bond &bond, const InterestRate &yield, Date settlementDate=Date()) |

| |

| static Real | cleanPrice (const Bond &bond, Rate yield, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, Date settlementDate=Date()) |

| |

| static Real | dirtyPrice (const Bond &bond, const InterestRate &yield, Date settlementDate=Date()) |

| |

| static Real | dirtyPrice (const Bond &bond, Rate yield, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, Date settlementDate=Date()) |

| |

| static Real | bps (const Bond &bond, const InterestRate &yield, Date settlementDate=Date()) |

| |

| static Real | bps (const Bond &bond, Rate yield, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, Date settlementDate=Date()) |

| |

| static Rate | yield (const Bond &bond, Bond::Price price, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, Date settlementDate=Date(), Real accuracy=1.0e-10, Size maxIterations=100, Rate guess=0.05) |

| |

| template<typename Solver > |

| static Rate | yield (const Solver &solver, const Bond &bond, Bond::Price price, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, Date settlementDate=Date(), Real accuracy=1.0e-10, Rate guess=0.05) |

| |

| static Time | duration (const Bond &bond, const InterestRate &yield, Duration::Type type=Duration::Modified, Date settlementDate=Date()) |

| |

| static Time | duration (const Bond &bond, Rate yield, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, Duration::Type type=Duration::Modified, Date settlementDate=Date()) |

| |

| static Real | convexity (const Bond &bond, const InterestRate &yield, Date settlementDate=Date()) |

| |

| static Real | convexity (const Bond &bond, Rate yield, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, Date settlementDate=Date()) |

| |

| static Real | basisPointValue (const Bond &bond, const InterestRate &yield, Date settlementDate=Date()) |

| |

| static Real | basisPointValue (const Bond &bond, Rate yield, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, Date settlementDate=Date()) |

| |

| static Real | yieldValueBasisPoint (const Bond &bond, const InterestRate &yield, Date settlementDate=Date()) |

| |

| static Real | yieldValueBasisPoint (const Bond &bond, Rate yield, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, Date settlementDate=Date()) |

| |

|

| static Real | cleanPrice (const Bond &bond, const ext::shared_ptr< YieldTermStructure > &discount, Spread zSpread, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, Date settlementDate=Date()) |

| |

| static Real | dirtyPrice (const Bond &bond, const ext::shared_ptr< YieldTermStructure > &discount, Spread zSpread, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, Date settlementDate=Date()) |

| |

| static Spread | zSpread (const Bond &bond, Bond::Price price, const ext::shared_ptr< YieldTermStructure > &, const DayCounter &dayCounter, Compounding compounding, Frequency frequency, Date settlementDate=Date(), Real accuracy=1.0e-10, Size maxIterations=100, Rate guess=0.0) |

| |

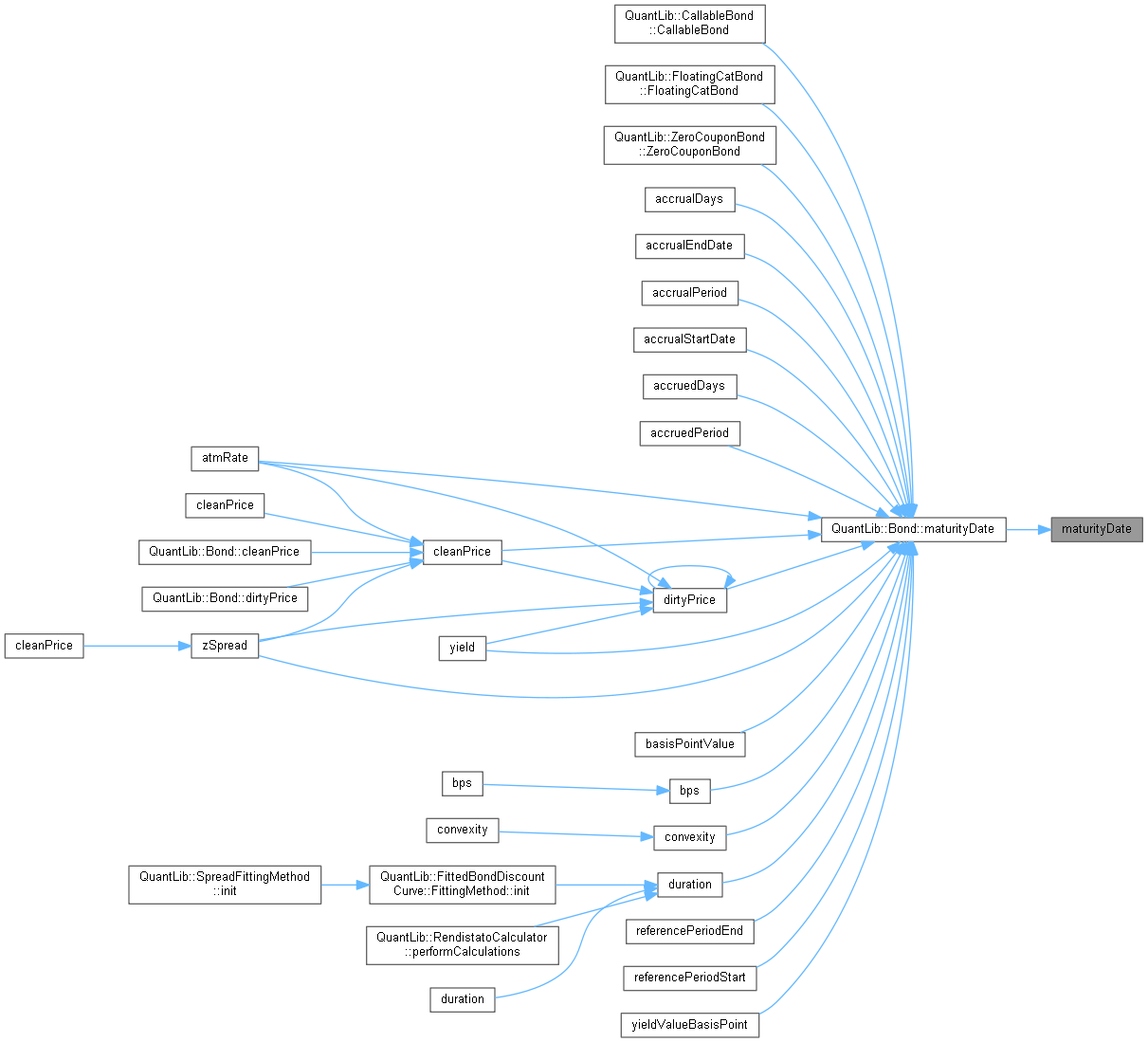

Bond adapters of CashFlows functions.

See CashFlows for functions' documentation.

These adapters calls into CashFlows functions passing as input the Bond cashflows, the dirty price (i.e. npv) calculated from clean price, the bond settlement date (unless another date is given), zero ex-dividend days, and excluding any cashflow on the settlement date.

Prices are always clean, as per market convention.

Definition at line 54 of file bondfunctions.hpp.

