#include <callablebond.hpp>

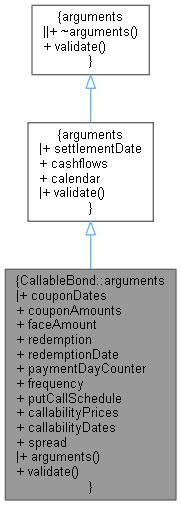

Inheritance diagram for CallableBond::arguments:

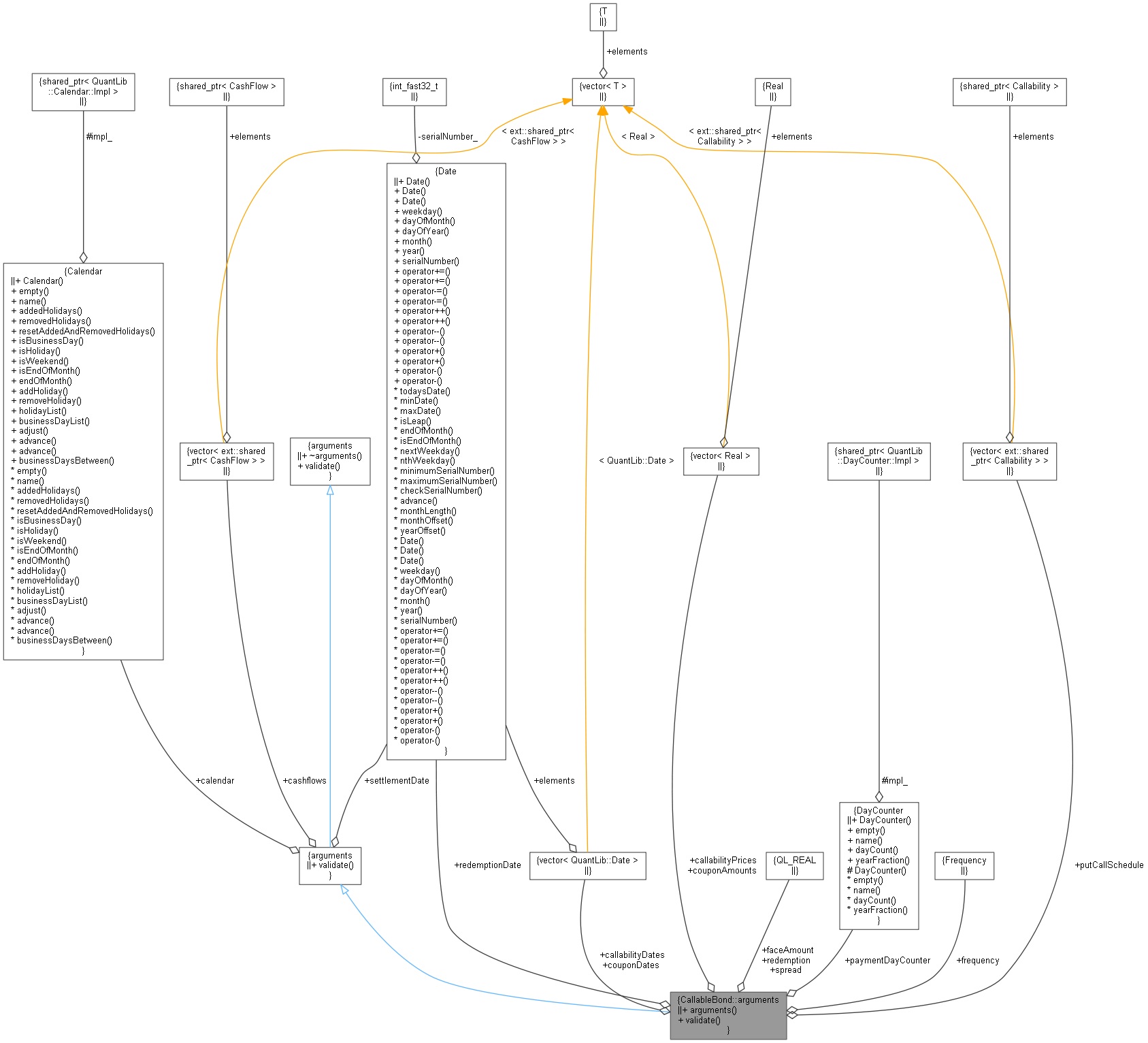

Inheritance diagram for CallableBond::arguments: Collaboration diagram for CallableBond::arguments:

Collaboration diagram for CallableBond::arguments:Public Member Functions | |

| arguments ()=default | |

| void | validate () const override |

Public Member Functions inherited from Bond::arguments Public Member Functions inherited from Bond::arguments | |

| void | validate () const override |

Public Member Functions inherited from PricingEngine::arguments Public Member Functions inherited from PricingEngine::arguments | |

| virtual | ~arguments ()=default |

| virtual void | validate () const =0 |

Public Attributes | |

| std::vector< Date > | couponDates |

| std::vector< Real > | couponAmounts |

| Real | faceAmount |

| Real | redemption |

| redemption = face amount * redemption / 100. More... | |

| Date | redemptionDate |

| DayCounter | paymentDayCounter |

| Frequency | frequency |

| CallabilitySchedule | putCallSchedule |

| std::vector< Real > | callabilityPrices |

| bond full/dirty/cash prices More... | |

| std::vector< Date > | callabilityDates |

| Real | spread |

Public Attributes inherited from Bond::arguments Public Attributes inherited from Bond::arguments | |

| Date | settlementDate |

| Leg | cashflows |

| Calendar | calendar |

Detailed Description

Definition at line 160 of file callablebond.hpp.

Constructor & Destructor Documentation

◆ arguments()

|

default |

Member Function Documentation

◆ validate()

|

overridevirtual |

Implements PricingEngine::arguments.

Definition at line 56 of file callablebond.cpp.

Member Data Documentation

◆ couponDates

| std::vector<Date> couponDates |

Definition at line 163 of file callablebond.hpp.

◆ couponAmounts

| std::vector<Real> couponAmounts |

Definition at line 164 of file callablebond.hpp.

◆ faceAmount

| Real faceAmount |

Definition at line 165 of file callablebond.hpp.

◆ redemption

| Real redemption |

redemption = face amount * redemption / 100.

Definition at line 167 of file callablebond.hpp.

◆ redemptionDate

| Date redemptionDate |

Definition at line 168 of file callablebond.hpp.

◆ paymentDayCounter

| DayCounter paymentDayCounter |

Definition at line 169 of file callablebond.hpp.

◆ frequency

| Frequency frequency |

Definition at line 170 of file callablebond.hpp.

◆ putCallSchedule

| CallabilitySchedule putCallSchedule |

Definition at line 171 of file callablebond.hpp.

◆ callabilityPrices

| std::vector<Real> callabilityPrices |

bond full/dirty/cash prices

Definition at line 173 of file callablebond.hpp.

◆ callabilityDates

| std::vector<Date> callabilityDates |

Definition at line 174 of file callablebond.hpp.

◆ spread

| Real spread |

Spread to apply to the valuation. This is a continuously componded rate added to the model. Currently only applied by the TreeCallableFixedRateBondEngine

Definition at line 178 of file callablebond.hpp.