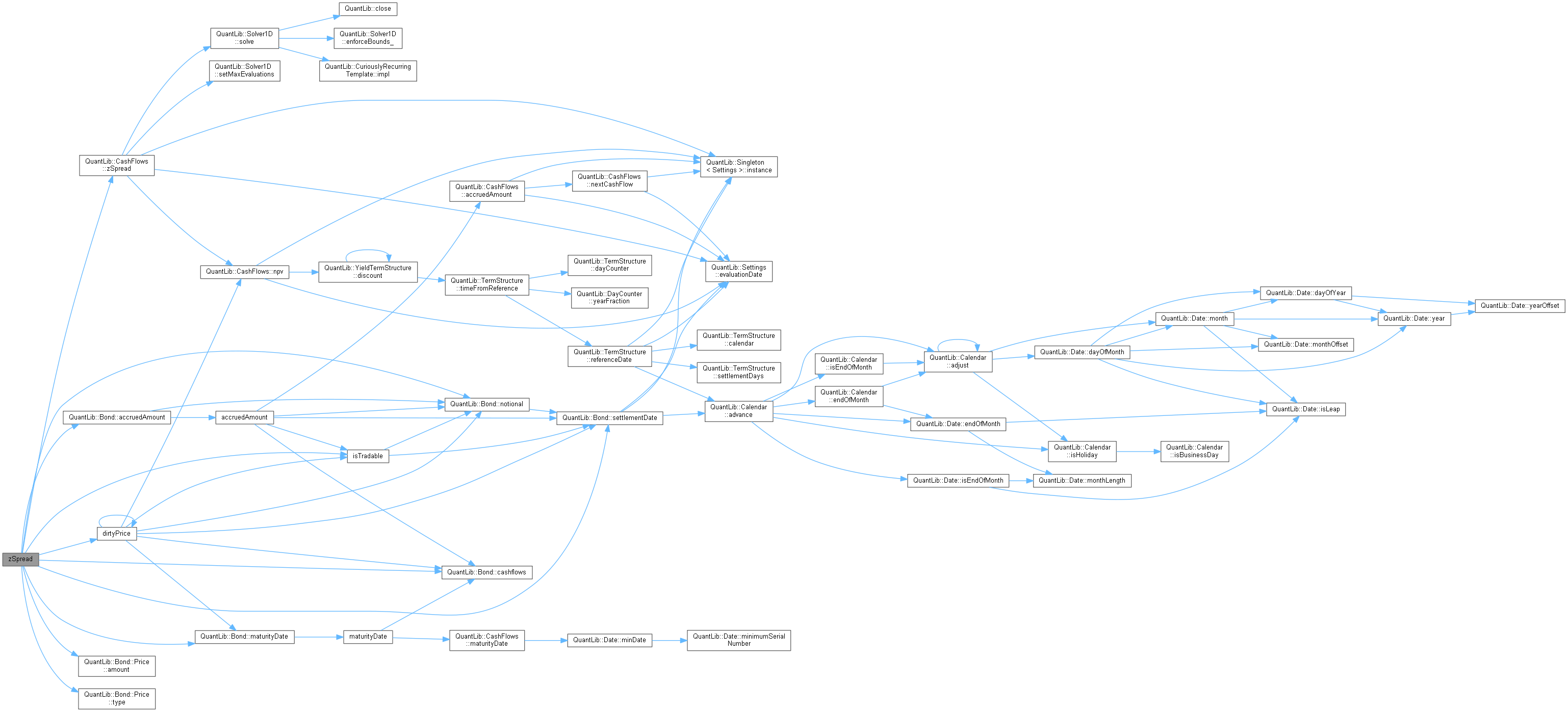

Collaboration diagram for BondFunctions:

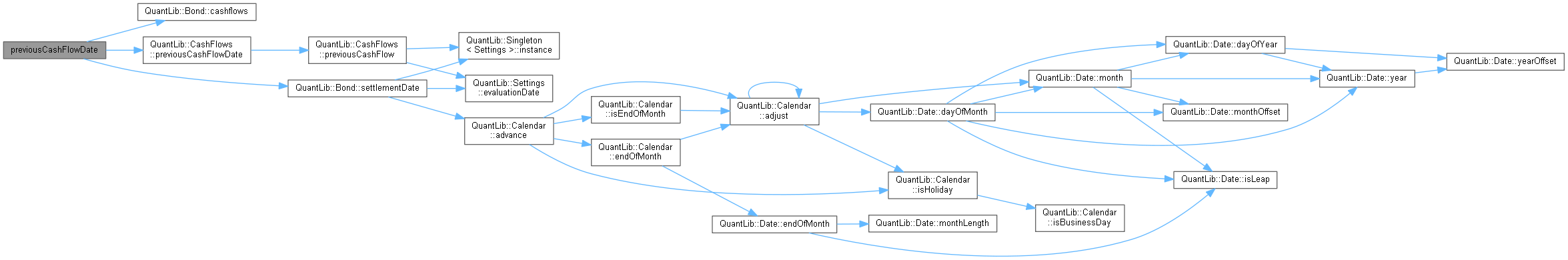

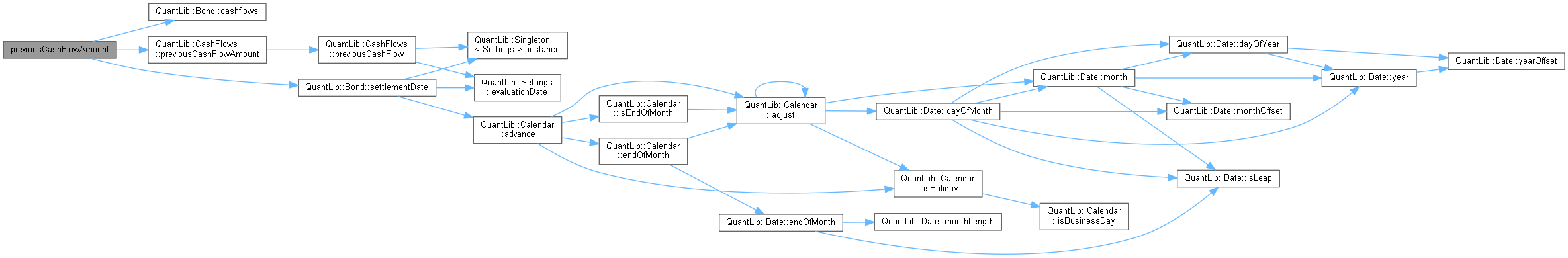

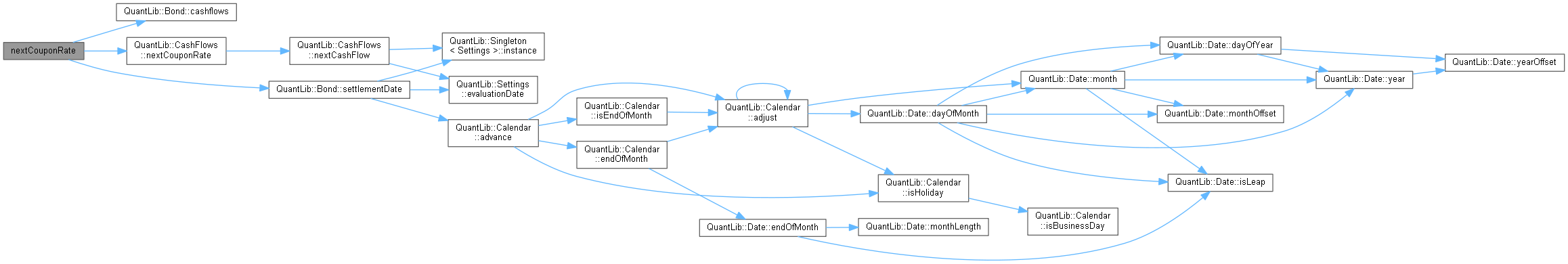

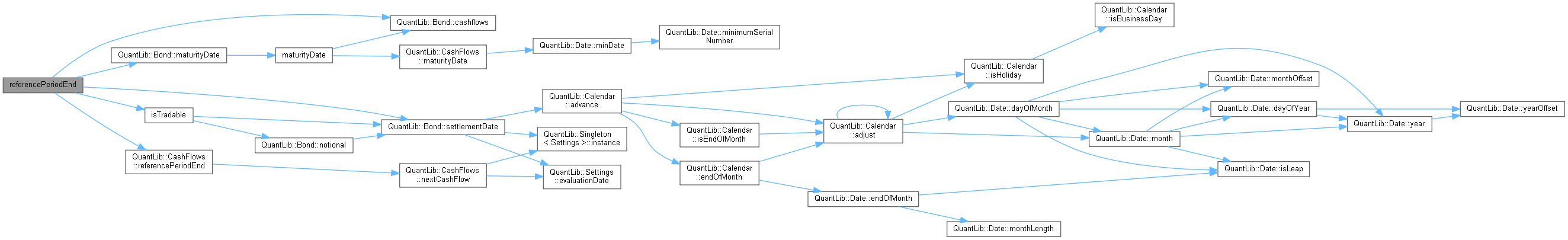

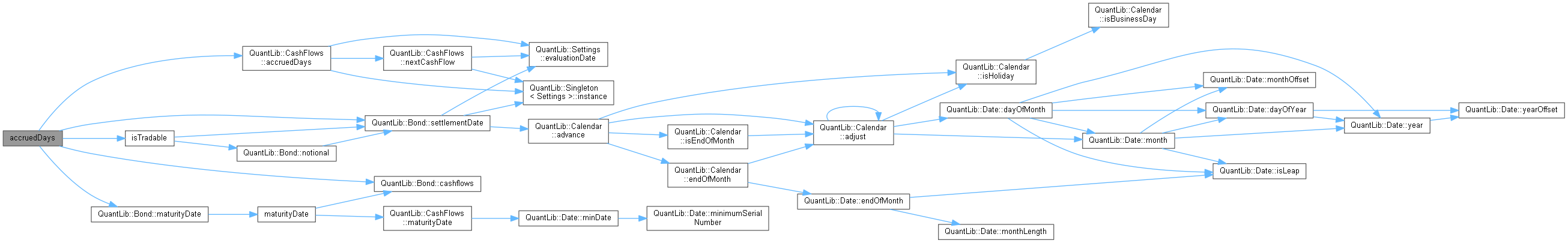

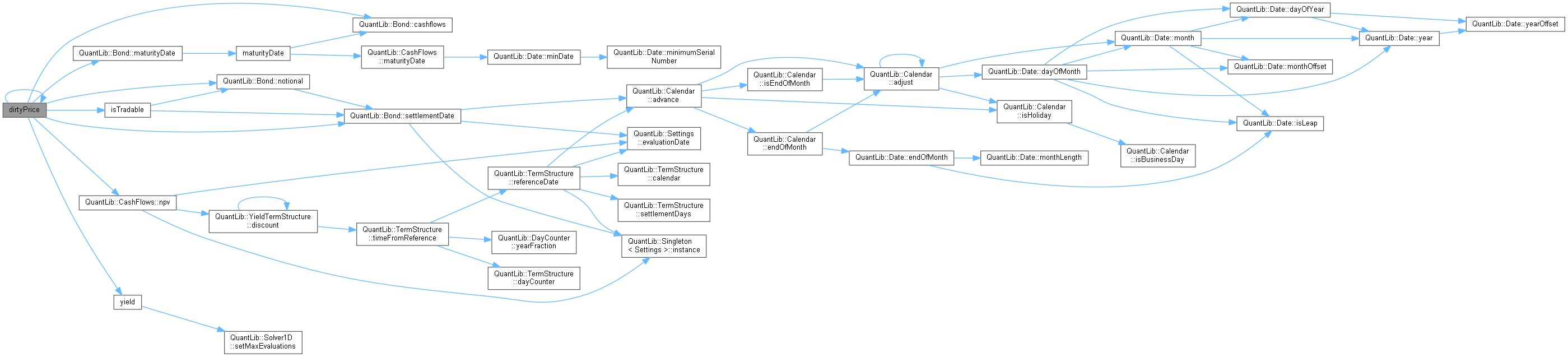

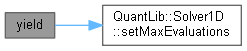

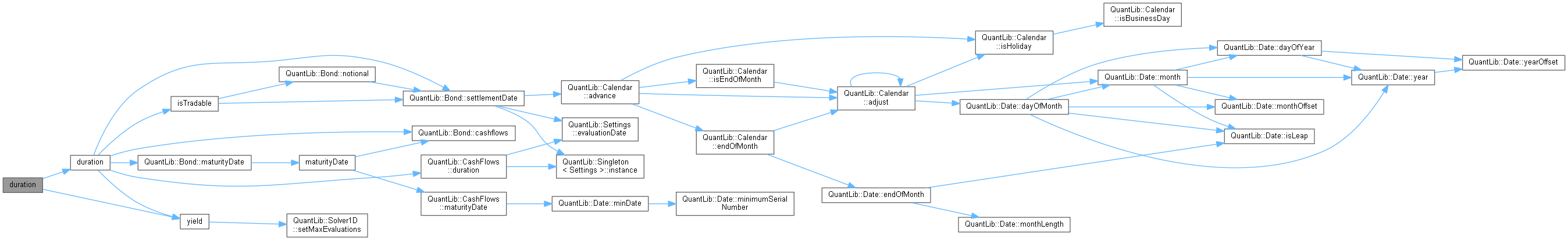

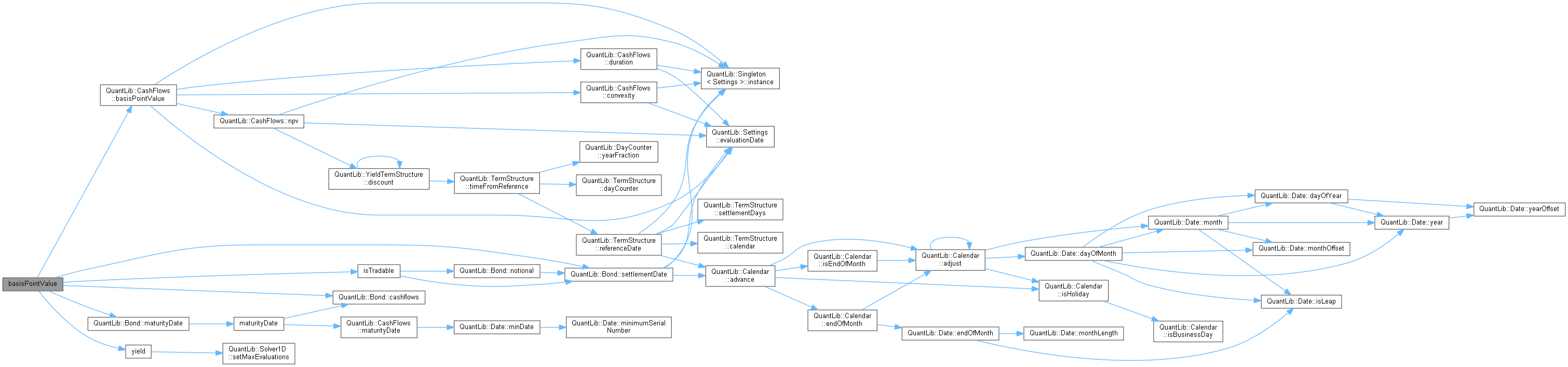

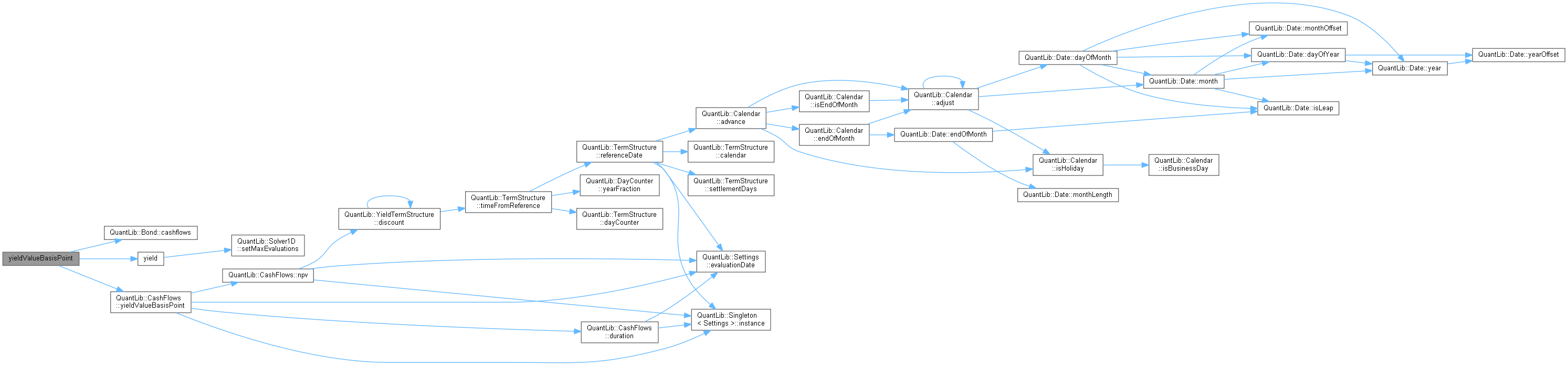

Collaboration diagram for BondFunctions: Here is the call graph for this function:

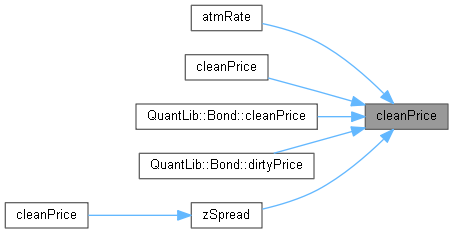

Here is the call graph for this function: Here is the caller graph for this function:

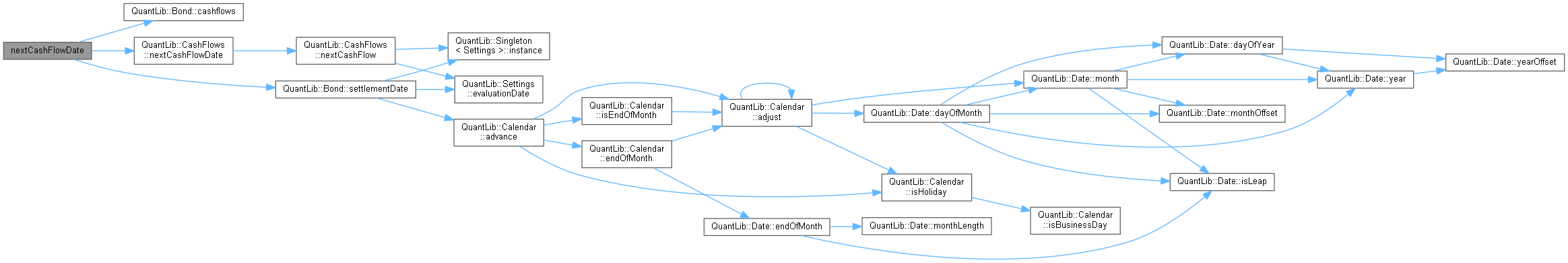

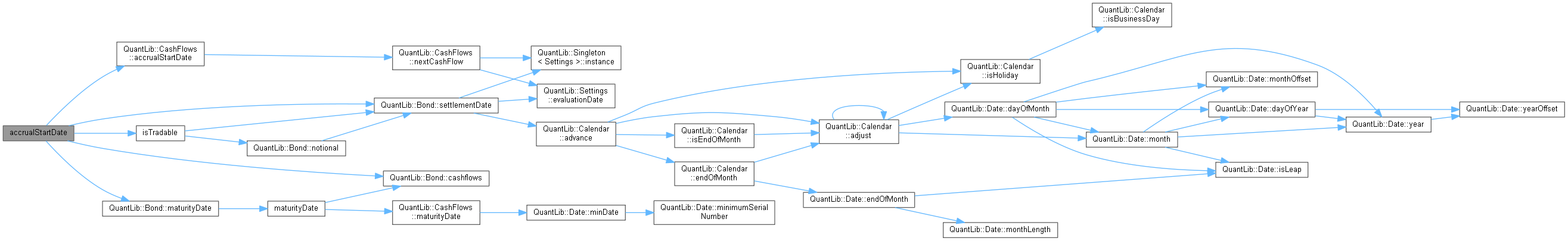

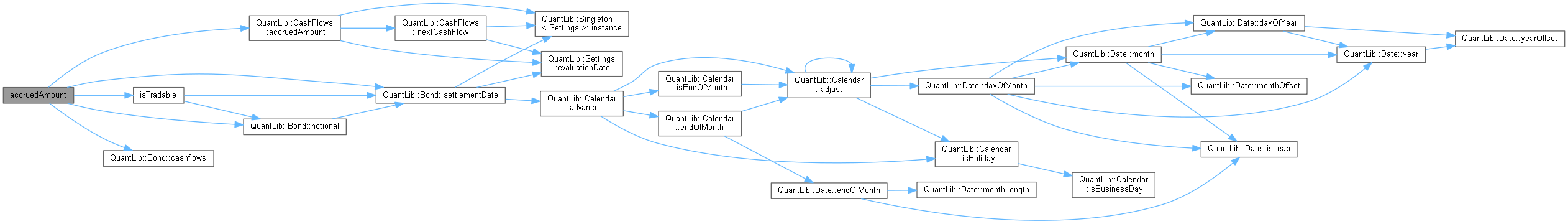

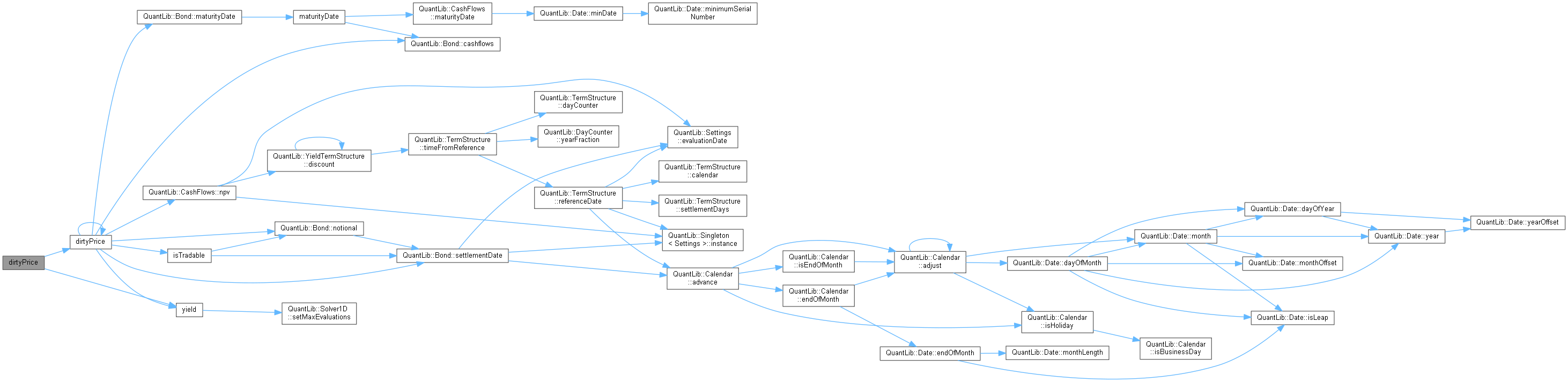

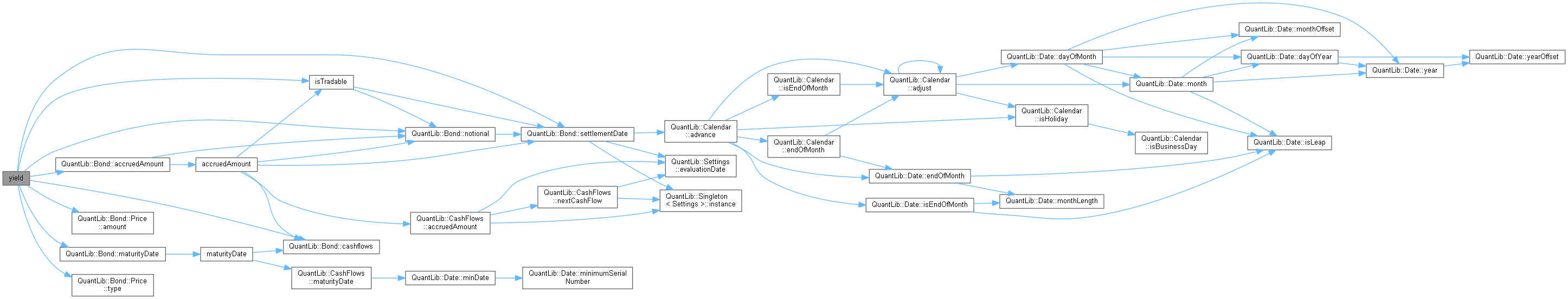

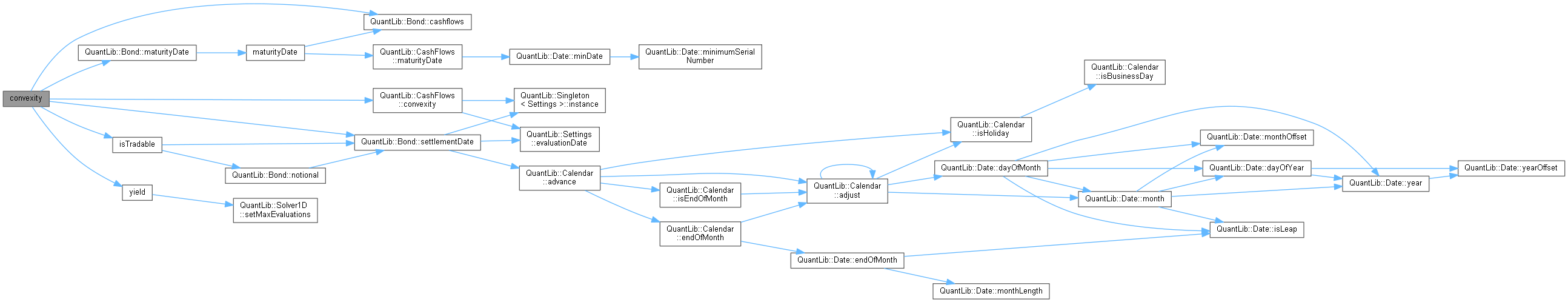

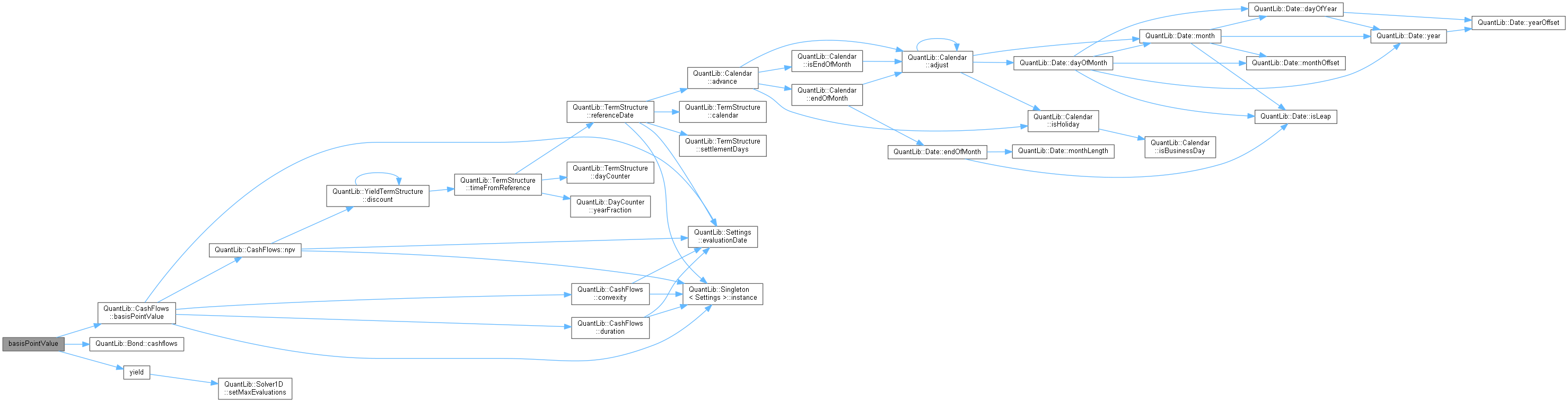

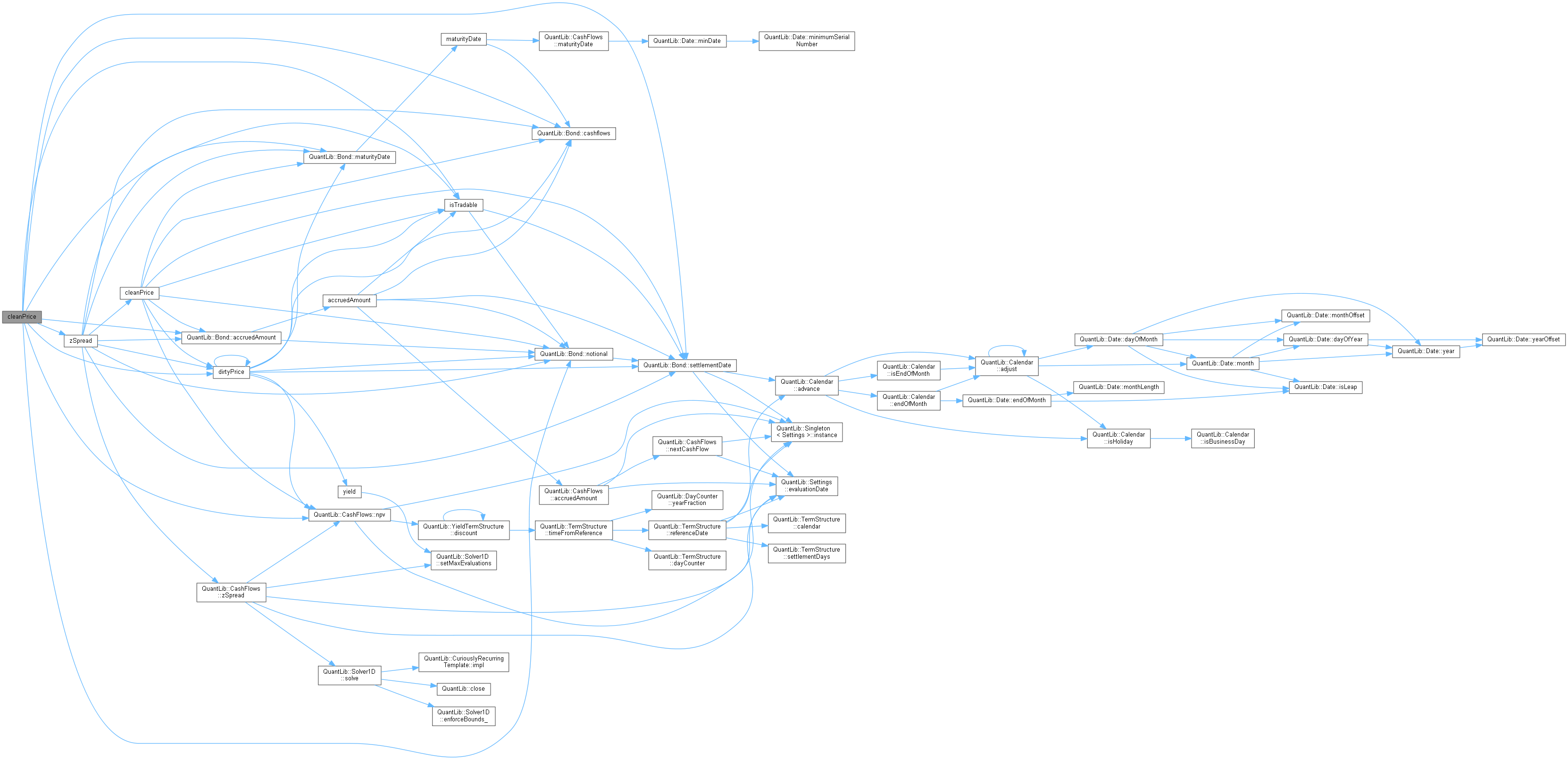

Here is the caller graph for this function: Here is the call graph for this function:

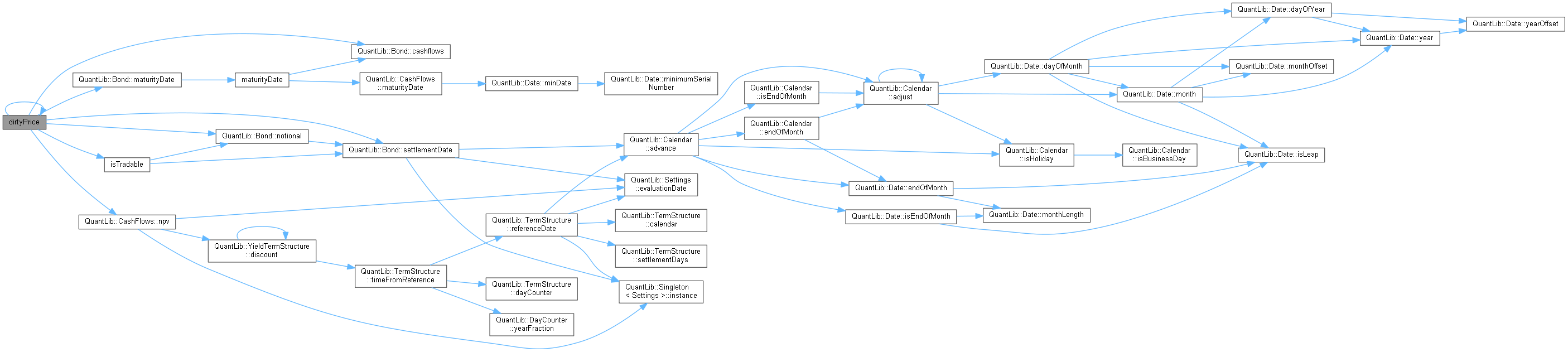

Here is the call graph for this function: Here is the caller graph for this function:

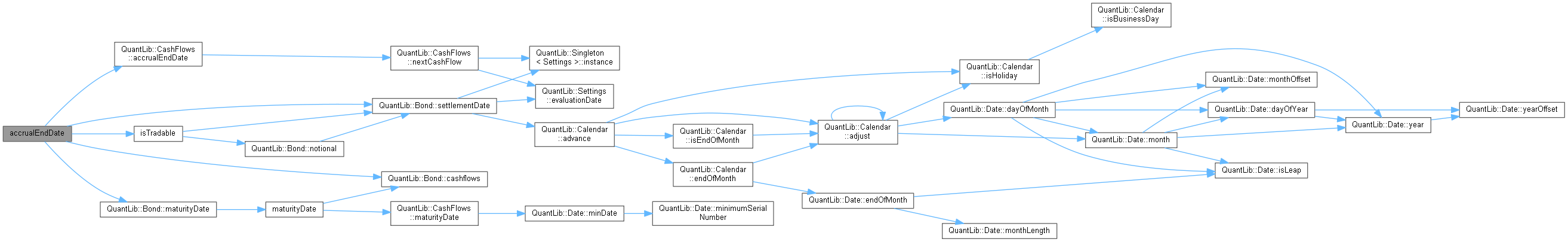

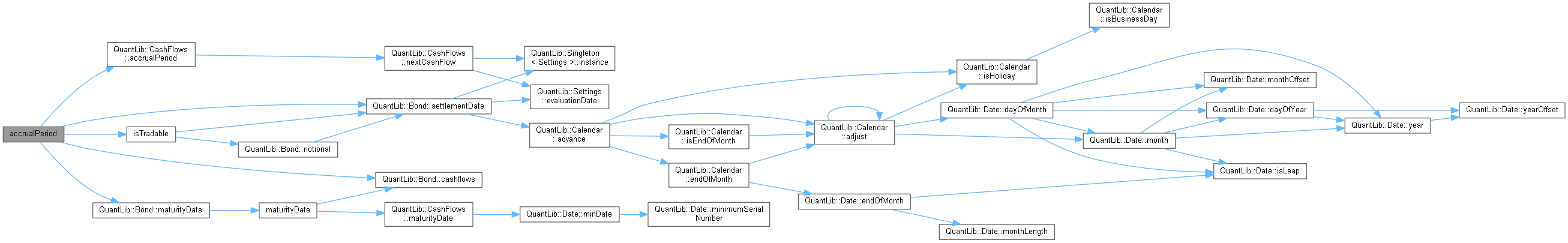

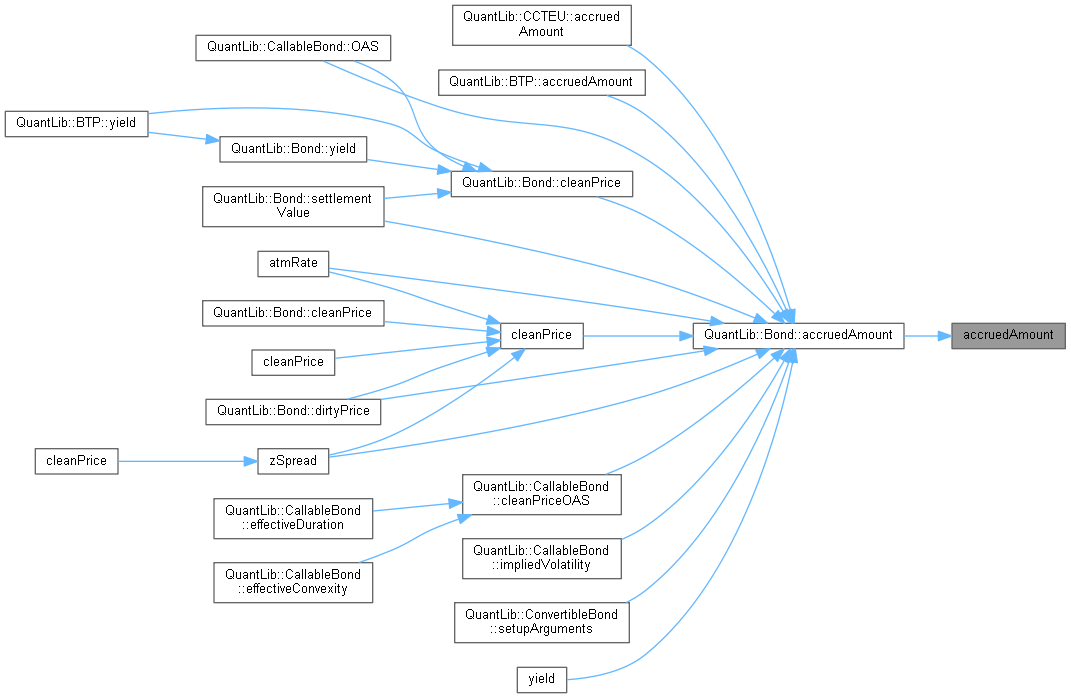

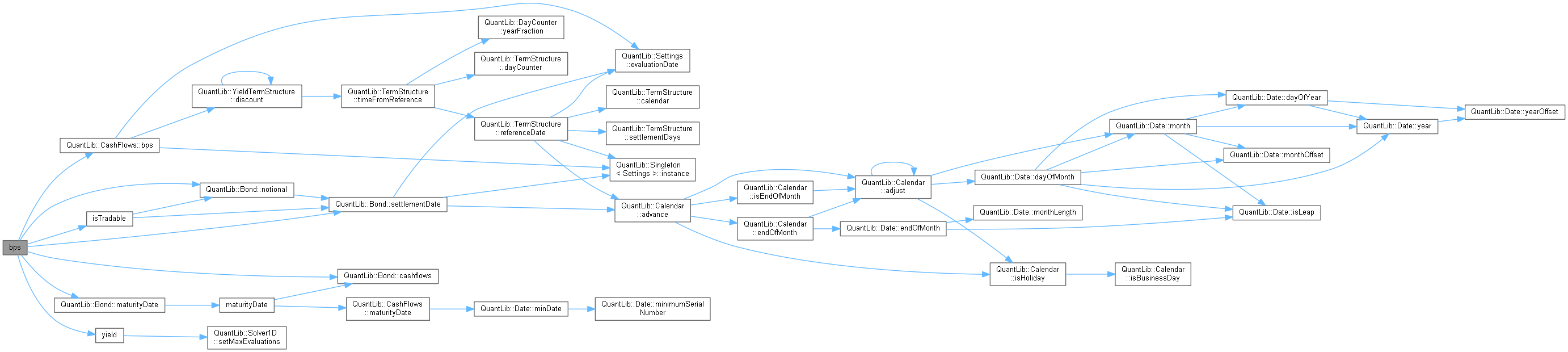

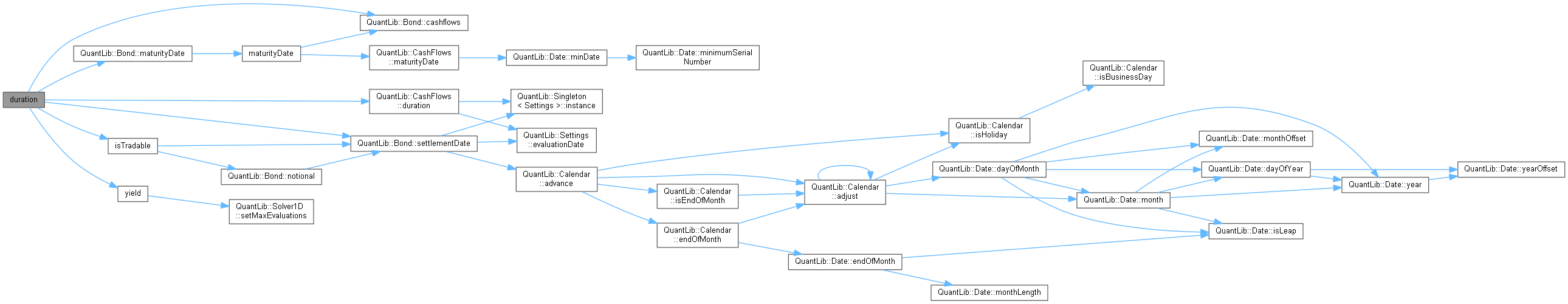

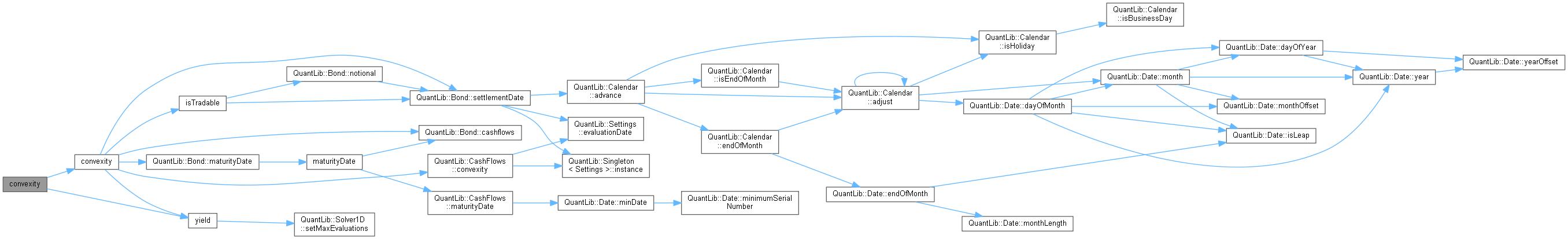

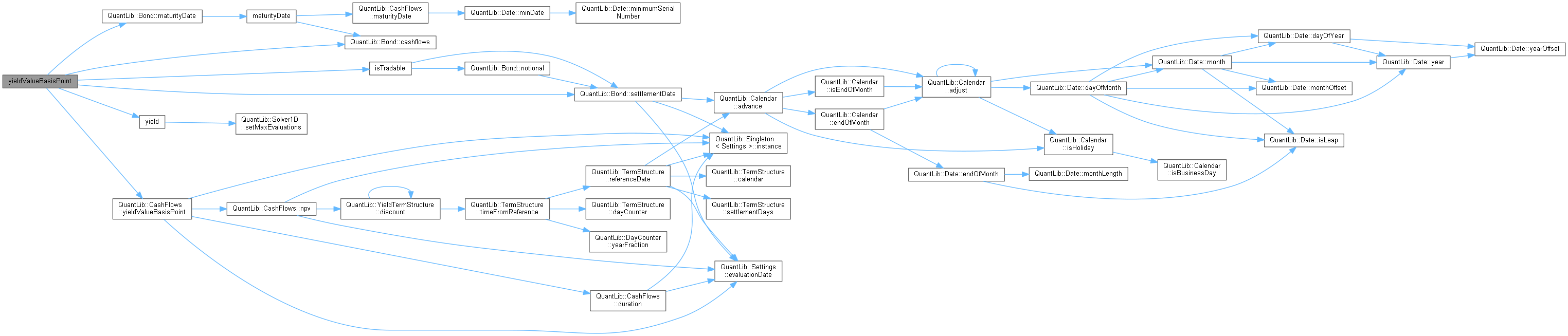

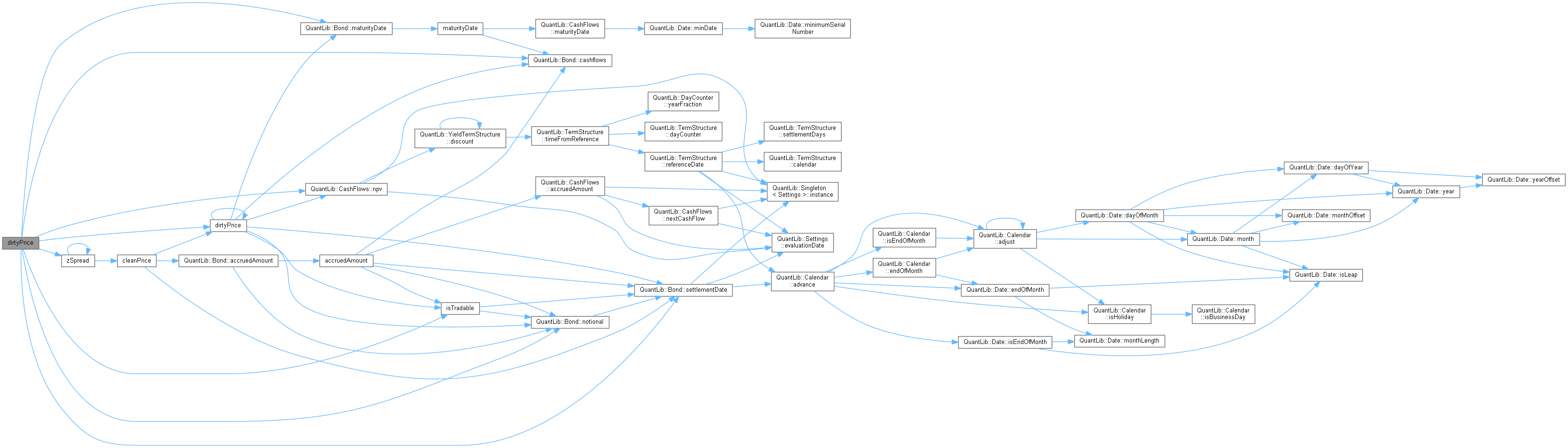

Here is the caller graph for this function: Here is the call graph for this function:

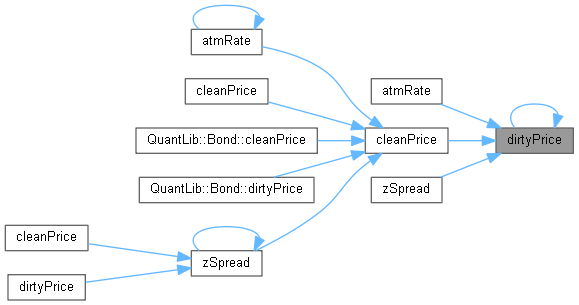

Here is the call graph for this function: Here is the caller graph for this function:

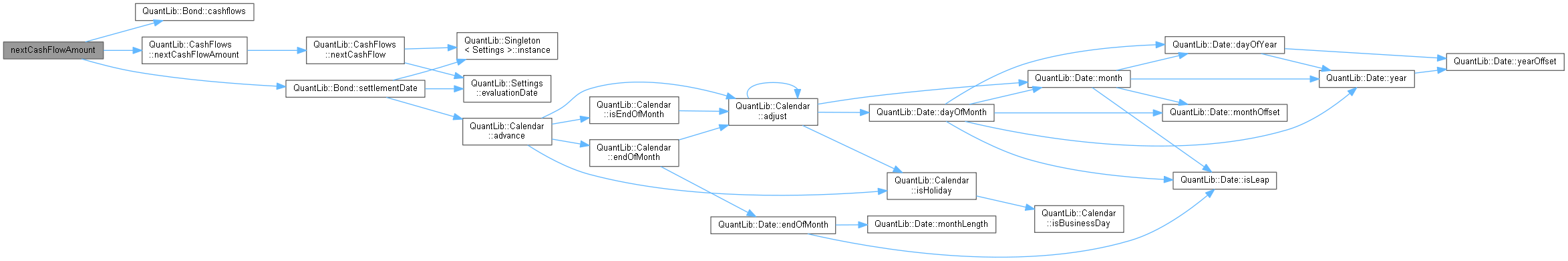

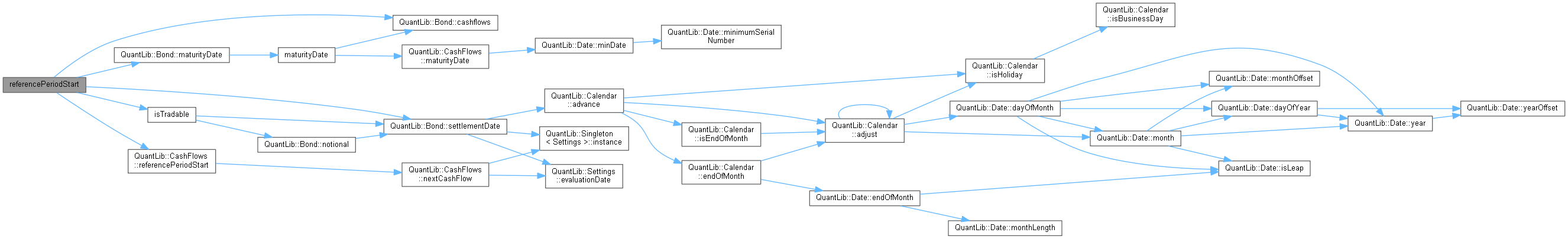

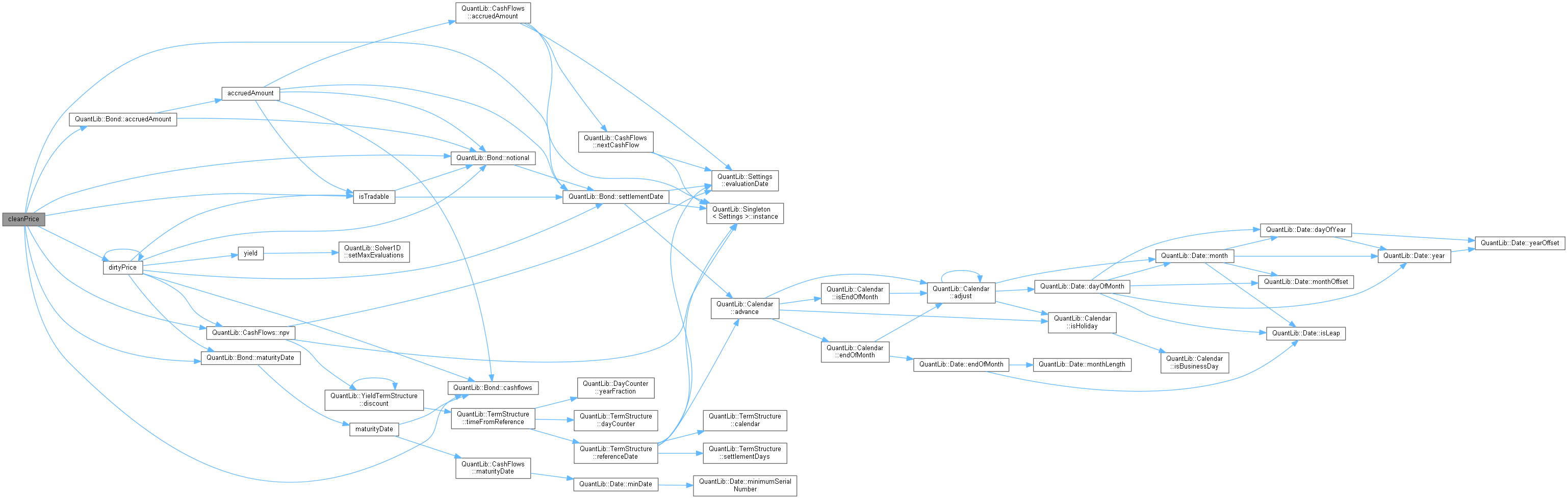

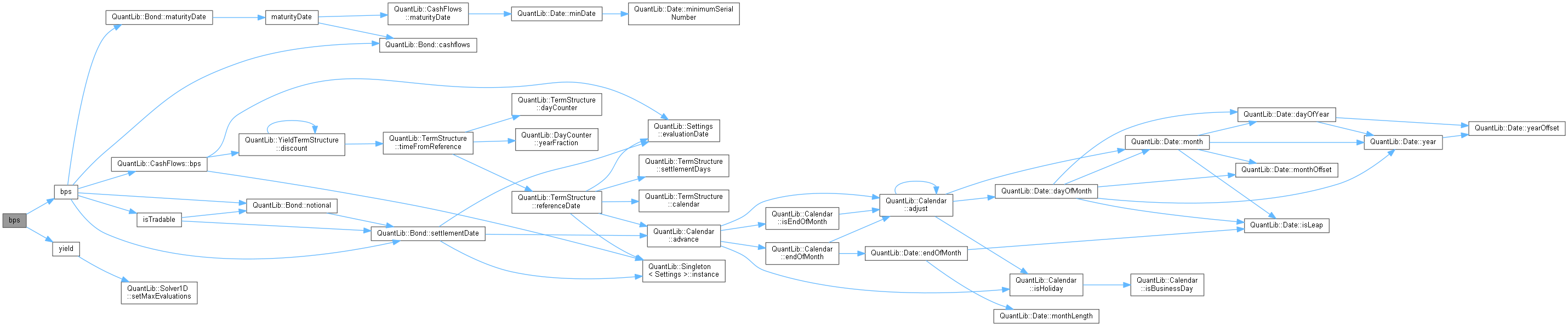

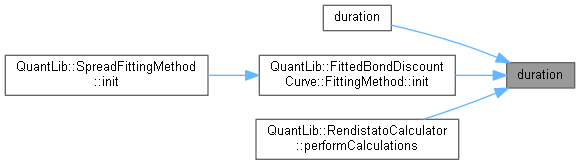

Here is the caller graph for this function: Here is the call graph for this function:

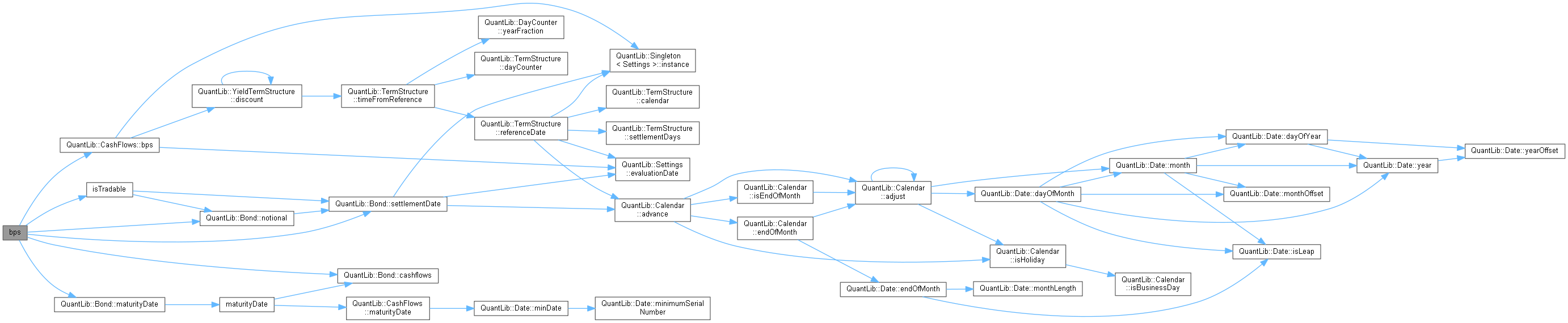

Here is the call graph for this function: Here is the caller graph for this function:

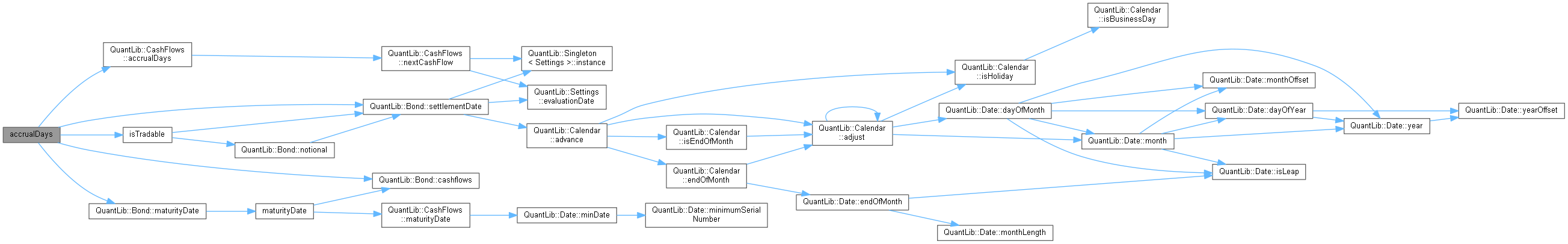

Here is the caller graph for this function: Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

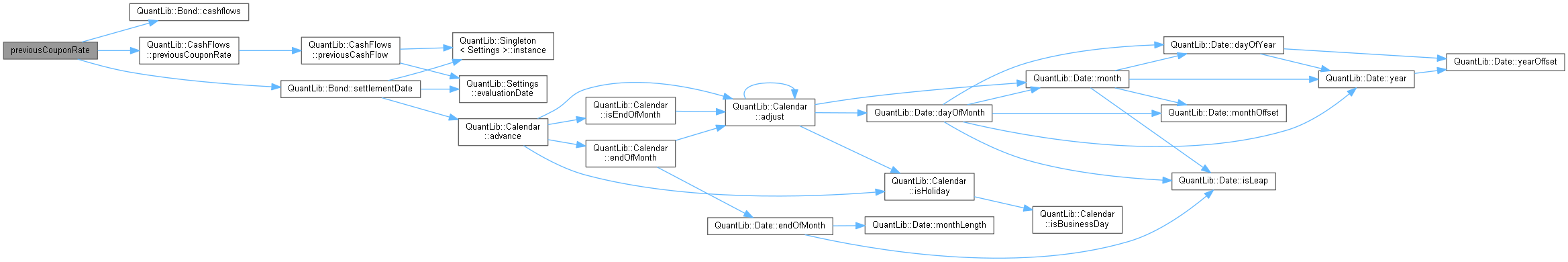

Here is the caller graph for this function: Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

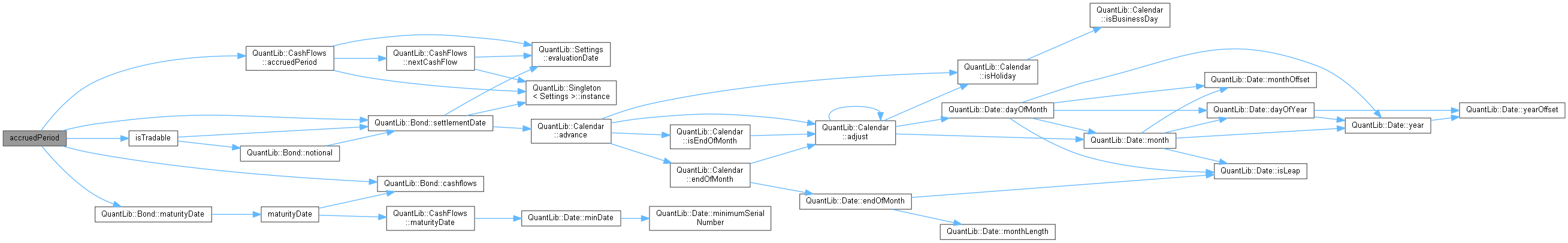

Here is the caller graph for this function: Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

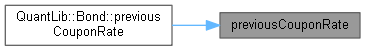

Here is the caller graph for this function: Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function: Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function: Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function: Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function: Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function: Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function: Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function: Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function: Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function: Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function: